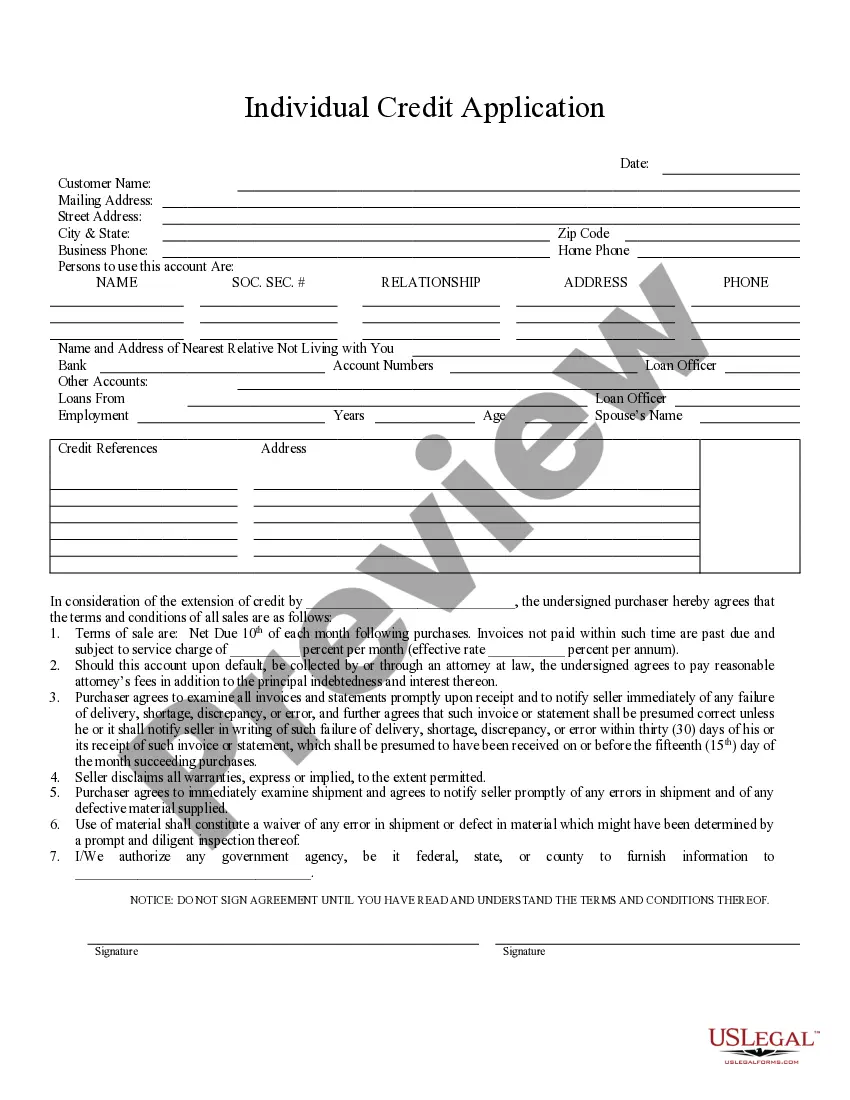

Connecticut Individual Credit Application

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Connecticut Individual Credit Application?

The greater number of documents you need to produce - the more anxious you become.

You can find thousands of Connecticut Individual Credit Application forms online, but you cannot determine which ones to trust.

Eliminate the inconvenience of obtaining samples by utilizing US Legal Forms.

Select a preferred file format and receive your template.

- Ensure the Connecticut Individual Credit Application is applicable in your state.

- Verify your choice by reviewing the description or using the Preview mode if available for the selected document.

- Click on Buy Now to initiate the registration process and select a pricing plan that fits your needs.

- Provide the requested information to create your account and pay for your order using your PayPal or credit card.

Form popularity

FAQ

Getting a Connecticut tax registration number involves filling out a registration form, which can be submitted online or by mail. Make sure you have your business details and relevant tax information ready. Completing your Connecticut Individual Credit Application efficiently can be achieved by using resources like uslegalforms, which provide templates and expert guidance to simplify the process.

To obtain a Connecticut tax registration number, you need to complete the appropriate application forms available from the Connecticut Department of Revenue Services. The application process usually requires information about your business structure, ownership, and activities. By applying for a Connecticut Individual Credit Application, you can streamline your registration. Uslegalforms can guide you through the application and ensure you have all necessary documentation.

A tax registration number and a tax ID number are often used interchangeably, but they vary by context. The tax registration number typically refers to a state identifier, while the tax ID number can refer more broadly to federal or state identifiers. In the context of your Connecticut Individual Credit Application, clarity on these terms is crucial for accurate completion. Uslegalforms offers easy access to the necessary information to ensure you're using the right terms.

No, a Connecticut tax registration number is not the same as an Employer Identification Number (EIN). The tax registration number is used for state tax purposes, while the EIN is a federal tax identification number used by the IRS. When completing your Connecticut Individual Credit Application, ensure you have the correct identifiers to avoid any processing errors. If you are unsure, uslegalforms can assist you in navigating these distinctions.

The registration tax in Connecticut varies based on the type of vehicle or property you are registering. Generally, this tax is calculated using a specific rate for the assessed value of the property or vehicle. When applying for a Connecticut Individual Credit Application, being aware of these costs can help you budget appropriately. Utilizing platforms like uslegalforms can provide you with guidance on registration tax and related requirements.

To receive credit for property taxes in Connecticut, you must apply through the appropriate state channels. Completing the Connecticut Individual Credit Application is an excellent first step, as it provides a clear pathway to accessing potential refunds. Make sure to gather all required documentation to support your application and maximize your credits.

Yes, senior citizens may be eligible for property tax breaks in Connecticut. Various programs are available specifically designed to assist older adults with their property taxes. Applying through the Connecticut Individual Credit Application allows seniors to discover the benefits and credits available to them.

Qualifying for a tax credit in Connecticut often involves meeting specific income thresholds and residency requirements. You'll need to provide financial information that demonstrates your eligibility. Completing the Connecticut Individual Credit Application will streamline this process and help ensure that you take advantage of all available credits.

In Connecticut, the income limit for the earned income tax credit varies based on your filing status and number of dependents. This limit is subject to change annually, so it's crucial to check the latest updates. Utilizing the Connecticut Individual Credit Application ensures you understand the current limits and efficiently determine your potential benefits.

To qualify for the Connecticut property tax credit, you must be a resident of Connecticut and meet specific income requirements. Homeowners and renters may apply if they earn less than the set income limit. The Connecticut Individual Credit Application captures necessary information to assess your eligibility and maximize the tax credit you deserve.