Colorado Cosmetologist Agreement - Self-Employed Independent Contractor

Description

How to fill out Cosmetologist Agreement - Self-Employed Independent Contractor?

Are you currently in the situation where you require documents for either business or personal purposes nearly every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, such as the Colorado Cosmetologist Agreement - Self-Employed Independent Contractor, which can be tailored to meet federal and state regulations.

When you obtain the correct form, click Get now.

Select the pricing plan you want, provide the necessary information to create your account, and pay for your order using PayPal or Visa or Mastercard. Choose a suitable document format and download your copy. Access all the document templates you have purchased in the My documents section. You can download an additional copy of the Colorado Cosmetologist Agreement - Self-Employed Independent Contractor at any time if needed. Just click on the desired form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Colorado Cosmetologist Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct region/state.

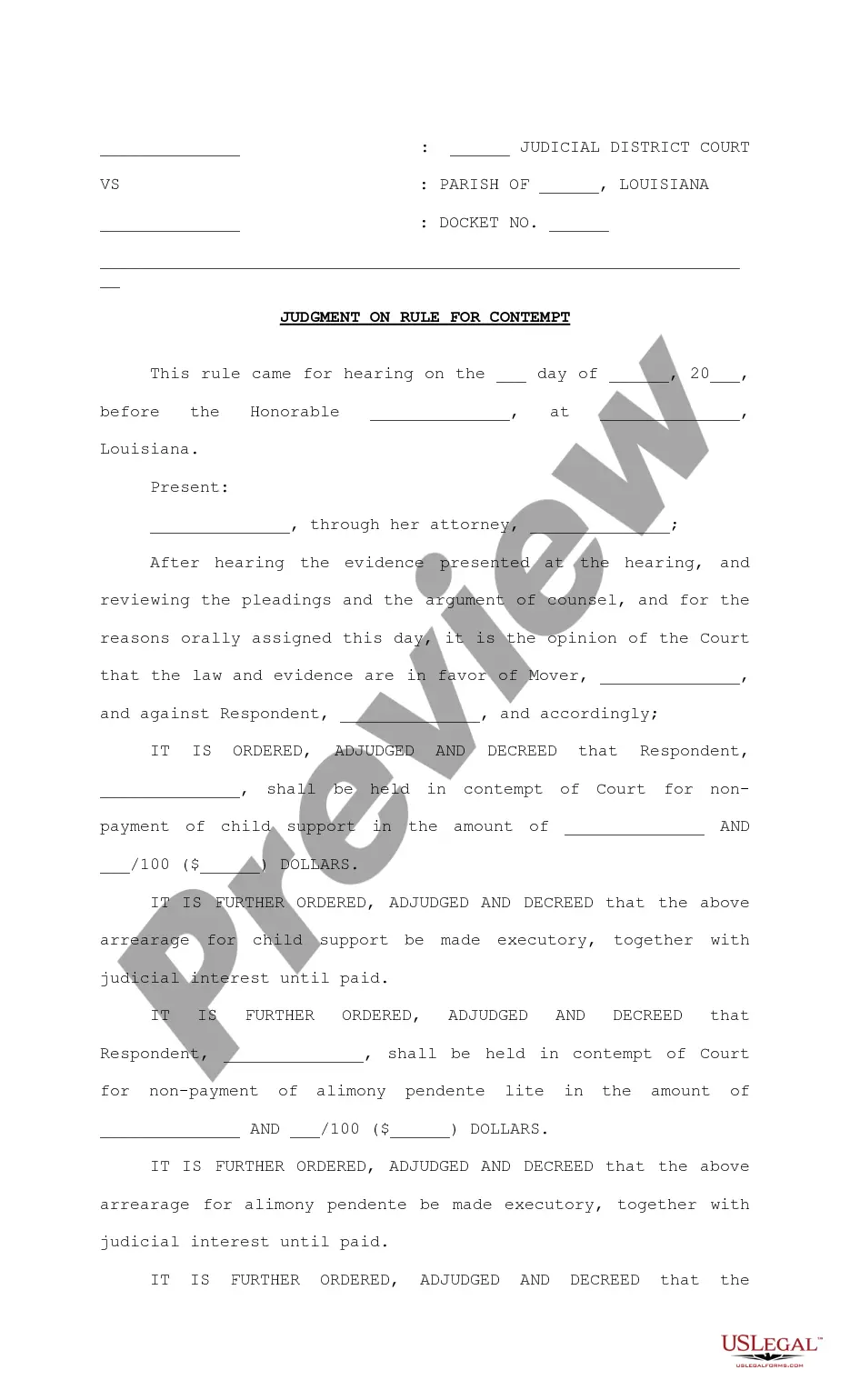

- Utilize the Preview button to review the document.

- Check the description to confirm you have selected the appropriate form.

- If the document isn’t what you need, use the Search field to locate the form that suits your requirements.

Form popularity

FAQ

Yes, independent contractors file as self-employed individuals. This means they report income and expenses related to their business activities on their tax returns. Utilizing resources like uslegalforms can help clarify the filing process and ensure you correctly align with the Colorado Cosmetologist Agreement - Self-Employed Independent Contractor.

Hairstylists generally owe self-employment taxes, which include Social Security and Medicare, in addition to income taxes. The exact amount depends on your overall earnings after deductions for business expenses. Knowing your obligations is essential to comply with the Colorado Cosmetologist Agreement - Self-Employed Independent Contractor, ensuring you meet all tax responsibilities.

Hair stylists can show proof of income by providing copies of 1099 forms from clients or detailing their financial records through bank statements. Additionally, maintaining invoices or detailed transaction logs can help substantiate their income claims. This documentation is crucial, especially for those operating under the Colorado Cosmetologist Agreement - Self-Employed Independent Contractor.

Filing taxes as an independent contractor may present challenges, but you can manage them with proper preparation. Having organized financial records simplifies the tax process significantly. Resources like uslegalforms can provide templates and guidance to help you navigate tax season and stay aligned with the Colorado Cosmetologist Agreement - Self-Employed Independent Contractor.

An independent contractor in cosmetology is a professional who operates independently and provides services without being tied to a specific employer. This arrangement allows hairstylists to set their own hours, work under their terms, and have a more flexible lifestyle. Understanding your role is essential for compliance with the Colorado Cosmetologist Agreement - Self-Employed Independent Contractor, as it outlines expectations and responsibilities.

Independent hairstylists file taxes by reporting all income and necessary expenses. They typically use IRS Form 1040 along with Schedule C to detail their earnings and claim deductions for tools, products, and other business-related expenses. Staying organized with receipts will simplify this process and uphold the standards set in the Colorado Cosmetologist Agreement - Self-Employed Independent Contractor.

Yes, as an independent contractor in Colorado, you typically need a business license to operate legally. Regulations may vary by county or city, so it is important to check local requirements. By having a valid business license, you comply with the law and enhance your credibility under the Colorado Cosmetologist Agreement - Self-Employed Independent Contractor.

To file taxes as a hairstylist, you need to report your income earned as a self-employed independent contractor. First, gather all your income statements, including 1099 forms if applicable. Utilize tax forms like Schedule C to document your income and expenses under the Colorado Cosmetologist Agreement - Self-Employed Independent Contractor. If you need assistance, consider using platforms like uslegalforms to ensure proper filing.

Yes, an independent contractor is considered self-employed. When you work as a self-employed individual, you have the freedom to choose your clients and set your rates. A Colorado Cosmetologist Agreement - Self-Employed Independent Contractor specifies the terms of your work relationship and outlines your responsibilities and obligations. This agreement ensures clarity and protects your rights as a self-employed professional.

In Colorado, it is not a strict requirement for an independent contractor agreement to be notarized. However, notarization can add an extra layer of authenticity to the document and help prevent disputes. It is advisable to check specific business needs or contractual agreements that could require notarization. You can find helpful information through the Colorado Cosmetologist Agreement - Self-Employed Independent Contractor on US Legal Forms to ensure your agreement meets all necessary guidelines.