Connecticut Letter from Landlord to Tenant Returning security deposit less deductions

Overview of this form

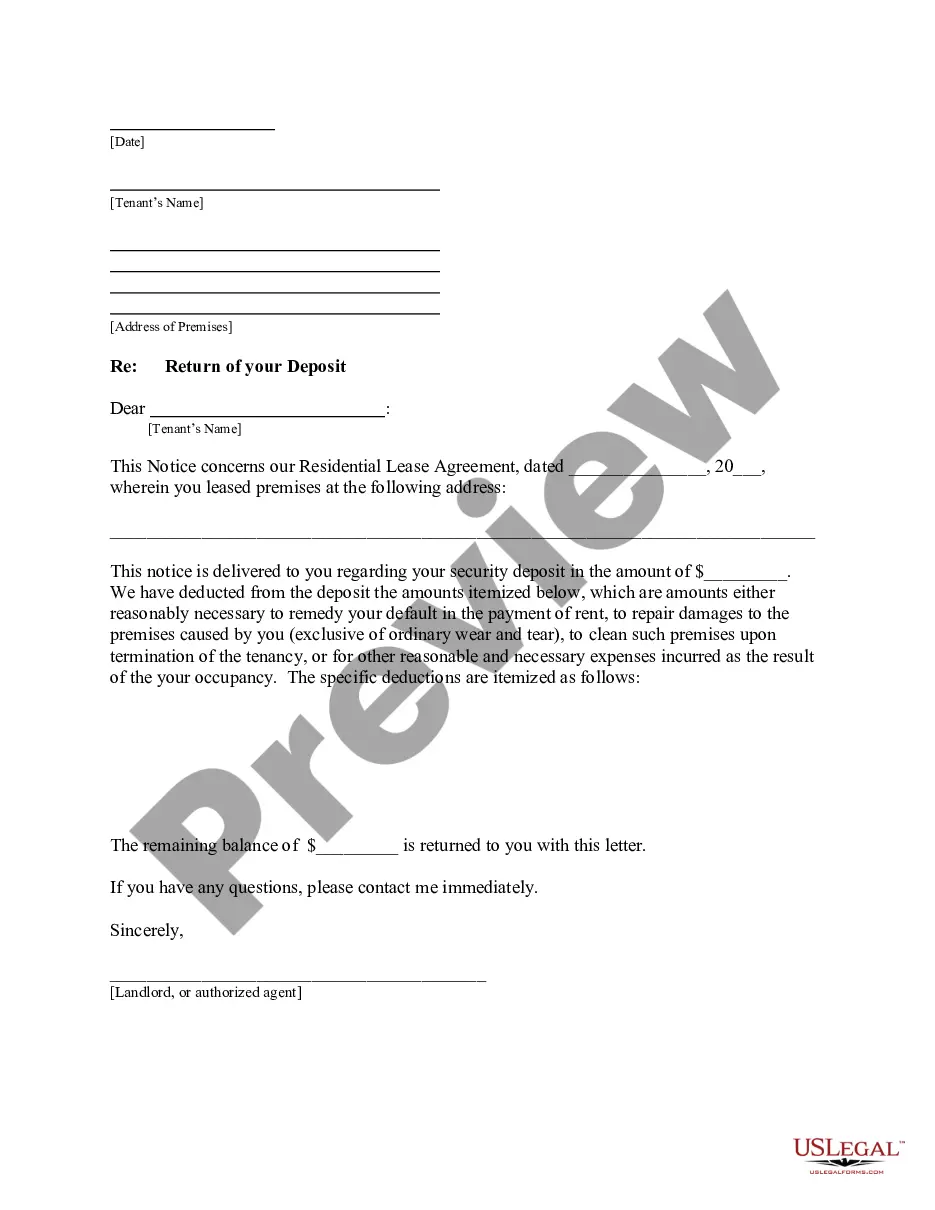

This form is a Letter from Landlord to Tenant Returning security deposit less deductions. It serves to notify the tenant about the specific deductions made from their security deposit. These deductions may cover unpaid rent, damages caused by the tenant, cleaning costs upon lease termination, or other necessary expenses incurred. This form clarifies the difference between the security deposit and rent, ensuring that both parties have a clear understanding of their financial responsibilities upon the end of the tenancy.

What’s included in this form

- Information about the landlord and tenant, including names and contact details.

- Lease agreement details, including the date and property address.

- The total amount of the security deposit being returned.

- A breakdown of deductions made from the security deposit with specific reasons.

- Signature lines for the landlord and date of sending the letter.

When this form is needed

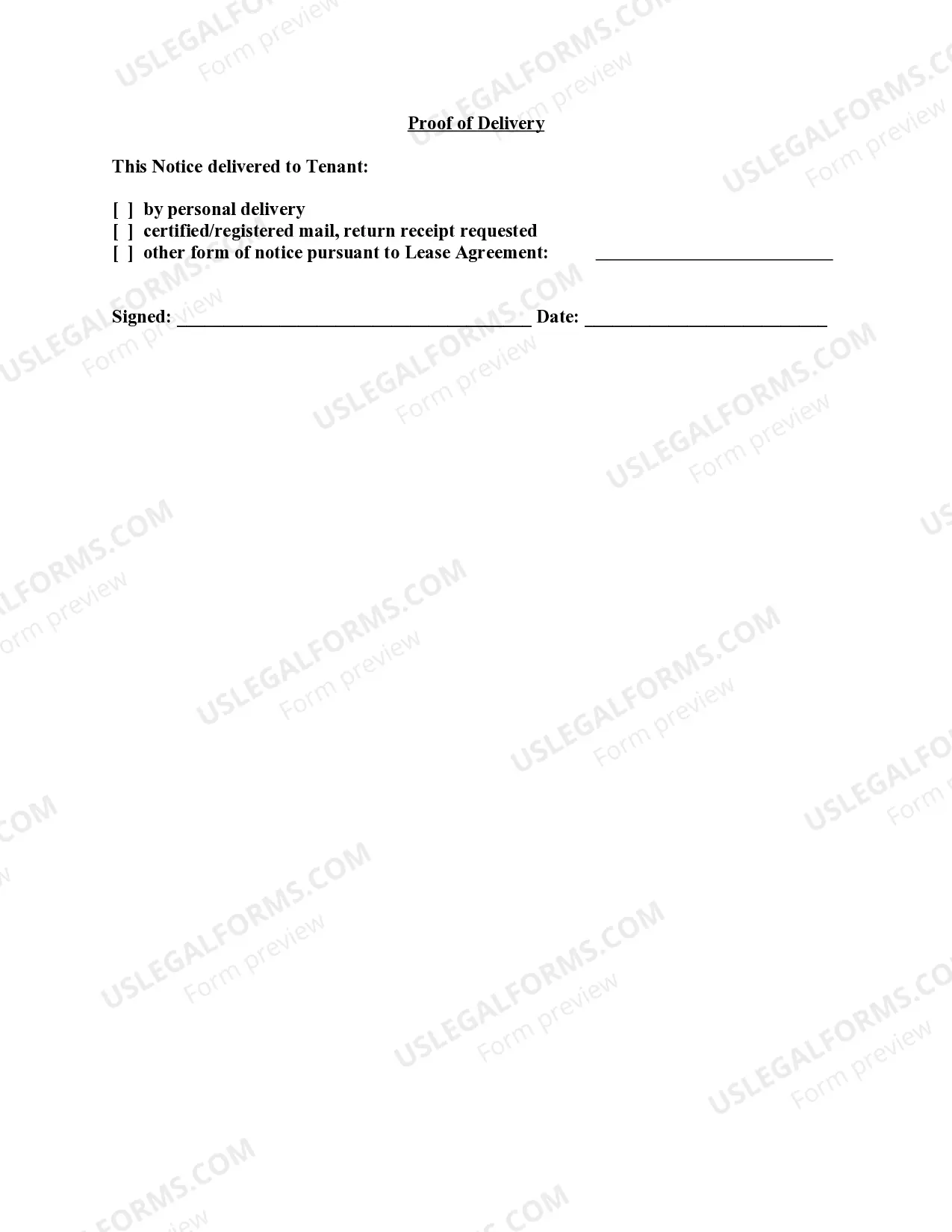

This form should be used when a landlord needs to formally communicate the return of a tenant's security deposit, along with any deductions. It is particularly necessary after a tenant has vacated the rental property and may cover various costs related to the unit's condition and any unpaid obligations. Utilizing this letter helps ensure clarity and documentation of the financial aspects related to the security deposit.

Who should use this form

This form is relevant for:

- Landlords who have rented out residential properties and are returning security deposits.

- Tenants who wish to understand the deductions from their security deposit at the lease's conclusion.

- Property managers handling rental agreements and tenant relations.

How to prepare this document

- Identify the parties involved by filling in the landlord's and tenant's names and contact information.

- Specify the address of the rental property and the date of the lease agreement.

- Enter the total amount of the security deposit being returned.

- Itemize the deductions being made from the deposit, with clear explanations for each.

- Sign and date the letter to finalize the notification to the tenant.

Is notarization required?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Typical mistakes to avoid

- Failing to itemize deductions properly, which can lead to disputes.

- Not providing the notice within the required timeframe set by state law.

- Using ambiguous language that may confuse the tenant regarding the reasons for deductions.

Benefits of using this form online

- Convenience of accessing and completing the form from home.

- Editability allows you to customize the form as per specific circumstances.

- Reliability in ensuring compliance with legal standards and formatting.

Form popularity

FAQ

To write a letter to your landlord for your security deposit, start with a clear and polite opening that states your intention. Mention your rental property details, the date you moved out, and the condition of the apartment. You can refer to the Connecticut Letter from Landlord to Tenant Returning security deposit less deductions to ensure you include necessary points like your forwarding address for the deposit. Using a structured approach not only makes your letter effective but also shows your professionalism.

To write a letter to your landlord requesting a rent reduction, start by clearly stating your intention at the top of the letter. Include your address, the landlord's address, and the date. Next, briefly explain your reasons for the request, such as financial hardship or changes in market conditions. Remember to express appreciation for their consideration and mention the Connecticut Letter from Landlord to Tenant Returning security deposit less deductions as a formal way to communicate any financial adjustments.

In requesting a security deposit return, start with your name, date, and the rental address. Clearly state your request for the return of the security deposit, referencing the number of days since move-out. Lastly, mention any lack of communication regarding deductions to motivate a timely response from the landlord.

When crafting a return letter, begin by stating the tenant's name, rental property address, and the total security deposit amount. Clearly outline any deductions, along with their corresponding explanations and costs. Conclude with the final amount being returned, ensuring to send this within the mandated 30 days for compliance with Connecticut law.

The security deposit may cover unpaid rent, costs for repairs from tenant damages, cleaning fees beyond normal wear and tear, replacement of lost or unreturned items, and any necessary expenses to restore the property to its original condition. Understanding these elements can guide both landlords and tenants in handling the return process effectively.

Landlords in Connecticut can deduct for damages such as broken windows, large holes in walls, or excessive cleaning costs. Other deductions may include unpaid rent, fees for lost keys, or items left behind in the rental. Providing clear documentation is crucial when creating the Connecticut Letter from Landlord to Tenant Returning security deposit less deductions.

An example letter can detail the specific damages observed during the move-out inspection, alongside corresponding repair costs. It should clearly state the total amount of the security deposit, any deductions, and the final amount being returned to the tenant. This structured approach ensures transparency and helps prevent disputes about the deductions.

Connecticut law stipulates the maximum security deposit a landlord can collect is equal to two months' rent for leases. Upon termination, landlords must return the security deposit within 30 days, detailing any deductions made for property damage or other permissible reasons. For clarity and compliance, using the Connecticut Letter from Landlord to Tenant Returning security deposit less deductions is advisable.

In Connecticut, landlords can deduct expenses related to damages beyond normal wear and tear, unpaid rent, or costs associated with cleaning the unit if it is not returned in satisfactory condition. Additionally, they can deduct for repairs that are necessary due to tenant negligence or intentional harm. These deductions must be well documented to ensure transparency when issuing the security deposit return letter.

In Connecticut, normal wear and tear refers to the natural deterioration that occurs over time due to regular use of the rental property. This includes minor scuffs on walls, worn carpet, or fading paint. Such damage cannot be deducted from the security deposit. Landlords should differentiate between normal wear and damages beyond this acceptable threshold.