Colorado Sample Letter for Notice of Charge Account Credit Limit Raise

Description

How to fill out Sample Letter For Notice Of Charge Account Credit Limit Raise?

If you desire to be thorough, acquire, or print legal document templates, utilize US Legal Forms, the largest collection of legal documents available online.

Take advantage of the site's simple and convenient search to locate the documents you require.

Various templates for business and personal use are categorized by type and state, or keywords.

Every legal document you acquire is yours permanently. You have access to every form you downloaded within your account. Navigate to the My documents section and choose a form to print or download again.

Be proactive and download, and print the Colorado Sample Letter for Notice of Charge Account Credit Limit Increase with US Legal Forms. There are thousands of professional and state-specific documents available for your business or personal needs.

- Utilize US Legal Forms to locate the Colorado Sample Letter for Notice of Charge Account Credit Limit Increase in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and select the Download button to obtain the Colorado Sample Letter for Notice of Charge Account Credit Limit Increase.

- You can also access forms you previously downloaded from the My documents section of your account.

- If this is your first time using US Legal Forms, follow these steps.

- Step 1. Ensure you have chosen the form for your specific region/state.

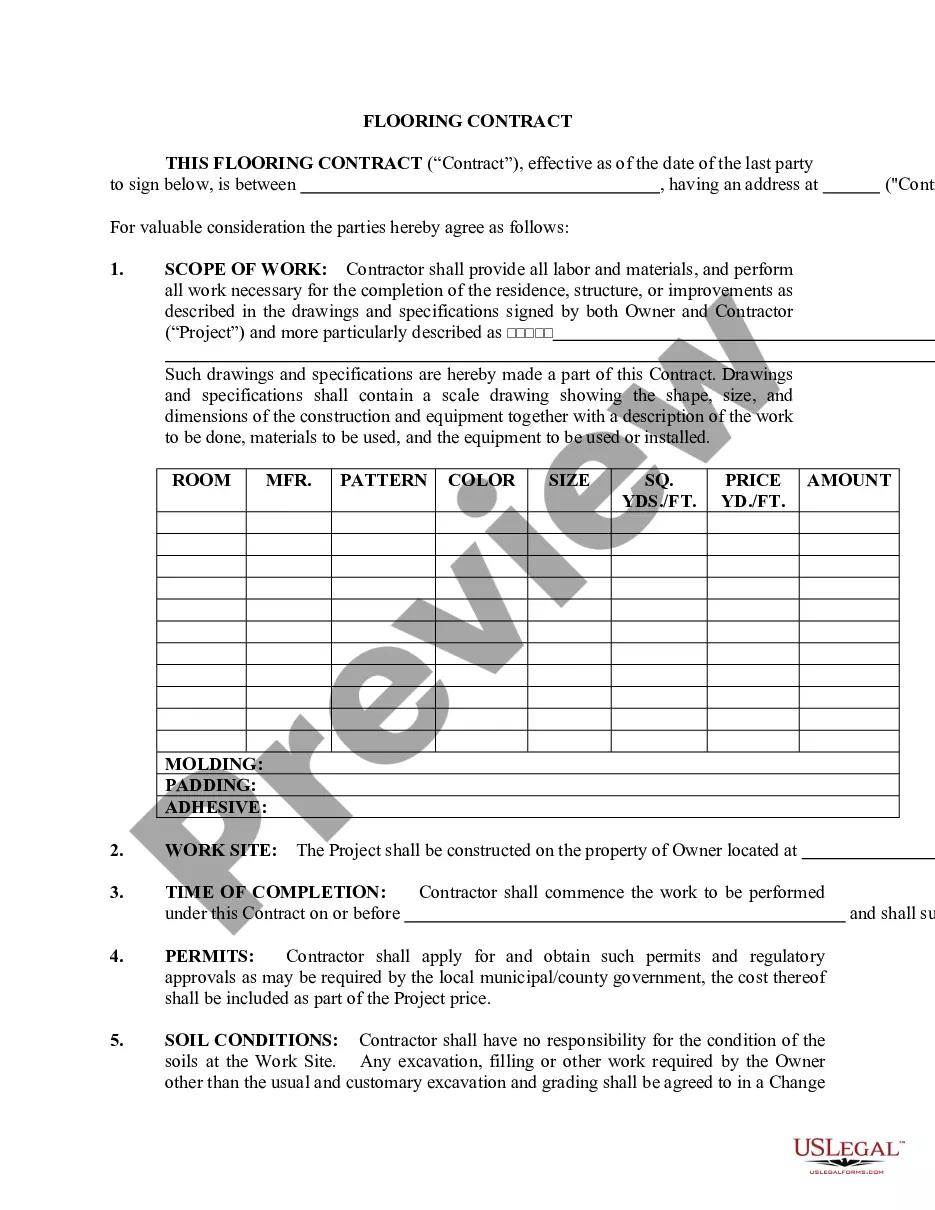

- Step 2. Utilize the Preview option to review the contents of the form. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the page to find alternative versions of the legal document template.

- Step 4. Once you have found the form you require, click the Buy now button. Choose your preferred pricing plan and submit your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Colorado Sample Letter for Notice of Charge Account Credit Limit Increase.

Form popularity

FAQ

How to Raise Your Credit LimitPay your bills on time.Ask the card company to raise your credit limit.Apply for a new card with a higher limit.Balance transfer.Roll two cards into one.Increase your income.Wait for an Automatic Credit Limit Increase.Increase your Security Deposit.

Increasing your credit limit can lower credit utilization, potentially boosting your credit score. A credit score is an important metric lenders use to determine a borrower's ability to repay. A higher credit limit can also be an efficient way to make large purchases and provide a source of emergency funds.

A personal line of credit is a temporary credit account with a specified limit. With this type of credit, you can borrow the amounts you need as you wish instead of getting a lump-sum amount.

Respected Sir/ Madam, My name is (Name) and I do hold a cash credit limit in your branch i.e. (Branch Name) bearing account number (Account number). I look forward to your kind and quick support. In case of any queries, you may contact me at (Contact number).

As long as you don't increase your spending by too much and keep making payments on time, your credit score shouldn't be negatively affected by a credit limit increase. And that's because a higher credit limit can lower your overall credit utilization ratio.

What is a Temporary Credit Limit Increase? A temporary increase of credit limit on your credit card account(s) which can be used for the following purposes: Overseas travel expenses. Wedding banquet expenses.

Respected Sir/Madam, I like to state that my name is (Name) and, I hold a (name of credit card) credit card with your bank having credit card number (credit card number). I am writing this letter to ask you to kindly increase the limit of my credit card.

You can apply for a credit limit increase but this might take from a few days to a few weeks. One trick to temporarily increase your credit limit is by making an overpayment towards your credit card.

I am writing to request an increase of $5,000.00 in my credit limit with Doe. My current limit is insufficient to cover my monthly purchases at your firm. As you know, my credit history with you is spotless. I have always made payments on time, so I do not anticipate problems handling the increased limit.

Tips for Writing a Hardship LetterKeep it original.Be honest.Keep it concise.Don't cast blame or shirk responsibility.Don't use jargon or fancy words.Keep your objectives in mind.Provide the creditor an action plan.Talk to a Financial Couch.