Connecticut Assignment of Money Due

Description

How to fill out Assignment Of Money Due?

Are you currently in a situation where you require documents for either business or personal purposes on a regular basis.

There are numerous legal document templates accessible online, but finding ones you can rely on is not simple.

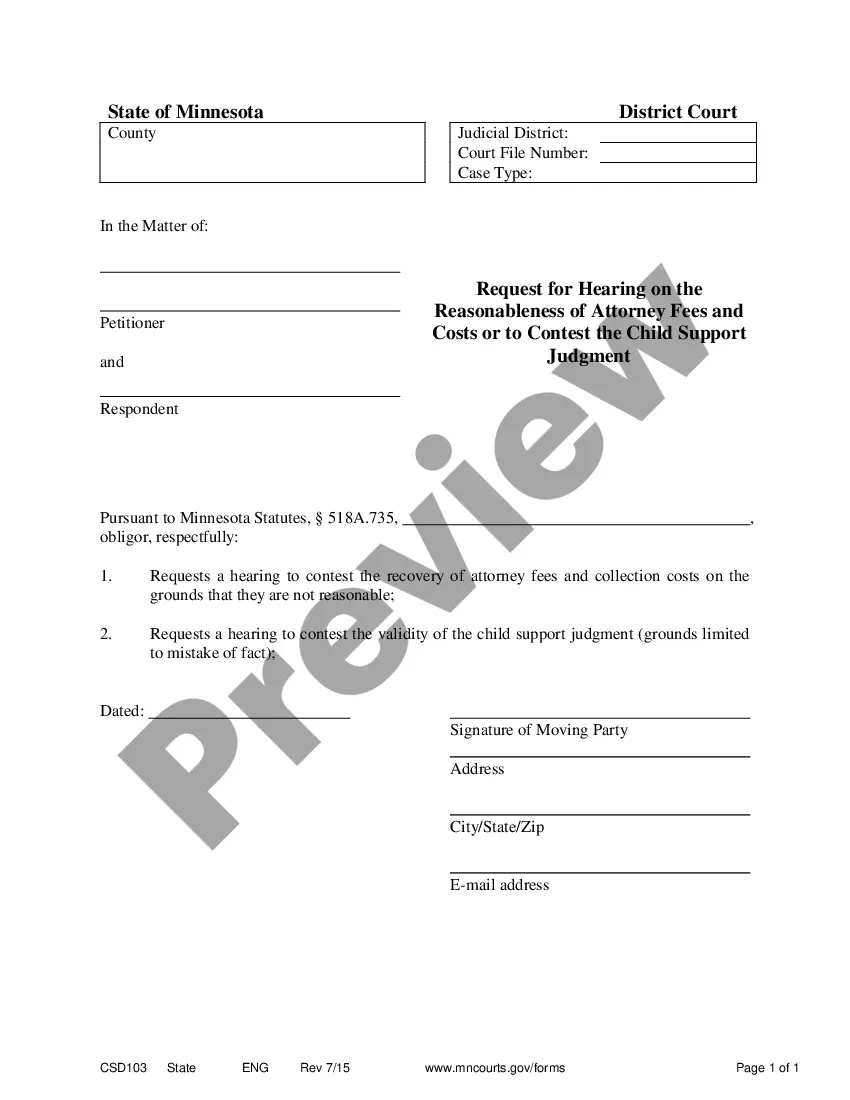

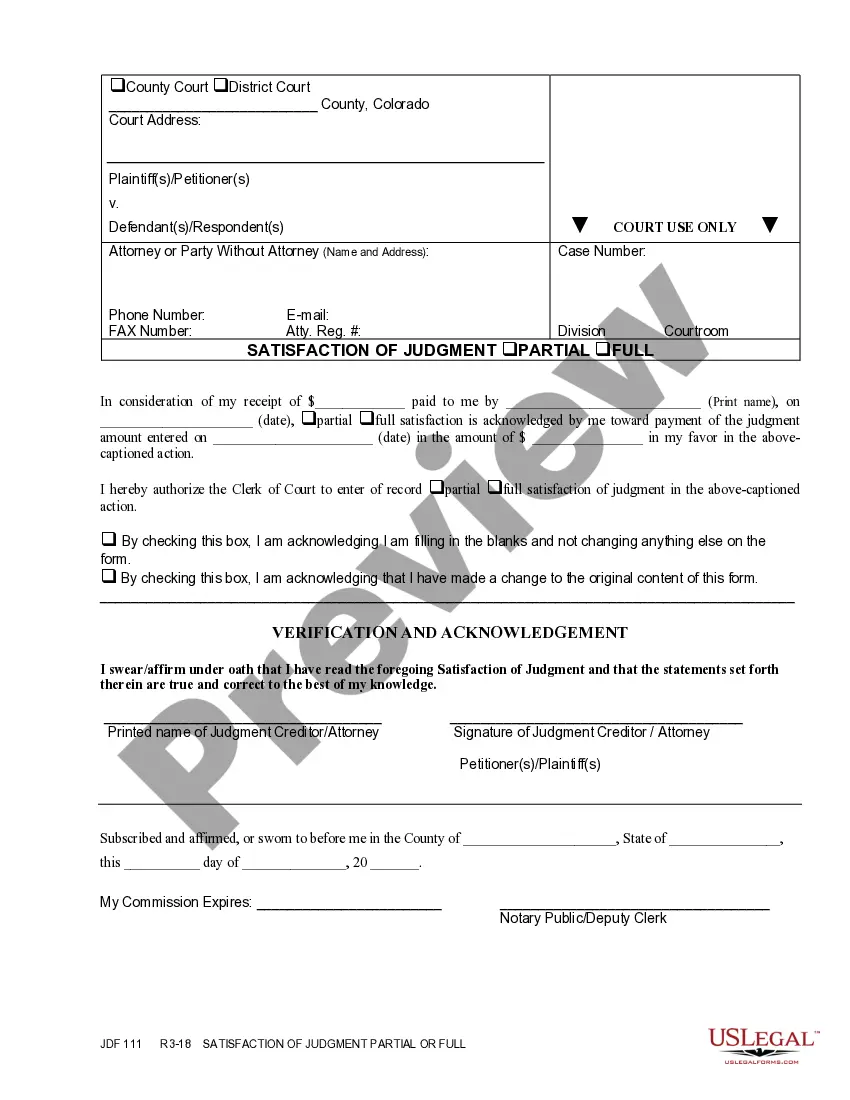

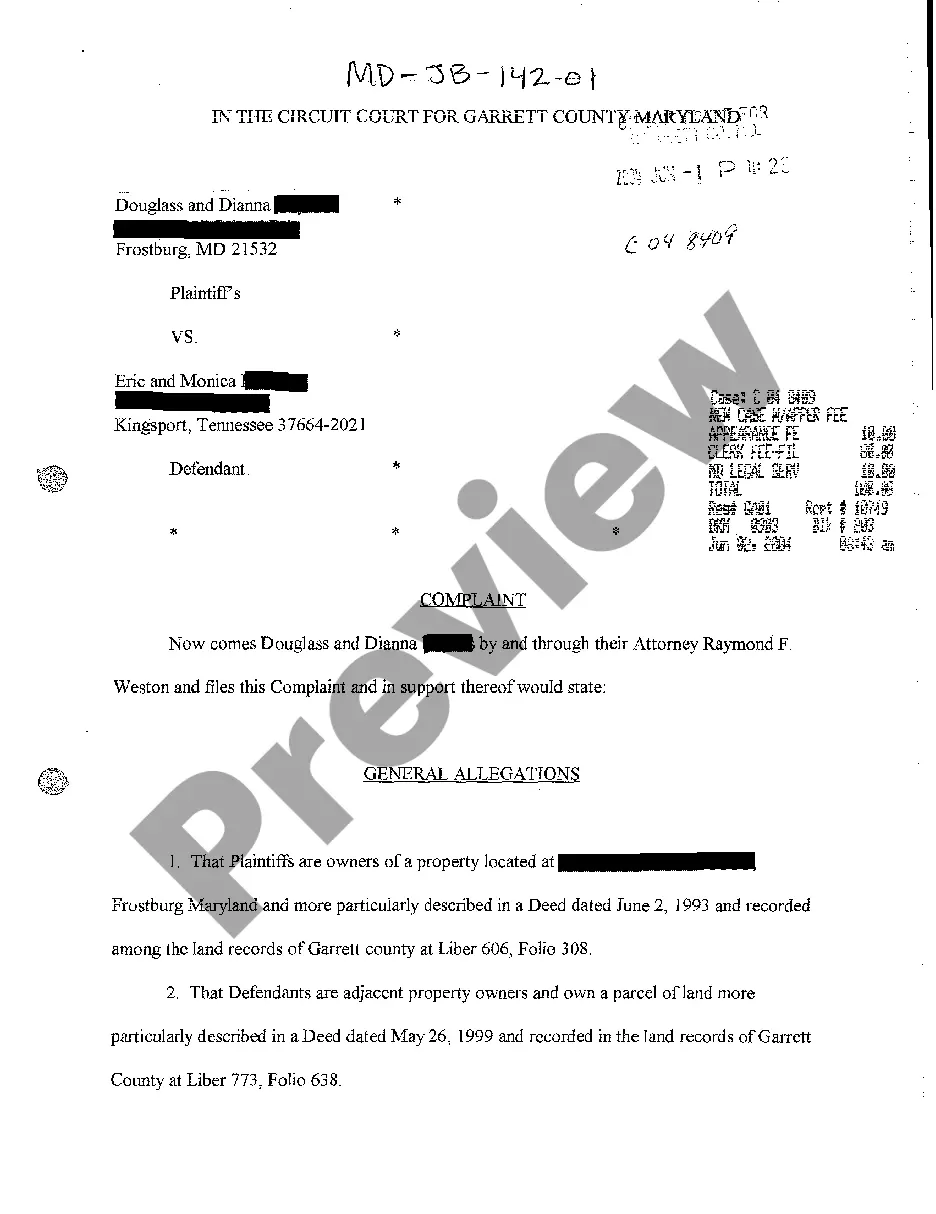

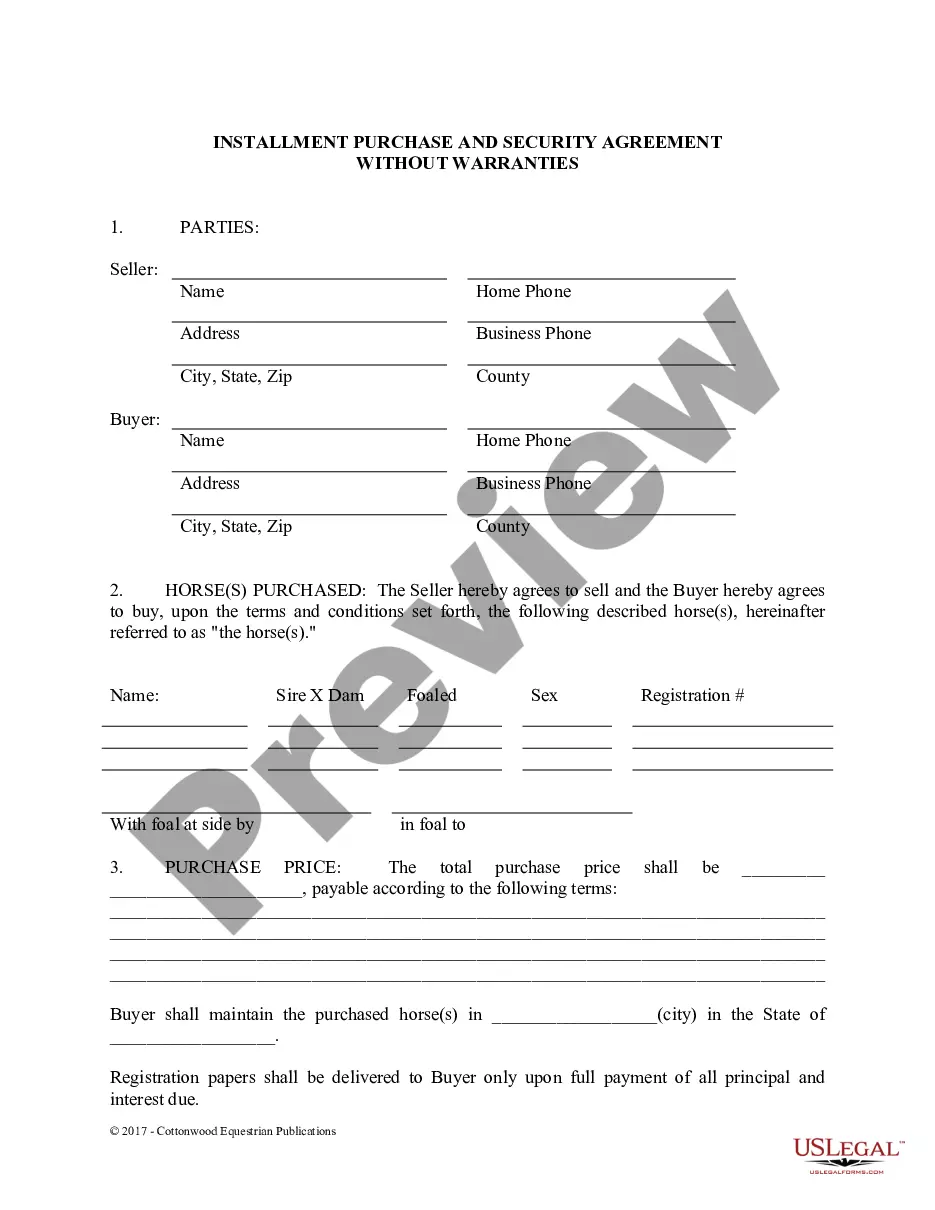

US Legal Forms provides thousands of template forms, such as the Connecticut Assignment of Money Due, designed to meet federal and state requirements.

Choose the pricing plan you want, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

Select a preferred document format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Connecticut Assignment of Money Due anytime if needed. Just click on the required form to download or print the document template. Utilize US Legal Forms, the largest collection of legal forms, to save time and avoid errors. The service offers professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Connecticut Assignment of Money Due template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct state/region.

- Use the Review button to examine the form.

- Read the description to ensure you have selected the correct document.

- If the form is not what you are looking for, use the Search area to find the form that suits your needs and requirements.

- Once you find the right form, click Purchase now.

Form popularity

FAQ

In Connecticut, a debt usually becomes uncollectible after six years, depending on the type of debt involved. This timeline is governed by the statute of limitations, which protects consumers from indefinite collection efforts. Learning about Connecticut Assignment of Money Due can empower you to take control of your financial situation. If you have further questions, consulting a legal expert can provide valuable insights.

In Connecticut, the time frame for a debt to become uncollectible generally falls under the statute of limitations, which is typically six years for most debts. After this period, creditors lose the legal right to collect unless certain conditions apply. Understanding Connecticut Assignment of Money Due can provide clarity on your situation and options. If you need assistance, consider reaching out to a legal service for support.

Section 52-46 of the Connecticut General Statutes addresses the time frame within which a creditor can file a lawsuit to collect a debt. This statute outlines the importance of timely action in pursuing debts. Familiarizing yourself with Connecticut Assignment of Money Due can help you navigate these legal requirements effectively. Always consult a legal expert if you have specific questions about your case.

In the United States, including Connecticut, you cannot be jailed for simply owing money. However, if you fail to comply with a court order related to a debt, you may face legal consequences. It’s crucial to understand your rights and options regarding debts, such as those outlined in Connecticut Assignment of Money Due. When in doubt, seek guidance from a legal professional.

A debt becomes uncollectible when the creditor cannot legally pursue collection, typically after the statute of limitations expires. In Connecticut, this period can vary depending on the type of debt. Understanding Connecticut Assignment of Money Due can help you recognize your rights and the timeline for collecting debts. If you are uncertain about your situation, consider consulting with a legal expert.

If you need to mail a Connecticut amended tax return, you should send it to the address specified by the Connecticut Department of Revenue Services. Typically, the mailing address is different from that for regular returns, so it's crucial to verify the correct destination. For assistance with your tax filing, consider utilizing the Connecticut Assignment of Money Due, which can help you navigate the process smoothly. Always double-check the latest address on the official website to avoid any delays.

Yes, Connecticut allows taxpayers to file amended returns electronically. This process can streamline your filing experience and help you correct any errors efficiently. When filing an amended return, consider using resources like the Connecticut Assignment of Money Due to ensure you meet all necessary requirements. Always stay updated with the latest guidelines from the Connecticut Department of Revenue Services.

In Connecticut, seniors may be eligible for property tax relief programs that can reduce or defer their property tax payments. However, there is no specific age at which seniors automatically stop paying property taxes. Instead, qualifying seniors can apply for various tax relief programs, such as the Connecticut Assignment of Money Due, which can provide financial assistance. It is advisable to check with local tax assessors for specific eligibility requirements.

To fill out a CT financial affidavit, begin by clearly listing your monthly income and necessary expenses. Next, provide a comprehensive overview of your assets and any outstanding debts. After completing the form, sign and date it to affirm that the information you provided is accurate. If you want to ensure compliance with state requirements, US Legal Forms can offer the necessary templates and resources, particularly for documents like the Connecticut Assignment of Money Due.

Filling out a Connecticut title requires you to provide essential details about the vehicle, including the Vehicle Identification Number (VIN), make, model, and year. You must also include the seller's and buyer's information, along with their signatures. Ensure that all sections are completed to avoid delays in the title transfer process. For precise instructions and templates, consider visiting the US Legal platform, which also covers topics like the Connecticut Assignment of Money Due.