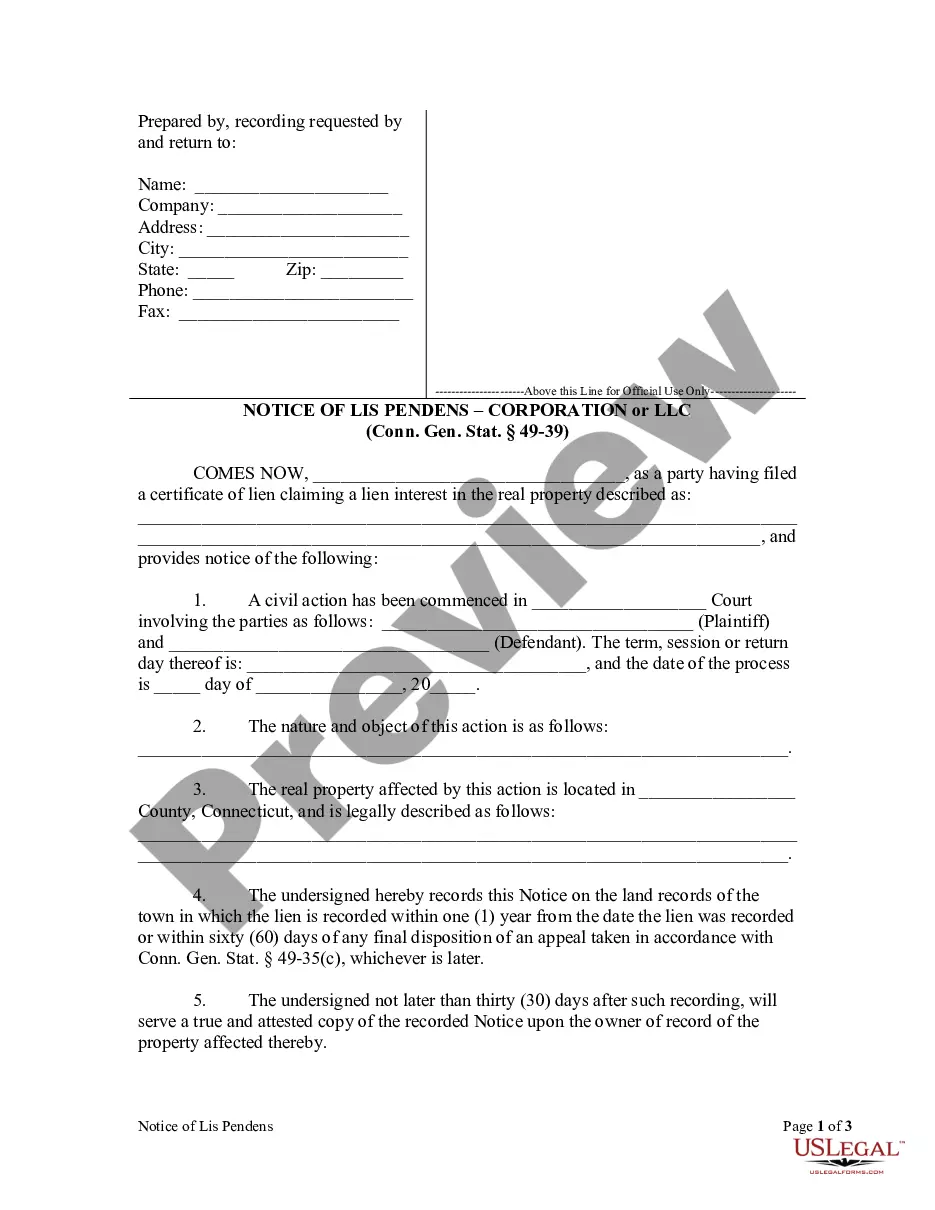

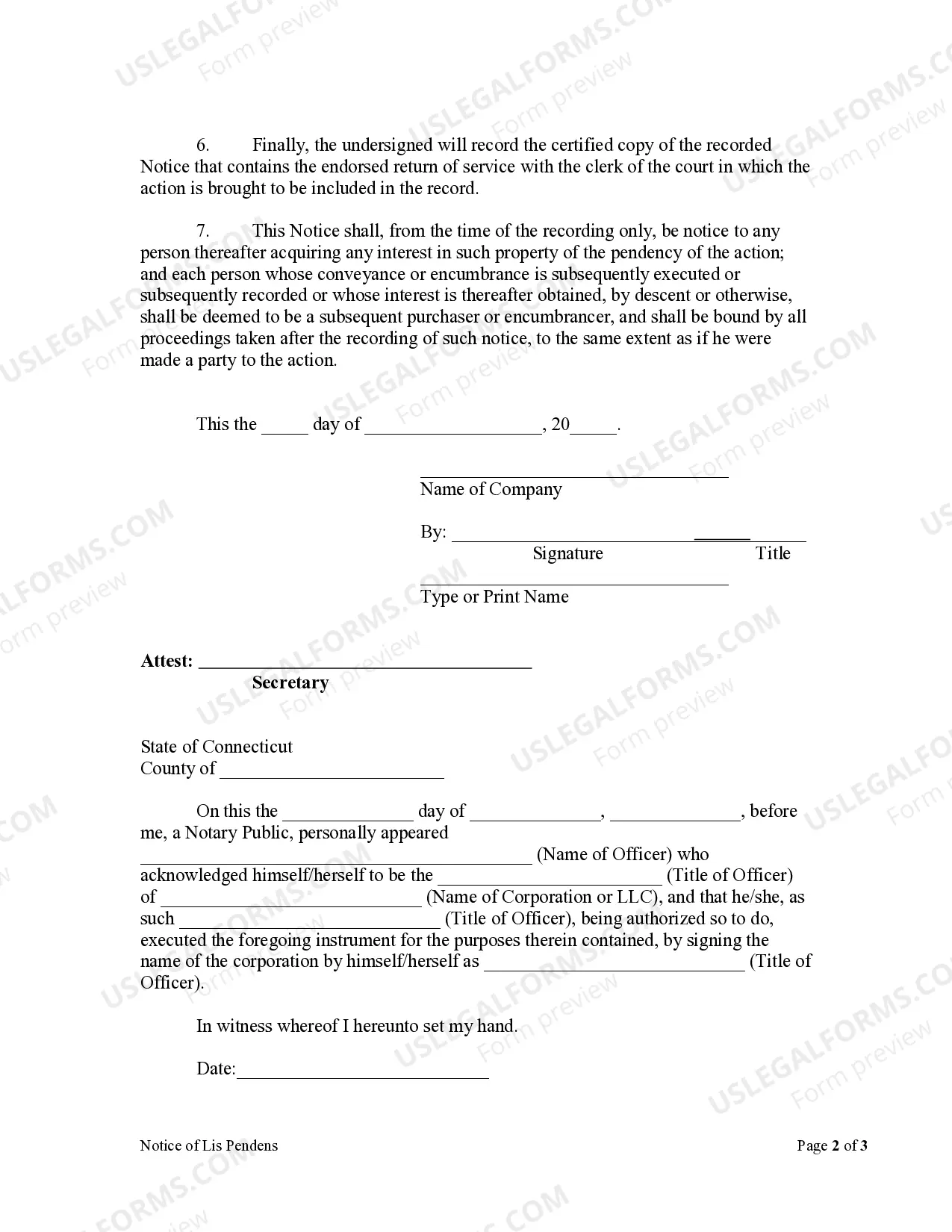

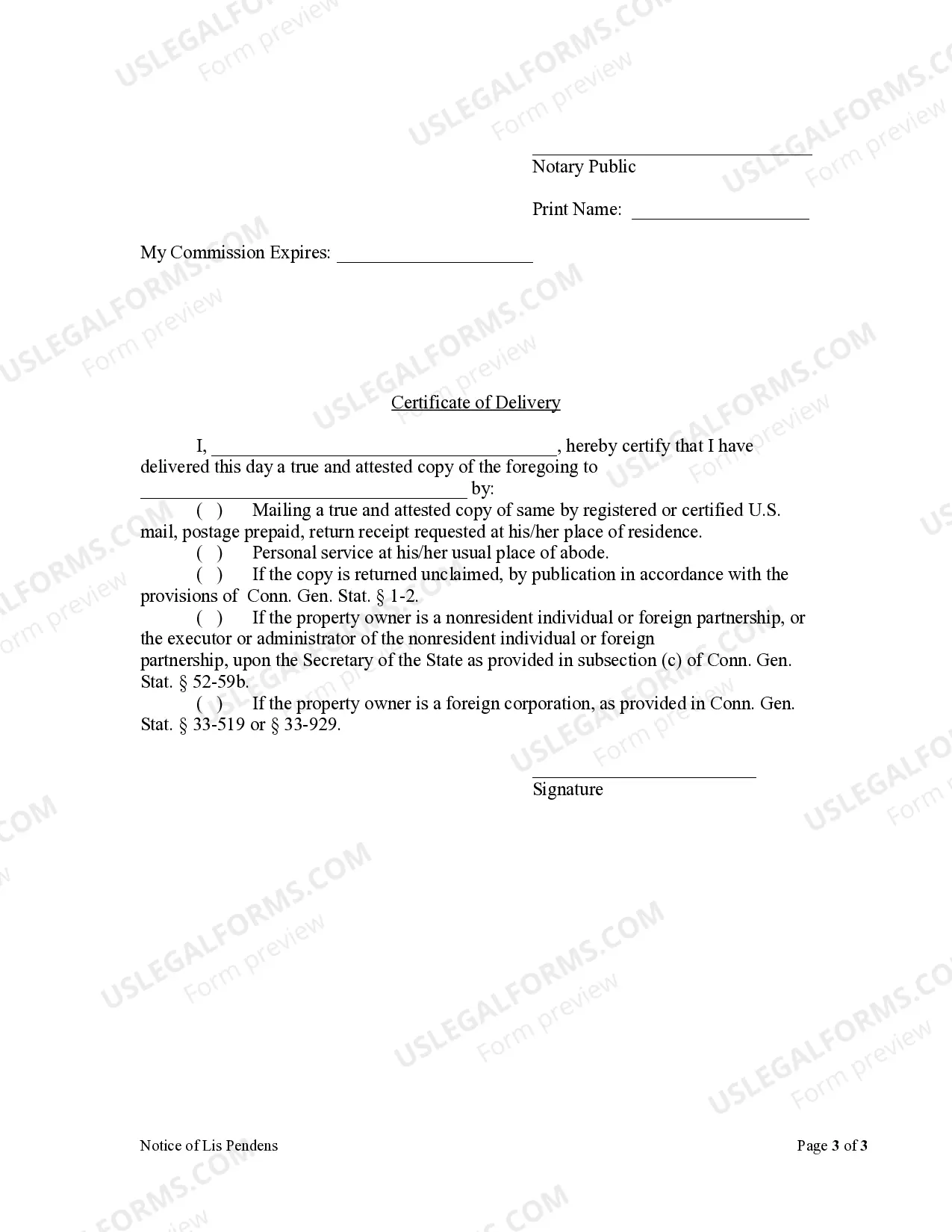

This Notice of Lis Pendens form is for use by a corporate or LLC party who has filed a certificate of lien claiming a lien interest in real property to provide notice of a civil action. The notice includes the name of the court where the action has been filed, the name of the parties to the action, the nature and object of the action, and the location and legal description of the property affected by the action. The notice must be recorded on the land records of the town in which the lien is recorded within one year from the date the lien was recorded or within 60 days of any final disposition of an appeal taken in accordance with Conn. Gen. Stat. § 49-35(c), whichever is later. The recorded notice must not later than 30 days after such recording, be served upon the owner of record of the property affected thereby. The certified copy of the recorded notice that contains the endorsed return of service must also be recorded with the clerk of the court in which the action is brought to be included in the record.

Connecticut Notice of Lis Pendens - Corporation or LLC

Description

How to fill out Connecticut Notice Of Lis Pendens - Corporation Or LLC?

The greater the number of documents you need to produce - the more stressed you become.

You can discover a vast array of Connecticut Notice of Lis Pendens - Corporation or LLC forms online, but you may be uncertain which ones to trust.

Eliminate the inconvenience of acquiring samples and make the process much easier with US Legal Forms.

Enter the required details to create your account and settle your order through PayPal or credit card. Choose a suitable document format and obtain your copy. Locate every template you acquire in the My documents section. Just visit there to prepare a new version of your Connecticut Notice of Lis Pendens - Corporation or LLC. Even with expertly crafted formats, it is still vital to consider consulting your local attorney to verify that your document is accurately completed. Achieve more for less with US Legal Forms!

- If you currently hold a US Legal Forms subscription, sign in to your account, and you will see the Download button on the Connecticut Notice of Lis Pendens - Corporation or LLC’s page.

- If you haven't utilized our platform before, follow these steps to register.

- Verify that the Connecticut Notice of Lis Pendens - Corporation or LLC is recognized in your residing state.

- Confirm your selection by reviewing the description or utilizing the Preview mode if it's available for the selected document.

- Click Buy Now to initiate the registration process and select a pricing plan that satisfies your requirements.

Form popularity

FAQ

To change the ownership of an LLC in Connecticut, begin by amending your operating agreement with the new ownership details. Subsequently, file the required amendment forms with the Secretary of State to officially register the change. It’s critical to ensure that you properly document all changes and update any relevant contracts. For a thorough solution, uslegalforms can assist with the necessary paperwork and guide you through the process to align with the Connecticut Notice of Lis Pendens - Corporation or LLC.

Changing ownership of your business involves drafting a sale agreement or an ownership transfer document. You will need to notify your state tax office and update any required licenses or permits. Additionally, if your business is an LLC, the Connecticut Notice of Lis Pendens - Corporation or LLC may play a role in protecting the interests of the new owner. For assistance, consider using uslegalforms for clear guidance and professional templates.

You can transfer an LLC to another person online by submitting the necessary documents through the Connecticut Secretary of State’s website. This typically involves filing a Certificate of Amendment or a document stating the ownership transfer. Make sure to follow any specific instructions provided on the state’s platform, as details can vary. Utilizing resources like uslegalforms can help simplify this process by providing templates necessary for a smooth transfer.

To change ownership of an LLC in Connecticut, you must first draft an operating agreement that outlines the new ownership structure. Once you agree on the changes, you may need to file an amendment with the Connecticut Secretary of State. Additionally, ensure that you notify relevant parties, such as your financial institutions and clients, about this change. This process is important for maintaining compliance and could be impacted by a Connecticut Notice of Lis Pendens - Corporation or LLC.

To apply the rule of lis pendens in Connecticut, there must be an active lawsuit regarding the property, and the notice should be filed at the court. Importantly, the notice must include a description of the property and the nature of the claim. It is essential that all interested parties receive proper notification. If you’re unsure of the filing process, ulegalforms can assist in ensuring compliance with all legal requirements.

The primary purpose of a lis pendens notice is to inform the public of an ongoing legal dispute involving a piece of real estate. It ensures that anyone interested in the property is aware of the pending litigation, thus protecting the rights of the claimant. This notice can also prevent the sale or transfer of the property until the dispute resolves. By effectively utilizing the Connecticut Notice of Lis Pendens - Corporation or LLC, you can secure your claims without unnecessary complications.

A notice of lis pendens in Connecticut serves as a public declaration about an ongoing legal action that may affect real estate ownership. This notation is crucial for anyone considering purchasing property or for lenders assessing risks. It acts as a warning to potential buyers that the property is subject to litigation. For proper compliance and documentation, using ulegalforms can simplify this important process.

In the context of a notice of lis pendens, the grantor is typically the party that files the notice with the court. This party is usually involved in a legal conflict concerning the property in question. Understanding the role of the grantor is crucial for corporations and LLCs in Connecticut because it establishes who is asserting a claim. You can easily navigate this through ulegalforms for efficient legal processes.

The terms notice of pendency and lis pendens refer to the same legal concept in Connecticut. Both indicate a pending lawsuit that may affect the ownership of specific real property. This notification ensures interested parties are aware of actions that could alter the status of property. Thus, utilizing the Connecticut Notice of Lis Pendens - Corporation or LLC can clarify property interests clearly.

In Connecticut, a notice of lis pendens remains in effect until the conclusion of the underlying litigation or until it is formally withdrawn. Generally, if the case does not reach a resolution, the notice may last indefinitely. However, it can be removed by the court or through a voluntary withdrawal. For precise handling, consider using ulegalforms for proper documentation.