This form is used when all activities and operations on the Contract Area have ceased, and the Agreement is deemed, as of the Effective Date stated above, to have terminated, and the Contract Area, and all interests in it, are no longer subject to the terms and provisions of the Agreement.

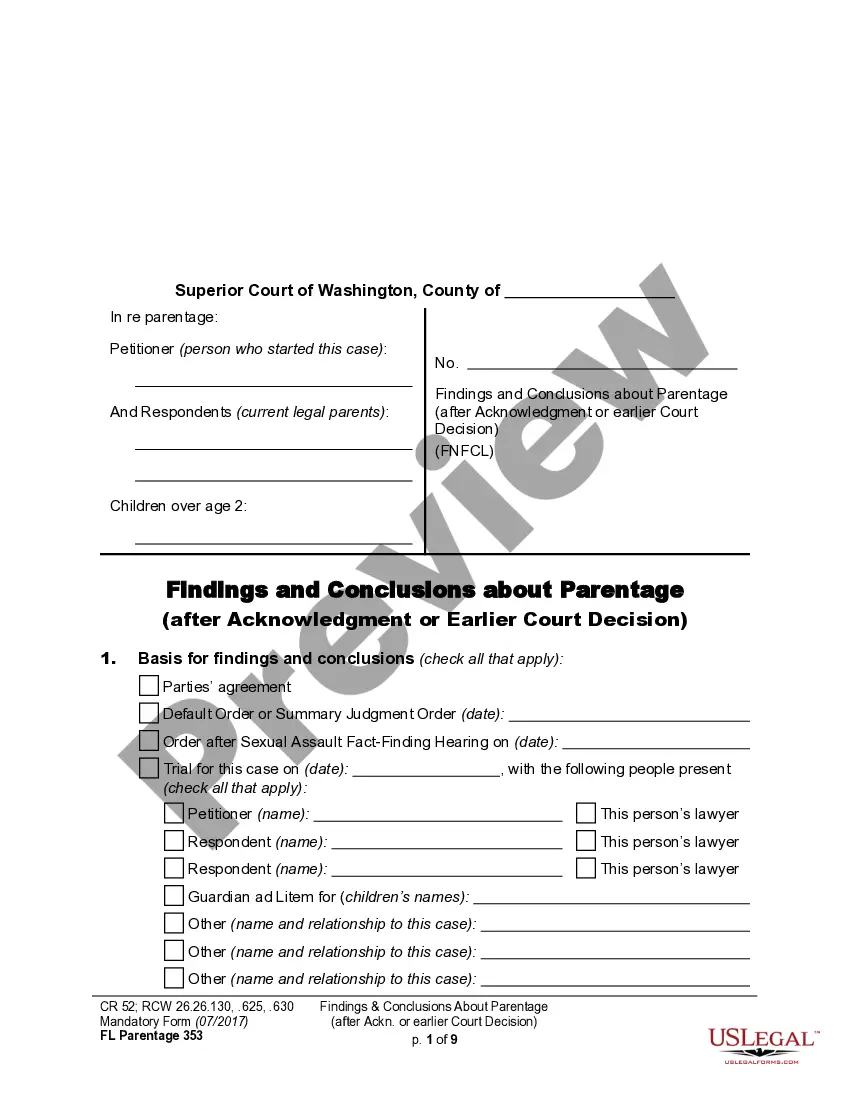

Colorado Termination of Operating Agreement

Description

How to fill out Termination Of Operating Agreement?

US Legal Forms - one of many biggest libraries of legitimate kinds in the States - provides a wide range of legitimate record templates you may down load or print out. Making use of the website, you will get a huge number of kinds for enterprise and personal uses, categorized by classes, claims, or key phrases.You can find the latest models of kinds like the Colorado Termination of Operating Agreement within minutes.

If you already possess a membership, log in and down load Colorado Termination of Operating Agreement in the US Legal Forms local library. The Download option will appear on each form you see. You have access to all in the past saved kinds within the My Forms tab of your profile.

If you would like use US Legal Forms for the first time, here are straightforward guidelines to get you started out:

- Be sure you have chosen the best form to your metropolis/county. Go through the Review option to examine the form`s content material. Look at the form information to actually have chosen the proper form.

- If the form does not satisfy your specifications, make use of the Lookup industry near the top of the display to obtain the one who does.

- When you are pleased with the shape, verify your choice by clicking the Purchase now option. Then, pick the prices strategy you want and provide your references to sign up to have an profile.

- Approach the purchase. Use your bank card or PayPal profile to perform the purchase.

- Choose the format and down load the shape in your gadget.

- Make changes. Fill out, revise and print out and indicator the saved Colorado Termination of Operating Agreement.

Every single web template you put into your money lacks an expiry time and is yours for a long time. So, if you want to down load or print out yet another backup, just check out the My Forms area and click on in the form you require.

Get access to the Colorado Termination of Operating Agreement with US Legal Forms, the most considerable local library of legitimate record templates. Use a huge number of professional and status-certain templates that meet up with your company or personal needs and specifications.

Form popularity

FAQ

What are 5 steps that are necessary in order to dissolve your Colorado business? Obtain agreement to dissolve ing to corporation formalities & contracts. File a Certification of Dissolution (Articles of Dissolution) File federal, state, and local tax returns. Notify creditors, customers, and employees.

However, it can take the Secretary of State a few weeks to process all the paperwork. If you are rushing to dissolve your firm, you should tell the Secretary of State. They may expedite the process for you. The filing fee for dissolving an LLC in Colorado is $25.

The State of Colorado requires you to file a periodic report annually for your SMLLC. File the report online at the SOS website. As of 2023, the filing fee is $10. There's also a $50 penalty fee for reports filed late.

How to Dissolve a Nonprofit Corporation in Colorado Authorizing Dissolution. ... Articles of Dissolution. ... Winding Up. ... Notice to Creditors and Other Claimants. ... Federal Tax Note. ... Additional Information. ... Final Note: Dissolving and winding up your nonprofit corporation is only one piece of the process of closing your organization.

Failure to dissolve your business can also leave you open to forms of business fraud, such as business identity theft. Step 1: Get approval of the owners of the corporation or LLC. ... Step 2: File the Certificate of Dissolution with the state. ... Step 3: File federal, state, and local tax forms. ... Step 4: Wind up affairs.

What are 5 steps that are necessary in order to dissolve your Colorado business? Obtain agreement to dissolve ing to corporation formalities & contracts. File a Certification of Dissolution (Articles of Dissolution) File federal, state, and local tax returns. Notify creditors, customers, and employees.

Colorado does not require you to submit an Operating Agreement to form your LLC. However, it is important for every LLC to have an Operating Agreement, establishing the rules and structure of the business.

In general, all Colorado LLCs, including PLLCs, must contain the term or abbreviation "limited liability company," "ltd. liability company," "limited liability co.," "ltd. liability co.," "limited," "l.l.c.," "llc," or "ltd." Colorado law also allows you to use "P.L.L.C" or "PLLC." (Colo. Rev.