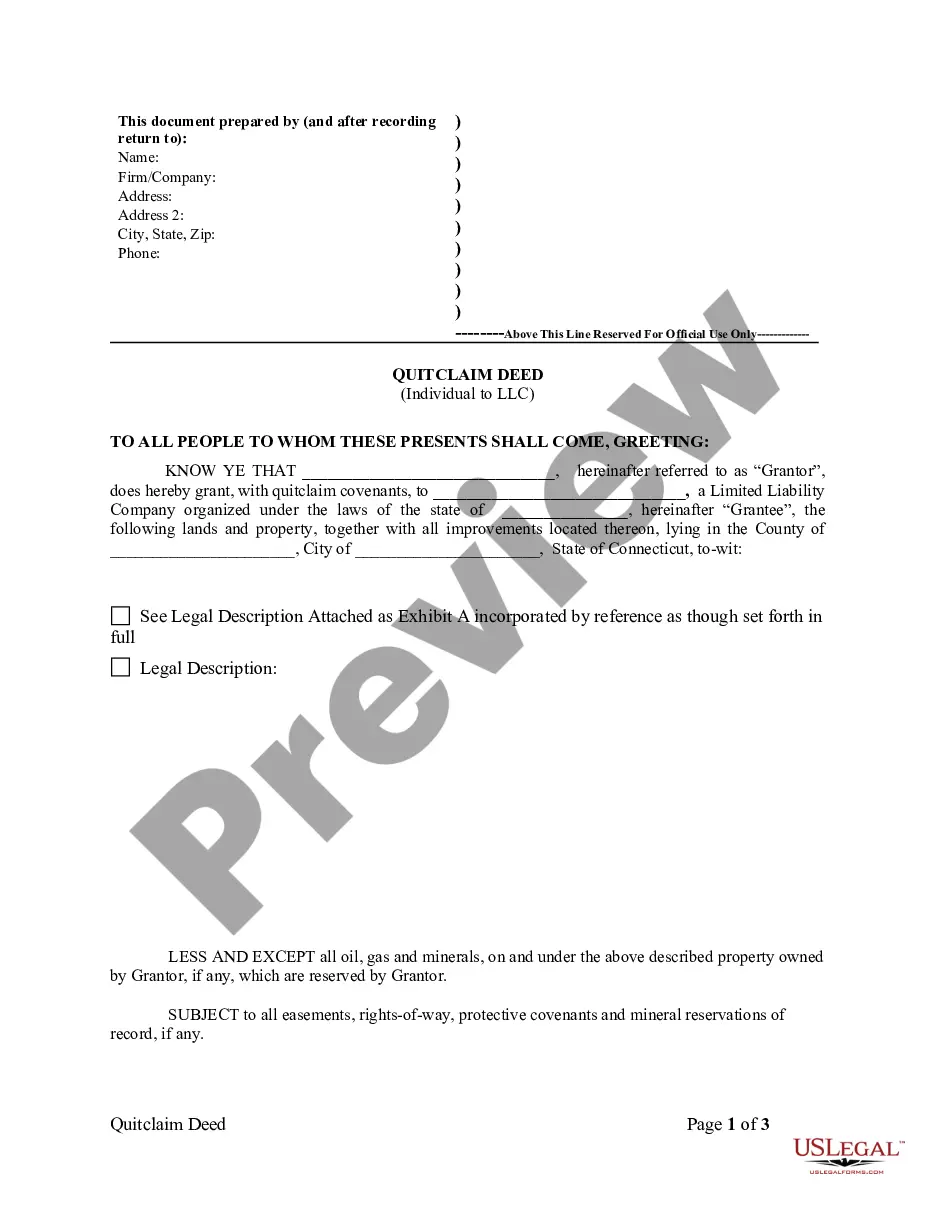

Connecticut Quitclaim Deed from Individual to LLC

What this document covers

This Quitclaim Deed from Individual to LLC is a legal document that allows an individual (the grantor) to transfer ownership of property to a limited liability company (the grantee). This form is essential for ensuring a clear and binding transfer of property rights, while differing from warranty deeds as it provides no guarantees about the property title. The quitclaim deed simply conveys whatever interest the grantor has in the property without any warranties or assurances regarding potential claims from others.

Main sections of this form

- Identification of the grantor (individual transferring the property)

- Identification of the grantee (the LLC receiving the property)

- Description of the property being transferred

- Reservation of potential mineral rights or other interests

- Effective date of the deed

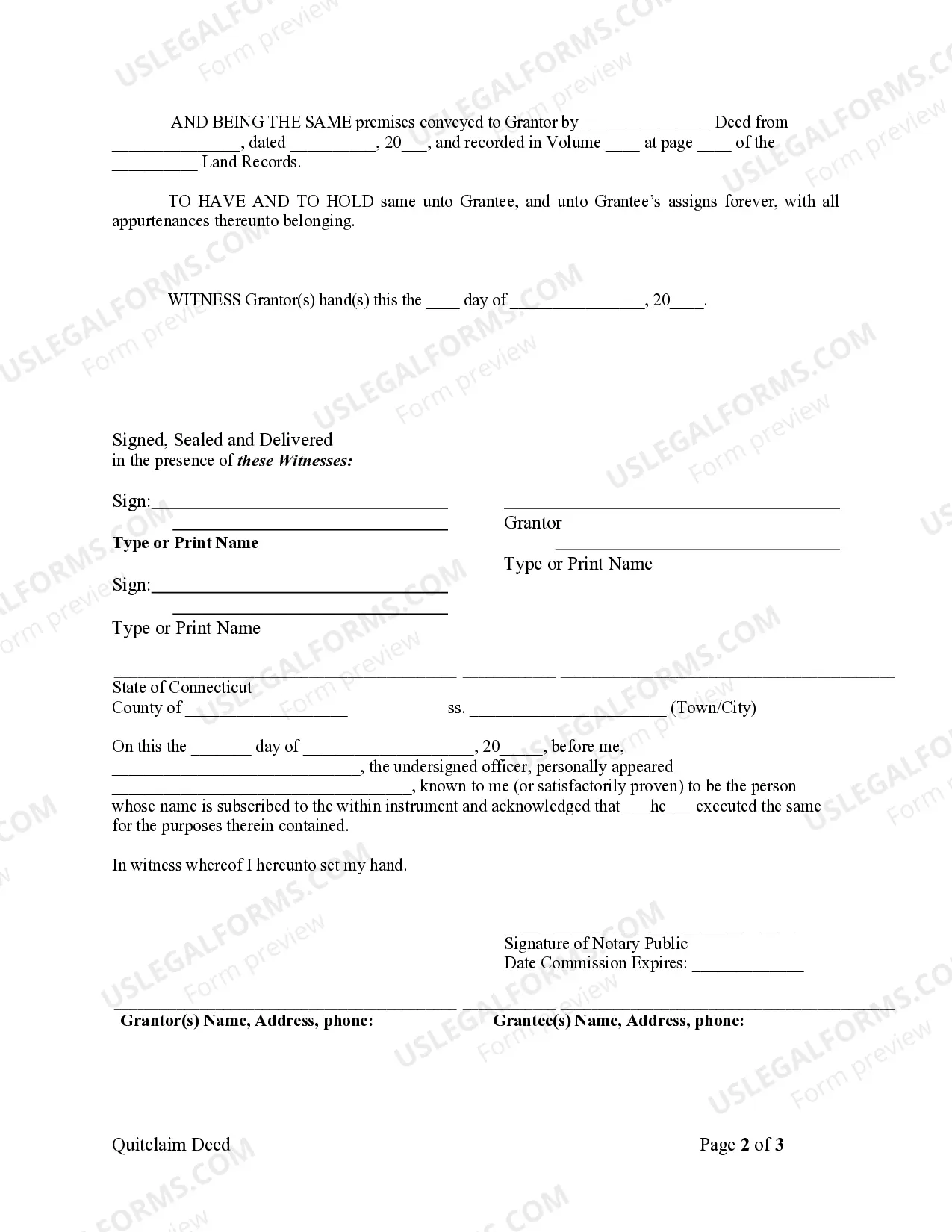

- Signature section for the grantor and witnesses

When to use this document

This form should be used when an individual wishes to transfer property to an LLC, often for purposes of asset protection, business operations, or estate planning. It is commonly utilized in situations where the grantor wants to ensure that the property is owned by the LLC rather than personally, which can help separate legal liabilities.

Who needs this form

- Individuals who are members or owners of an LLC

- Real estate investors transferring property to their LLC

- Business owners looking to protect their personal assets

- Estate planners needing to change the ownership structure of property

How to prepare this document

- Identify the parties involved: enter the grantor's name and the LLC's name.

- Specify the property: describe the property accurately in the designated section.

- Detail any reservations: indicate if there are any mineral rights or other interests being retained by the grantor.

- Enter the date and sign the form in the presence of witnesses.

- Ensure all required fields are filled before finalizing the document.

Does this document require notarization?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Avoid these common issues

- Failing to complete the property description adequately.

- Not signing the document in front of witnesses, if required.

- Omitting to clarify reserved rights, leading to disputes later.

- Not checking state-specific requirements for validity.

Benefits of completing this form online

- Convenience of downloading and filling out the form at your own pace.

- Access to templates that are drafted by licensed attorneys, ensuring legal compliance.

- Ability to customize the form to fit your specific needs.

Legal requirements by state

Ensure to check the specific requirements for your state as laws and regulations regarding quitclaim deeds can vary significantly. It is important to confirm that the form complies with your stateâs legal standards for such agreements.

Main things to remember

- A Quitclaim Deed transfers property from an individual to an LLC without warranties.

- Properly filling out the deed is crucial for legal verification.

- State laws may impact the use and effectiveness of the deed.

- Consider potential tax or legal implications of property transfers.

Form popularity

FAQ

Yes, you can prepare a quitclaim deed yourself. However, it's important to ensure that you follow all required steps and include necessary information. Using the templates available on US Legal Forms can help simplify the process. Just remember to record the deed to make the transfer official and protect your interests.

You can obtain a quitclaim deed in Connecticut by visiting the US Legal Forms platform, where you can find templates and specific instructions. Ensure that you complete the form accurately, including all essential details about the property and the parties involved. Once filled out, have it notarized and file it with your relevant county clerk's office.

In Ohio, a quitclaim deed operates similarly to the Connecticut Quitclaim Deed from Individual to LLC. It allows a property owner to transfer any interest they have in the property without making any guarantees about its validity. Ensure that both parties understand the implications and, if necessary, consult with a legal professional.

To transfer a deed from an individual to an LLC in Connecticut, you need to draft a Connecticut Quitclaim Deed from Individual to LLC. This deed must include specific details about the property and the LLC. After completing the deed, sign it before a notary public and record it with your local land records office to finalize the transfer.

Filing a quitclaim deed in Connecticut is a straightforward process. Once you fill out the Connecticut Quitclaim Deed from Individual to LLC form, take it to the town clerk’s office where the property is located. Submit the completed deed along with any required filing fees. It’s essential to keep a copy for your records, as this maintains proof of the ownership transfer.

To transfer a title from an individual to an LLC, you will need to complete a quitclaim deed that specifies the transfer of ownership. This deed should clearly state the names of both the individual and the LLC, as well as the property description. After filling out the Connecticut Quitclaim Deed from Individual to LLC, ensure all parties sign the document. Finally, file the signed deed with the appropriate county office to formalize the transfer.

To fill out a quitclaim deed form, first gather the necessary information about the transfer, including the names of the parties involved and the legal description of the property. Utilize the Connecticut Quitclaim Deed from Individual to LLC template, which ensures that you include all required details. After completing the form, both the individual transferring the property and a witness or notary public should sign it. Make sure to check local requirements to ensure compliance.

You can certainly file a quit claim deed yourself, as long as you follow the necessary procedures and requirements. It's important to ensure that the Connecticut Quitclaim Deed from Individual to LLC is correctly filled out and filed in accordance with local laws. Consider using online resources for guidance and templates to streamline the process.

In California, a quitclaim deed may be prepared by the property owner or an attorney. When dealing with complex property issues or the transition of a Connecticut Quitclaim Deed from Individual to LLC, professional assistance can ensure all legalities are addressed. Utilizing a user-friendly platform like uslegalforms can also make this process easier.

To file a quitclaim deed in Connecticut, prepare the document with required details, including the property description and the parties involved. Then, execute the deed in front of a notary public. Finally, submit the completed deed to your local town clerk for recording, finalizing the Connecticut Quitclaim Deed from Individual to LLC.