Colorado Sub-Advisory Agreement of Neuberger and Berman Management, Inc.

Description

How to fill out Sub-Advisory Agreement Of Neuberger And Berman Management, Inc.?

You are able to commit hrs on the web attempting to find the legitimate record design which fits the state and federal specifications you need. US Legal Forms supplies a huge number of legitimate types that happen to be analyzed by specialists. You can actually download or print out the Colorado Sub-Advisory Agreement of Neuberger and Berman Management, Inc. from my service.

If you have a US Legal Forms account, it is possible to log in and then click the Down load option. After that, it is possible to full, change, print out, or indicator the Colorado Sub-Advisory Agreement of Neuberger and Berman Management, Inc.. Each legitimate record design you acquire is the one you have for a long time. To acquire yet another backup for any bought kind, check out the My Forms tab and then click the related option.

If you use the US Legal Forms site the very first time, follow the basic directions beneath:

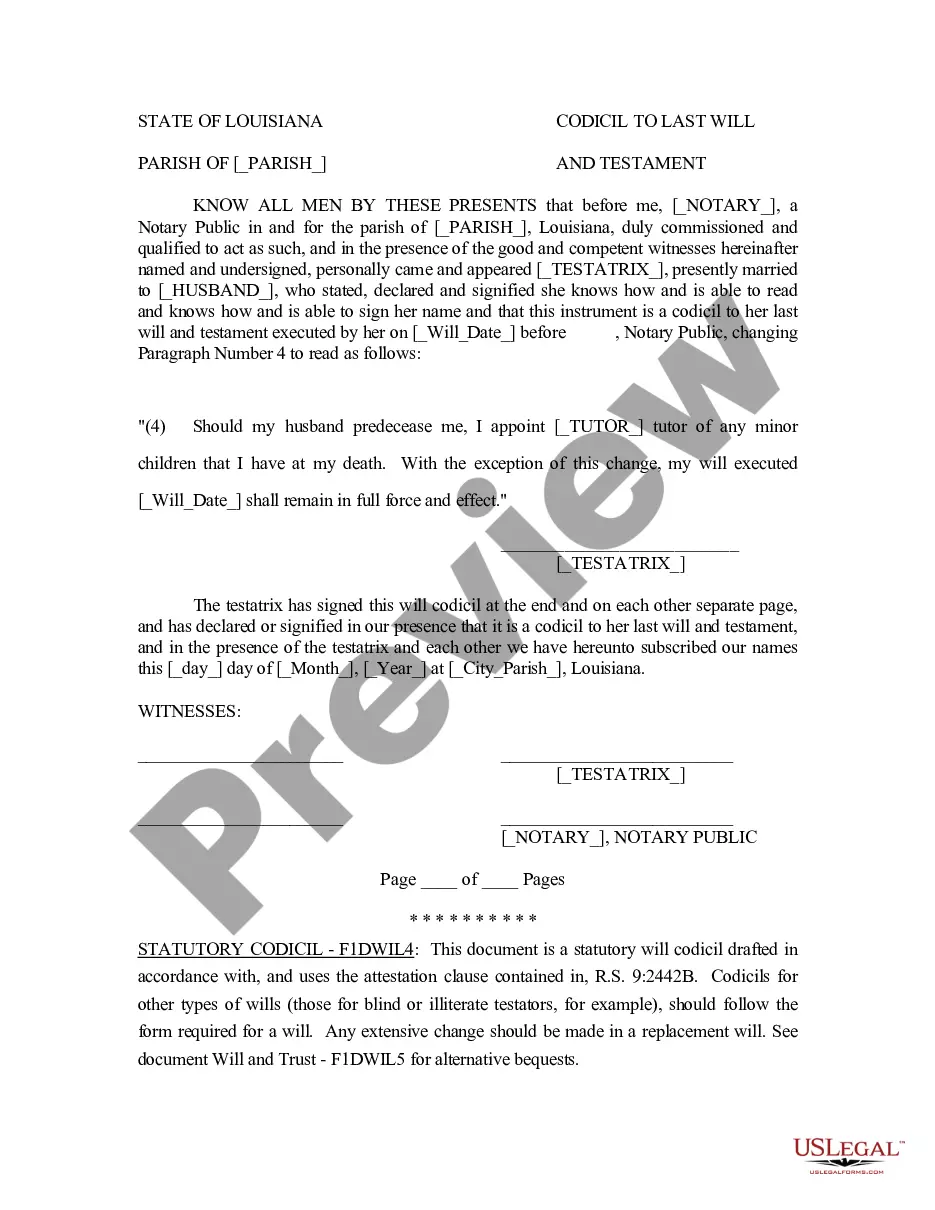

- First, make sure that you have chosen the correct record design for that region/metropolis of your choosing. See the kind outline to ensure you have picked out the appropriate kind. If available, use the Review option to check with the record design too.

- If you would like get yet another version of your kind, use the Research discipline to obtain the design that fits your needs and specifications.

- Once you have located the design you need, just click Buy now to carry on.

- Pick the rates strategy you need, type in your qualifications, and register for a merchant account on US Legal Forms.

- Complete the financial transaction. You should use your bank card or PayPal account to pay for the legitimate kind.

- Pick the file format of your record and download it to the gadget.

- Make modifications to the record if needed. You are able to full, change and indicator and print out Colorado Sub-Advisory Agreement of Neuberger and Berman Management, Inc..

Down load and print out a huge number of record web templates while using US Legal Forms Internet site, which offers the biggest collection of legitimate types. Use professional and status-certain web templates to handle your small business or person requirements.

Form popularity

FAQ

A subadvisory agreement is a legally binding agreement between a mutual fund and an advisor. These agreements outline the terms and conditions of the relationship between the fund and the advisor and what rights and responsibilities are expected of each party.

Neuberger Berman Group LLC is a private, independent, employee-owned investment management firm. The firm manages equities, fixed income, private equity and hedge fund portfolios for global institutional investors, advisors and high-net-worth individuals.

With offices in 25 countries, Neuberger Berman's diverse team has over 2,400 professionals. For eight consecutive years, the company has been named first or second in Pensions & Investments Best Places to Work in Money Management survey (among those with 1,000 employees or more).

adviser is an asset management firm hired by an investment adviser to help identify, evaluate and manage investments within a portfolio. Subadvisers are typically selected based on their investment style, expertise and track record in a specific investment strategy.

Neuberger Berman is a private, independent, employee-owned investment manager?a rare structure for a large asset management firm, almost all of which are either public or owned by other financial institutions.

NEUBERGER BERMAN BD LLC - Brokerage/Investment Adviser Firm.

Neuberger Berman is an experienced hedge fund solutions provider investing on behalf of institutional, high-net-worth and retail clients via registered liquid alternative funds, custom portfolios, and commingled products.

Neuberger Berman Group LLC is a private, independent, employee-owned investment management firm. The firm manages equities, fixed income, private equity and hedge fund portfolios for global institutional investors, advisors and high-net-worth individuals.