Colorado Self-Employed Independent Contractor Chemist Agreement

Description

How to fill out Self-Employed Independent Contractor Chemist Agreement?

Have you been inside a situation the place you need to have paperwork for sometimes company or personal uses nearly every time? There are a lot of legitimate record templates available on the Internet, but finding versions you can trust is not simple. US Legal Forms provides thousands of kind templates, much like the Colorado Self-Employed Independent Contractor Chemist Agreement, that happen to be published in order to meet federal and state needs.

Should you be already knowledgeable about US Legal Forms site and have your account, basically log in. After that, you can down load the Colorado Self-Employed Independent Contractor Chemist Agreement design.

If you do not provide an accounts and wish to start using US Legal Forms, abide by these steps:

- Get the kind you want and make sure it is to the proper area/state.

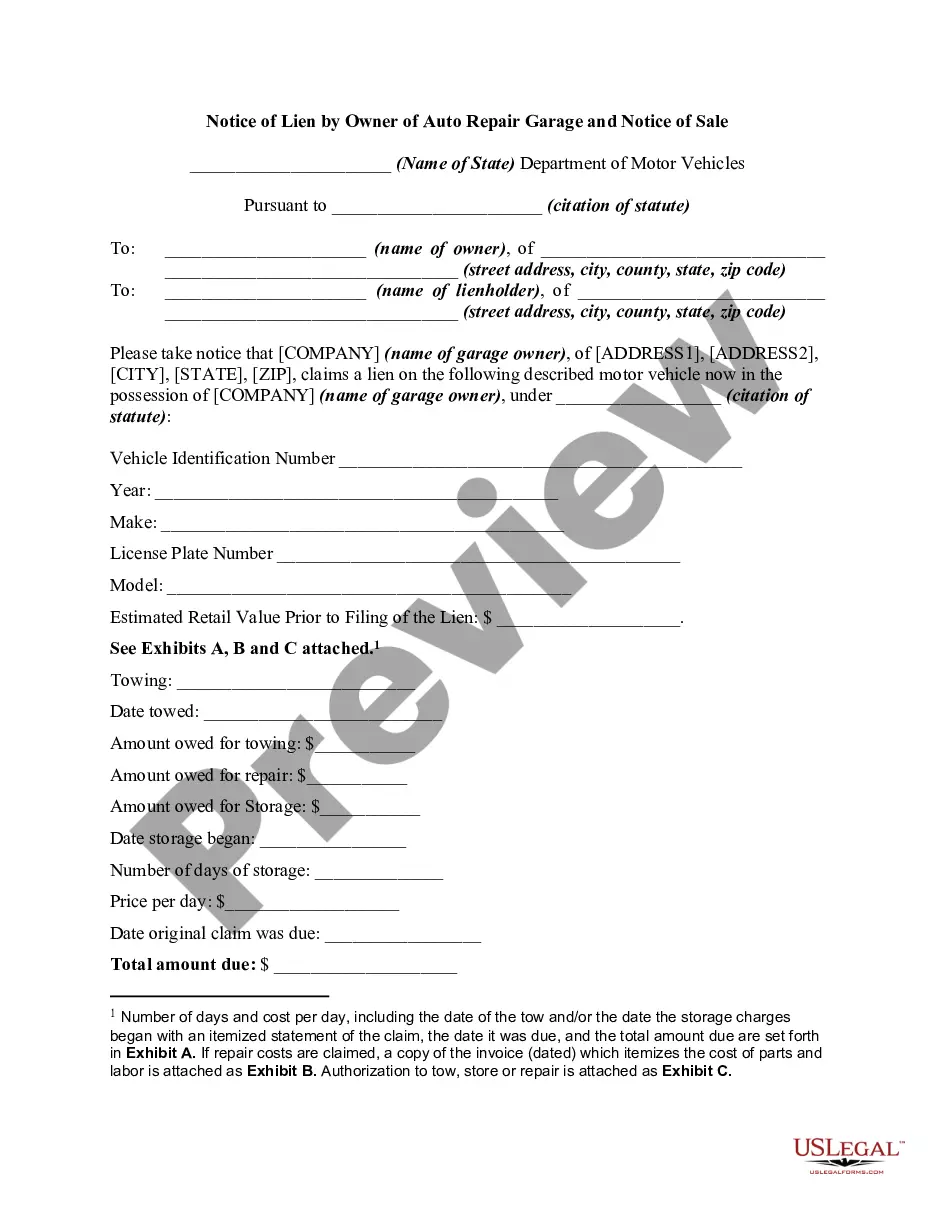

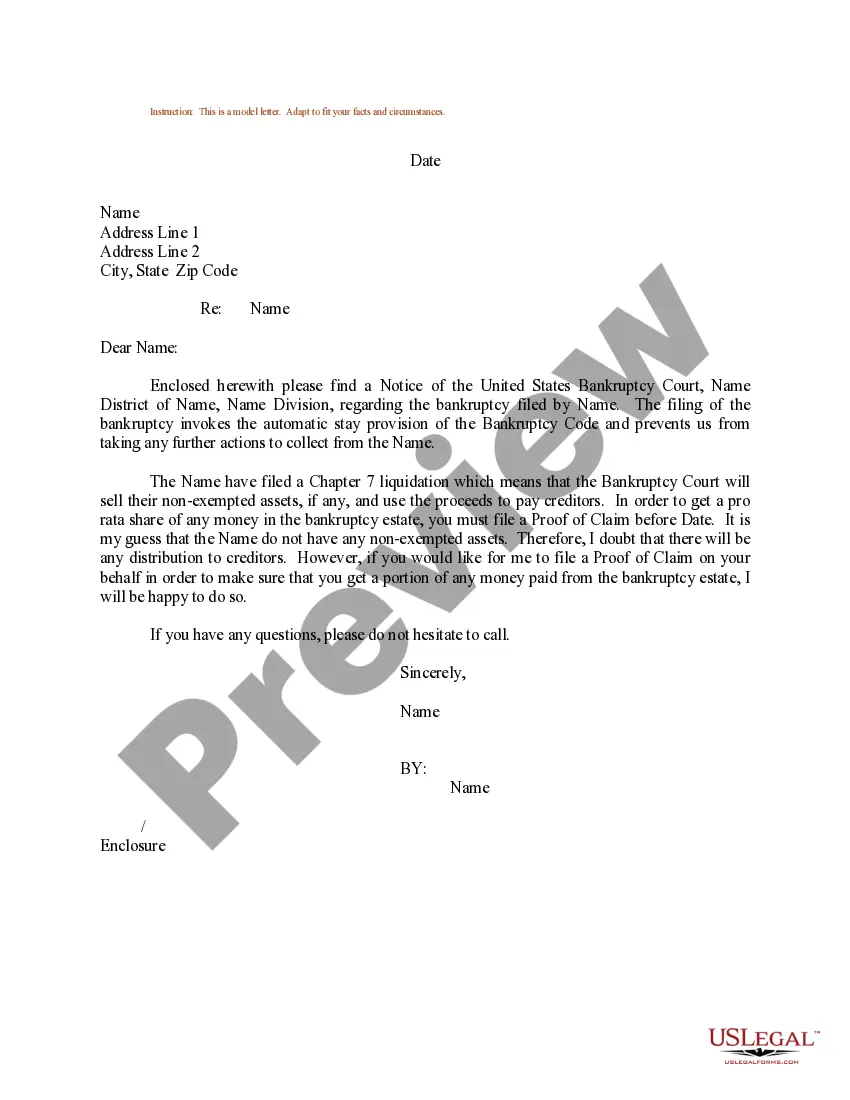

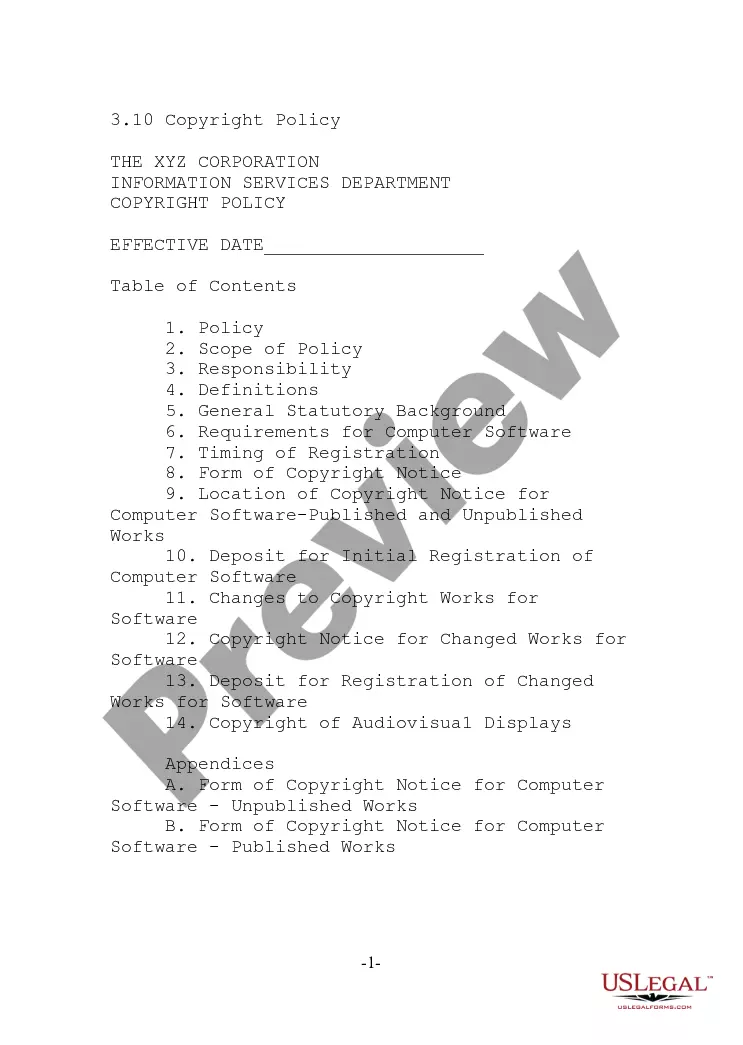

- Take advantage of the Review key to check the form.

- Browse the explanation to actually have selected the appropriate kind.

- If the kind is not what you are trying to find, utilize the Look for area to discover the kind that suits you and needs.

- If you get the proper kind, click on Purchase now.

- Select the costs program you would like, submit the specified details to generate your money, and buy an order utilizing your PayPal or bank card.

- Choose a hassle-free data file format and down load your duplicate.

Get all the record templates you have bought in the My Forms menus. You can obtain a extra duplicate of Colorado Self-Employed Independent Contractor Chemist Agreement whenever, if possible. Just click on the needed kind to down load or produce the record design.

Use US Legal Forms, the most comprehensive collection of legitimate types, to save time as well as stay away from faults. The services provides appropriately made legitimate record templates which you can use for a range of uses. Make your account on US Legal Forms and commence making your daily life easier.

Form popularity

FAQ

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The state now requires that anyone filing a 1099 either has an LLC associated with their operations as a contractor or that they fully incorporate their business.

In the event that you are not paid as an employee, you are considered an independent contractor and must have a business license.

The major difference between those workers and Independent Contractors is that the contractors are actually W-2 employees, but they are employed by a staffing agency or a back-office service provider such as FoxHire instead of by the company they are performing work for.

In the event that you are not paid as an employee, you are considered an independent contractor and must have a business license.

Under Colorado Law, an individual is presumed to be in covered employment unless and until it is shown that the individual is free from control and direction in the performance of services, both under contract and in fact, and that the individual is customarily engaged in an independent trade, occupation, profession or

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Under Colorado Law, an individual is presumed to be in covered employment unless and until it is shown that the individual is free from control and direction in the performance of services, both under contract and in fact, and that the individual is customarily engaged in an independent trade, occupation, profession or