Colorado Application Service Provider Software License Agreement

Description

How to fill out Application Service Provider Software License Agreement?

If you require to aggregate, obtain, or create official document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the website's straightforward and user-friendly search to find the documents you need.

A variety of templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. After you have found the form you need, click on the Buy now option. Choose the pricing plan you prefer and provide your credentials to register for an account.

Step 5. Complete the payment. You can use your Visa or MasterCard or PayPal account to finalize the transaction. Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Colorado Application Service Provider Software License Agreement. All legal document templates you purchase are yours permanently. You will have access to each form you downloaded in your account. Go to the My documents section and select a form to print or download again. Complete and download, and print the Colorado Application Service Provider Software License Agreement with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- Utilize US Legal Forms to find the Colorado Application Service Provider Software License Agreement in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download option to obtain the Colorado Application Service Provider Software License Agreement.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Take advantage of the Preview feature to review the form's details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

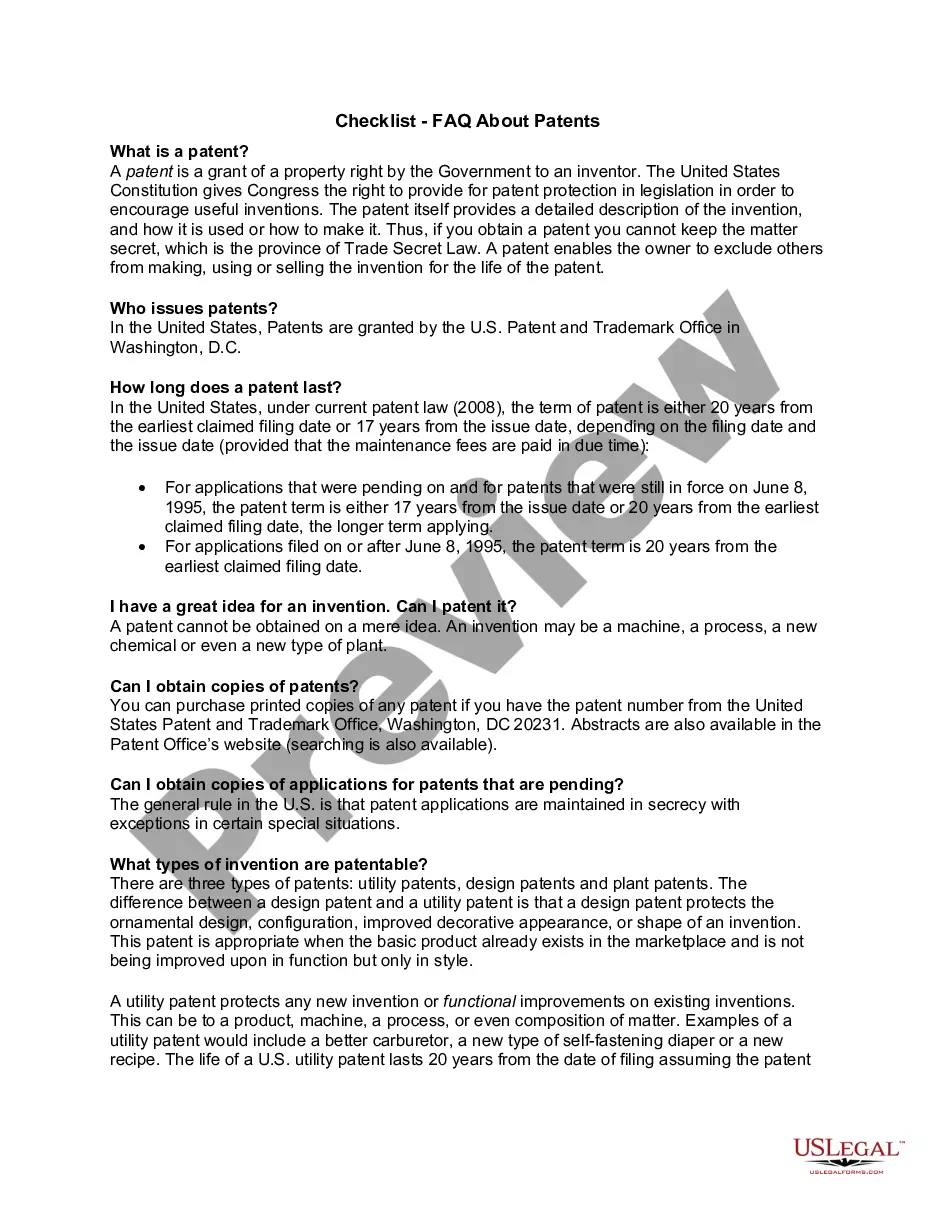

Because Colorado doesn't define SaaS, cloud computing or electronically downloaded software as a tangible item, all of them are nontaxable/exempt from sales and use tax in the state.

Colorado: Electronically delivered software, SaaS, and backup service not subject to sales tax.

In most states, where services aren't taxable, SaaS also isn't taxable. Other states, like Washington, consider SaaS to be an example of tangible software and thus taxable. Just like with anything tax related, each state has made their own rules and laws.

Services that are taxable when sold or furnished to customers in Denver include, but are not limited to:Informational services.Entertainment services.Software as a service.Telecommunications services.Gas, electric, or heating services.

A customer's use of Company's cloud storage to store and view images raises the question of whether the software, service, or servers are subject to Colorado sales tax. Colorado does not levy sales or use tax on the sale or use of computer software used by application service providers.

Colorado: Electronically delivered software, SaaS, and backup service not subject to sales tax.

Only two states Tennessee and Vermont have specific statutes in place to address SaaS transactions and sales tax. Several states have ping-ponged on their decisions, the most recent being Michigan, who ultimately decided to exempt it.

Luckily, California - the US's biggest state for digital goods - has defined digital goods, software, and SaaS as exempt from sales tax.

For example, SaaS is not subject to the 2.9% sales tax by the state of Colorado, but Denver subjects SaaS to a sales tax of 4.31%.

But, in most, it's a mixed bag. California exempts most software sales but taxes one type: canned software delivered on tangible personal property an actual object you can touch or hold, such as a disc. Nebraska taxes most software sales with the exception of one type: SaaS.