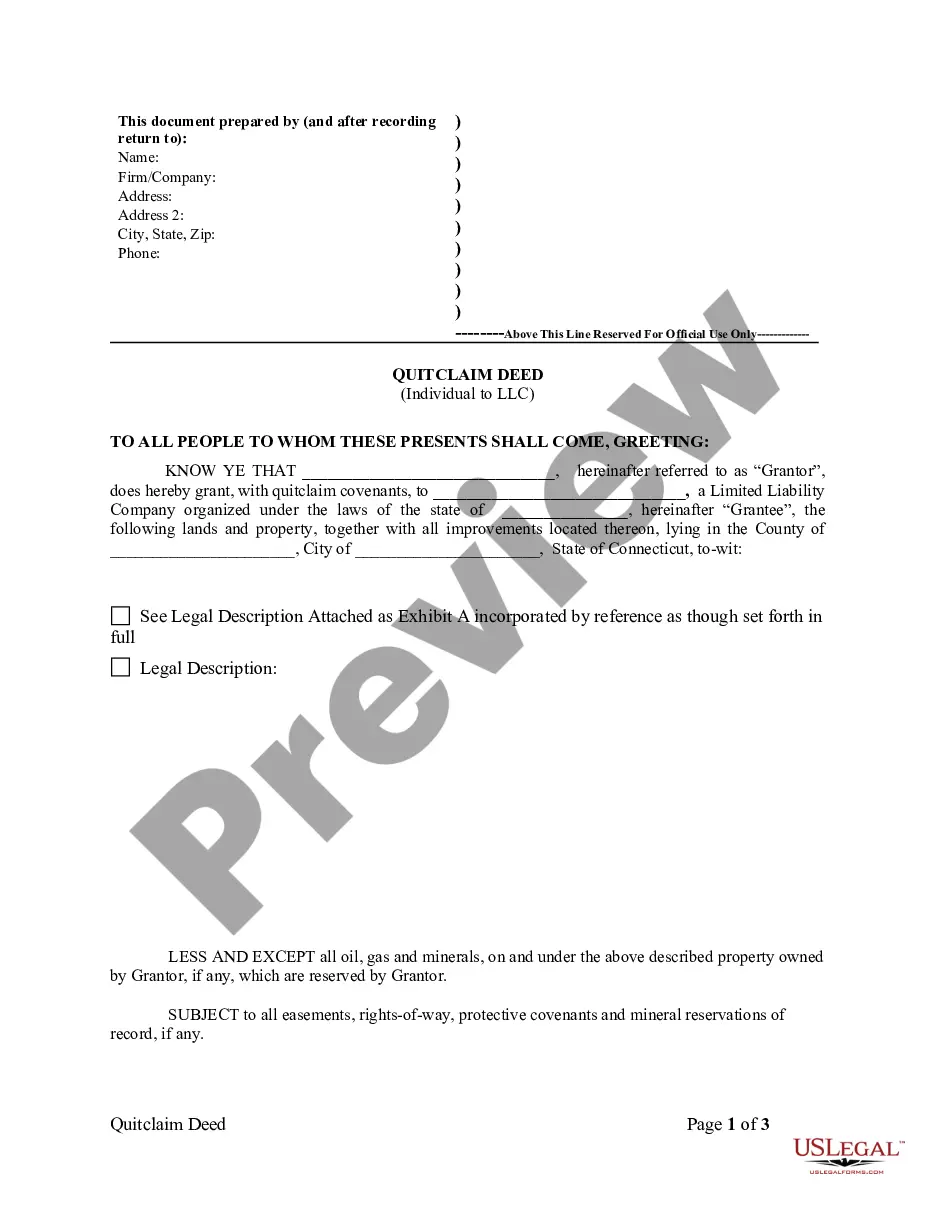

This Quitclaim Deed from Individual to LLC form is a Quitclaim Deed where the grantor is an individual and the grantee is a limited liability company. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

Connecticut Quitclaim Deed from Individual to LLC

Description

How to fill out Connecticut Quitclaim Deed From Individual To LLC?

The higher quantity of documents you need to prepare - the more anxious you become.

You can find thousands of Connecticut Quitclaim Deed from Individual to LLC templates online, but you may be unsure which ones to trust.

Eliminate the hassle of obtaining samples by using US Legal Forms.

Select Buy Now to initiate the registration process and pick a pricing plan that suits your needs. Fill in the required details to create your account and pay for your order using PayPal or a credit card. Choose a preferred document type and obtain your sample. Locate each sample you download in the My documents section. Simply go there to generate a new version of the Connecticut Quitclaim Deed from Individual to LLC. Even when utilizing professionally drafted templates, it’s still advisable to consider asking a local attorney to verify the filled-out sample to ensure that your document is accurately completed. Achieve more for less with US Legal Forms!

- Obtain professionally created documents that comply with state standards.

- If you have a US Legal Forms subscription, Log In to your account, and you'll find the Download button on the Connecticut Quitclaim Deed from Individual to LLC webpage.

- If you have not used our service before, follow these instructions to register.

- Ensure that the Connecticut Quitclaim Deed from Individual to LLC is valid in your state.

- Verify your choice by reviewing the description or utilizing the Preview feature if accessible for the chosen document.

Form popularity

FAQ

Yes, you can prepare a quitclaim deed yourself. However, it's important to ensure that you follow all required steps and include necessary information. Using the templates available on US Legal Forms can help simplify the process. Just remember to record the deed to make the transfer official and protect your interests.

You can obtain a quitclaim deed in Connecticut by visiting the US Legal Forms platform, where you can find templates and specific instructions. Ensure that you complete the form accurately, including all essential details about the property and the parties involved. Once filled out, have it notarized and file it with your relevant county clerk's office.

In Ohio, a quitclaim deed operates similarly to the Connecticut Quitclaim Deed from Individual to LLC. It allows a property owner to transfer any interest they have in the property without making any guarantees about its validity. Ensure that both parties understand the implications and, if necessary, consult with a legal professional.

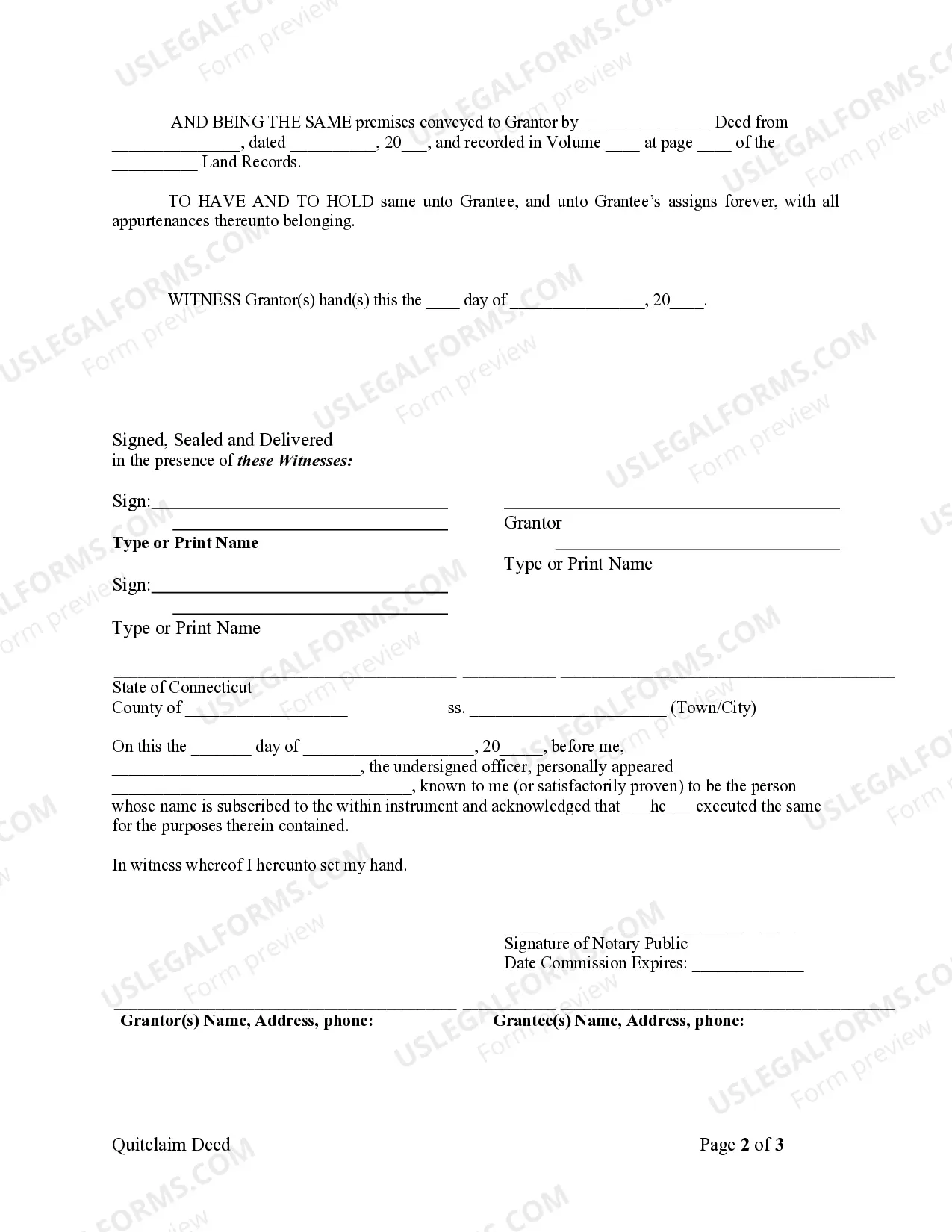

To transfer a deed from an individual to an LLC in Connecticut, you need to draft a Connecticut Quitclaim Deed from Individual to LLC. This deed must include specific details about the property and the LLC. After completing the deed, sign it before a notary public and record it with your local land records office to finalize the transfer.

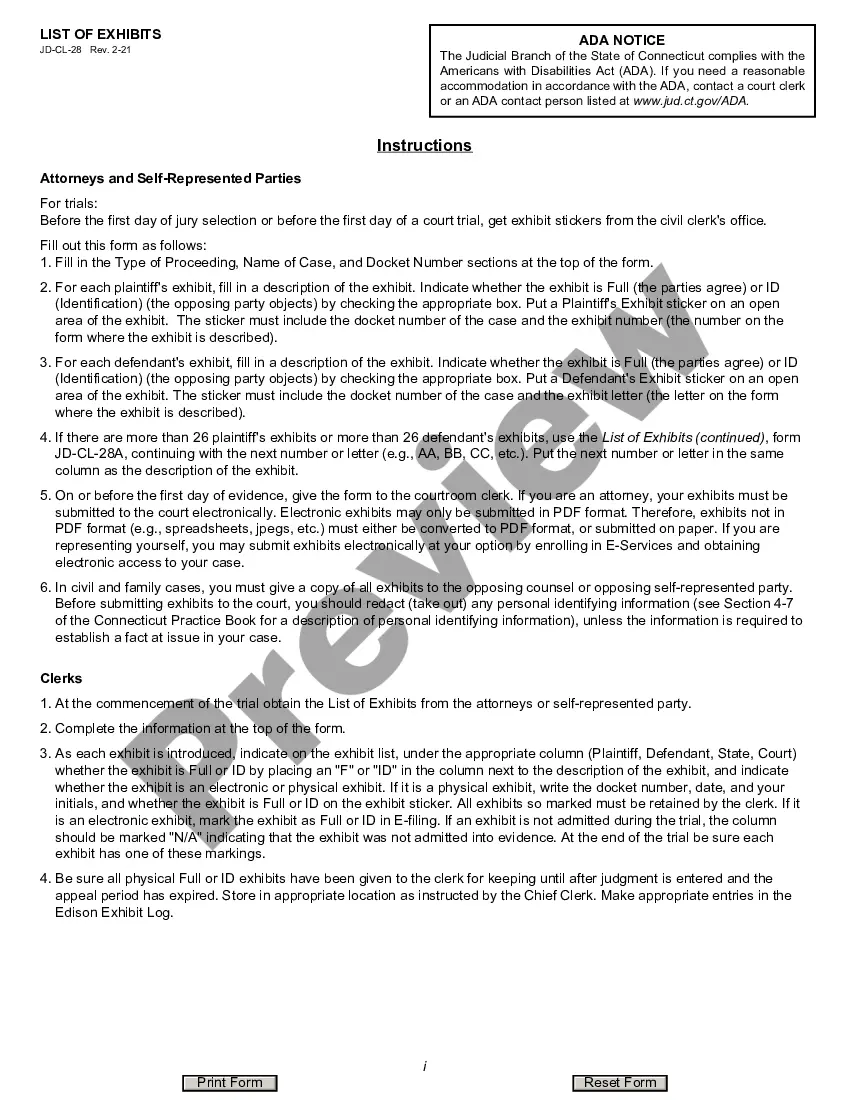

Filing a quitclaim deed in Connecticut is a straightforward process. Once you fill out the Connecticut Quitclaim Deed from Individual to LLC form, take it to the town clerk’s office where the property is located. Submit the completed deed along with any required filing fees. It’s essential to keep a copy for your records, as this maintains proof of the ownership transfer.

To transfer a title from an individual to an LLC, you will need to complete a quitclaim deed that specifies the transfer of ownership. This deed should clearly state the names of both the individual and the LLC, as well as the property description. After filling out the Connecticut Quitclaim Deed from Individual to LLC, ensure all parties sign the document. Finally, file the signed deed with the appropriate county office to formalize the transfer.

To fill out a quitclaim deed form, first gather the necessary information about the transfer, including the names of the parties involved and the legal description of the property. Utilize the Connecticut Quitclaim Deed from Individual to LLC template, which ensures that you include all required details. After completing the form, both the individual transferring the property and a witness or notary public should sign it. Make sure to check local requirements to ensure compliance.

You can certainly file a quit claim deed yourself, as long as you follow the necessary procedures and requirements. It's important to ensure that the Connecticut Quitclaim Deed from Individual to LLC is correctly filled out and filed in accordance with local laws. Consider using online resources for guidance and templates to streamline the process.

In California, a quitclaim deed may be prepared by the property owner or an attorney. When dealing with complex property issues or the transition of a Connecticut Quitclaim Deed from Individual to LLC, professional assistance can ensure all legalities are addressed. Utilizing a user-friendly platform like uslegalforms can also make this process easier.

To file a quitclaim deed in Connecticut, prepare the document with required details, including the property description and the parties involved. Then, execute the deed in front of a notary public. Finally, submit the completed deed to your local town clerk for recording, finalizing the Connecticut Quitclaim Deed from Individual to LLC.