Colorado Fuel Delivery And Storage Services - Self-Employed

Description

How to fill out Fuel Delivery And Storage Services - Self-Employed?

US Legal Forms - one of the most prominent collections of legal templates in the United States - offers a variety of legal document formats that you can download or print.

By utilizing the site, you will access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest editions of forms such as the Colorado Fuel Delivery And Storage Services - Self-Employed in moments.

If you already have a subscription, Log In and retrieve Colorado Fuel Delivery And Storage Services - Self-Employed from your US Legal Forms library. The Download option will appear on every form you view. You can access all previously downloaded forms from the My documents tab of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Edit. Fill out, modify, and print and sign the downloaded Colorado Fuel Delivery And Storage Services - Self-Employed. Each template you added to your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you want. Gain access to the Colorado Fuel Delivery And Storage Services - Self-Employed with US Legal Forms, the largest collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your area/county.

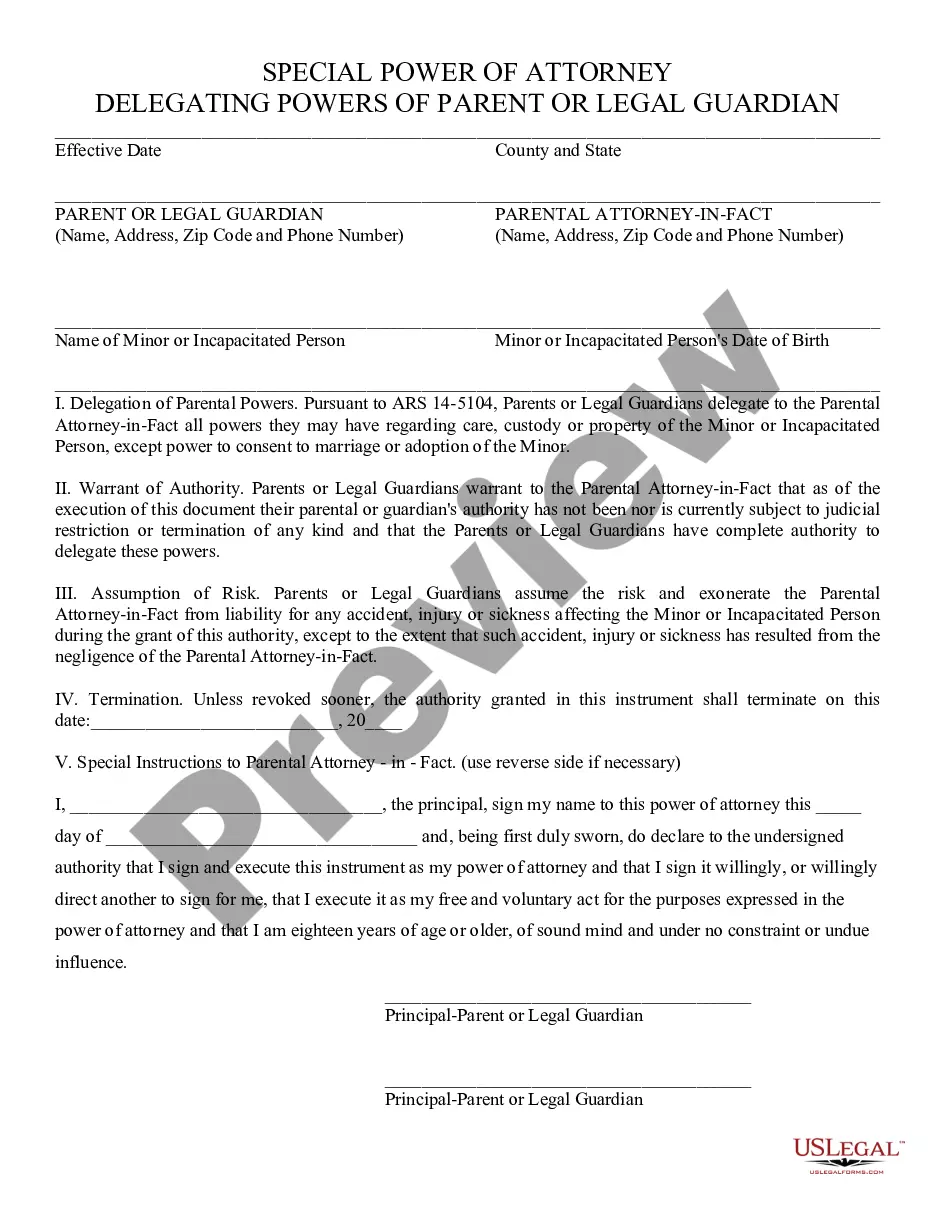

- Click the Preview option to review the form's content.

- Check the form's description to ensure you have chosen the right document.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, choose the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

To start a fuel delivery business under Colorado Fuel Delivery and Storage Services - Self-Employed, you will need a valid business license and appropriate permits. You will also require specialized equipment, such as fuel tanks and delivery vehicles, designed to safely transport fuel. Additionally, having a clear understanding of safety regulations and environmental guidelines is essential. Lastly, consider using USLegalForms to access resources and templates that help streamline your business formation process.

The self-employment tax in Colorado consists of Social Security and Medicare taxes, totaling 15.3% on your net earnings. Understanding this tax is vital for those operating in Colorado Fuel Delivery And Storage Services - Self-Employed, as it impacts your overall tax liability. Self-employed individuals must plan for this expense to avoid surprises during tax time. Proper accounting and financial planning can help you manage this responsibility effectively.

Yes, Colorado recognizes single-member LLCs as valid business entities. This recognition allows owners to benefit from limited liability protection while enjoying pass-through taxation. This status is an excellent option for individuals engaged in Colorado Fuel Delivery And Storage Services - Self-Employed, providing legal protection while simplifying tax obligations. Leveraging this structure can lead to significant advantages for your business.

member LLC typically does not file a separate tax return, as it is considered a disregarded entity for tax purposes. Instead, the individual owner reports business income on their personal tax return. This arrangement simplifies tax reporting, especially for those in Colorado Fuel Delivery And Storage Services SelfEmployed. It's essential to stay organized to ensure all income is accurately reported.

To claim your fuel tax credit in Colorado, you must fill out specific forms available from the Colorado Department of Revenue. Ensure you have all relevant documentation related to your fuel purchases. This is especially crucial for self-employed individuals relying on Colorado Fuel Delivery And Storage Services - Self-Employed. Properly documenting your fuel expenses can maximize your potential credits and reduce your tax liability.

Any individual or business earning income in Colorado must file a tax return. This includes self-employed individuals, such as those utilizing Colorado Fuel Delivery And Storage Services - Self-Employed. Even if your income is below a certain threshold, filing is often beneficial for potential tax credits and refunds. Stay informed about your filing responsibilities to make the most out of your earnings.

Yes, a single member LLC must file a Colorado tax return if it conducts income-generating activities. In this case, the owner reports income on their personal tax return under federal guidelines. Although the LLC is a separate entity, the state requires you to declare any business income in Colorado. Understanding your obligations can help you navigate Colorado Fuel Delivery And Storage Services - Self-Employed effectively.

The gasoline tax in Colorado is currently around 22 cents per gallon, in addition to federal taxes. Given that fuel expenses can greatly impact your bottom line as a self-employed individual, consider using Colorado Fuel Delivery And Storage Services - Self-Employed. They can provide crucial insights regarding these tax rates, which can help you make more strategic financial choices.

In Colorado, the tax on one gallon of gasoline includes both state and federal taxes, totaling approximately 34 cents per gallon. This amount can fluctuate with regulatory changes or potential new legislation. If you're self-employed and depend on fuel for your business, understanding these costs is essential when managing your finances with Colorado Fuel Delivery And Storage Services - Self-Employed.

No, dyed diesel is generally not subject to sales tax in Colorado, as it is intended for off-road use. However, if you are considering using dyed diesel through Colorado Fuel Delivery And Storage Services - Self-Employed for business purposes, it's wise to consult a tax professional to navigate any specific regulations related to your situation.