Colorado Self-Employed Plumbing Services Contract

Description

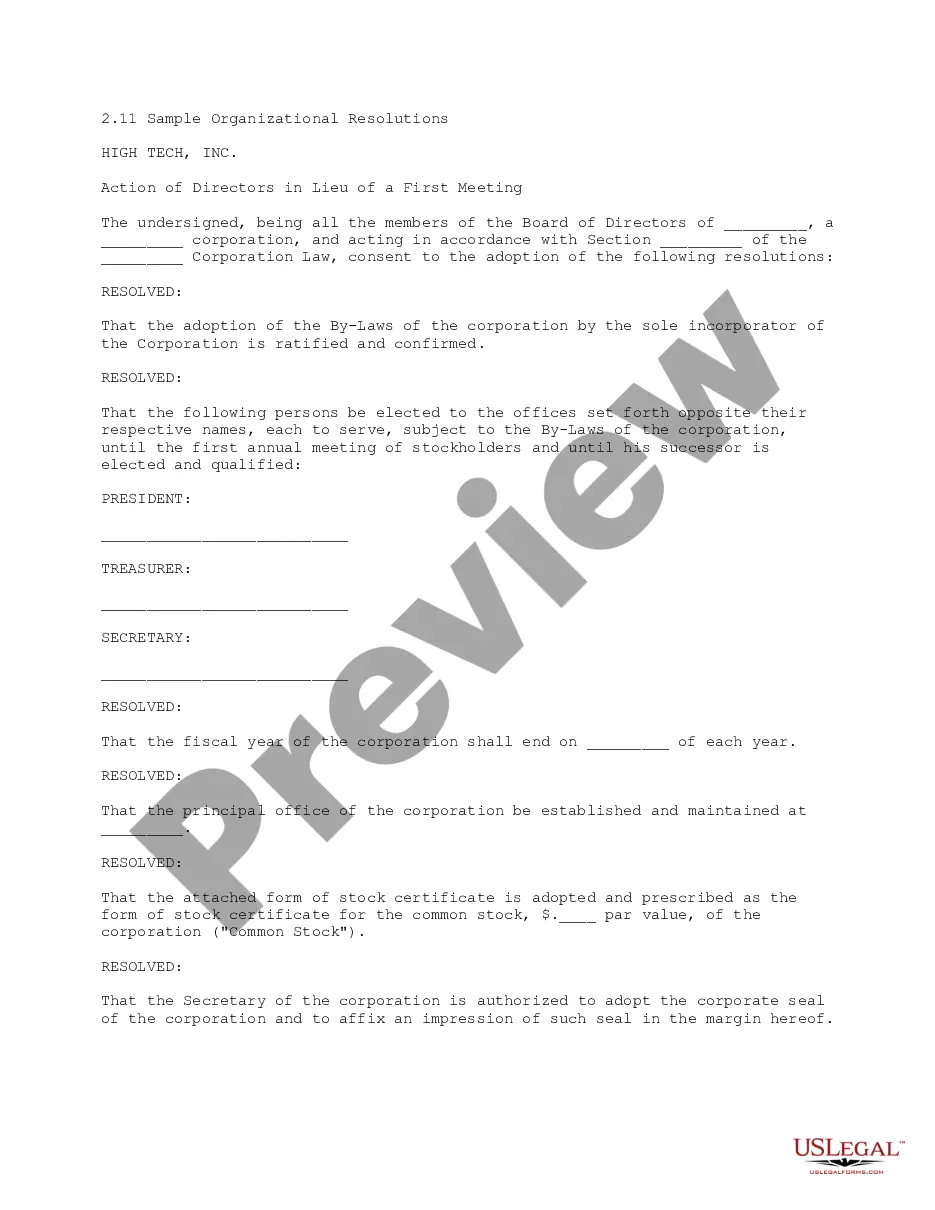

How to fill out Self-Employed Plumbing Services Contract?

US Legal Forms - one of the largest collections of official documents in the United States - offers a broad array of legal document templates that you can download or print. Through the website, you can access thousands of forms for business and personal purposes, organized by type, state, or keywords. You can find the latest versions of documents like the Colorado Self-Employed Plumbing Services Contract in just moments.

If you already have a subscription, Log In and download the Colorado Self-Employed Plumbing Services Contract from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple steps to help you get started: Ensure you have selected the correct form for your area/county. Click on the Review button to examine the form’s content. Check the form summary to confirm that you have selected the correct document. If the form does not meet your needs, utilize the Search field at the top of the page to find one that does. If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, choose your preferred payment plan and provide your details to register for the account. Complete the transaction. Use Visa, Mastercard, or a PayPal account to finalize the payment. Select the format and download the form to your device. Edit. Complete, modify, and print and sign the downloaded Colorado Self-Employed Plumbing Services Contract. Every template you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

- Access the Colorado Self-Employed Plumbing Services Contract with US Legal Forms, the most extensive collection of legal document templates.

- Utilize a plethora of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

Filing taxes as an independent contractor can seem daunting, but it’s manageable with the right guidance. You must report your income and expenses on your tax return using Schedule C. Additionally, consider making estimated tax payments throughout the year to avoid penalties. Utilizing resources like the Colorado Self-Employed Plumbing Services Contract from US Legal Forms can help you understand your tax obligations and keep accurate records.

Setting up as a self-employed contractor involves a few key steps. First, choose a business structure that suits your needs, such as a sole proprietorship or LLC. Next, you’ll need to register your business and obtain the necessary licenses. Using a Colorado Self-Employed Plumbing Services Contract from US Legal Forms can streamline the process, ensuring you cover all essential aspects of your new venture.

Yes, independent contractors in Colorado typically need a business license, especially when providing services like plumbing. Obtaining a license ensures you comply with state regulations and demonstrates professionalism to your clients. You can easily secure a Colorado Self-Employed Plumbing Services Contract through platforms like US Legal Forms, which can guide you in meeting all legal requirements.

A handyman can perform some plumbing tasks, but only minor ones that do not require a license in Colorado. For more extensive plumbing work, such as installations or repairs that affect the system's integrity, hiring a licensed plumber is necessary. Always check local laws to avoid any legal issues. To protect your interests and define the scope of work, consider using a Colorado Self-Employed Plumbing Services Contract.

To own a plumbing company in Colorado, you do not necessarily need to be a licensed plumber, but your employees must be properly licensed. As the business owner, understanding the legal requirements and ensuring compliance with local regulations is crucial. Having a clear contract, such as a Colorado Self-Employed Plumbing Services Contract, helps outline the roles and responsibilities of all parties involved.

In Colorado, a handyman can perform tasks like minor repairs, maintenance, and installation work without a license, as long as it does not involve plumbing, electrical, or structural changes. This includes tasks such as painting, drywall repair, and basic home improvements. However, for plumbing-related work, it is advisable to consult local regulations. A Colorado Self-Employed Plumbing Services Contract can help clarify the services you are authorized to provide.

Yes, a handyman can perform minor plumbing tasks in Colorado, such as fixing leaky faucets or unclogging drains. However, the scope of work is limited and does not include major plumbing installations or repairs. Always verify the local laws to ensure that the work performed is within legal boundaries. For detailed service agreements, a Colorado Self-Employed Plumbing Services Contract can be beneficial.

In Colorado, you typically need a license to work as a contractor, including plumbing services. Specific licensing requirements can vary based on the city or county. It's essential to check local regulations to ensure compliance. To simplify this process, consider using a Colorado Self-Employed Plumbing Services Contract to outline your services and responsibilities.

To fill out an independent contractor agreement, begin by entering the names and contact information of both parties. Clearly state the services to be provided, payment terms, and any specific deadlines. Using a Colorado Self-Employed Plumbing Services Contract can simplify this task, ensuring you cover all necessary details.

You can certainly write your own service contract, provided it includes essential elements like scope of services, payment details, and terms of termination. Make sure both parties understand and agree to the terms laid out in the document. A Colorado Self-Employed Plumbing Services Contract is an excellent resource to help you create a comprehensive service agreement.