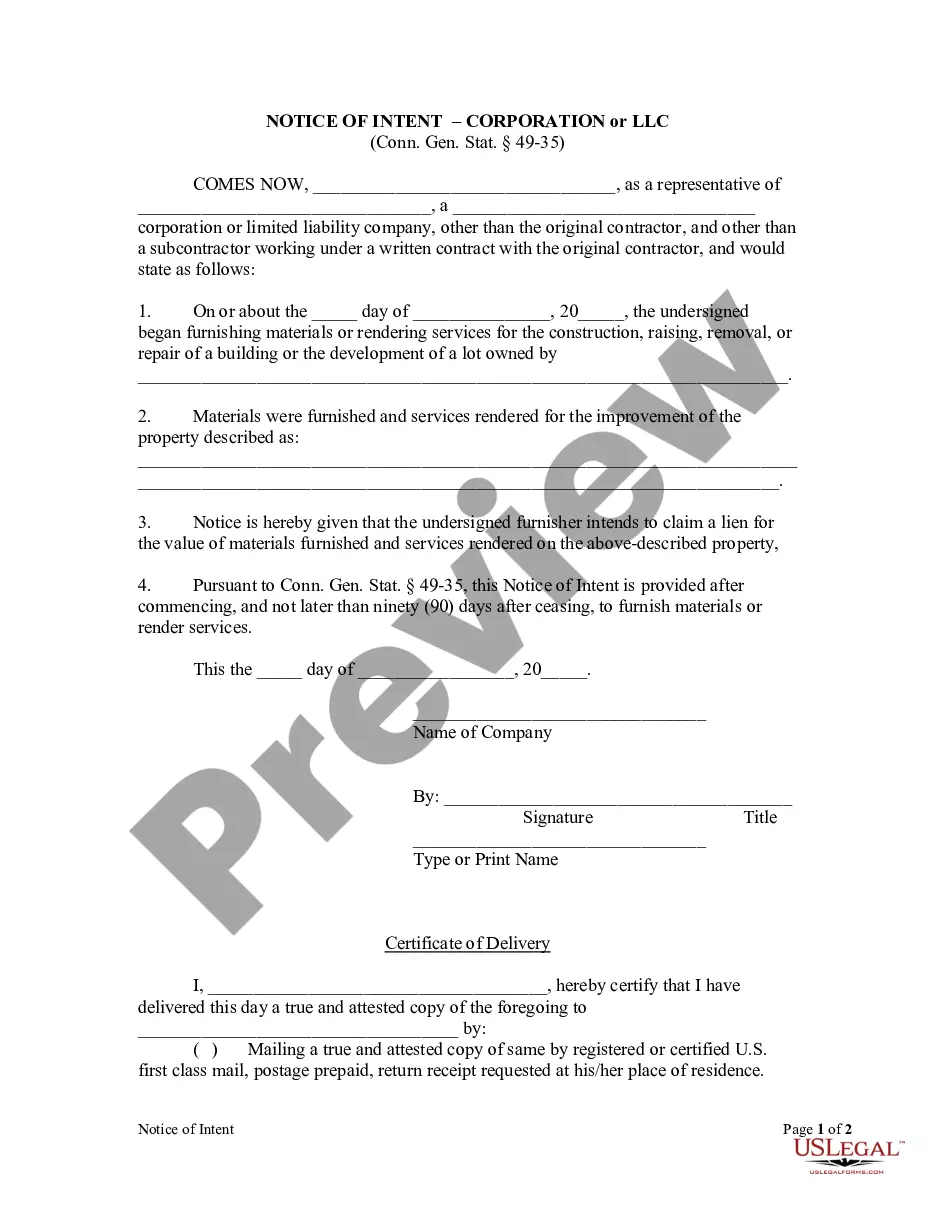

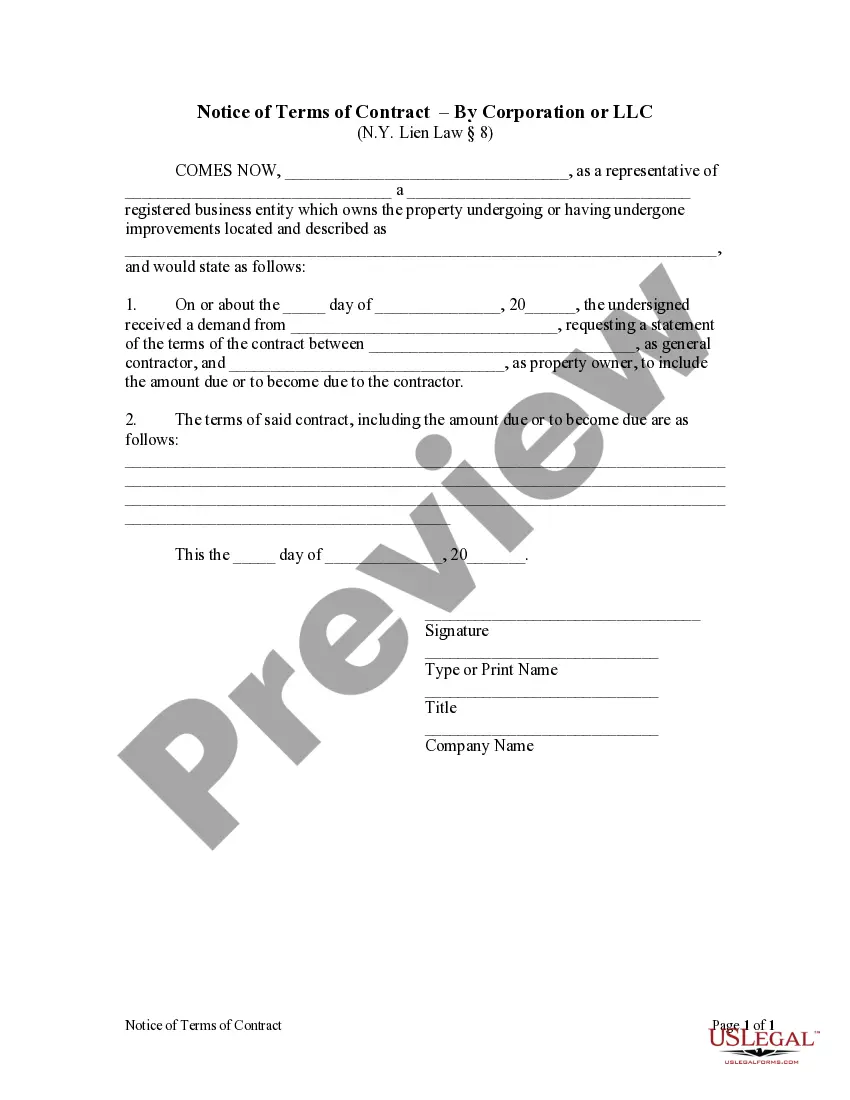

With one exception, Connecticut law only allows original contractors, and subcontractors whose contract with the original contractor is in writing and has been assented to in writing by the other party to the original contract, to claim a mechanic's lien. However, other parties may claim a lien if they provide a written notice to the property owner after commencing to furnish materials or render services but not later than ninety (90) days after ceasing to furnish materials or render services. This notice must be given to the property owner. Also, if the original contractor has recorded an affidavit stating the contractor's name, business address, and including a property description, a copy of the Notice of Intent must be served on the original contractor as well.

Connecticut Notice of Intent by Corporation

Description

How to fill out Connecticut Notice Of Intent By Corporation?

The greater the documentation you are required to produce - the more anxious you become.

You can discover a vast array of Connecticut Notice of Intent by Corporation or LLC templates online, yet you remain uncertain which ones to trust.

Eliminate the stress and simplify the process of obtaining samples by utilizing US Legal Forms.

Access every document you download in the My documents section. Just navigate there to create a new copy of your Connecticut Notice of Intent by Corporation or LLC. Even with professionally crafted forms, it remains essential to consider consulting a local attorney to verify that your form is accurately completed. Achieve more for less with US Legal Forms!

- Ensure the Connecticut Notice of Intent by Corporation or LLC is valid in your region.

- Verify your choice by examining the description or by using the Preview feature if available for the chosen document.

- Select Buy Now to initiate the registration process and choose a payment plan that suits your needs.

- Enter the required information to set up your profile and finalize your order using PayPal or credit card.

- Select a convenient document type and obtain your copy.

Form popularity

FAQ

The Secretary of State in Connecticut is responsible for overseeing business filings and maintaining public records. The current officeholder can be found on the official Connecticut Secretary of State's website. Keeping up with the current officeholder helps ensure you receive accurate and relevant updates concerning corporation regulations in Connecticut.

A corporation might dissolve due to financial difficulties leading to insolvency or a strategic decision by owners to exit a non-profitable venture. Additionally, changes in market conditions or regulatory compliance can necessitate dissolution. Understanding these reasons can help business owners make informed decisions regarding their corporations.

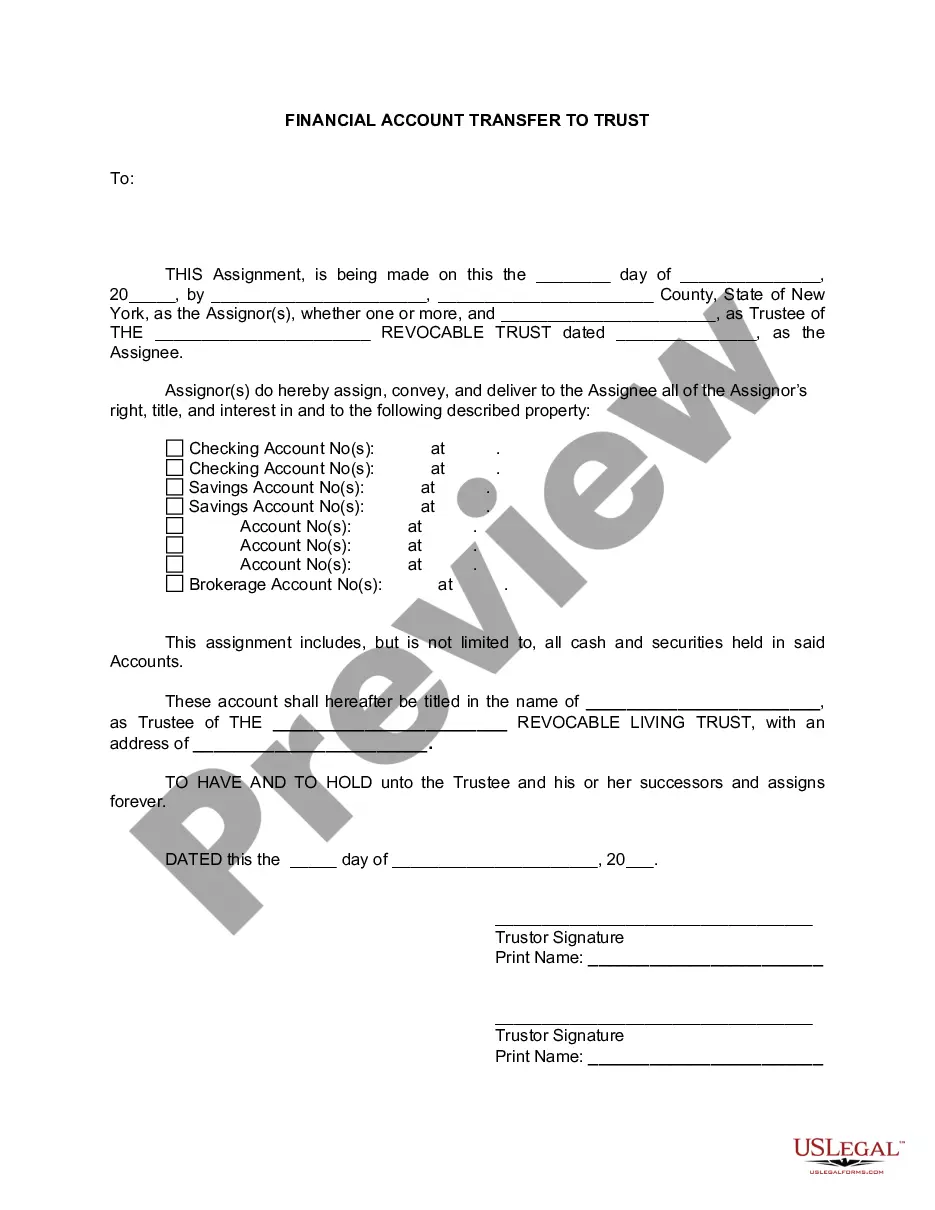

To register as a small business, start by choosing your business structure, such as a sole proprietorship or LLC. Then, register your business name and obtain any necessary licenses or permits. Additionally, consider using platforms like uslegalforms for guidance on handling all registration steps efficiently.

To notify the IRS of your corporation's dissolution, you need to file your final tax return and check the box indicating that it is your final return. Along with this, ensure that all outstanding tax liabilities are settled. Once completed, this process will formally inform the IRS of your corporation's status change.

To check if a business name is available in Connecticut, you can use the Secretary of State's online business name database. This is a quick and efficient way to confirm name availability. If the name is not available, you might consider alternatives. Make sure to secure your desired business name once it is available.

In Connecticut, small business owners who meet specific criteria, such as being a registered small business, can apply for the $5000 grant. This funding often supports business improvements or expansions. It's beneficial to review the eligibility requirements on the Connecticut government website to see if your business qualifies.

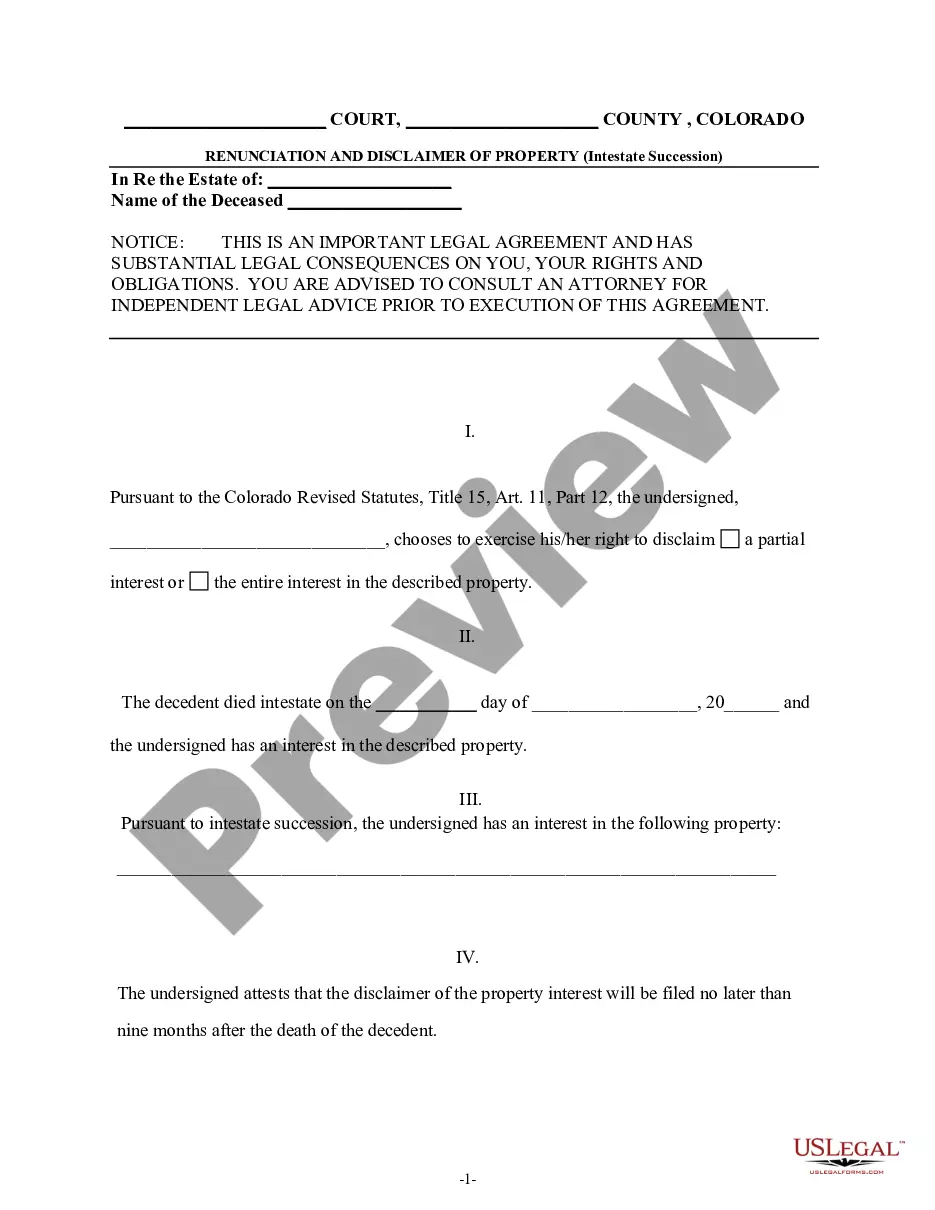

Dissolving a corporation in Connecticut involves submitting a Certificate of Dissolution to the Secretary of State. Make sure to address any liabilities and obligations before submission. Filing a Connecticut Notice of Intent by Corporation can signal your intent to dissolve, allowing for a structured and compliant dissolution process.

To dissolve a corporation in Connecticut, you must file a Certificate of Dissolution with the Secretary of State. Additionally, you need to settle any outstanding debts, notify creditors, and ensure tax obligations are met. Finally, submitting a Connecticut Notice of Intent by Corporation can formalize your intention to dissolve the business, making the process smoother.

You can dissolve a corporation through various methods, including voluntary dissolution, administrative dissolution, and judicial dissolution. Voluntary dissolution occurs when the corporation's owners decide to terminate its existence. Administrative dissolution happens when the state takes action due to non-compliance with regulations. To ensure proper processing, it is important to submit a Connecticut Notice of Intent by Corporation.

A notice of intent to lien in Connecticut is a legal document that notifies property owners and relevant parties of your intention to file a lien. This step is crucial, as it initiates the process of securing a claim against a property due to unpaid debts or obligations. Utilizing a Connecticut Notice of Intent by Corporation can help streamline the process, ensuring you follow the necessary legal protocols.