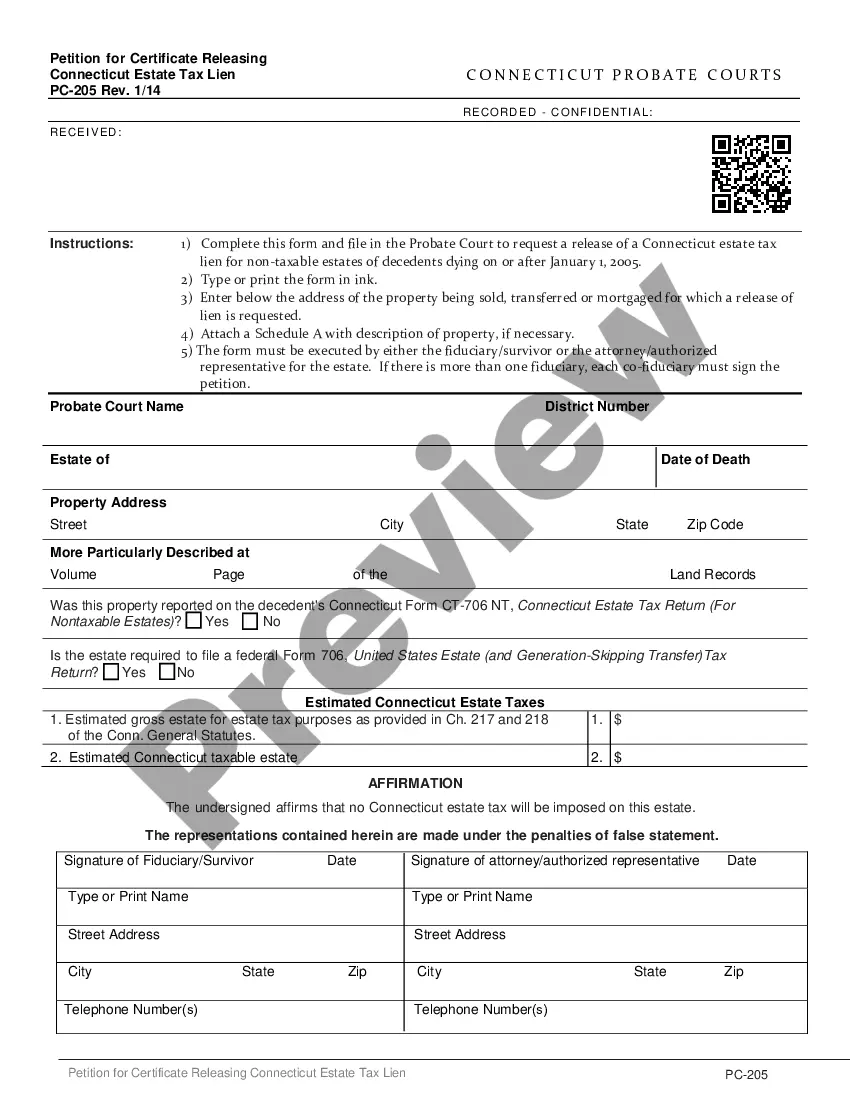

This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

Application for Certificate Releasing Connecticut Estate Tax Lien

Description

How to fill out Application For Certificate Releasing Connecticut Estate Tax Lien?

The greater quantity of documents you need to produce - the more apprehensive you become.

You can discover a vast array of Application for Certificate Releasing Connecticut Estate Tax Lien formats online; however, you are uncertain about which ones to trust.

Remove the difficulty in locating samples, making it simpler through US Legal Forms. Obtain expertly created documents that are formatted to comply with state regulations.

Enter the required details to create your account and pay for your purchase using PayPal or a credit card. Choose a convenient file format and retrieve your template. Access all templates you acquire in the My documents section. Just navigate there to fill out a new version of the Application for Certificate Releasing Connecticut Estate Tax Lien. Even when utilizing professionally prepared documents, it is still important to consider consulting your local attorney to verify that your completed document is accurately filled in. Achieve more for less with US Legal Forms!

- If you already have a US Legal Forms subscription, Log In to your account, and you will find the Download button on the Application for Certificate Releasing Connecticut Estate Tax Lien’s page.

- If you have not used our site before, complete the registration process by following these steps.

- Verify that the Application for Certificate Releasing Connecticut Estate Tax Lien is applicable in your state.

- Confirm your selection by reviewing the details or utilizing the Preview option if available for the selected document.

- Click Buy Now to initiate the registration process and select a pricing plan that meets your needs.

Form popularity

FAQ

The CT form for releasing a lien is known as the Application for Certificate Releasing Connecticut Estate Tax Lien. This form serves as a formal request to remove any estate tax liens assessed by the state of Connecticut. Completing this application is essential for settling estate matters and facilitating asset distribution. At USLegalForms, we provide comprehensive guidance and the necessary forms to help you navigate this process smoothly.

No, Connecticut is not a no tax state. It has state income tax, sales tax, and various local taxes that contribute to its revenue. If you face difficulties with estate taxes, utilizing the Application for Certificate Releasing Connecticut Estate Tax Lien can be beneficial. It enables you to address estate tax liens efficiently, giving you peace of mind regarding your financial obligations.

Yes, Connecticut is a tax lien state where local municipalities can put liens on properties for unpaid taxes. When you submit the Application for Certificate Releasing Connecticut Estate Tax Lien, you can initiate the process to remove these liens. This process is crucial for homeowners who wish to sell or refinance their property without tax encumbrances.

With a tax lien certificate, you have the opportunity to collect the owed tax amount along with interest, or in some cases, acquire the property if debts remain unpaid. This investment can be lucrative, but it also requires a clear understanding of local tax laws and strategies. If you ever need to address any estate tax lien needs, consider using the Application for Certificate Releasing Connecticut Estate Tax Lien for better clarity and process efficiency.

A released tax lien means that the taxing authority no longer has a claim against your property due to unpaid taxes. This release allows you to freely sell, transfer, or refinance your property without encumbrances. It's important to ensure this status is properly documented, possibly through the Application for Certificate Releasing Connecticut Estate Tax Lien, to avoid future complications.

To apply for a certificate of discharge from a federal tax lien, you must submit Form 12277 to the IRS along with supporting documentation. This form provides details about the property and your circumstances that warrant the release. Effective management of this process can simplify your financial situation, especially if you are also dealing with state requirements like the Application for Certificate Releasing Connecticut Estate Tax Lien.

A certificate of release of tax lien is an official document that confirms the removal of a tax lien from your property records. It verifies that any outstanding tax obligations have been satisfied and legally restores clear title to the property. Obtaining this certificate is essential for homeowners looking to sell or refinance and can be processed through the Application for Certificate Releasing Connecticut Estate Tax Lien.