Colorado Shared Earnings Agreement between Fund & Company

Description

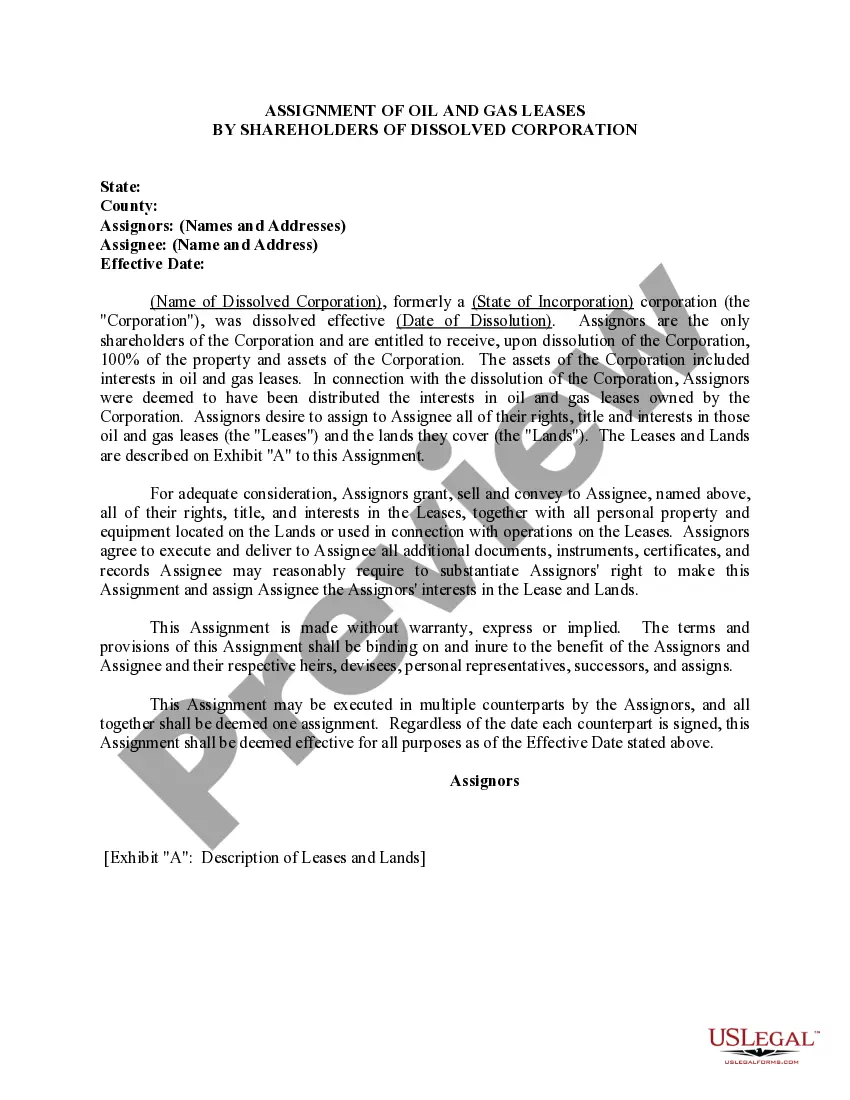

used as a substitute for equity-like structures like a SAFE, convertible note, or equity. It is not debt, doesn't have a fixed repayment schedule, doesn't require a personal guarantee."

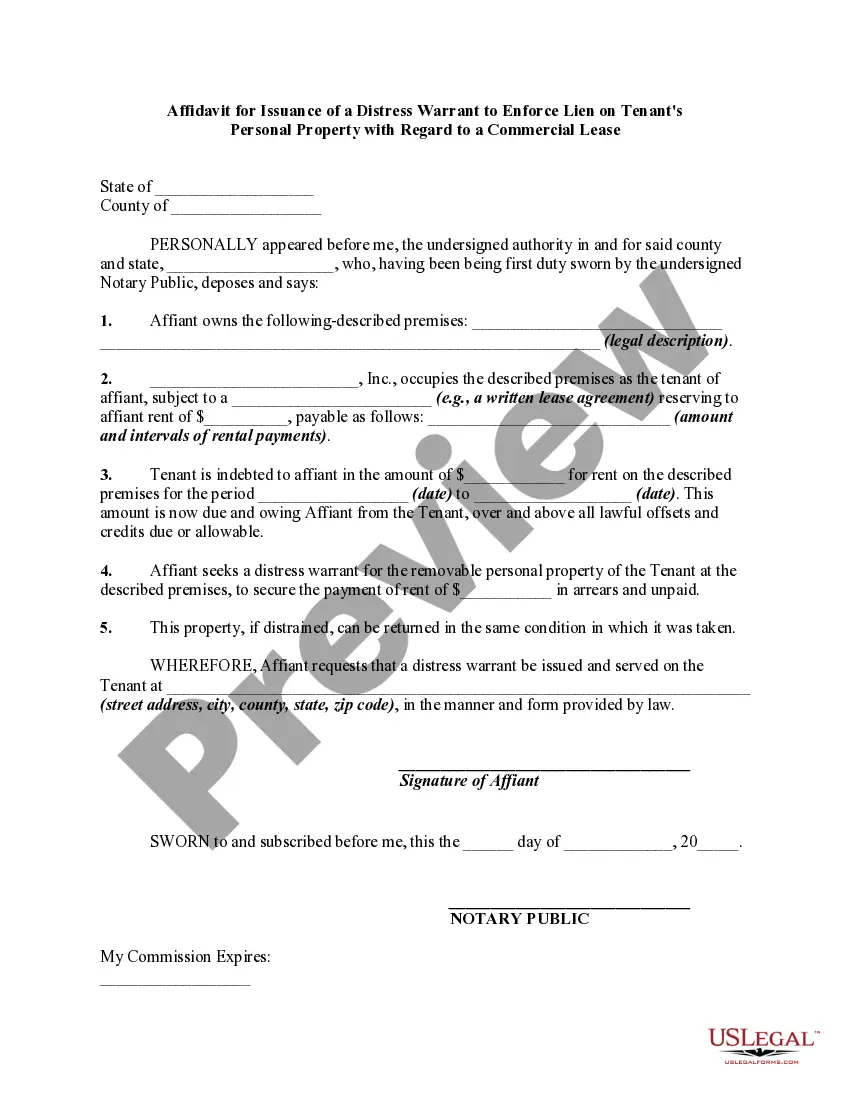

How to fill out Shared Earnings Agreement Between Fund & Company?

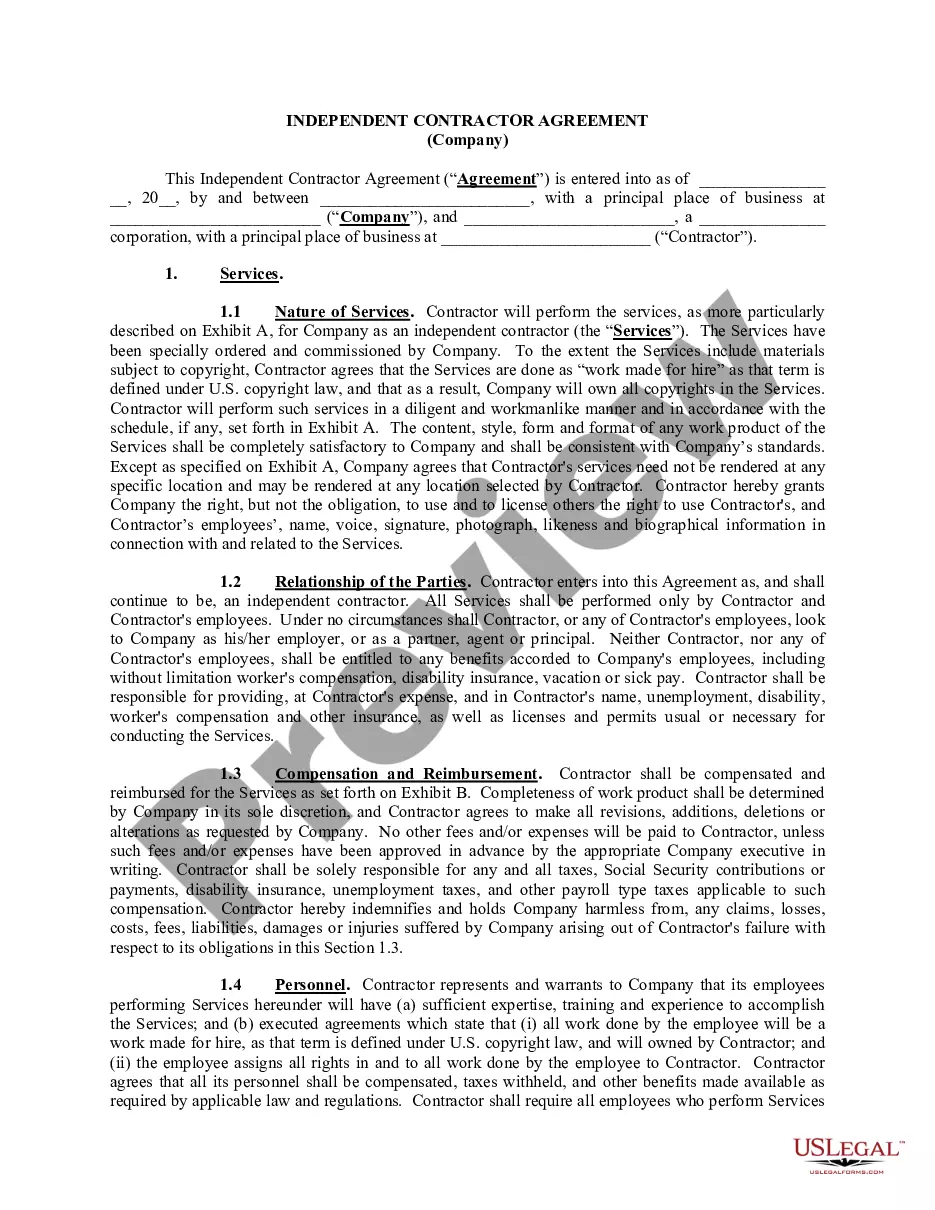

US Legal Forms - one of the largest libraries of lawful kinds in the United States - gives a wide range of lawful record themes you can acquire or print out. Making use of the site, you can get a huge number of kinds for company and person reasons, sorted by classes, claims, or keywords and phrases.You will discover the latest types of kinds such as the Colorado Shared Earnings Agreement between Fund & Company in seconds.

If you already have a monthly subscription, log in and acquire Colorado Shared Earnings Agreement between Fund & Company through the US Legal Forms catalogue. The Obtain button will appear on each and every kind you view. You have access to all formerly downloaded kinds from the My Forms tab of your respective account.

If you wish to use US Legal Forms for the first time, allow me to share basic recommendations to help you started out:

- Be sure you have selected the best kind for your personal town/county. Select the Preview button to analyze the form`s content. Look at the kind explanation to ensure that you have selected the right kind.

- In the event the kind does not satisfy your needs, utilize the Lookup discipline near the top of the monitor to obtain the the one that does.

- In case you are pleased with the shape, confirm your selection by clicking the Buy now button. Then, opt for the prices plan you want and supply your accreditations to register for an account.

- Process the transaction. Make use of your bank card or PayPal account to finish the transaction.

- Pick the format and acquire the shape on the product.

- Make changes. Load, modify and print out and sign the downloaded Colorado Shared Earnings Agreement between Fund & Company.

Every web template you added to your account does not have an expiry time which is your own eternally. So, if you want to acquire or print out another version, just go to the My Forms segment and click on about the kind you will need.

Gain access to the Colorado Shared Earnings Agreement between Fund & Company with US Legal Forms, one of the most comprehensive catalogue of lawful record themes. Use a huge number of skilled and express-particular themes that meet your company or person requires and needs.

Form popularity

FAQ

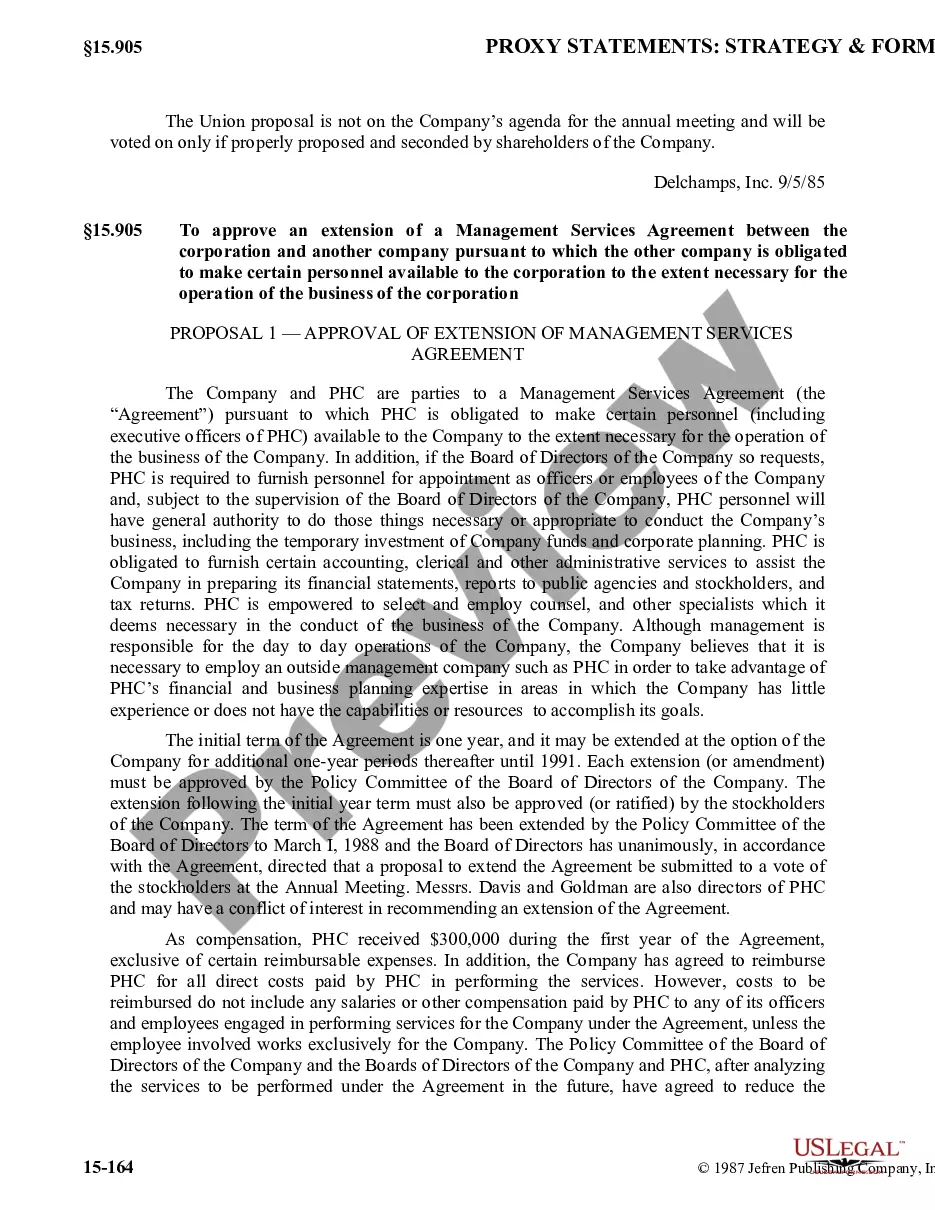

A Shared Earnings Agreement establishes alignment between investors and founders without the need for equity, shares, preferred voting rights, or board seats.

The source of income refers to the location where income is earned and not to the location of the payor or to the residency of the taxpayer. § 39-22-109, C.R.S., lists several types of income that are conclusively presumed to be Colorado-source income, but it is not an exclusive list of Colorado-source income.

A Colorado resident is subject to tax by Colorado on his entire income from all sources. Credit for tax paid other states will be allowed with respect to income from sources within such states.

Nonresident Definition However, the person may have temporarily worked in Colorado and/or received income from a source in Colorado. A nonresident is required to file a Colorado income tax return if they: are required to file a federal income tax return, and. had taxable Colorado-sourced income.

An S CORPORATION must file Form 106 for any year it is doing business in Colorado. Doing business in a state is defined as having income arising from the activity of one or more employees located in the state; or arising from the fact that real or personal property is located in the state for business purposes.

A partnership or S corporation may file a composite income tax return for its nonresident partners or shareholders, as a simplified way of paying the income tax owed by those partners or shareholders.

Colorado Income Tax PERA can withhold Colorado state income tax if requested. PERA does not withhold taxes for any other state. Colorado law excludes from Colorado state income tax total pension income up to $20,000 per year per person for those retirees age 55 through 64, or $24,000 for those retirees age 65 and over.

39-22-301(1) Rule 39-22-301(1) - Doing Business in Colorado (1) A corporation is doing business in Colorado for income tax purposes whenever the minimum standards of Public Law 86-272(15 U.S.C. 381) are exceeded, and it has substantial nexus with this state as further provided in this rule.