Colorado Form of Revolving Promissory Note

Description

How to fill out Form Of Revolving Promissory Note?

US Legal Forms - among the most significant libraries of lawful forms in the United States - offers a wide array of lawful document layouts you can obtain or produce. Making use of the internet site, you can get thousands of forms for enterprise and personal reasons, categorized by classes, suggests, or keywords.You can get the latest variations of forms like the Colorado Form of Revolving Promissory Note in seconds.

If you already possess a membership, log in and obtain Colorado Form of Revolving Promissory Note in the US Legal Forms catalogue. The Obtain switch can look on every single develop you look at. You gain access to all previously saved forms within the My Forms tab of the account.

If you wish to use US Legal Forms the first time, listed here are easy directions to obtain started off:

- Ensure you have picked the right develop for the city/state. Click the Preview switch to check the form`s information. Read the develop explanation to ensure that you have selected the proper develop.

- In the event the develop doesn`t fit your specifications, make use of the Research area towards the top of the display screen to obtain the one which does.

- If you are satisfied with the shape, validate your decision by simply clicking the Acquire now switch. Then, select the costs prepare you like and give your accreditations to sign up for an account.

- Process the purchase. Make use of charge card or PayPal account to finish the purchase.

- Choose the format and obtain the shape on your own product.

- Make changes. Load, modify and produce and sign the saved Colorado Form of Revolving Promissory Note.

Each and every format you included with your money does not have an expiry date and is also yours for a long time. So, if you wish to obtain or produce one more backup, just proceed to the My Forms area and then click about the develop you want.

Get access to the Colorado Form of Revolving Promissory Note with US Legal Forms, probably the most comprehensive catalogue of lawful document layouts. Use thousands of professional and condition-certain layouts that meet your organization or personal requires and specifications.

Form popularity

FAQ

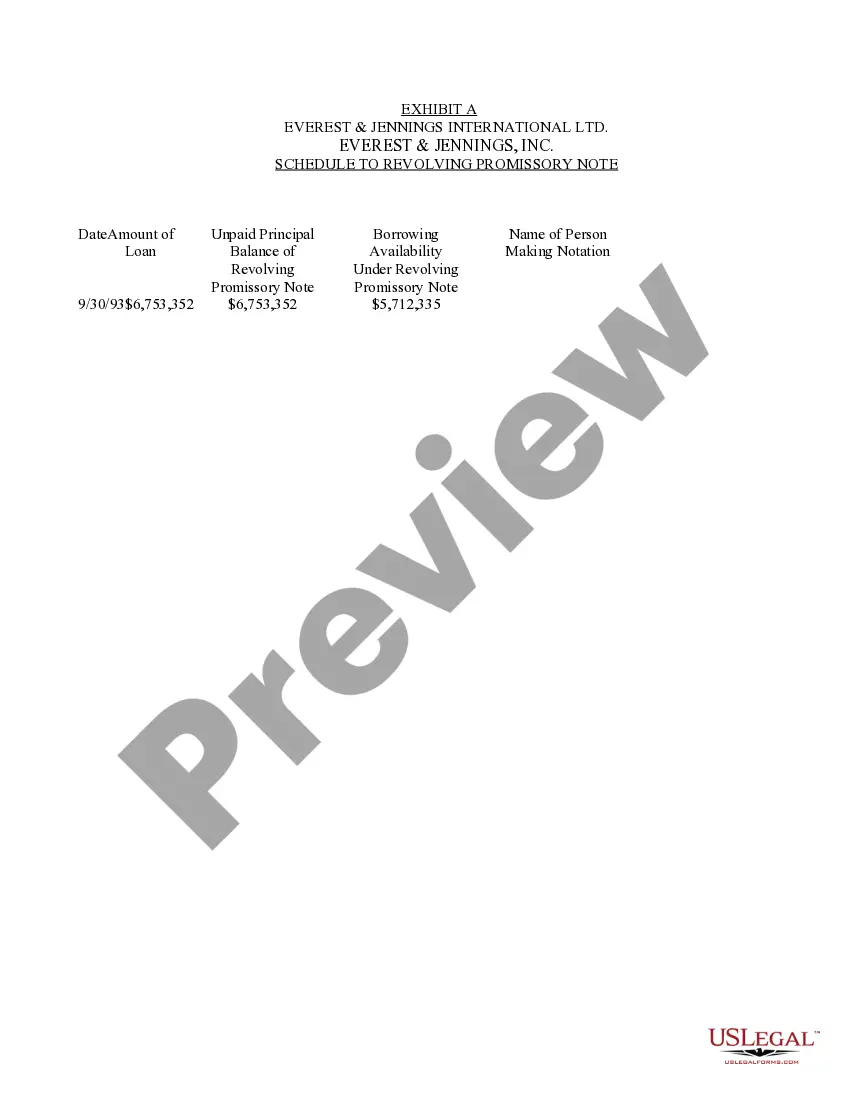

A revolving promissory note is a form of business financing that allows the company to borrow more money when needed. The process starts with an initial loan and then can be used as collateral for future loans that are paid back over time.

Although it's a legal document, writing a promissory note doesn't have to be difficult. There are even websites online that offer fill-in-the-blank templates, like eForms or .

All parties must print their names on the document. A promissory note is not required to be witnessed or notarized in Colorado. Still, you may decide to have the document certified by a notary public. Doing so can offer protection in the event of a lawsuit.

Types of Promissory Notes Simple Promissory Note. ... Student Loan Promissory Note. ... Real Estate Promissory Note. ... Personal Loan Promissory Notes. ... Car Promissory Note. ... Commercial Promissory note. ... Investment Promissory Note. ... Installment Payments.

Signatures: Make sure signatures of both the borrower and the lender are included on the promissory note.

To be legally enforceable, a promissory note must meet multiple legal conditions. Moreover, it must contain both an offer of agreement and an acceptance of agreement. All contracts state the type of services or goods rendered and indicate how much they cost.

Promissory notes don't have to be notarized in most cases. You can typically sign a legally binding promissory note that contains unconditional pledges to pay a certain sum of money. However, you can strengthen the legality of a valid promissory note by having it notarized.

A promissory note could become invalid if: It isn't signed by both parties. The note violates laws. One party tries to change the terms of the agreement without notifying the other party.