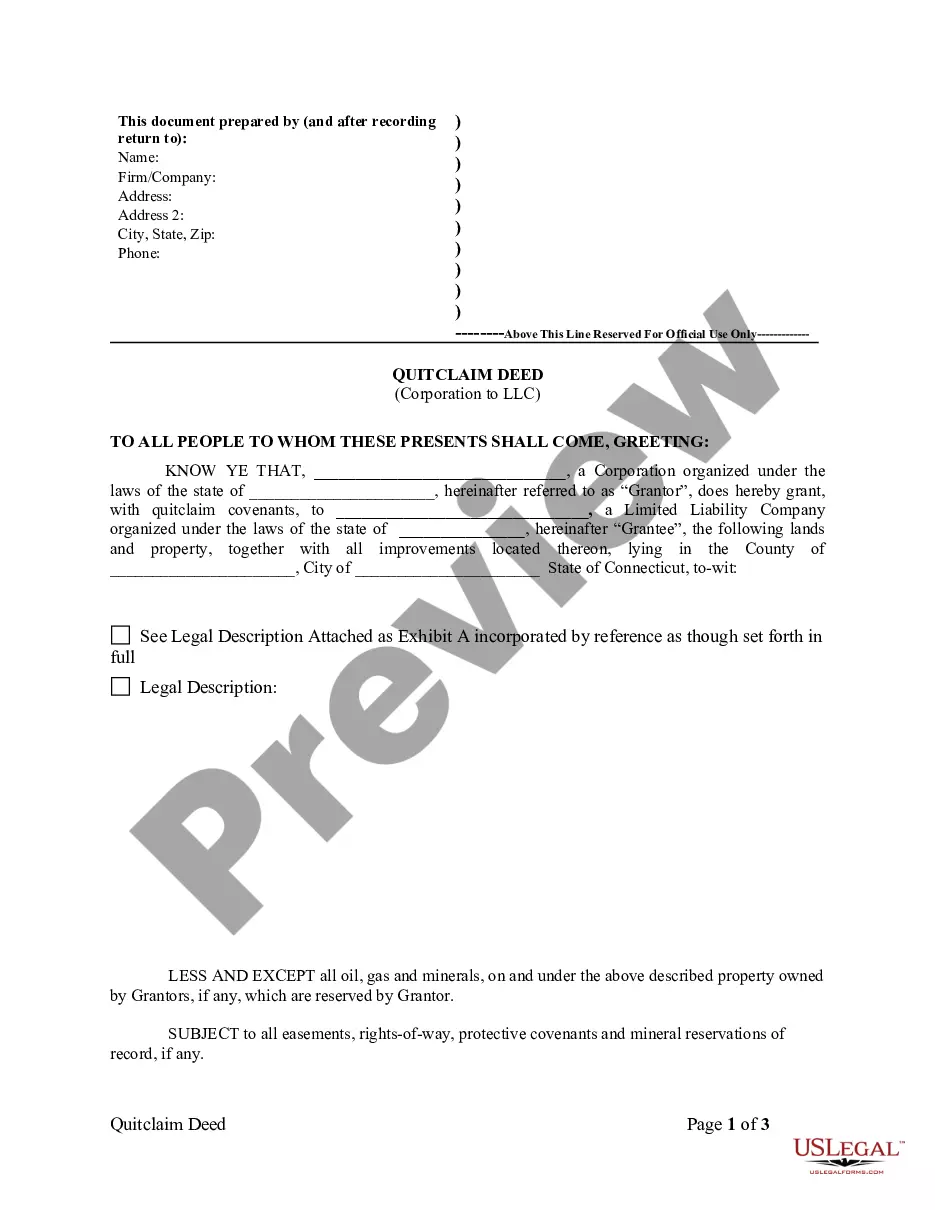

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Connecticut Quitclaim Deed from Corporation to LLC

Description

How to fill out Connecticut Quitclaim Deed From Corporation To LLC?

The greater the number of documents you need to create - the more stressed you become.

There is an extensive selection of Connecticut Quitclaim Deed from Corporation to LLC templates available online, but you may be unsure which ones to trust.

Simplify the process and make finding samples much easier by using US Legal Forms. Obtain professionally crafted documents that comply with state standards.

Input the required details to create your account and complete the payment using your PayPal or credit card. Choose a convenient file format and retrieve your copy. Access each template you download in the My documents section. Simply go there to complete a new copy of your Connecticut Quitclaim Deed from Corporation to LLC. Even with professionally prepared templates, it remains crucial to consider consulting a local attorney to verify that your form is accurately completed. Achieve more for less with US Legal Forms!

- If you already hold a US Legal Forms subscription, Log In to your account, and you'll see the Download button on the Connecticut Quitclaim Deed from Corporation to LLC webpage.

- If you are new to our website, follow these steps to register.

- Ensure that the Connecticut Quitclaim Deed from Corporation to LLC is applicable in your state.

- Double-check your choice by reading the description or utilizing the Preview feature if available for the selected document.

- Click Buy Now to start the registration process and choose a pricing plan that meets your needs.

Form popularity

FAQ

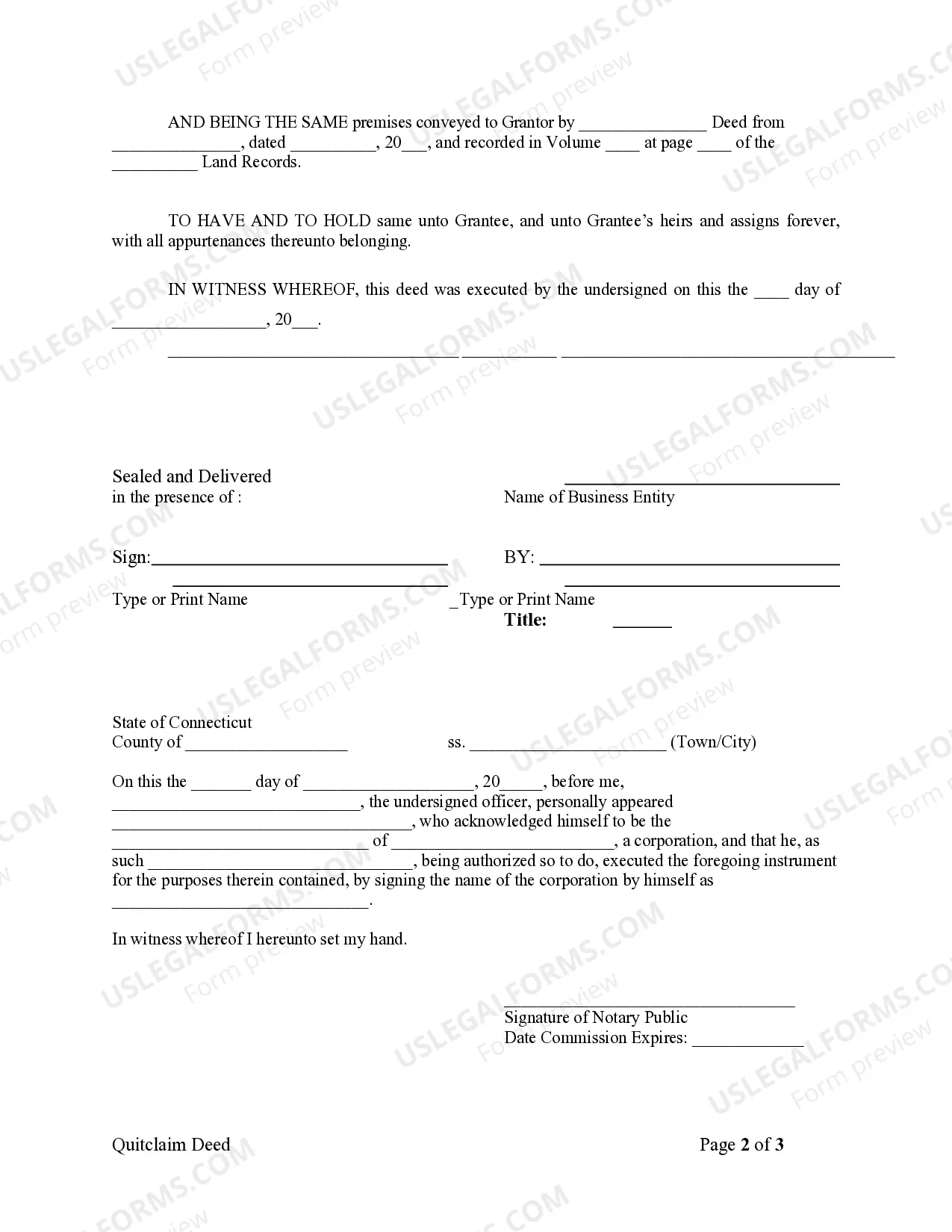

The process for a quitclaim deed in Connecticut involves several key steps. Start by completing the quitclaim deed form, ensuring you have the correct details of both the corporation and the LLC. Next, the authorized representative must sign the document, and it should be notarized. Once signed, file the Connecticut Quitclaim Deed from Corporation to LLC with the local town clerk to officially record the transfer of ownership.

Filling out a quitclaim deed form is a straightforward process. First, gather the required information, including the names of the grantor and grantee, as well as the property details. When dealing with a Connecticut Quitclaim Deed from Corporation to LLC, include the corporation's name in the grantor section and the LLC's name in the grantee section. Make sure all information is accurate and complete before submitting the form.

Yes, when a corporation transfers property ownership using a Connecticut Quitclaim Deed from Corporation to LLC, the deed must be signed by an authorized representative. This signature legally binds the corporation to the transfer. It is crucial to ensure that the deed is executed correctly to avoid any future disputes. Properly signing the deed also helps in smoothening the transition of the property title.

Individuals often place property into an LLC to protect personal assets from liability associated with the property. This structure also allows for easier management and transfer of ownership through a Connecticut Quitclaim Deed from Corporation to LLC. Additionally, LLCs can provide tax flexibility and potential benefits when it comes to property sales. Overall, this setup is a strategic move for many property owners.

One notable disadvantage of placing a property in an LLC is the costs associated with formation and filing. Additionally, there may be limitations on mortgage options, as lenders can view LLCs as higher-risk borrowers. Despite these concerns, using a Connecticut Quitclaim Deed from Corporation to LLC can help mitigate personal liability, making it a worthwhile consideration in many situations.

Transferring a deed to an LLC involves a few straightforward steps. First, create a Connecticut Quitclaim Deed from Corporation to LLC that specifies the property details and parties. Then, execute the document in front of a notary and submit it to the appropriate local government office for recording. Ensuring proper documentation is vital for a smooth transition.

To transfer a deed to an LLC, you typically need to complete a quitclaim deed form, ensuring that it accurately identifies the property and the parties involved. After drafting the Connecticut Quitclaim Deed from Corporation to LLC, you must sign it in front of a notary public. Finally, file the deed with your local land records office to formalize the transfer.

Transferring property to an LLC can have significant tax implications. In California, the transfer may trigger reassessment of the property tax, leading to higher property taxes. However, using a Connecticut Quitclaim Deed from Corporation to LLC may provide certain advantages, such as potential tax deductions upon sale. Always consult a tax professional to understand how this will affect your financial situation.

Quitclaim deeds, such as the Connecticut quitclaim deed from corporation to LLC, are often viewed skeptically due to their lack of guarantees. Unlike warranty deeds, quitclaims do not assure that the property title is clear, leaving grantees potentially vulnerable to future claims. Exercise caution and due diligence when using this method, as it is wise to ensure the property title is in good standing.

Filing a quitclaim deed in Connecticut involves completing the deed and then submitting it to the local town clerk's office. You should ensure that the Connecticut quitclaim deed from corporation to LLC meets all state requirements. Once filed, keep a copy for your records, which can be helpful in future transactions.