Colorado Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status

Description

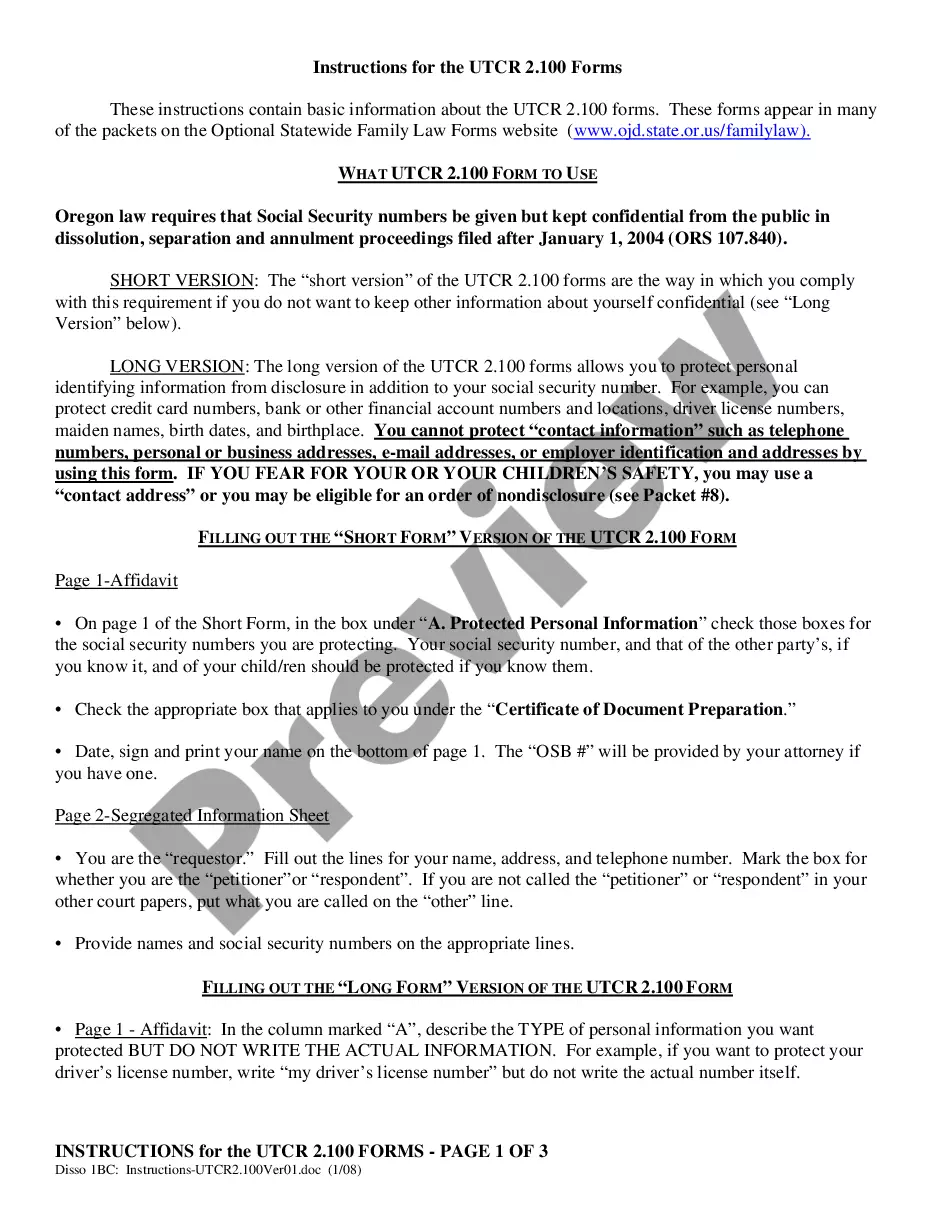

How to fill out Charitable Trust With Creation Contingent Upon Qualification For Tax Exempt Status?

You can spend several hours online searching for the legal document template that meets the federal and state requirements that you require.

US Legal Forms offers thousands of legal forms which can be reviewed by experts.

You can download or print the Colorado Charitable Trust with Creation Dependent on Qualification for Tax Exempt Status from our service.

Read the form details to ensure that you have selected the appropriate template. If available, use the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can complete, edit, print, or sign the Colorado Charitable Trust with Creation Dependent on Qualification for Tax Exempt Status.

- Each legal document template you purchase is yours indefinitely.

- To obtain another copy of any purchased form, visit the My documents tab and click the relevant button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for your area/city of preference.

Form popularity

FAQ

A qualified charitable organization is recognized as tax-exempt in the pursuit of philanthropic, nonprofit, or civic activities. Section 501(c)(3) is the specific portion of the U.S. Internal Revenue Code (IRC) and a specific tax category for nonprofit organizations.

Organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, educational, or other specified purposes and that meet certain other requirements are tax exempt under Internal Revenue Code Section 501(c)(3).

Exemption Requirements - 501(c)(3) Organizations To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earnings may inure to any private shareholder or individual.

Tax-exempt statusCharities and non-profits are exempt from corporation tax as well as the trustees being exempt from income tax.

How do I become exempt from corporate income tax and sales tax? You can apply by submitting Colorado Department of Revenue Form DR 0715 with a copy of your Articles of Incorporation, a financial statement, and a copy of the 501c3 Determination Letter from the IRS concerning your Colorado Nonprofit.

Colorado statute exempts from state and state-collected sales tax all sales to the United States government and the state of Colorado, its departments and institutions, and its political subdivisions (county and local governments, school districts and special districts) in their governmental capacities only (§39-26-

The state of Colorado requires retailers to keep records of purchases you made tax-free for resale for three years, and to make these records available if asked.

Where To Get a Certificate of Tax Exemption? The Certificate of Tax Exemption (CTE) is obtained from the Revenue District Office (RDO) having jurisdiction over the residence of the taxpayer or where the taxpayer is registered.

Colorado allows charitable organizations to be exempt from state-collected sales tax for purchases made in the conduct of their regular charitable functions and activities.

(a) A seller must verify that the purchaser's sales tax license or exemption certificate is current and valid at the time of the sale. a license or certificate is current and valid, a seller can go online to and follow the link to Verify a License or Certificate.