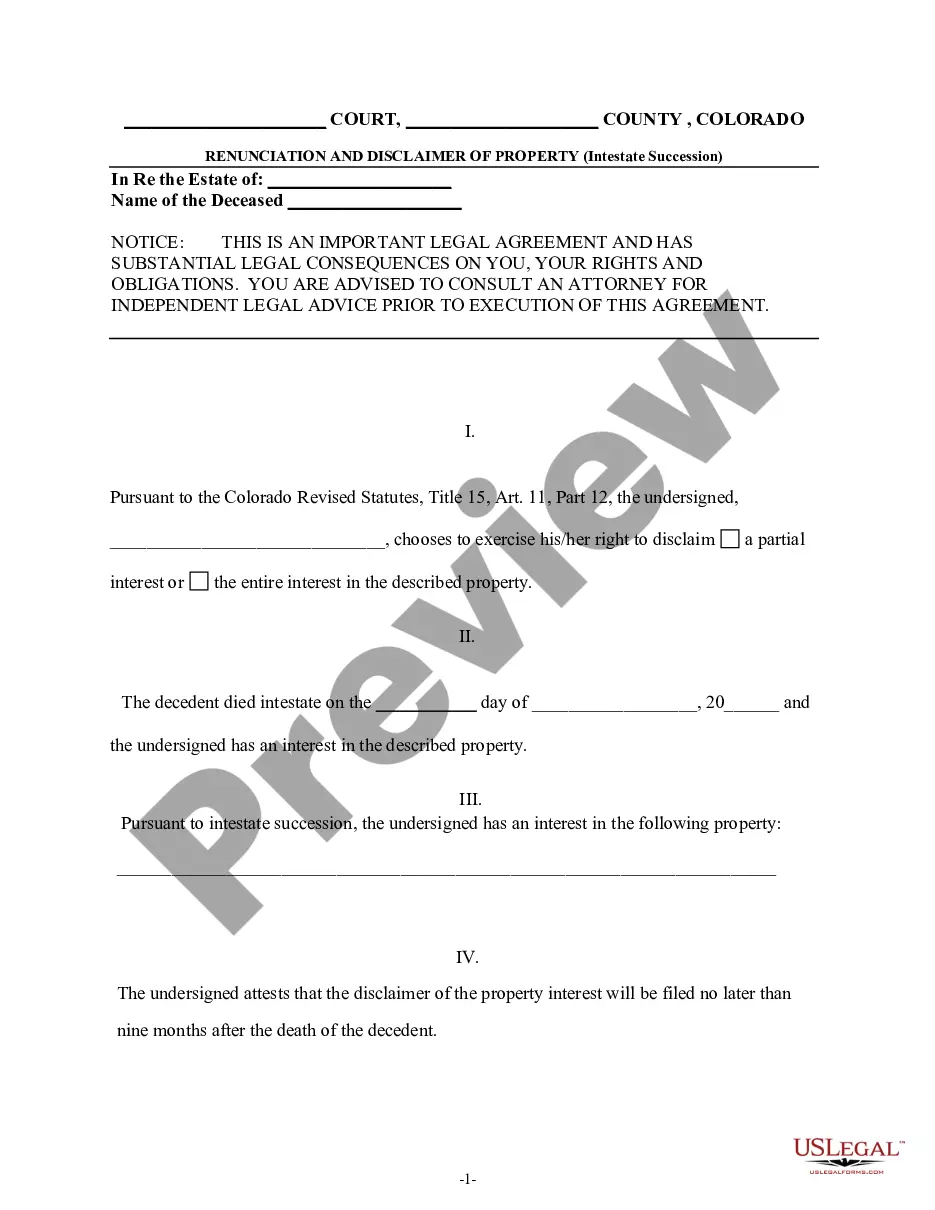

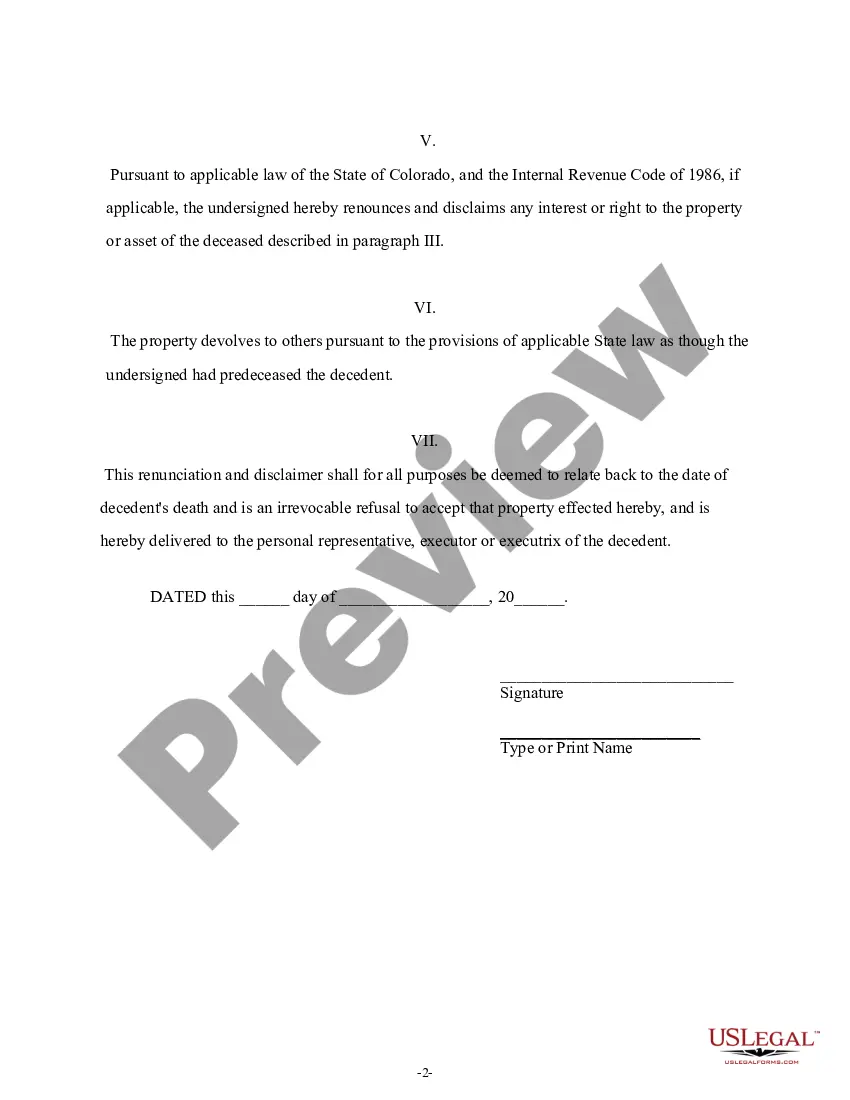

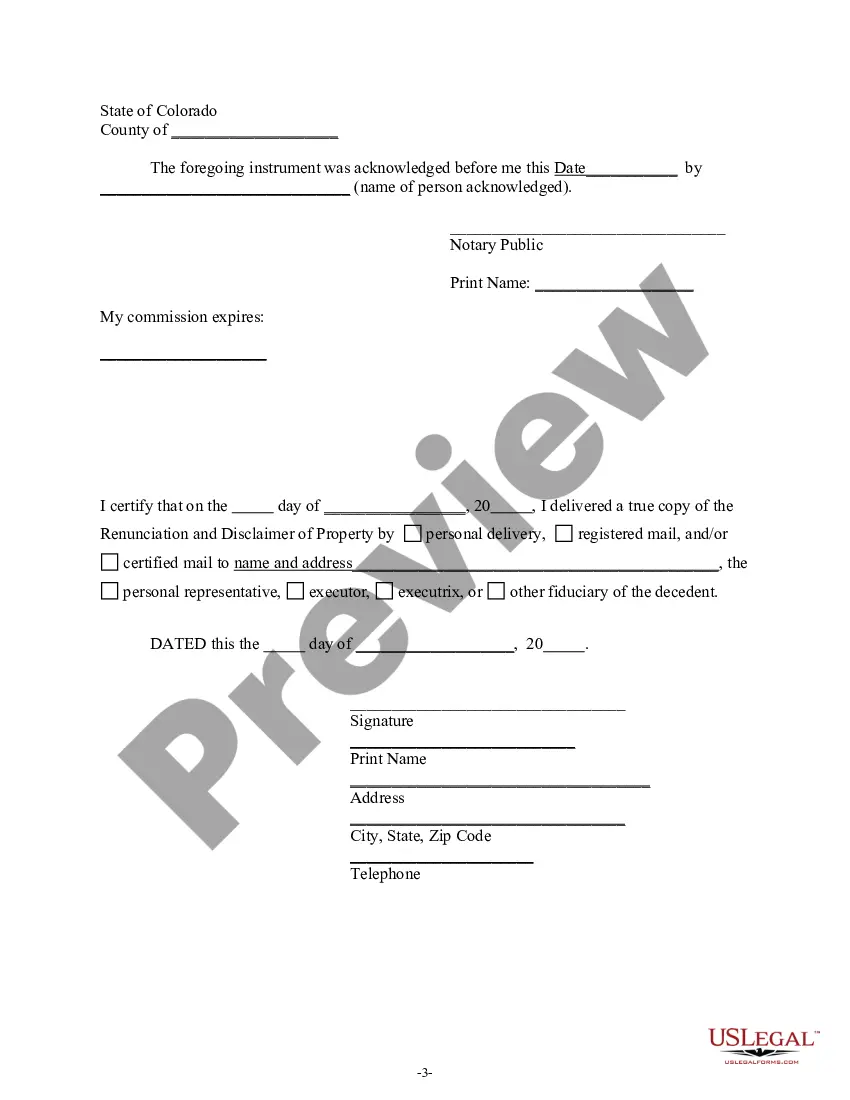

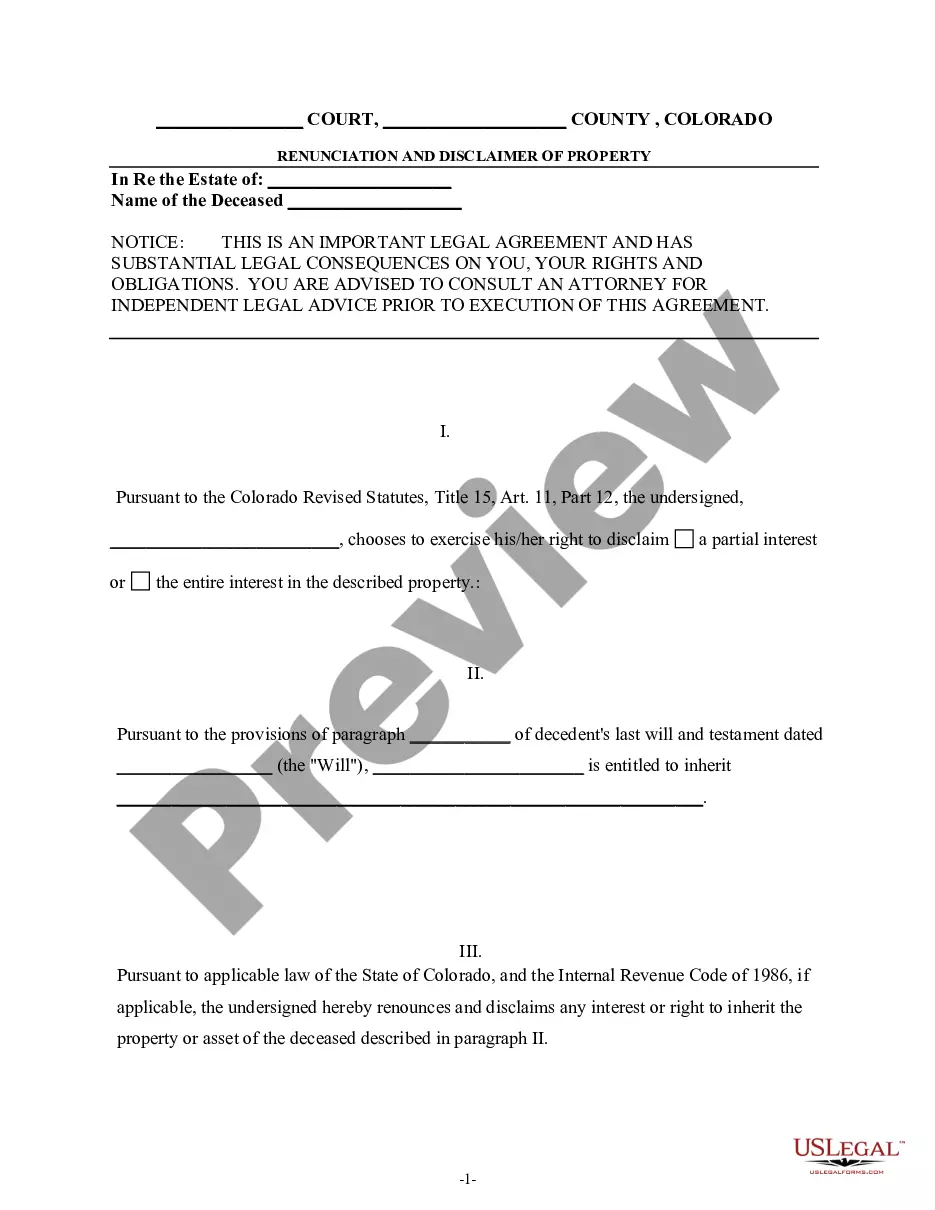

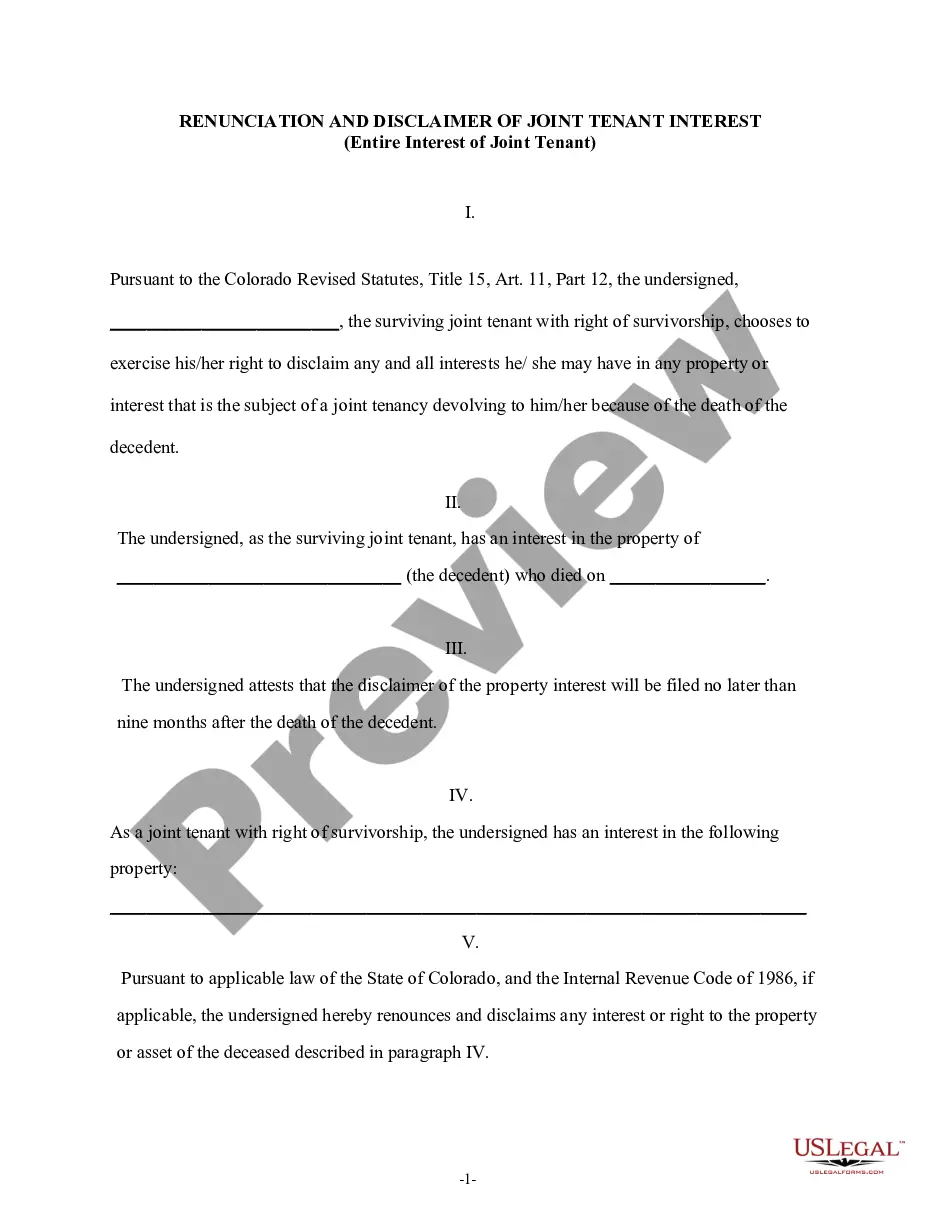

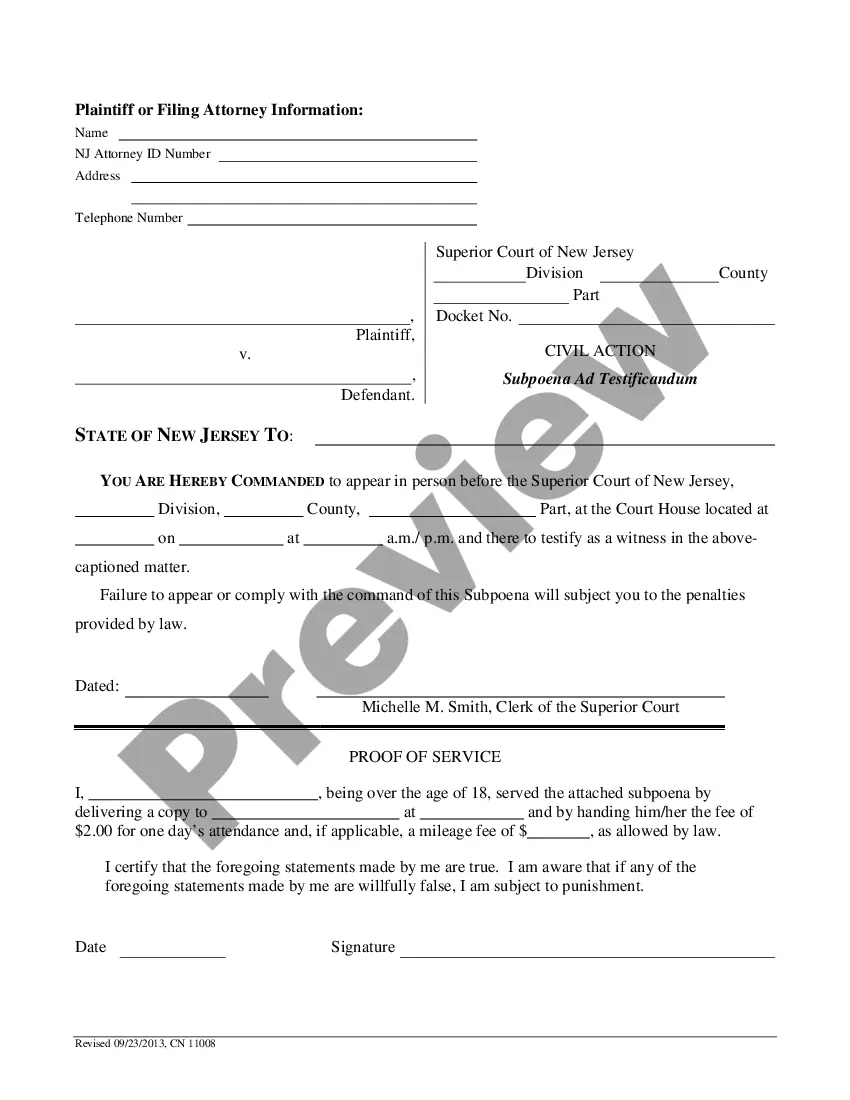

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the described property. Pursuant to the Colorado Revised Statutes, Title 15, Art. 11, Part 8, the beneficiary has chosen to disclaim a portion of or the entire interest in the property. The disclaimer will relate back to the date of death of the decedent and is an irrevocable refusal to accept the property. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Colorado Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out Colorado Renunciation And Disclaimer Of Property Received By Intestate Succession?

If you're in search of appropriate Colorado Renunciation and Disclaimer of Property acquired through Intestate Succession web templates, US Legal Forms is exactly what you require; discover files crafted and verified by state-certified legal professionals.

Using US Legal Forms not only protects you from issues related to legal documentation; it also saves you time, effort, and money! Downloading, printing, and filling out a professional web template is far less expensive than asking a lawyer to do it on your behalf.

And just like that, in just a few simple clicks you own an editable Colorado Renunciation and Disclaimer of Property received by Intestate Succession. Once you create your account, all subsequent requests will be processed even more easily. After obtaining a US Legal Forms subscription, simply Log In to your account and click the Download button located on the form’s webpage. Thus, whenever you wish to use this template again, you will always be able to locate it in the My documents section. Don’t waste your time sifting through various forms on multiple websites. Acquire accurate documents from one trusted source!

- To start, complete your registration process by entering your email and creating a secure password.

- Follow the steps below to set up your account and find the Colorado Renunciation and Disclaimer of Property received by Intestate Succession web template that meets your requirements.

- Make use of the Preview option or review the document description (if available) to confirm that the template is the one you desire.

- Verify its legitimacy in your residing state.

- Click on Buy Now to place your order.

- Select a preferred pricing plan.

- Establish an account and complete the payment with your credit card or PayPal.

- Choose a suitable format and save the document.

Form popularity

FAQ

Disclaiming inherited property in Colorado involves a straightforward process. First, you must file a written disclaimer that states your intent to renounce the property received through intestate succession. This document should be submitted to the probate court handling the estate. For ease and accuracy, consider utilizing Uslegalforms to access templates and ensure you follow the correct procedures.

In Colorado, a disclaimer of inheritance does not require notarization to be valid. However, having it notarized could provide additional assurance of authenticity. It’s crucial that the disclaimer clearly states your intention to renounce property you received through intestate succession. Using resources from Uslegalforms can guide you through preparation and ensure compliance with legal standards in Colorado.

To write an inheritance disclaimer, clearly state that you refuse the inheritance and include specific details about the property. Ensure that your disclaimer is signed and dated to provide legal clarity. Accessing templates on the US Legal Forms platform can streamline the process in line with Colorado Renunciation and Disclaimer of Property received by Intestate Succession, making it easier for you to manage your choices.

In Colorado, there are currently no state inheritance taxes; however, the federal threshold for estate taxes can apply, but many people do not reach this limit. It's essential to be informed about potential federal obligations as well. Utilizing the US Legal Forms can provide insight into navigating matters related to Colorado Renunciation and Disclaimer of Property received by Intestate Succession and tax implications on inheritances.

An example of a disclaimer of estate could involve a child who chooses not to accept their portion of a parent's estate. They would formally refuse the inheritance in writing, stipulating the specific property involved. This formal document is essential, and you can find sample disclaimers on the US Legal Forms platform that specifically focus on Colorado Renunciation and Disclaimer of Property received by Intestate Succession.

In Colorado, property transferred after death without a will goes through intestate succession laws, which dictate how the estate is distributed among legal heirs. This process is handled by the probate court, where assets are allocated based on family relationships. If you are considering disclaiming an inheritance, understanding these rules through US Legal Forms can be beneficial for managing Colorado Renunciation and Disclaimer of Property received by Intestate Succession.

The rules for disclaiming inheritance require that the disclaimer must be irrevocable and must be made within a specific time frame set by law. You cannot accept any benefits from the property before disclaimed, nor can you choose to disclaim only part of a property. Following these guidelines is essential, and the US Legal Forms platform provides resources to assist you with Colorado Renunciation and Disclaimer of Property received by Intestate Succession.

If you refuse your inheritance in Colorado, the property typically passes to your heirs according to the state's intestacy laws. This means that if you have children, they may receive what you would have inherited. Understanding these implications is vital, and utilizing tools from US Legal Forms can help you navigate the Colorado Renunciation and Disclaimer of Property received by Intestate Succession.

Disclaiming an inheritance in Colorado involves submitting a written disclaimer to the estate's personal representative or the court. It's crucial to ensure the disclaimer is signed, dated, and clearly states your intention to refuse the property. Using resources from US Legal Forms can guide you through honoring the legal requirements for Colorado Renunciation and Disclaimer of Property received by Intestate Succession.

To write a sample disclaimer of inheritance, start by clearly stating your intent to disclaim any interest in the property. Include your name, the relationship to the deceased, and a description of the property you are disclaiming. For legal assurance, consider using a formal template, like those available on the US Legal Forms platform, specifically framed for Colorado Renunciation and Disclaimer of Property received by Intestate Succession.