Colorado Clauses Relating to Venture IPO

Description

How to fill out Clauses Relating To Venture IPO?

Are you in a position the place you need to have files for both business or person reasons just about every time? There are tons of authorized papers layouts available on the net, but discovering types you can rely isn`t easy. US Legal Forms offers thousands of develop layouts, much like the Colorado Clauses Relating to Venture IPO, which can be published to satisfy state and federal demands.

In case you are previously knowledgeable about US Legal Forms web site and get an account, basically log in. After that, you may obtain the Colorado Clauses Relating to Venture IPO design.

If you do not have an bank account and need to start using US Legal Forms, abide by these steps:

- Get the develop you need and make sure it is for the proper town/area.

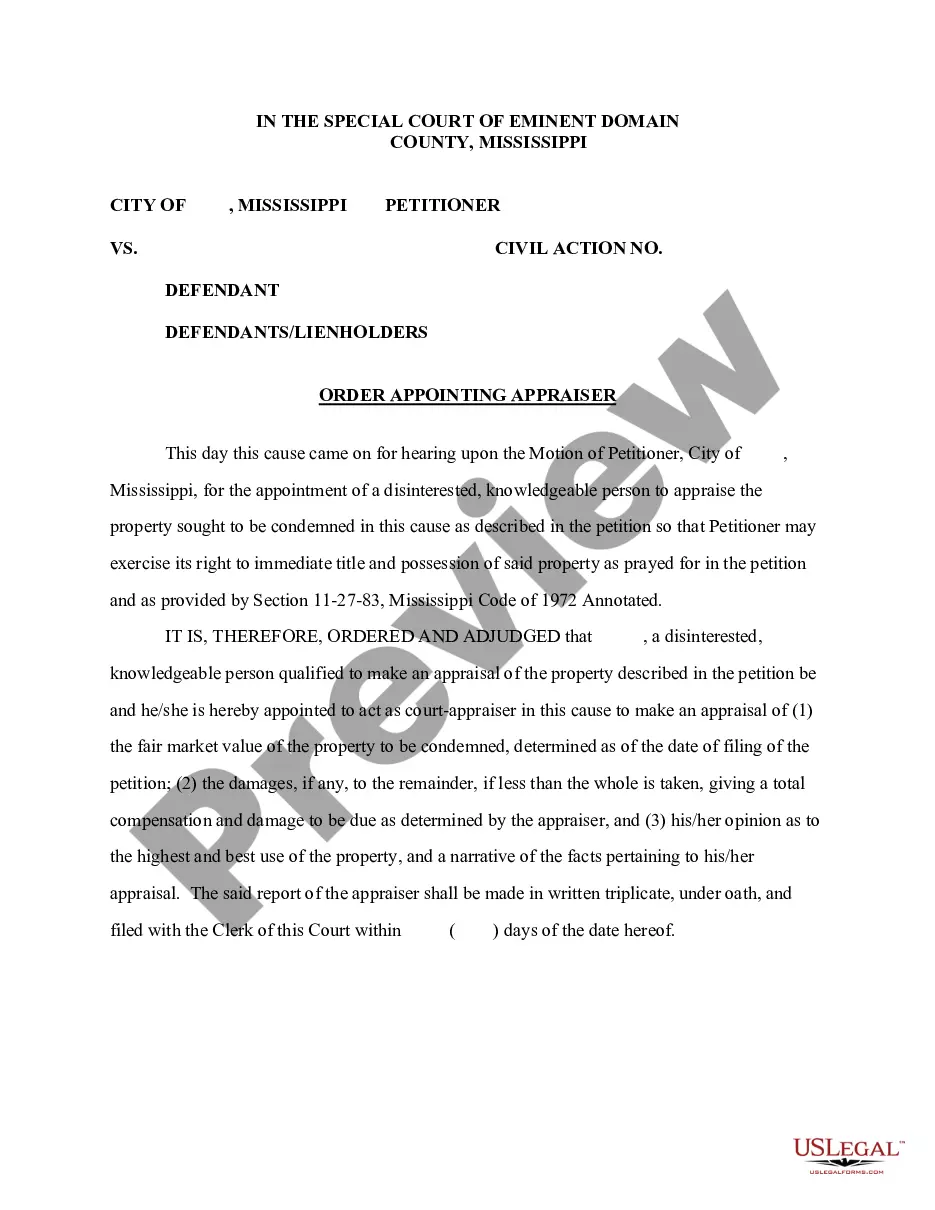

- Utilize the Review key to examine the shape.

- Look at the description to ensure that you have selected the proper develop.

- In the event the develop isn`t what you`re seeking, utilize the Research industry to discover the develop that meets your needs and demands.

- When you discover the proper develop, click Buy now.

- Choose the costs program you want, submit the desired details to make your bank account, and purchase an order making use of your PayPal or charge card.

- Pick a handy data file formatting and obtain your copy.

Locate each of the papers layouts you have purchased in the My Forms food selection. You can aquire a further copy of Colorado Clauses Relating to Venture IPO anytime, if needed. Just go through the essential develop to obtain or print out the papers design.

Use US Legal Forms, probably the most considerable variety of authorized varieties, to save efforts and avoid faults. The assistance offers expertly created authorized papers layouts which you can use for a selection of reasons. Generate an account on US Legal Forms and initiate generating your daily life a little easier.