This is the accounting form used in an accounting of a law firm on the complaint of a former partner. It includes assets, liabilities, total liabilities, net assets, and a computation of the former partner's share.

Colorado Form of Accounting Index

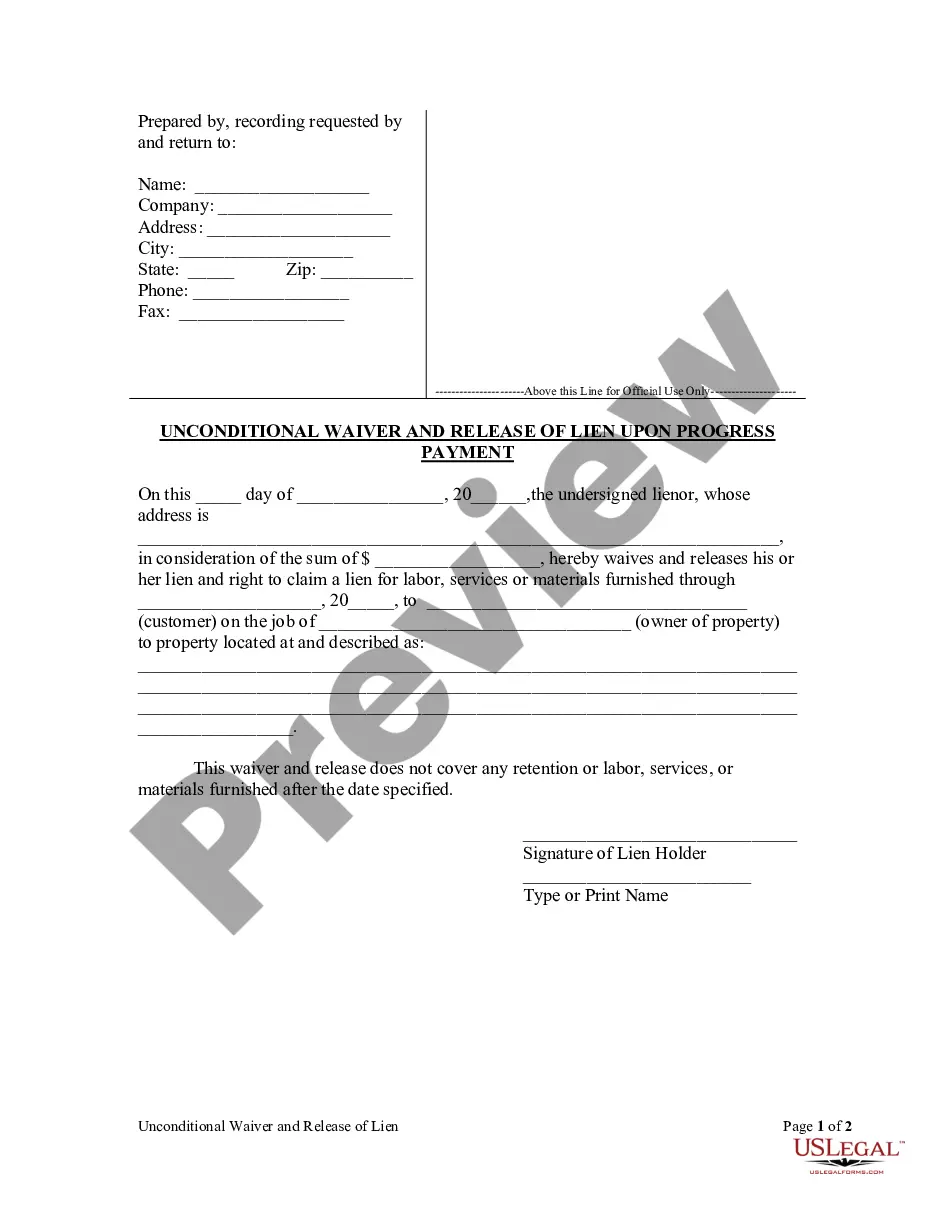

Description

How to fill out Form Of Accounting Index?

Have you ever been in a situation where you need documentation for both professional or certain purposes almost every time.

There are numerous legal document templates available online, but finding forms you can trust isn't easy.

US Legal Forms provides a vast selection of form templates, such as the Colorado Form of Accounting Index, that are designed to fulfill both state and federal requirements.

If you find the right form, click Purchase now.

Choose the pricing plan you want, provide the necessary information to create your account, and complete the purchase with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Colorado Form of Accounting Index template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/county.

- Utilize the Preview button to review the form.

- Read the description to confirm that you have selected the right form.

- If the form isn’t what you’re looking for, use the Lookup field to find the form that meets your needs and requirements.

Form popularity

FAQ

In Colorado, tax account numbers depend on the type of tax you are filing, such as sales tax or income tax. You can often find the account number on your tax forms or delving into your online tax accounts. It is crucial to locate the correct account number to ensure compliance with state regulations and the Colorado Form of Accounting Index. If you need assistance, uslegalforms offers resources tailored for filing and keeping your documents organized.

The seven common types of accounting are financial accounting, managerial accounting, tax accounting, auditing, forensic accounting, project accounting, and fund accounting. Each type serves a specific purpose in managing finances and ensuring accuracy. Familiarity with these types can enhance your understanding of the Colorado Form of Accounting Index. This knowledge enables better decision-making and strategic planning for businesses.

You can get tax forms printed at local print shops or libraries that offer printing services. Additionally, consider printing them directly from the Colorado Department of Revenue's website for the most up-to-date versions. By utilizing the Colorado Form of Accounting Index, you can access the correct forms quickly, making the printing process much easier.

To obtain Colorado state tax forms, visit the Colorado Department of Revenue's website, where you can easily download the required documents. They also provide paper forms upon request if you prefer physical copies. The Colorado Form of Accounting Index is a helpful resource, assisting you in determining which forms align with your specific tax needs.

Yes, Colorado requires residents to fill out state tax forms if their income meets certain criteria. The forms are critical for accurately reporting your income and calculating any state tax owed. Using the Colorado Form of Accounting Index simplifies this process, allowing you to find the specific forms necessary based on your earnings and circumstances.

Finding your Colorado account number is usually straightforward. You may refer to previous tax filings or documentation from the Colorado Department of Revenue to locate it. Moreover, the Colorado Form of Accounting Index serves as an excellent reference tool to help identify different account-related queries, ensuring you have reliable information at hand.

You can obtain tax return forms directly from the Colorado Department of Revenue's website. They offer downloadable versions of all necessary forms, ensuring you have easy access to what you need. Additionally, the Colorado Form of Accounting Index can guide you in selecting the right forms based on your specific tax situation.

To obtain a copy of your Colorado tax return, you can request it through the Colorado Department of Revenue. They provide various methods to access your tax return information, including online services, phone requests, or by mail. Utilizing the Colorado Form of Accounting Index can help streamline the process and ensure you receive the correct documentation efficiently.

To file Colorado use tax, you need to report the tax on your Colorado Individual Income Tax Return or through a specific use tax return form. The Colorado Form of Accounting Index outlines the necessary steps and provides clarity on what items are subject to use tax. Using platforms like US Legal Forms can simplify this process and ensure accurate reporting.

The standard deadline for filing your Colorado tax return is typically April 15. However, if this date falls on a weekend or holiday, the deadline extends to the next business day. By referring to the Colorado Form of Accounting Index, you can confirm specific dates and circumstances that may affect your filing schedule.