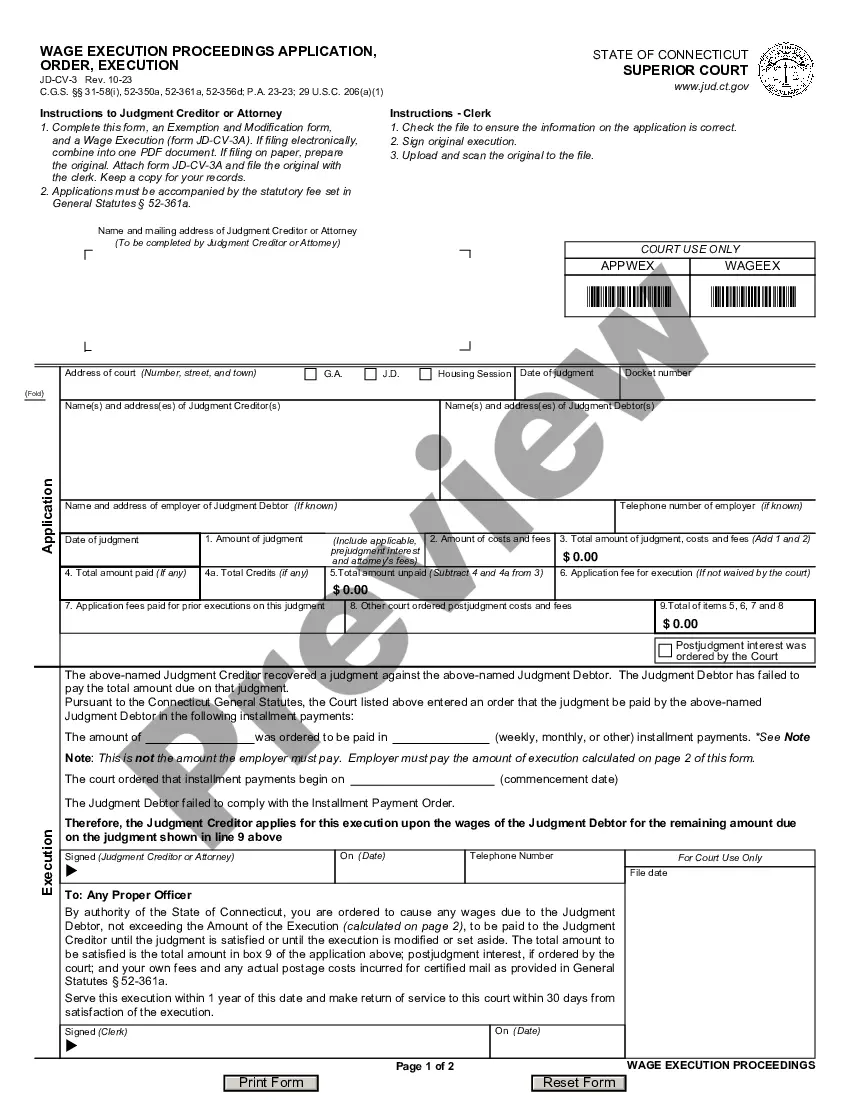

Connecticut Application for Wage Execution and Order is a legal form that is used to garnish wages from an employer for the purpose of collecting a debt owed by an employee. It is also known as a “wage garnishment” or an “execution of earnings.” The form is filed in the Connecticut Superior Court and requires the employer to withhold a certain percentage of the employee’s wages to be sent to the creditor. The application must include information such as the employee’s name and address, the amount of debt owed, and the creditor’s name and address. The types of Connecticut Application for Wage Execution and Order include Child Support Wage Execution, Student Loan Wage Execution, and General Wage Execution.

Connecticut Application for Wage Execution and Order

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Connecticut Application For Wage Execution And Order?

Handling legal paperwork demands focus, precision, and utilizing well-constructed templates. US Legal Forms has been assisting individuals nationwide for 25 years, so when you select your Connecticut Application for Wage Execution and Order template from our collection, you can be confident it adheres to federal and state regulations.

Using our service is straightforward and quick. To acquire the required documentation, all you need is an account with an active subscription. Here’s a concise guide to help you obtain your Connecticut Application for Wage Execution and Order in just a few minutes.

All documents are prepared for multiple uses, such as the Connecticut Application for Wage Execution and Order displayed on this page. If you need them again in the future, you can complete them without any extra payment - simply go to the My documents tab in your profile and finalize your document whenever needed. Experience US Legal Forms and efficiently handle your business and personal paperwork in complete legal compliance!

- Ensure to carefully review the form's content and its alignment with general and legal standards by previewing it or reading its description.

- Look for an alternate formal template if the previously accessed one does not fit your needs or state laws (the option for that is located in the top page corner).

- Log in to your account and save the Connecticut Application for Wage Execution and Order in your desired format. If this is your first time using our service, click Buy now to proceed.

- Create an account, select your subscription plan, and make a payment using your credit card or PayPal.

- Choose the format in which you want to receive your form and click Download. Print the template or add it to a professional PDF editor for a paperless submission.

Form popularity

FAQ

Wage garnishment can significantly impact your financial situation, as it reduces your disposable income. It may create hardships in meeting everyday living expenses or saving for future needs. Understanding the implications through the Connecticut Application for Wage Execution and Order enables you to take proactive steps to mitigate the effects and explore possible solutions.

Wage execution in Connecticut is a legal process through which a creditor can obtain a court order to garnish an employee's wages for debt repayment. This process involves specific procedures and documentation. Utilizing the Connecticut Application for Wage Execution and Order can help you navigate the steps and safeguard your rights during the process.

You can fight wage garnishment in Connecticut by filing objections with the court that issued the wage execution. Ensure you submit your objections within the specified time frame to avoid complications. Seeking assistance from a legal professional can be beneficial, and the Connecticut Application for Wage Execution and Order will help you understand your rights and process.

To write a letter to stop wage garnishment, begin by clearly stating your intent to contest the wage execution. Include your personal information, the case number, and a request for reconsideration. Use the Connecticut Application for Wage Execution and Order as a guide for ensuring that all required information is included to support your case effectively.

Quitting your job may seem like an easy way to avoid wage garnishment, but it can lead to other difficulties. Instead of taking drastic steps, consider addressing the Connecticut Application for Wage Execution and Order directly with your employer or seek legal advice. Understand that walking away could affect your future employment opportunities and financial stability.

When writing a letter to the judge regarding wage garnishment, start by clearly stating your case and including pertinent details such as your name, case number, and the specifics of the garnishment. Explain your situation and why you believe the garnishment should be reviewed or modified, referencing the Connecticut Application for Wage Execution and Order as necessary. Be concise, respectful, and ensure your letter adheres to the court’s guidelines. USLegalForms can assist you in drafting a professional letter that meets legal standards.

To stop wage garnishment, consider filing a Connecticut Application for Wage Execution and Order. This legal process can help you contest the garnishment by addressing its validity or the amount being withheld. Additionally, you could negotiate a payment plan with your creditor to prevent further deductions from your wages. Using a service like USLegalForms can simplify this process and provide you with the necessary documents.

Challenging a wage garnishment is possible and often advisable if you believe it is unwarranted. You can contest it by filing a motion in the court that ordered the garnishment. This process involves providing evidence to support your case. Leveraging the Connecticut Application for Wage Execution and Order can assist in properly filing your challenge.

Yes, you can negotiate even after a wage garnishment has begun. Communication with your creditor may lead to a resolution that feels fair to both parties. You can discuss a repayment plan or a settlement that may satisfy the debt without ongoing garnishment. Using the Connecticut Application for Wage Execution and Order can help clarify the negotiation process.

To stop a wage garnishment in Connecticut, you can file a motion with the court that issued the wage execution or order. This application allows you to present your case as to why the garnishment should end. It's essential to act quickly, as deadlines apply. Utilizing the Connecticut Application for Wage Execution and Order can streamline this process.