Colorado Self-Employed X-Ray Technician Self-Employed Independent Contractor

Description

How to fill out Self-Employed X-Ray Technician Self-Employed Independent Contractor?

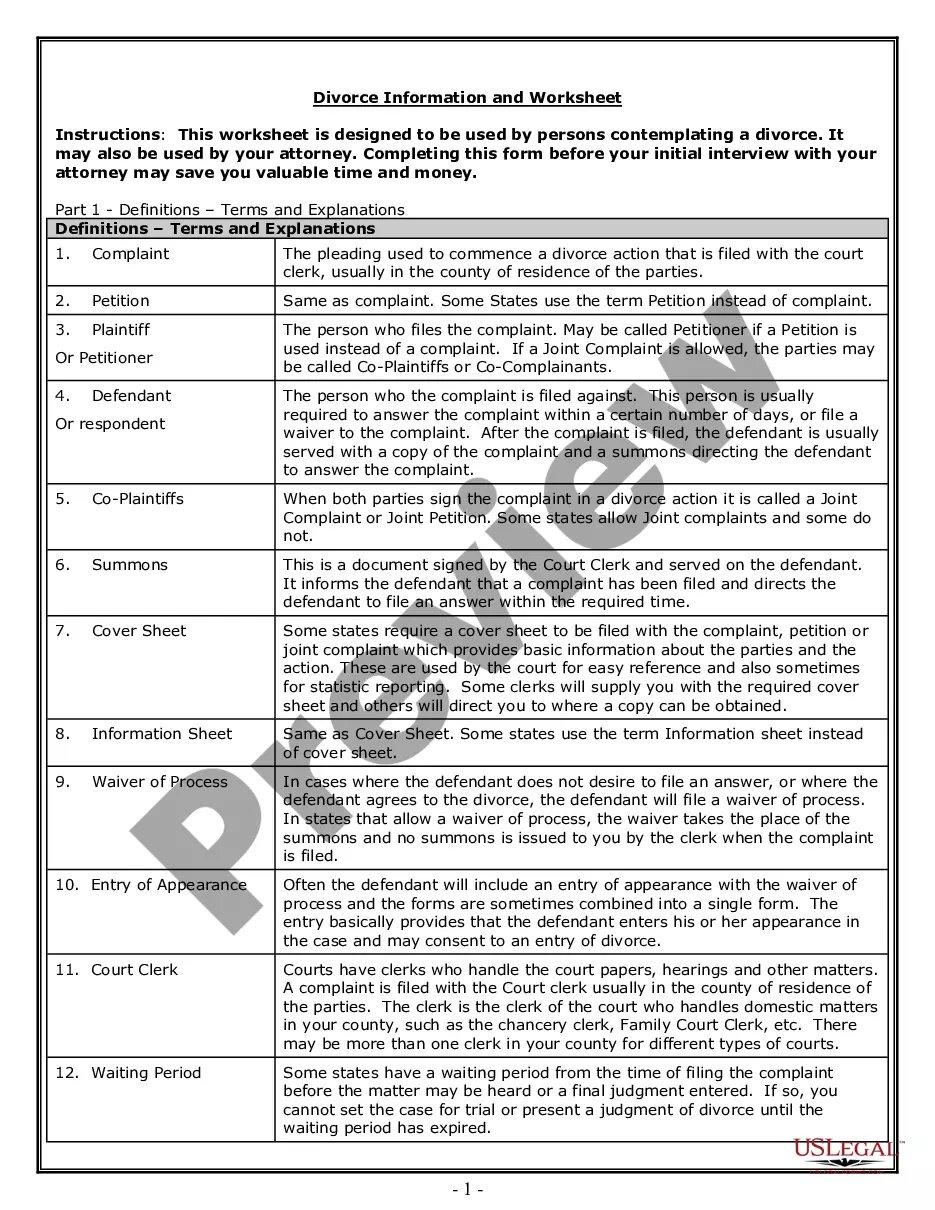

It is feasible to spend time online searching for the legal document template that meets the requirements of state and federal regulations you require. US Legal Forms offers thousands of legal documents that are reviewed by experts.

You can obtain or print the Colorado Self-Employed X-Ray Technician Self-Employed Independent Contractor from our service.

If you already possess a US Legal Forms account, you can Log In and then click the Download button. After that, you can fill out, modify, print, or sign the Colorado Self-Employed X-Ray Technician Self-Employed Independent Contractor. Every legal document template you acquire is yours permanently. To obtain another copy of the downloaded form, navigate to the My documents section and click the corresponding button.

Choose the format of the document and download it to your device. Make modifications to your document if needed. You can fill out, modify, sign, and print the Colorado Self-Employed X-Ray Technician Self-Employed Independent Contractor. Download and print thousands of document templates using the US Legal Forms website, which offers the largest selection of legal documents. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the state/city of your choice. Review the form description to confirm you have chosen the right form.

- If available, utilize the Preview button to examine the document template as well.

- If you wish to obtain another version of the form, use the Search field to find the template that meets your needs.

- Once you have located the template you require, click Purchase now to proceed.

- Select the pricing plan you desire, enter your credentials, and create an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal document.

Form popularity

FAQ

The difference between an independent contractor and an employee in Colorado primarily revolves around the level of autonomy and the nature of the working arrangement. Independent contractors, like a Colorado Self-Employed X-Ray Technician Self-Employed Independent Contractor, have more freedom to manage their schedules and work processes compared to employees, who follow specific instructions from their employers. This distinction is vital for your rights and responsibilities under the law, so consider consulting platforms like US Legal Forms for guidance on your specific situation.

The determination of whether someone is an employee or an independent contractor in Colorado is based on various factors such as the degree of control the employer has and the nature of the work relationship. For instance, if you, as a Colorado Self-Employed X-Ray Technician Self-Employed Independent Contractor, set your own hours and methods, you likely qualify as a contractor. This classification affects tax obligations, benefits, and legal protections, making it crucial to understand your status.

In Colorado, the main difference between an employee and a contractor lies in control and independence. An employee works under the direction of an employer, while a contractor operates independently, determining how to complete their tasks. For those considering becoming a Colorado Self-Employed X-Ray Technician Self-Employed Independent Contractor, it is important to understand this distinction to ensure compliance with state laws.

You can show income as an independent contractor by keeping detailed records of all your earnings and expenses. This includes invoices you send to clients and any 1099 forms you receive. As a Colorado Self-Employed X-Ray Technician Self-Employed Independent Contractor, maintaining organized financial documentation is crucial for reporting your income accurately come tax season.

To fill out a 1099 form, you will need to provide your personal information, including your name and Tax Identification Number. Then, input the total amount you earned from each client during the tax year. As a Colorado Self-Employed X-Ray Technician Self-Employed Independent Contractor, ensure you keep accurate records of your earnings to simplify this process.

Yes, receiving a 1099 form typically indicates that you are self-employed. This form is used to report income earned as an independent contractor, showing that you worked for a client without being their employee. For a Colorado Self-Employed X-Ray Technician Self-Employed Independent Contractor, this is a common way to receive payment and report earnings.

To qualify as self-employed, you must earn income from a business you operate. This could include freelance work, independent contracting, or any service you provide outside of traditional employment. As a Colorado Self-Employed X-Ray Technician Self-Employed Independent Contractor, your work arrangements and income sources will define your self-employment status.

Independent contractors fall under the category of self-employment. This means you operate as a business entity, providing services to clients without being directly employed by them. As a Colorado Self-Employed X-Ray Technician Self-Employed Independent Contractor, you have the ability to dictate your work terms, which can enhance job satisfaction.

Absolutely, an independent contractor qualifies as self-employed. This classification allows you to work on a project basis for various clients without being tied to a single employer. For a Colorado Self-Employed X-Ray Technician Self-Employed Independent Contractor, this means greater flexibility and the potential for diverse opportunities.

Yes, an independent contractor is indeed considered self-employed. This means you operate your own business, manage your own schedule, and take responsibility for your own taxes. As a Colorado Self-Employed X-Ray Technician Self-Employed Independent Contractor, you enjoy the freedom that comes with this status, but you also need to navigate your tax obligations.