Colorado Purchase of common stock for treasury of company

Description

How to fill out Purchase Of Common Stock For Treasury Of Company?

Have you been inside a position that you need files for sometimes business or individual uses just about every time? There are a lot of legal record templates accessible on the Internet, but discovering types you can rely on is not effortless. US Legal Forms gives thousands of type templates, like the Colorado Purchase of common stock for treasury of company, that happen to be created to meet federal and state specifications.

When you are currently familiar with US Legal Forms web site and get your account, basically log in. After that, you may acquire the Colorado Purchase of common stock for treasury of company web template.

Should you not come with an bank account and wish to begin to use US Legal Forms, adopt these measures:

- Get the type you need and ensure it is to the proper area/county.

- Make use of the Preview option to review the form.

- Look at the description to ensure that you have chosen the appropriate type.

- In case the type is not what you are trying to find, use the Research field to find the type that meets your requirements and specifications.

- If you get the proper type, simply click Purchase now.

- Pick the rates prepare you desire, fill in the specified info to create your bank account, and buy your order utilizing your PayPal or Visa or Mastercard.

- Choose a hassle-free data file formatting and acquire your copy.

Discover every one of the record templates you might have purchased in the My Forms menus. You may get a further copy of Colorado Purchase of common stock for treasury of company at any time, if necessary. Just click on the required type to acquire or produce the record web template.

Use US Legal Forms, by far the most substantial selection of legal forms, in order to save time and steer clear of mistakes. The service gives skillfully manufactured legal record templates that you can use for a selection of uses. Produce your account on US Legal Forms and commence creating your way of life easier.

Form popularity

FAQ

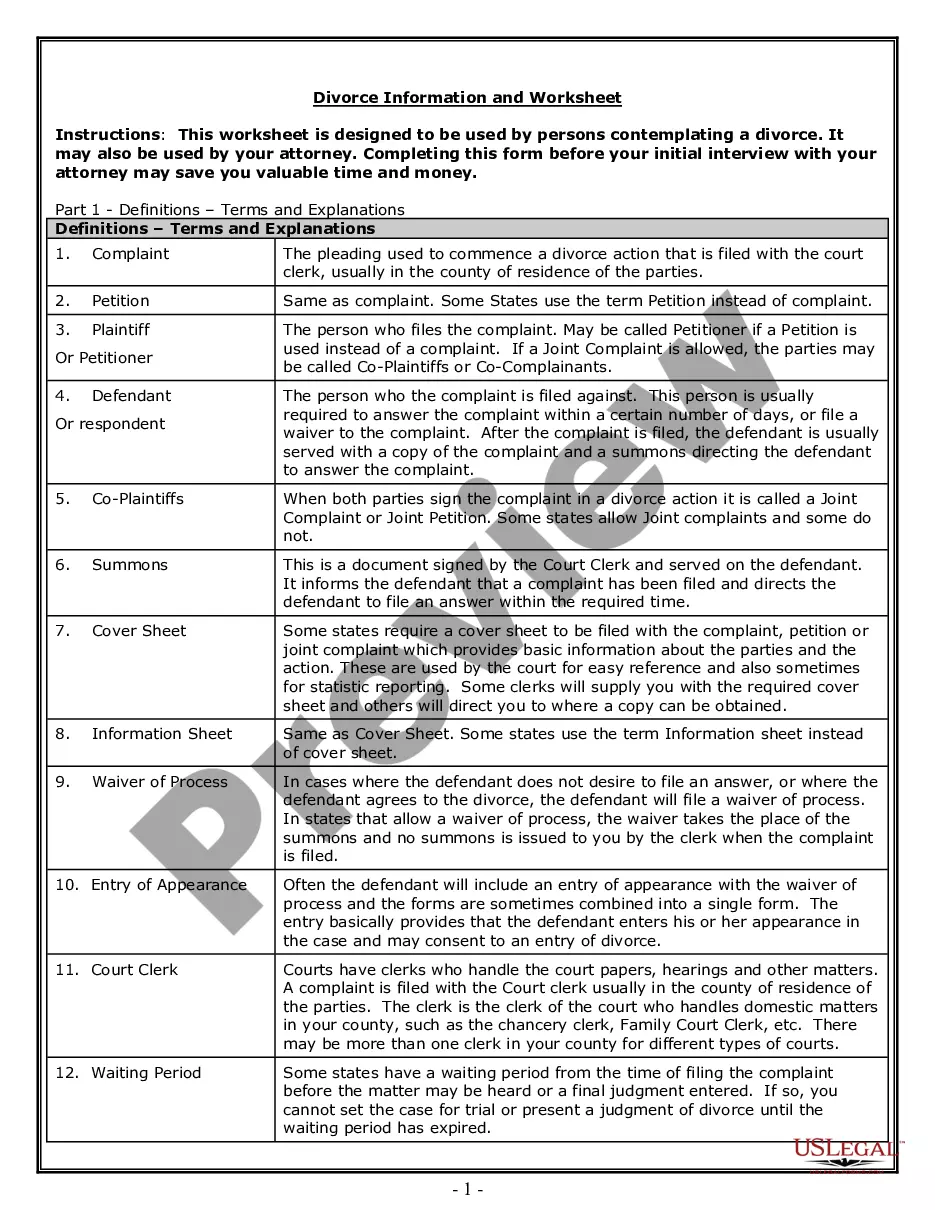

Accounting for Redemptions on the Corporation's Books Debit the treasury stock account for the amount the company paid for the redemption. Credit the company's cash account for any payments already made to the shareholder. Credit accounts receivable for any future payment obligations.

The benefits to having treasury stock for a company include limiting outside ownership as well as having stock in reserve to issue to the public in the future in case capital needs to be raised.

Retirement of Treasury Stock FAQs The journal entry to record the acquisition and retirement includes debits to the capital stock account for the stock's par value (or its equivalent) and the capital in excess of par account (or its equivalent) for the amount of claims created in excess of the par value.

What is the Treasury Stock Method? The treasury stock method is a way for companies to calculate how many additional shares may be generated from outstanding in-the-money warrants and options. The new additional shares are then used in calculating the company's diluted earnings per share (EPS).

Treasury Stock is a contra equity item. It is not reported as an asset; rather, it is subtracted from stockholders' equity. The presence of treasury shares will cause a difference between the number of shares issued and the number of shares outstanding.

Treasury Stock Contra-Equity Journal Entry On the cash flow statement, the share repurchase is reflected as a cash outflow (?use? of cash). After a repurchase, the journal entries are a debit to treasury stock and credit to the cash account.

Treasury stock, also known as treasury shares or reacquired stock, refers to previously outstanding stock that has been bought back from stockholders by the issuing company. 1 The result is that the total number of outstanding shares on the open market decreases.

When treasury stock is purchased, the number of shares issued remains unchanged, but the number of shares outstanding decreases. When treasury stock is purchased, the Treasury Stock account is debited for the number of shares purchased times the purchase price per share.