Colorado Stock Appreciation Right Plan of Helene Curtis Industries, Inc.

Description

How to fill out Stock Appreciation Right Plan Of Helene Curtis Industries, Inc.?

Are you currently in the situation the place you need documents for either organization or individual purposes almost every day? There are plenty of legal document themes available on the net, but locating versions you can rely on isn`t easy. US Legal Forms delivers a large number of type themes, just like the Colorado Stock Appreciation Right Plan of Helene Curtis Industries, Inc., which can be published in order to meet state and federal requirements.

If you are presently familiar with US Legal Forms site and have your account, basically log in. After that, you can down load the Colorado Stock Appreciation Right Plan of Helene Curtis Industries, Inc. template.

If you do not come with an account and need to begin to use US Legal Forms, adopt these measures:

- Get the type you require and make sure it is to the appropriate area/state.

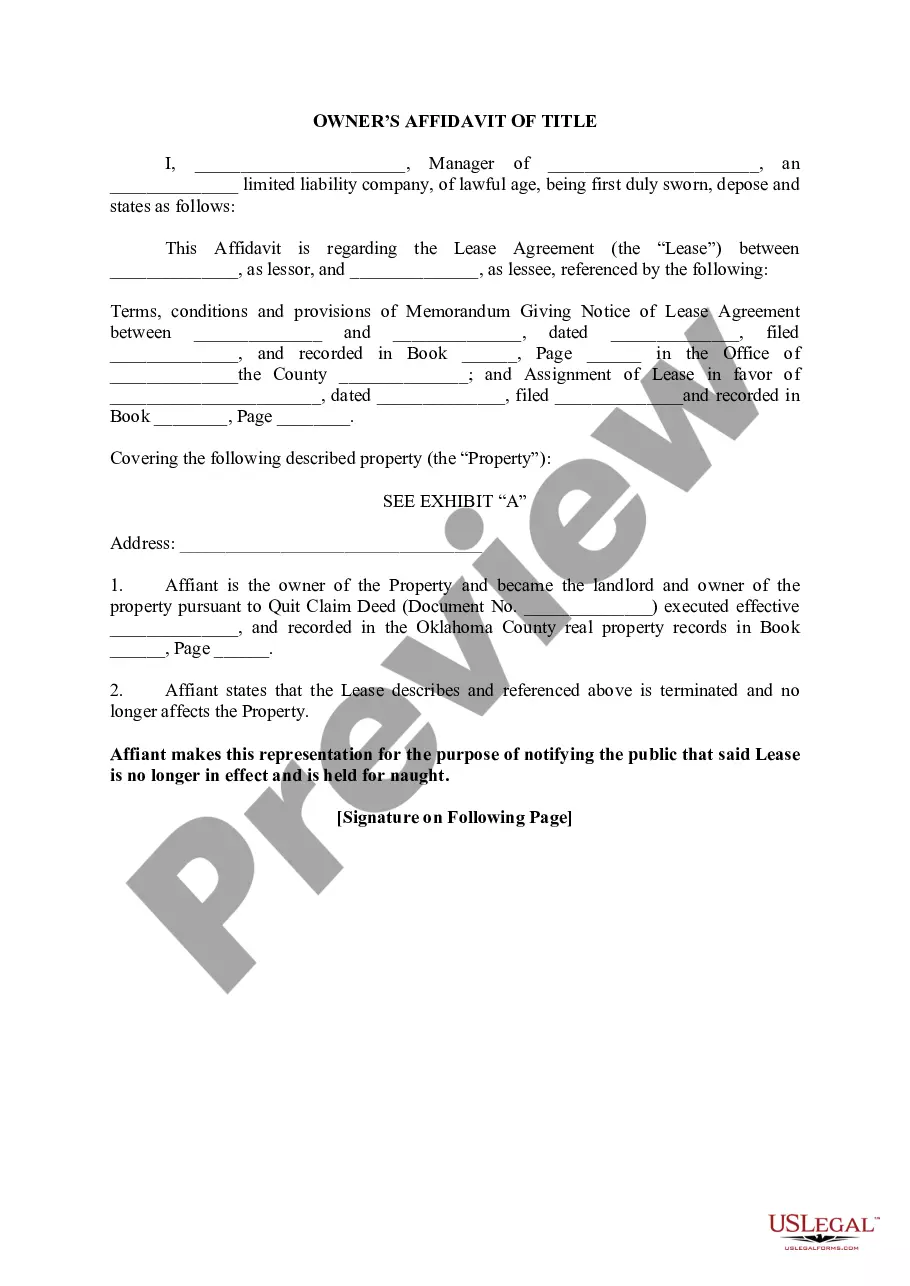

- Use the Review switch to review the form.

- See the description to ensure that you have chosen the right type.

- In the event the type isn`t what you are searching for, take advantage of the Lookup industry to obtain the type that suits you and requirements.

- When you obtain the appropriate type, click on Get now.

- Pick the prices program you would like, fill out the necessary info to produce your money, and buy the transaction utilizing your PayPal or bank card.

- Pick a handy paper formatting and down load your version.

Get each of the document themes you may have purchased in the My Forms menu. You can get a extra version of Colorado Stock Appreciation Right Plan of Helene Curtis Industries, Inc. at any time, if needed. Just click on the needed type to down load or printing the document template.

Use US Legal Forms, by far the most substantial variety of legal kinds, to save some time and steer clear of mistakes. The support delivers appropriately created legal document themes that can be used for a range of purposes. Create your account on US Legal Forms and initiate making your lifestyle a little easier.

Form popularity

FAQ

A stock appreciation right is a contract between an employer and an employee that grants the employee the right to receive a payment tied to any increase in the value of the employer's stock. When granting a stock appreciation right, the employer does not grant the employee any shares of the employer's stock.

The part of the change in the value of the stocks held by a business over any period which is due to price changes.

A stock appreciation right (SAR) entitles an employee to the appreciation in value of a specified number of shares of employer stock over an ?exercise price? or ?grant price? over a specified period of time. The base price generally is equal to the underlying stock's fair market value on the date of grant. Stock Appreciation Rights Fundamentals Meridian Compensation Partners ? uploads ? Stoc... Meridian Compensation Partners ? uploads ? Stoc... PDF

For purposes of financial disclosure, you may value a stock appreciation right based on the difference between the current market value and the grant price. This formula is: (current market value ? grant price) x number of shares = value.