Colorado Liquidation of Partnership with Sale and Proportional Distribution of Assets

Description

How to fill out Liquidation Of Partnership With Sale And Proportional Distribution Of Assets?

Finding the appropriate legal document template can be quite challenging.

Of course, there are numerous formats available online, but how can you find the legal form you need.

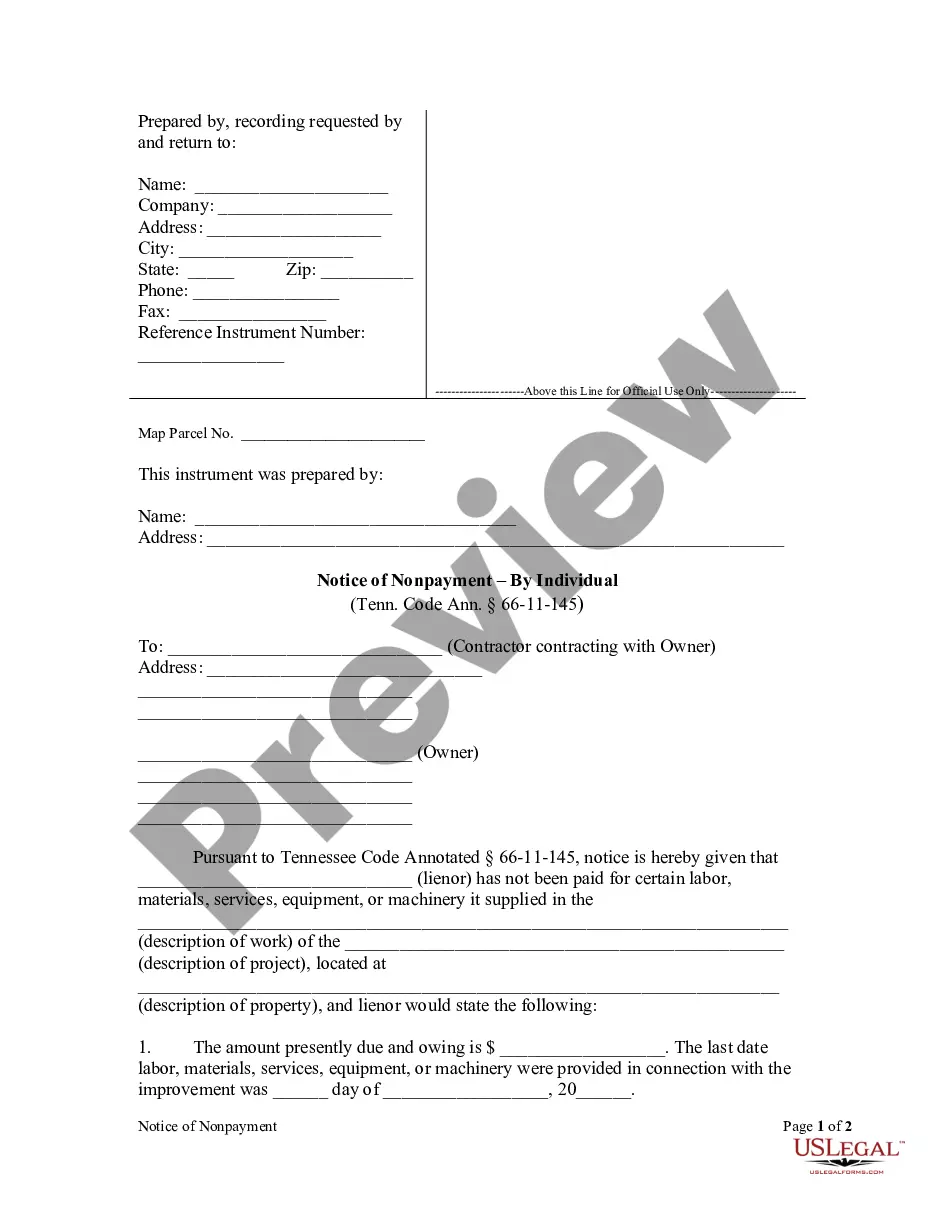

Utilize the US Legal Forms website. This service offers thousands of templates, including the Colorado Liquidation of Partnership with Sale and Proportional Distribution of Assets, suitable for both business and personal needs.

First, ensure you have selected the correct form for your city/region. You can review the form using the Preview button and read the form description to confirm it meets your requirements.

- All templates are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Colorado Liquidation of Partnership with Sale and Proportional Distribution of Assets.

- Use your account to look through the legal forms you have previously purchased.

- Go to the My documents tab in your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward steps to follow.

Form popularity

FAQ

The correct order for asset distribution upon the dissolution of a general partnership typically starts with settling any outstanding liabilities. Once liabilities are cleared, you distribute remaining assets to partners according to their ownership percentages. This structured approach aligns perfectly with the Colorado Liquidation of Partnership with Sale and Proportional Distribution of Assets guidelines.

Only partners who receive a liquidating distribution of cash may have an immediate taxable gain or loss to report. The value of marketable securities, such as stock investments that are traded on a public stock exchange, and decreases to your share of the partnership's debt are both treated as cash distributions.

Only partnership assets are to be divided among partners upon dissolution. If assets were used by the partnership, but did not form part of the partnership assets, then those assets will not be divided upon dissolution (see, for example, Hansen v Hansen, 2005 SKQB 436).

Partnership withdrawalsPartners withdrawing from the partnership are not taxed to the extent the withdrawal is a return of the partner's investment. In other words, any return or withdrawal paid to the partner up to and including the partner's capital investment will be non-taxable for the partner.

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.

Property Distributions. When property is distributed to a partner, then the partnership must treat it as a sale at fair market value ( FMV ). The partner's capital account is decreased by the FMV of the property distributed. The book gain or loss on the constructive sale is apportioned to each of the partners' accounts

Allocation of Income and Loss Credit each expense account and debit the income section account for total expenses. If the partnership had income, debit the income section for its balance and credit each partner's capital account based on his or her share of the income.

A distribution is a transfer of cash or property by a partnership to a partner with respect to the partner's interest in partnership capital or income. Distributions do not include loans to partners or amounts paid to partners for services or the use of property, such as rent, or guaranteed payments.

Both the distributee partner and the partnership can recognize taxable gain or loss in these distributions. The partnership will recognize gain or loss if its property involved in the deemed exchange of Section 751 property has unrealized appreciation or depreciation.

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.