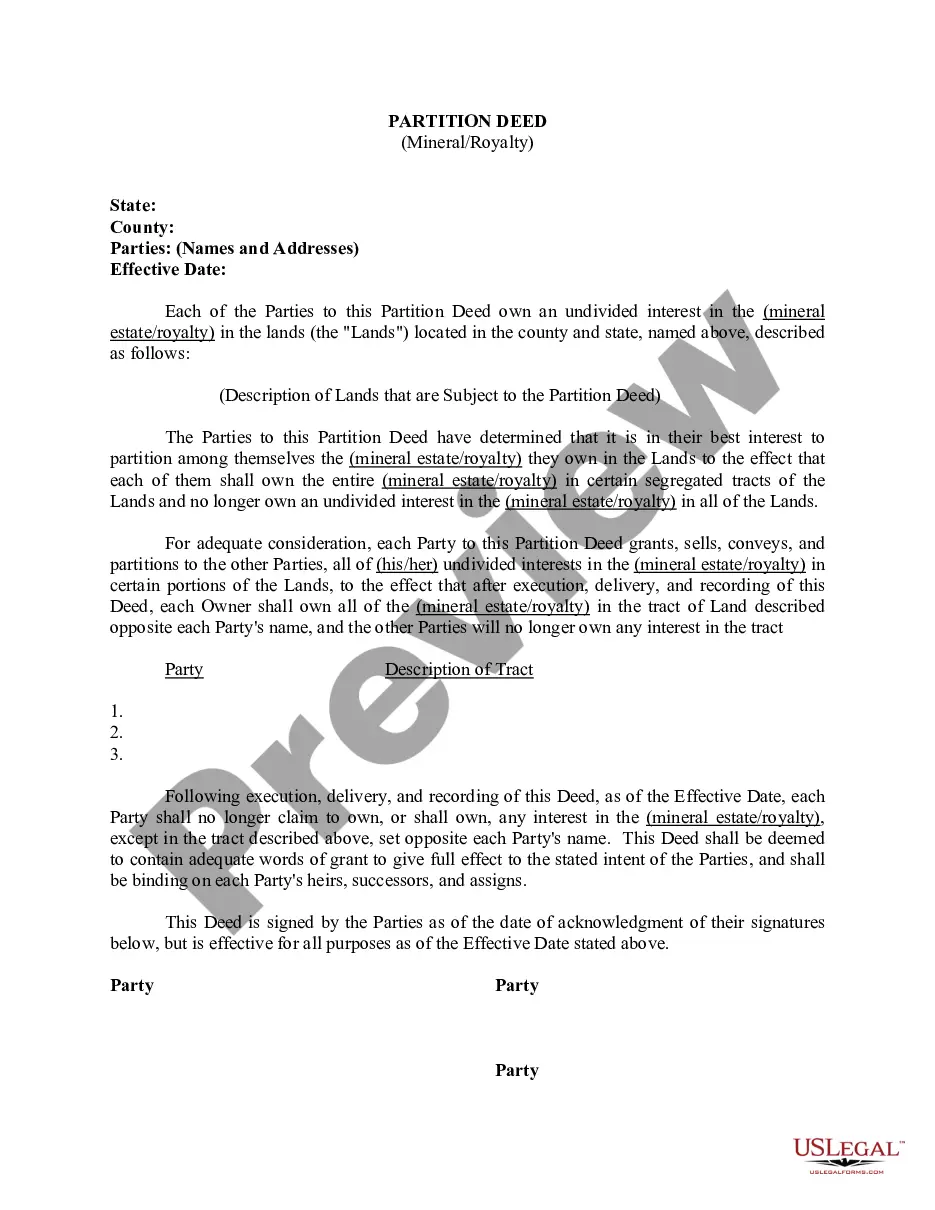

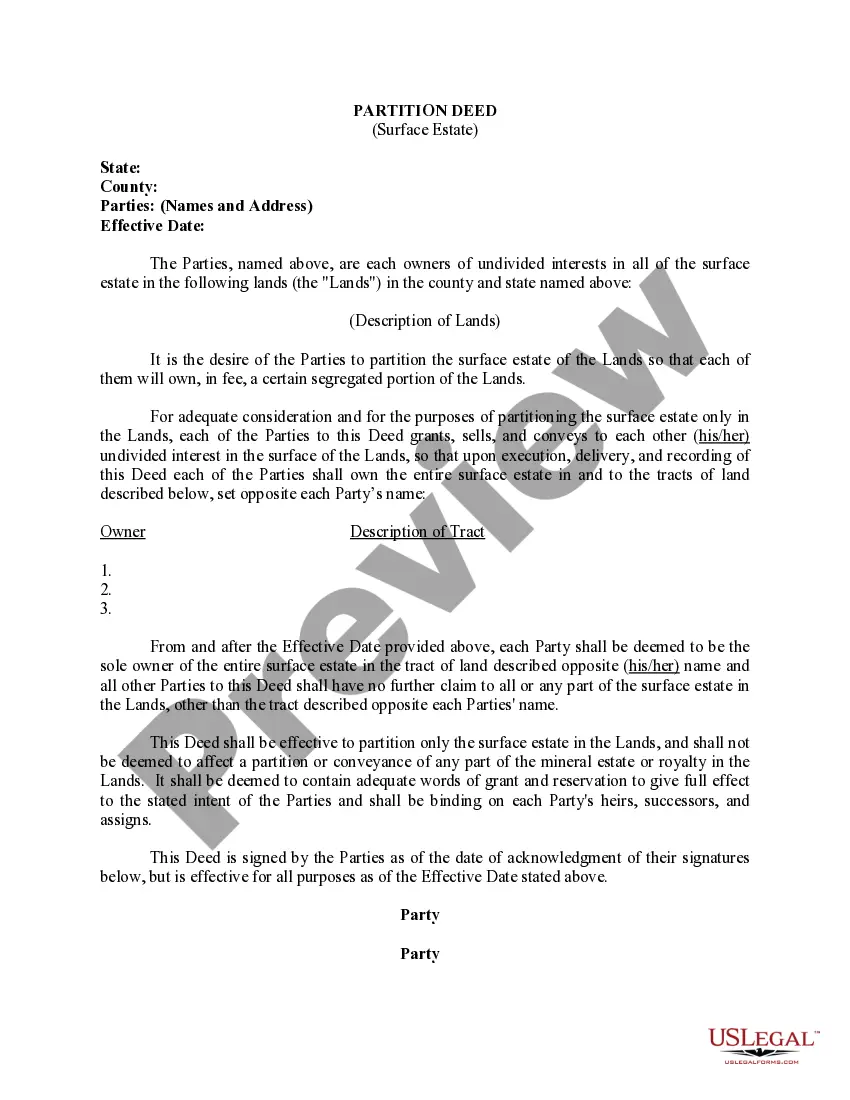

Colorado Partition Deed for Mineral / Royalty Interests

Description

How to fill out Partition Deed For Mineral / Royalty Interests?

US Legal Forms - one of several largest libraries of lawful types in America - provides an array of lawful document templates you may acquire or produce. Using the internet site, you can find a huge number of types for organization and individual purposes, categorized by classes, claims, or key phrases.You will discover the latest models of types just like the Colorado Partition Deed for Mineral / Royalty Interests in seconds.

If you already have a membership, log in and acquire Colorado Partition Deed for Mineral / Royalty Interests from your US Legal Forms collection. The Down load switch can look on every single form you look at. You gain access to all previously downloaded types inside the My Forms tab of the accounts.

In order to use US Legal Forms initially, listed here are straightforward guidelines to get you started:

- Be sure you have picked out the proper form for your personal metropolis/county. Select the Review switch to analyze the form`s content material. Look at the form explanation to actually have selected the appropriate form.

- When the form doesn`t satisfy your specifications, take advantage of the Research industry on top of the monitor to obtain the one which does.

- Should you be pleased with the shape, affirm your decision by visiting the Buy now switch. Then, pick the rates strategy you prefer and supply your accreditations to sign up to have an accounts.

- Approach the purchase. Utilize your charge card or PayPal accounts to perform the purchase.

- Select the format and acquire the shape on the gadget.

- Make changes. Complete, modify and produce and indicator the downloaded Colorado Partition Deed for Mineral / Royalty Interests.

Each and every web template you included in your money does not have an expiration day which is your own property forever. So, if you want to acquire or produce an additional backup, just proceed to the My Forms segment and click in the form you want.

Get access to the Colorado Partition Deed for Mineral / Royalty Interests with US Legal Forms, the most substantial collection of lawful document templates. Use a huge number of specialist and express-particular templates that meet your business or individual requirements and specifications.

Form popularity

FAQ

A quick overview of the differences between mineral rights and royalty interests shows a mineral interest is a real property interest obtained by severing the minerals from the surface and a royalty interest grants an owner a portion of the production revenue generated.

In contrast to a royalty interest, a working interest refers to an investment in an oil and gas operation where the investor does bear some costs for exploration, drilling and production. An investor holding a royalty interest bears only the cost of the initial investment and isn't liable for ongoing operating costs.

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals. Understanding the Mineral Deed - Landgate landgate.com ? news ? understanding-the-m... landgate.com ? news ? understanding-the-m...

Severed mineral interests are considered real property in Colorado law, and as such are subject to taxation. In the Assessor's Office, once a mineral interest is severed from the surface property it is assigned a unique account number, and the interest is valued and taxed each year. MINERAL INTERESTS | Douglas County douglas.co.us ? documents ? mineral-interests douglas.co.us ? documents ? mineral-interests

To transfer mineral rights: The grantor's lawyer has to come up with a deed of transfer to the grantee. The grantee accepts the deed of transfer and goes on to register themselves as the new rightful owner at the office of the Colorado State land board. Mineral Rights in Colorado - Lease, Buy or Sell in CO | Pheasantenergy pheasantenergy.com ? colorado-mineral-rights pheasantenergy.com ? colorado-mineral-rights

However, unlike royalty and working interests, an overriding royalty interest cannot be fractionalized unlike royalty and working interests. The ORRI is a non-possessory, undivided right to a share of the oil and gas production, but it excludes the production costs of the mineral lease.

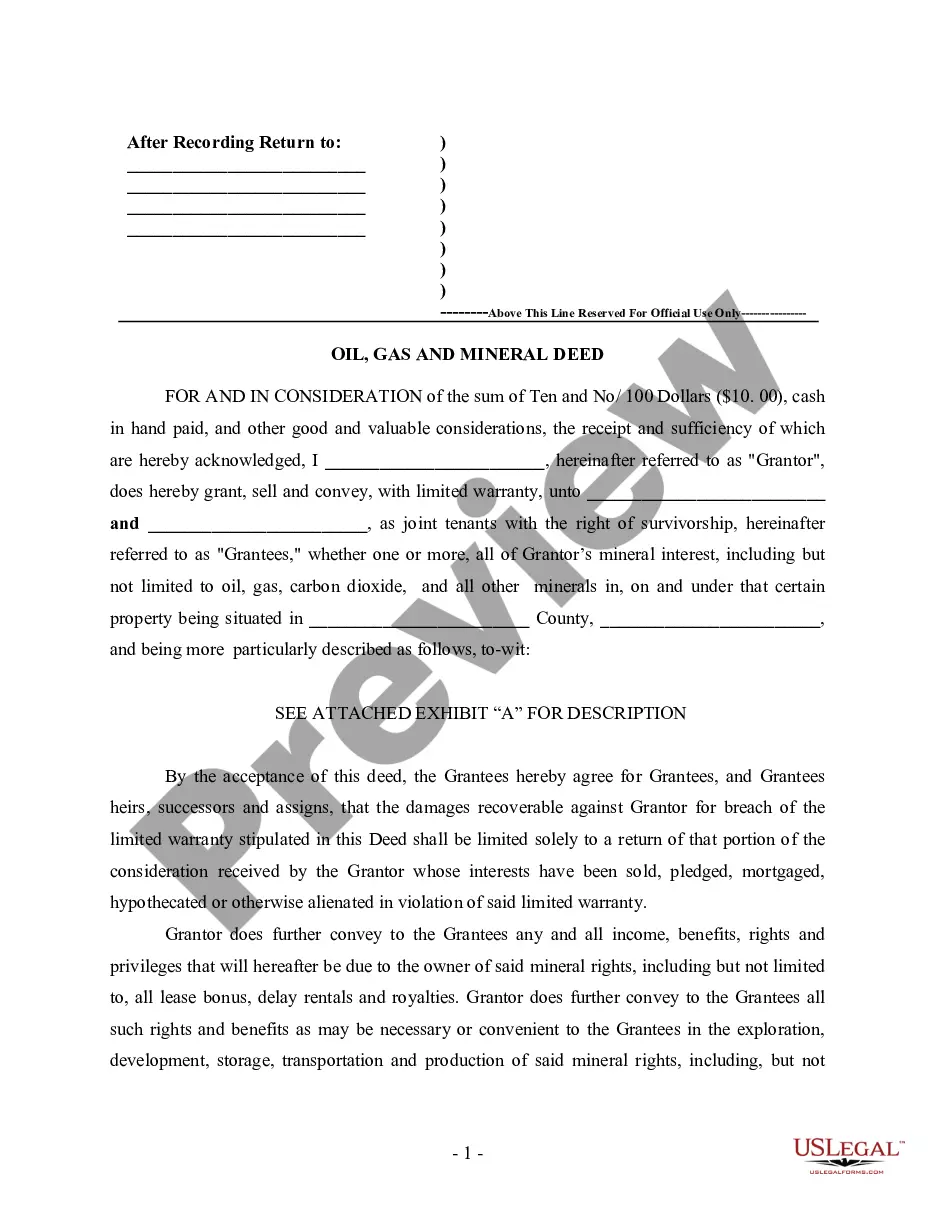

The General Mineral Deed in Colorado Quitclaims oil, gas, and mineral rights from the grantor to the grantee. THIS IS NOT A LEASE. There are no Exceptions or Reservations included. The transfer includes the oil, gas and other minerals of every kind and nature. Colorado Mineral Deed with Quit Claim Covenants Forms - Deeds.com deeds.com ? forms ? mineral-deed-with-quit... deeds.com ? forms ? mineral-deed-with-quit...

Royalty Rates: The royalty agreement or rate is a percentage of total revenue gotten from the sale of oil and gas, and it's always outlined in the lease agreement. The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations.