Colorado Specialty Services Contact - Self-Employed

Description

How to fill out Specialty Services Contact - Self-Employed?

Are you currently in a situation where you require documents for potential business or specific objectives almost every time.

There are numerous legitimate document templates accessible online, but finding reliable forms is not straightforward.

US Legal Forms offers a vast array of template options, including the Colorado Specialty Services Contact - Self-Employed, which can be tailored to comply with federal and state regulations.

Access all of the document templates you have purchased in the My documents section. You can obtain an additional copy of the Colorado Specialty Services Contact - Self-Employed at any time, if needed. Just click on the desired form to download or print the template.

Utilize US Legal Forms, the most extensive collection of legal documents, to save time and avoid errors. The service provides professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and have an account, simply sign in.

- Then, you can download the Colorado Specialty Services Contact - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

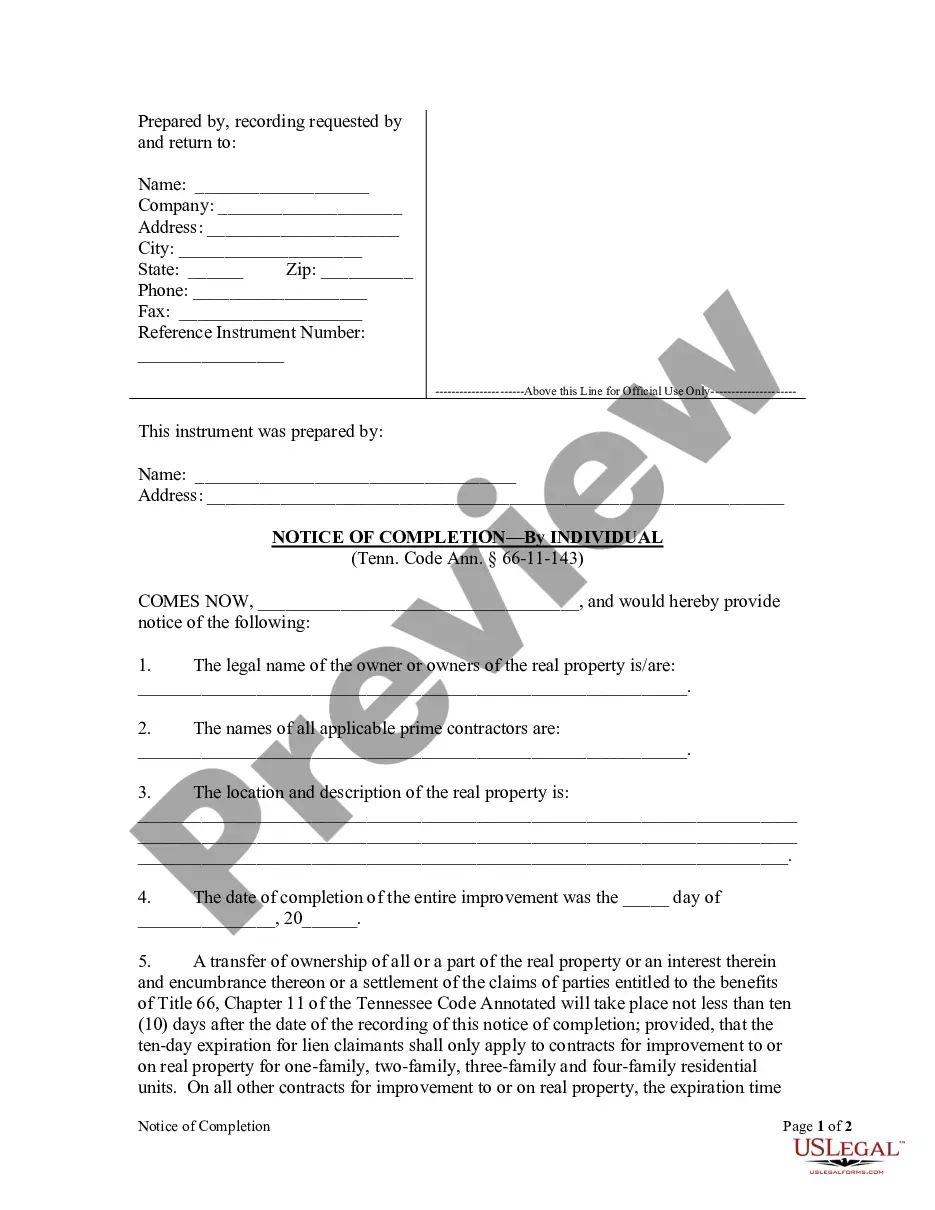

- Use the Preview button to review the form.

- Check the details to confirm you have selected the correct form.

- If the form is not what you’re looking for, utilize the Search field to find the form that suits your needs and requirements.

- Once you have the appropriate form, click on Purchase now.

- Select the pricing plan you want, fill in the necessary details to create your account, and pay for your order with your PayPal or credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

You can reach the Colorado Department of Revenue by calling their main line or visiting their official website for additional contact information. They offer various channels, including email and online forms, for inquiries. For a more personalized approach, using Colorado Specialty Services Contact - Self-Employed can enhance your communication and expedite responses relevant to your needs.

To get answers to your tax questions, consider reaching out to the Colorado Department of Revenue or consulting with a tax professional. You can also find valuable information online through reputable tax resources. Using Colorado Specialty Services Contact - Self-Employed can provide you with the exact support you need, simplifying your search for answers.

Yes, Colorado does have a self-employment tax, which contributes to Social Security and Medicare. As a self-employed individual, you are responsible for the full self-employment tax on your income, which is calculated when you file your taxes. For navigation through these complexities, consider using Colorado Specialty Services Contact - Self-Employed for tailored advice and resources.

To speak with someone at the Colorado Department of Revenue, call their customer service line during business hours. Be prepared to provide your information to help them assist you effectively. Alternatively, Colorado Specialty Services Contact - Self-Employed can connect you with experts who can handle your inquiries efficiently.

For inquiries regarding your Colorado state tax refund, you should call the Colorado Department of Revenue's taxpayer service line. They provide assistance with a variety of tax-related questions, including refunds. Utilizing resources like Colorado Specialty Services Contact - Self-Employed can help streamline your tax inquiries and provide supportive guidance.

A personal services contract is an agreement between a contractor and a client for specific services requested. This type of contract outlines the scope of work, payment terms, and the responsibilities of both parties. Utilizing Colorado Specialty Services Contact - Self-Employed ensures that your personal services contract meets all legal requirements and protects your interests.

To speak with a real person about your tax refund, you can contact the Colorado Department of Revenue directly. Prepare your tax information and be ready for verification to expedite the process. Engaging with professionals through Colorado Specialty Services Contact - Self-Employed can also help clarify your queries and ensure you receive accurate assistance.

An independent contractor in Colorado is a person or business that provides services to another entity under terms specified in a contract. Unlike an employee, you manage your own business, set your hours, and have control over the means and methods of performing the work. Understanding this distinction is essential for compliance and tax purposes, especially when considering your Colorado Specialty Services Contact - Self-Employed.

Several states, including Colorado, offer self-employment assistance programs to support new business owners. These programs aim to help self-employed individuals build sustainable businesses while navigating financial challenges. To find the most suitable options for you, consider exploring information provided by Colorado Specialty Services Contact - Self-Employed.

Yes, contract work typically falls under self-employment. As a contractor, you operate your own business and provide services on a project basis. This arrangement allows for flexibility, but also requires you to manage your taxes and business expenses. For further guidance on navigating this status, refer to Colorado Specialty Services Contact - Self-Employed.