Colorado Assignment of Equipment Lease by Dealer to Manufacturer

Description

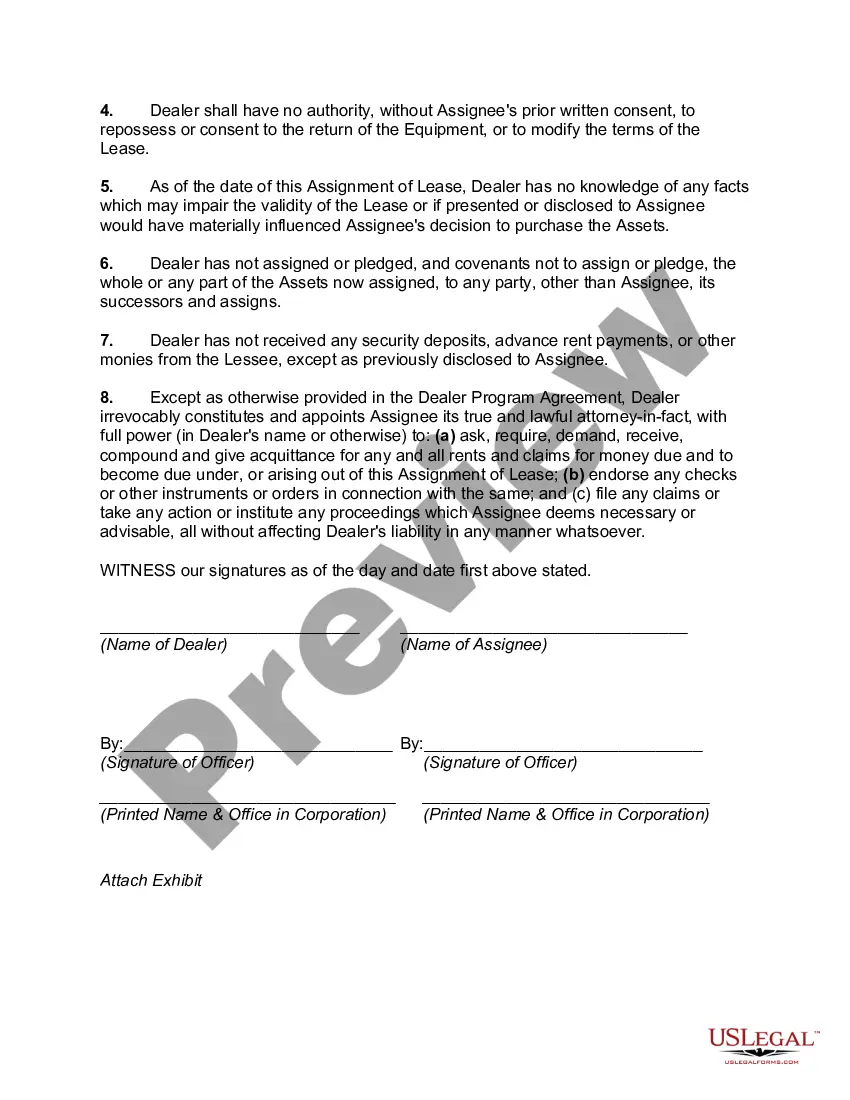

How to fill out Assignment Of Equipment Lease By Dealer To Manufacturer?

If you wish to obtain, download, or create sanctioned document templates, utilize US Legal Forms, the finest array of legal forms, available online.

Make the most of the website's user-friendly and convenient search feature to locate the documents you require.

A range of templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

Step 4. Once you have located the form you need, click the Purchase now button. Choose your preferred payment plan and enter your details to register for an account.

- Utilize US Legal Forms to locate the Colorado Assignment of Equipment Lease from Dealer to Manufacturer with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to access the Colorado Assignment of Equipment Lease from Dealer to Manufacturer.

- You can also retrieve forms you have previously downloaded from the My documents tab of your account.

- If this is your first time using US Legal Forms, adhere to the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Don't forget to read the overview.

Form popularity

FAQ

What Is Capital Lease? A capital lease is a contract entitling a renter to the temporary use of an asset and has the economic characteristics of asset ownership for accounting purposes.

The two most common types of leases are operating leases and financing leases (also called capital leases). In order to differentiate between the two, one must consider how fully the risks and rewards associated with ownership of the asset have been transferred to the lessee from the lessor.

Capital leases (such as a $1 buyout lease) and equipment finance agreements are essentially the same.

A capital lease is where the company or lessee wants the equipment to appear on the balance sheet as an asset, but also wants to spread out the payments over the life of a term. The equipment leased is considered part of the company's assets (i.e., capital, hence the name).

For tax purposes, a lease is considered a capital lease when the amount of the lease is $50,000 or more, the useful life of the asset is two or more years, and the lease meets at least one of these criteria: Transfers owner of the personal property to the lessee by the end of the lease term.

The equipment account is debited by the present value of the minimum lease payments and the lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year. Depreciation expense must be recorded for the equipment that is leased.

A capital lease (or finance lease) is treated like an asset on a company's balance sheet, while an operating lease is an expense that remains off the balance sheet. Think of a capital lease as more like owning a piece of property, and think of an operating lease as more like renting a property.

2 equipment lease types: Operating and finance There are two primary types of equipment leases: operating leases and financial leases.

An assignment is when the tenant transfers their lease interest to a new tenant using a Lease Assignment. The assignee takes the assignor's place in the landlord-tenant relationship, although the assignor may remain liable for damages, missed rent payments, and other lease violations.

What is equipment leasing? Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.