Colorado Reaffirmation Agreement, Motion and Order

Description

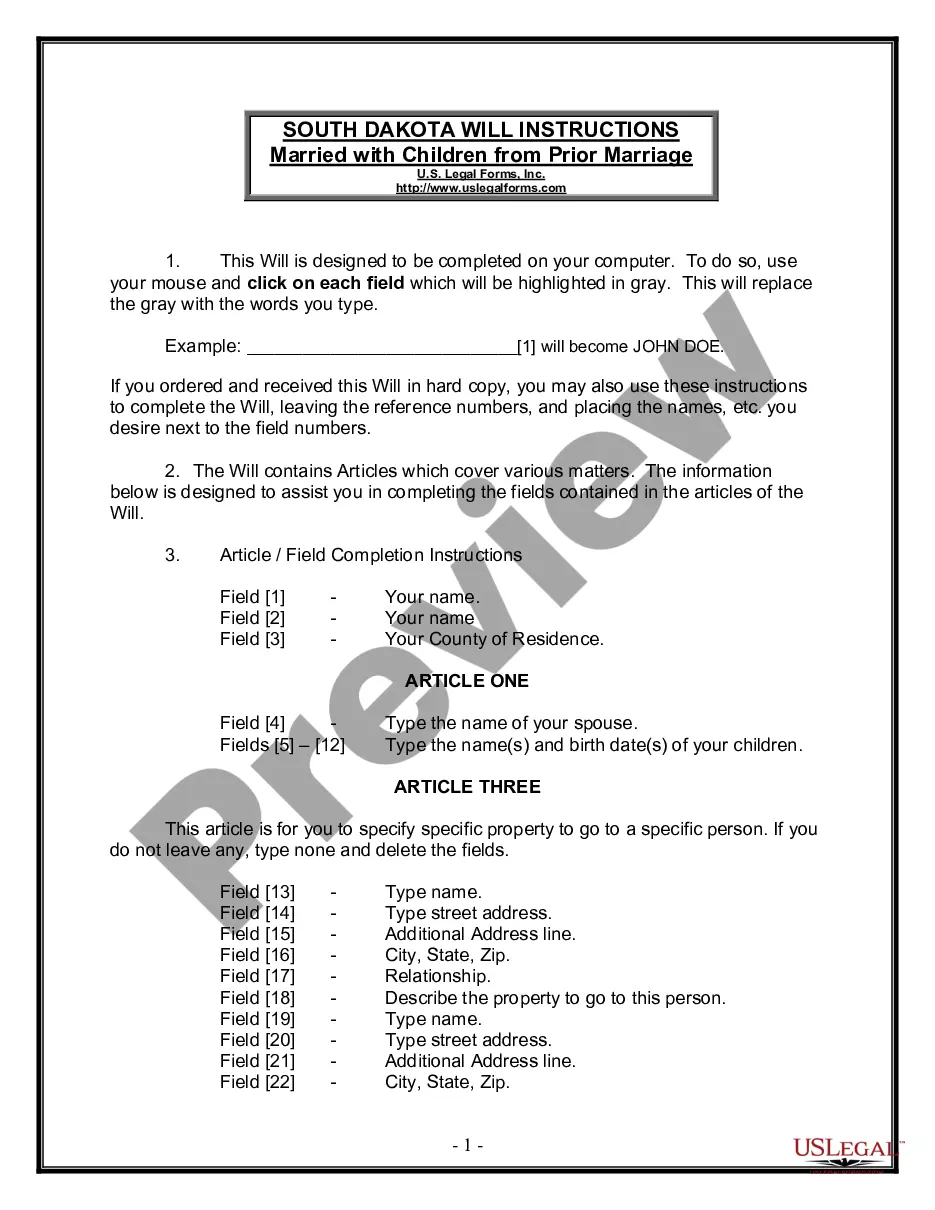

How to fill out Reaffirmation Agreement, Motion And Order?

US Legal Forms - one of the greatest libraries of lawful types in the States - gives a variety of lawful document layouts you can obtain or printing. While using website, you may get a huge number of types for company and individual reasons, categorized by categories, claims, or search phrases.You will find the most recent models of types like the Colorado Reaffirmation Agreement, Motion and Order within minutes.

If you already have a subscription, log in and obtain Colorado Reaffirmation Agreement, Motion and Order from your US Legal Forms catalogue. The Down load switch will appear on each kind you view. You have access to all earlier delivered electronically types inside the My Forms tab of your respective bank account.

If you want to use US Legal Forms the very first time, listed here are straightforward directions to help you began:

- Be sure you have selected the correct kind for the area/area. Go through the Review switch to examine the form`s information. See the kind explanation to actually have chosen the correct kind.

- In case the kind does not satisfy your requirements, utilize the Research area near the top of the display screen to obtain the one that does.

- In case you are pleased with the form, verify your option by simply clicking the Get now switch. Then, opt for the rates program you want and supply your credentials to register for the bank account.

- Procedure the financial transaction. Make use of charge card or PayPal bank account to finish the financial transaction.

- Select the formatting and obtain the form on the gadget.

- Make modifications. Complete, change and printing and indicator the delivered electronically Colorado Reaffirmation Agreement, Motion and Order.

Each and every design you put into your account does not have an expiration date and is yours eternally. So, if you wish to obtain or printing one more copy, just visit the My Forms section and click on on the kind you require.

Gain access to the Colorado Reaffirmation Agreement, Motion and Order with US Legal Forms, one of the most comprehensive catalogue of lawful document layouts. Use a huge number of professional and express-distinct layouts that meet your organization or individual requirements and requirements.

Form popularity

FAQ

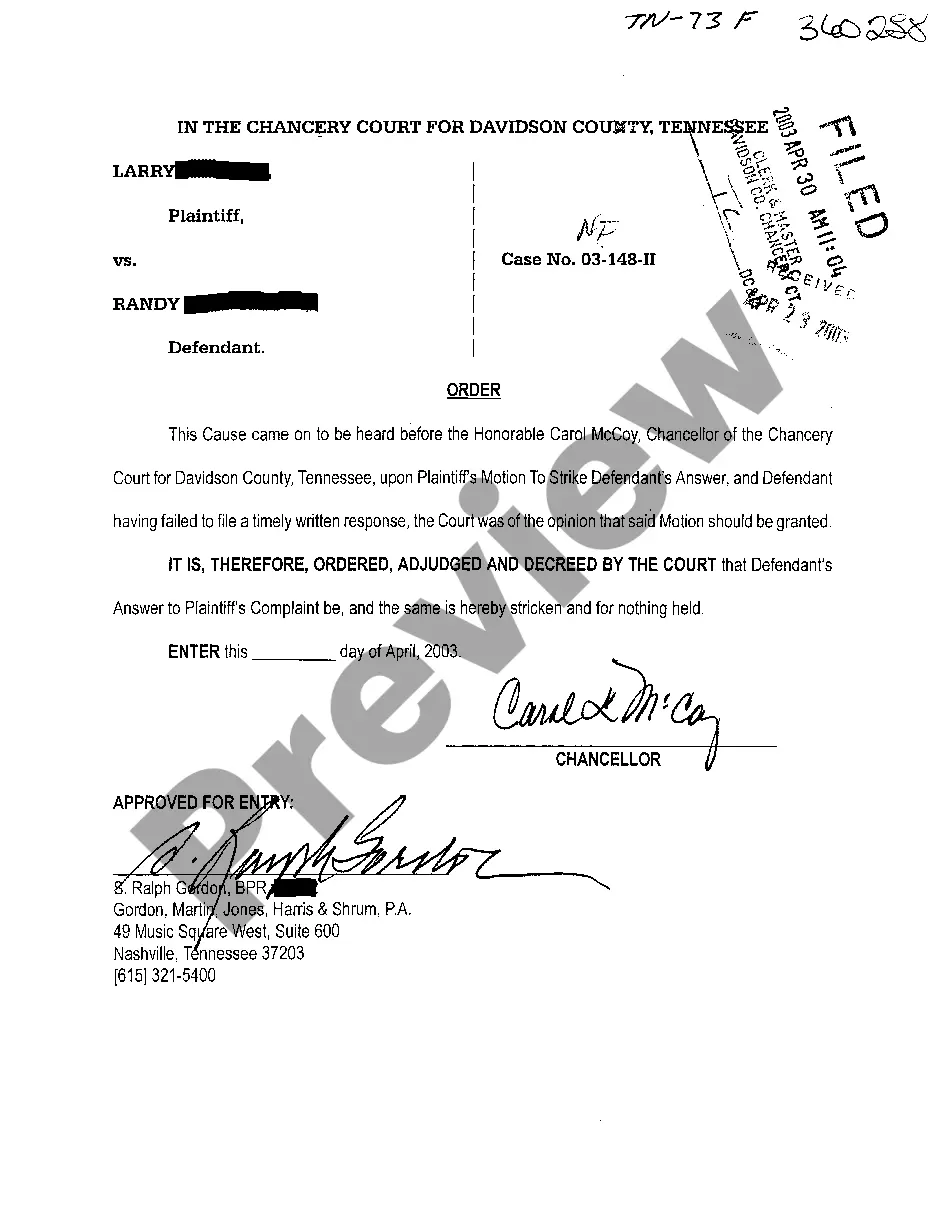

At the reaffirmation hearing, the judge will explain any concerns he or she has with the terms of your agreement. In addition, the judge will ask you certain questions to determine whether reaffirming the debt is in your best interest.

Creditors holding a security interest that they want to protect post-bankruptcy will request that a Reaffirmation Agreement is signed. They will prepare it and provide it to your attorney's office for review.

A reaffirmation agreement is an agreement between a chapter 7 debtor and a creditor that the debtor will pay all or a portion of the money owed, even though the debtor has filed bankruptcy. In return, the creditor promises that, as long as payments are made, the creditor will not repossess or take back its collateral.

Reaffirmation agreements can be rescinded any time before the Court issues the discharge, or within 60 days after the agreement is filed with the Court, whichever is the later. Notice of the rescission must be given to the creditor.

After you have entered into a reaffirmation agreement and all parts of this form that require a signature have been signed, either you or the creditor should file it as soon as possible.

Agreeing to repay the excess loan amount in ance with the terms of the promissory note is called ?reaffirmation.? You can reaffirm an excess loan amount by signing a reaffirmation agreement with your loan servicer.

Reaffirming a debt informs the lender that you intend to continue to pay the loan. Generally, the lender will continue to report the loan and all payments made on that loan to the credit reporting agencies, which may help improve your credit score after bankruptcy, provided timely payments are made on the loan.

In this article, you'll learn that lenders sometimes agree to new terms when completing a reaffirmation agreement, including lowering the amount owed, interest rate, or monthly payment. A local bankruptcy lawyer can help you with the negotiation process.