This form is a Quitclaim Deed where the Grantor is an LLC and the Grantee is an Individual. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Connecticut Quitclaim Deed from an LLC to an Individual

Description

How to fill out Connecticut Quitclaim Deed From An LLC To An Individual?

The larger amount of paperwork you must create - the more unsettled you feel.

You can discover a vast selection of Connecticut Quitclaim Deed from an LLC to an Individual samples online, however, you can't determine which ones to rely on.

Remove the frustration and make locating templates much simpler with US Legal Forms. Obtain expertly crafted documents that are created to meet state requirements.

Fill in the required information to create your profile and process the payment using PayPal or credit card. Choose a suitable document format and obtain your template. Access all files you receive in the My documents section. Simply go there to complete a new version of the Connecticut Quitclaim Deed from an LLC to an Individual. Even when utilizing professionally prepared templates, it’s still important to consider consulting a local attorney to verify that your document is correctly filled out. Maximize results for less with US Legal Forms!

- If you already maintain a US Legal Forms subscription, sign in to your profile, and you will see the Download button on the Connecticut Quitclaim Deed from an LLC to an Individual’s page.

- If you have not utilized our service before, complete the registration process using these steps.

- Ensure the Connecticut Quitclaim Deed from an LLC to an Individual is valid in your residing state.

- Verify your choice by reviewing the description or by using the Preview option if available for the selected document.

- Click Buy Now to initiate the registration process and select a pricing plan that suits your needs.

Form popularity

FAQ

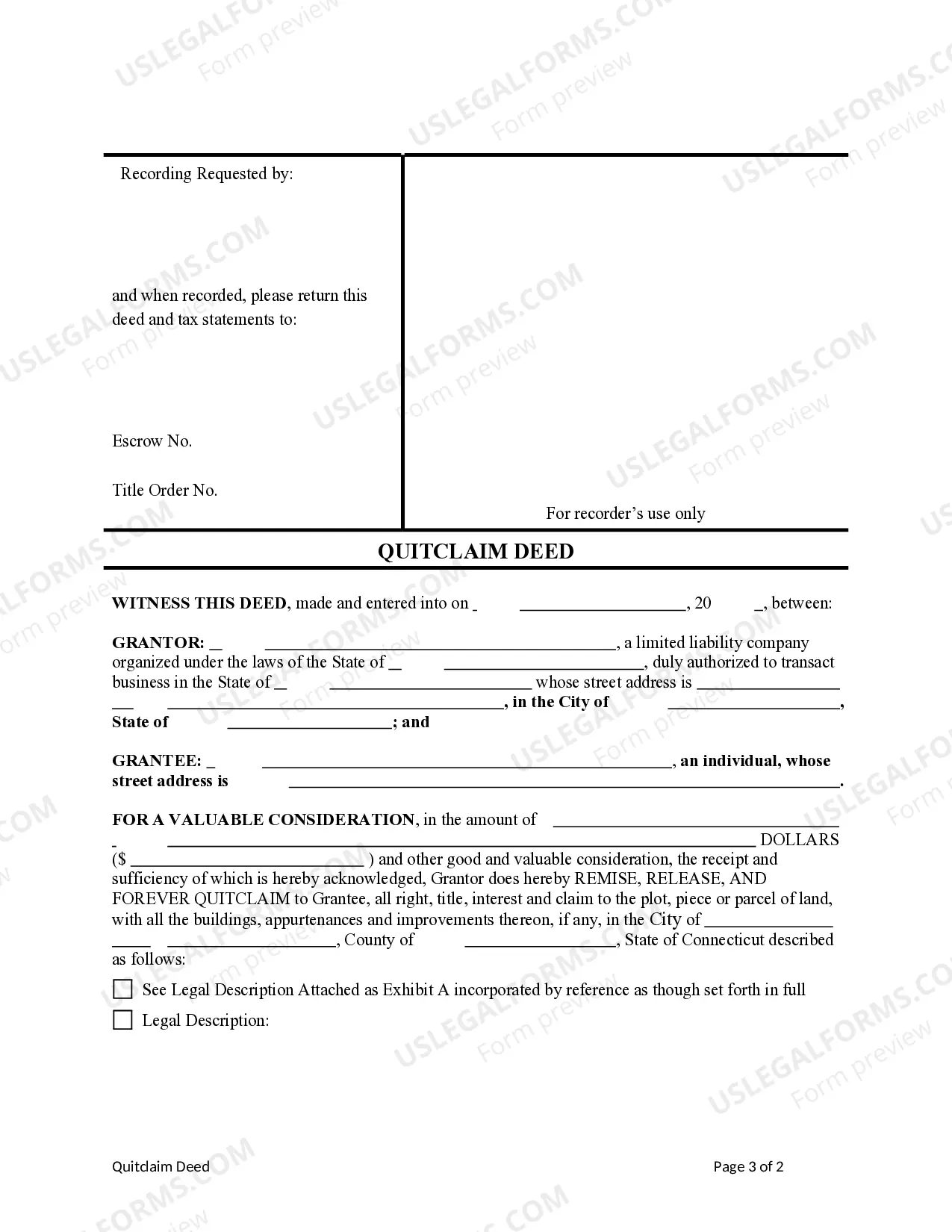

To transfer property from an LLC to an individual, you typically need to execute a Connecticut Quitclaim Deed. This document must be signed by appropriate parties and filed with the local registrar. Additionally, it’s wise to access resources like USLegalForms to guide you through the process, ensuring all legal requirements are met for a seamless transition.

Transferring ownership of an LLC can be complex due to the operating agreement and state regulations. These documents dictate the process, and they may impose restrictions on transfers. Moreover, with a Connecticut Quitclaim Deed from an LLC to an Individual, legal considerations must be navigated carefully to ensure that all parties comply with the law and that the transfer is executed smoothly.

When you transfer ownership of an LLC, it can trigger various tax consequences. The IRS may view the transfer as a sale, which could result in capital gains taxes depending on the fair market value of the assets involved. Additionally, when utilizing a Connecticut Quitclaim Deed from an LLC to an Individual, it's essential to consult with a tax professional to ensure compliance and understand your specific situation.

Yes, you can handle the process of creating a quitclaim deed yourself, especially with a Connecticut Quitclaim Deed from an LLC to an Individual. Many resources are available online to guide you through the steps. However, you may want to consider using a platform like US Legal Forms for access to templates and legal guidance. This can help ensure that the deed is completed accurately and filed correctly, avoiding potential issues in the future.

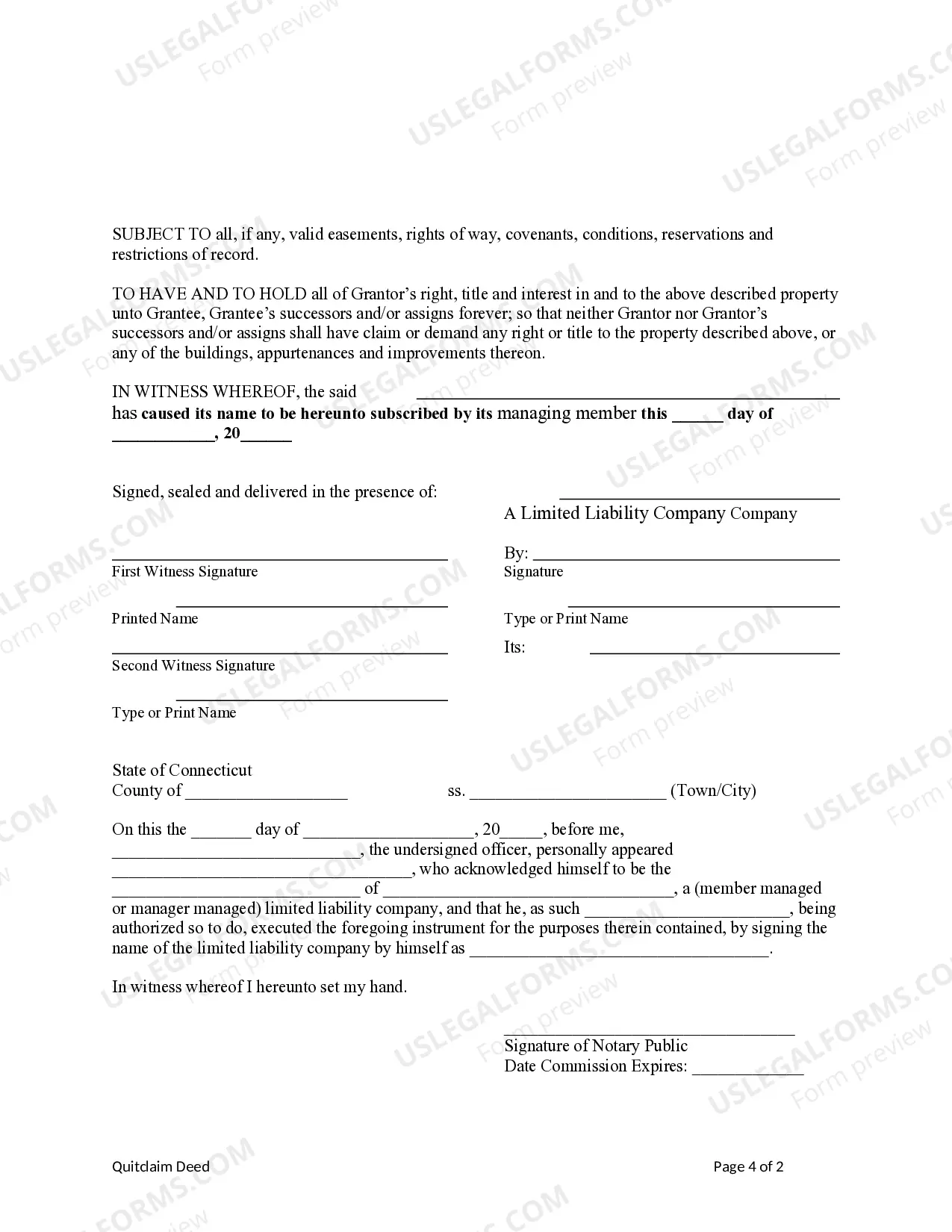

Filing a quitclaim deed in Connecticut requires you to properly fill out the deed with the correct details of the transfer. Ensure all parties involved, particularly from the LLC to the Individual, are accurately represented. Once completed, you must have the document notarized and then file it with your local town clerk’s office. Keeping a copy for your records is also a good practice.

People frequently use a quitclaim deed for a transfer of property between family members or during divorce settlements. The Connecticut Quitclaim Deed from an LLC to an Individual is particularly useful when the parties know each other well and trust the title being conveyed. Additionally, it simplifies the transfer process since no title insurance is typically involved. This deed allows for quick transfers without an extensive title search.

To file a quitclaim deed in Connecticut, you must complete the statutory form for the Connecticut Quitclaim Deed from an LLC to an Individual. Next, you need to sign the document in the presence of a notary public. Then, submit the signed deed to the local town clerk’s office where the property is located. It's also wise to check local requirements for any additional information or fees that may apply.

The process for a Connecticut Quitclaim Deed from an LLC to an Individual involves several steps. First, prepare the deed with the necessary information and have it signed by the grantor in the presence of a notary. After that, you must file the deed with the local town clerk's office where the property is located. This ensures that the transfer is officially recorded and publicly accessible.

Yes, you can fill out a Connecticut Quitclaim Deed from an LLC to an Individual yourself if you understand the process. However, it's important to ensure that all details are correct and meet state requirements. Using a platform like US Legal Forms can simplify this task, offering templates and guidance to make sure your deed adheres to legal standards.

To create a Connecticut Quitclaim Deed from an LLC to an Individual, you must provide basic information. This includes the names of both the grantor and the grantee, a legal description of the property, and the date of execution. Additionally, the deed must be signed by the grantor and notarized to ensure its validity. It's essential to follow these requirements to prevent complications later.