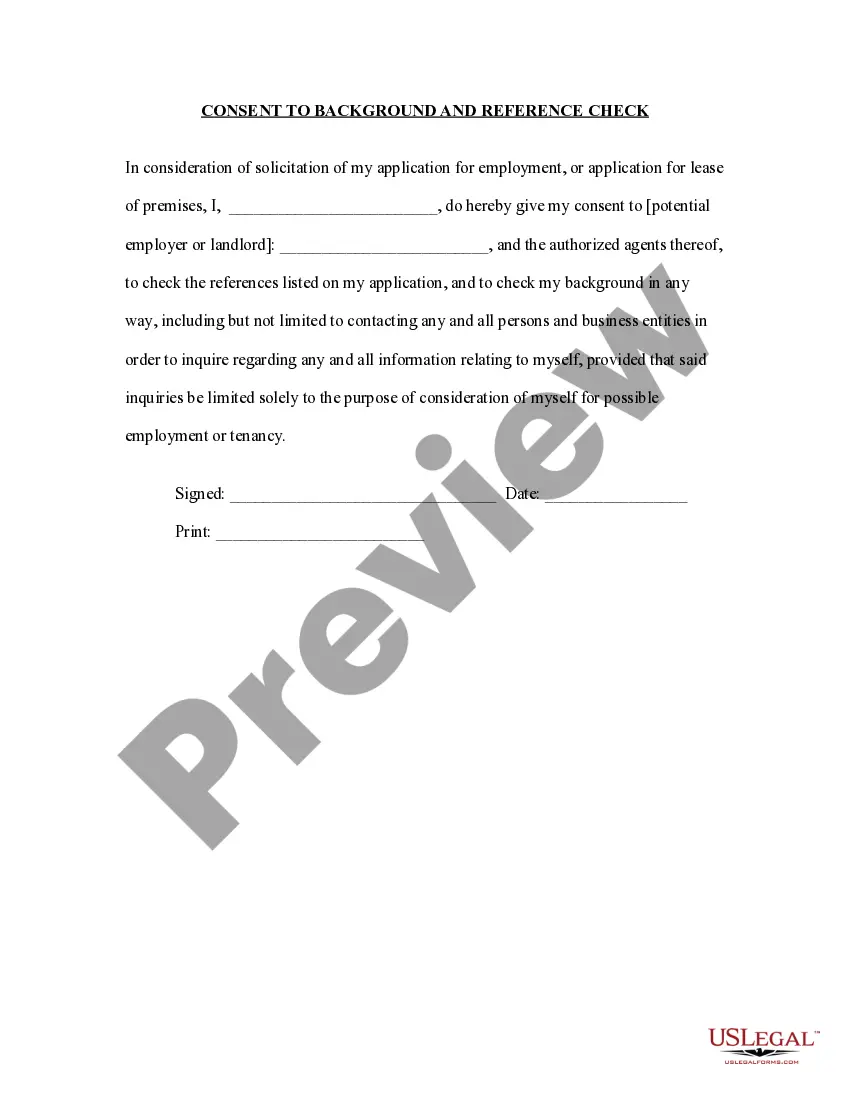

This NOTICE OF HARRASSMENT & VALIDATION OF DEBT is to be used when creditors call you repeatedly and mail you letters too. This form includes a cease and desist and a validation of debt, 2 letters in one.

Colorado Notice of Harassment and Validation of Debt

Description

How to fill out Notice Of Harassment And Validation Of Debt?

Locating the appropriate legal document template can be quite challenging. Of course, there are numerous templates available online, but how do you find the legal form you need? Utilize the US Legal Forms website. The service offers thousands of templates, such as the Colorado Notice of Harassment and Validation of Debt, that can be utilized for both business and personal needs. All of the forms are reviewed by experts and meet state and federal requirements.

If you are already registered, Log In to your account and click on the Download button to access the Colorado Notice of Harassment and Validation of Debt. Use your account to search through the legal forms you have previously acquired. Navigate to the My documents tab of your account and obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your area/state. You can review the form using the Review button and examine the form overview to ensure this is the right one for you. If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are confident that the form is suitable, click the Purchase now button to acquire the form. Choose the payment plan you prefer and provide the necessary information. Create your account and complete the purchase using your PayPal account or Visa or Mastercard. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the received Colorado Notice of Harassment and Validation of Debt.

- US Legal Forms is the largest library of legal forms where you can find numerous document templates.

- Utilize the service to download professionally-crafted documents that adhere to state requirements.

- Access a vast array of templates for various legal needs.

- Benefit from expert-reviewed forms to ensure compliance.

- Easily manage your forms through your online account.

- Streamline your legal documentation process with user-friendly tools.

Form popularity

FAQ

To dispute the validity of a debt, you should send a written notice to the debt collector stating your concerns. Clearly outline why you believe the debt is invalid, and refer to the Colorado Notice of Harassment and Validation of Debt for guidance on your rights. Keeping thorough records of your correspondence will be essential in resolving the dispute effectively.

Yes, pursuing debt validation is a smart decision, especially if you have doubts about the legitimacy of the debt. By validating the debt, you can confirm its authenticity and ensure that the collector has the right to pursue payment. This process aligns with the principles outlined in the Colorado Notice of Harassment and Validation of Debt, helping to protect your rights.

Filing a debt validation claim involves sending a written request to the debt collector within 30 days of their first contact. In your request, ask for verification of the debt and reference the Colorado Notice of Harassment and Validation of Debt to ensure compliance. Keep a copy of your request and any responses, as this documentation can be crucial if disputes arise.

To file harassment against a debt collector, start by documenting all instances of harassment, including dates, times, and specific actions taken. You can then file a complaint with the CFPB or your state’s attorney general. Utilizing the Colorado Notice of Harassment and Validation of Debt can strengthen your case and ensure that your rights are protected.

If you experience harassment from debt collectors, you can report them to the Consumer Financial Protection Bureau (CFPB) or your state’s attorney general. Additionally, you can reach out to the Federal Trade Commission (FTC). These organizations handle complaints related to unfair debt collection practices, including violations of the Colorado Notice of Harassment and Validation of Debt.

The best sample for a debt validation letter includes a clear structure, stating your intent to validate the debt and requesting specific information from the creditor. Look for samples that highlight the Colorado Notice of Harassment and Validation of Debt rights. A good sample will also include your contact information and a request for a written response. US Legal Forms provides a variety of sample letters that can help guide you in crafting your own.

To prepare a debt validation letter, start by stating your request for validation clearly. Include your name, address, and the account number related to the debt in question. Mention your rights under the Colorado Notice of Harassment and Validation of Debt to emphasize the importance of your request. Using tools available on US Legal Forms can simplify the preparation process by offering ready-made templates.

An example of a debt validation letter includes your request for the creditor to provide proof of the debt, along with your personal details and the account number. You should mention that you are exercising your rights under the Colorado Notice of Harassment and Validation of Debt. A well-structured letter increases the chances of receiving a prompt response. You can access templates through US Legal Forms to ensure your letter is comprehensive.

The 11 word phrase to stop debt collectors is often, 'I do not owe this debt, please cease all communication.' This phrase asserts your rights under the Colorado Notice of Harassment and Validation of Debt. It is important to communicate this clearly and in writing. Always keep a copy of your communication for your records.

Filling out a debt validation letter involves providing your personal details, the creditor's information, and a clear request for validation of the debt. Specify that you are invoking your rights under the Colorado Notice of Harassment and Validation of Debt. Be sure to include a statement requesting the original creditor's name and the amount owed. Utilizing US Legal Forms can help you find a proper template to streamline this process.