Colorado Promissory Note with Payments Amortized for a Certain Number of Years

Description

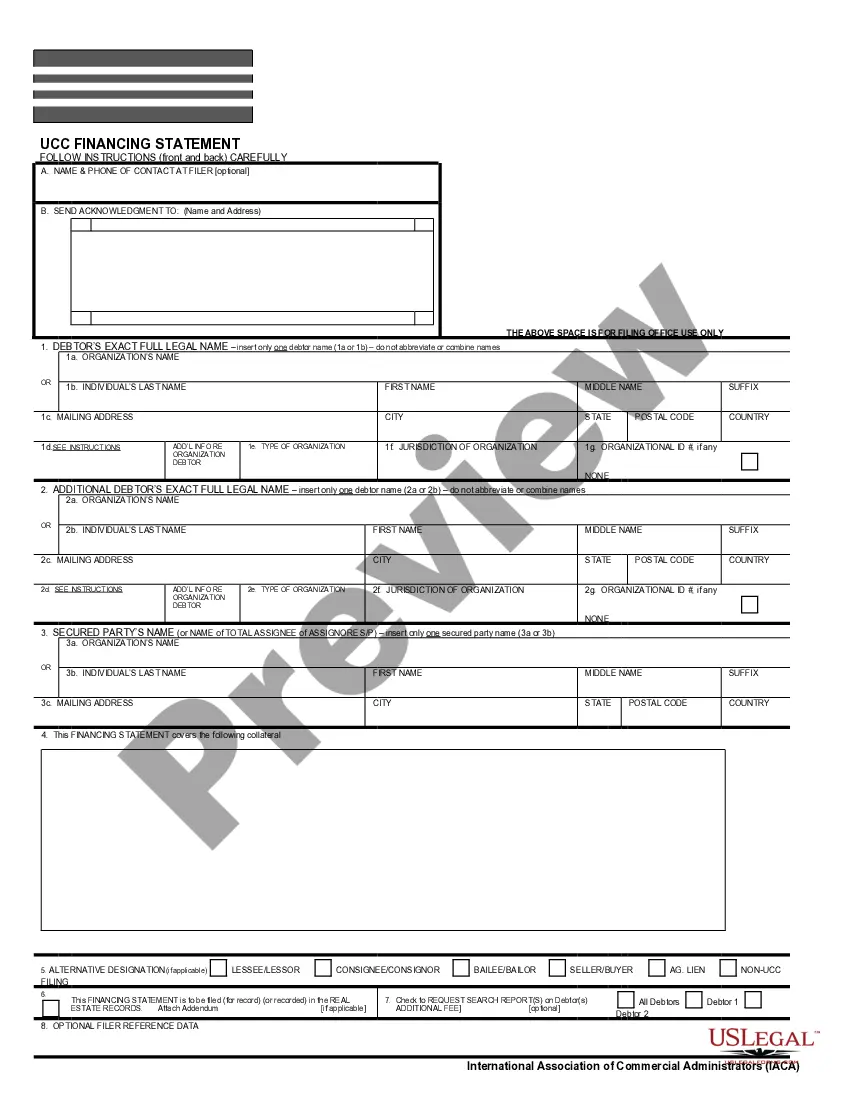

How to fill out Promissory Note With Payments Amortized For A Certain Number Of Years?

You might spend a number of hours online trying to locate the sanctioned document template that aligns with the federal and state requirements you need.

US Legal Forms provides a vast array of legal documents that have been reviewed by professionals.

You can effortlessly acquire or create the Colorado Promissory Note with Payments Amortized for a Specific Number of Years with my help.

First, ensure that you have selected the appropriate document template for the state/city of your choice. Review the form description to confirm you have chosen the correct template. If available, utilize the Review button to browse through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Download button.

- Subsequently, you may complete, modify, print, or sign the Colorado Promissory Note with Payments Amortized for a Certain Number of Years.

- Every legal document template you obtain is yours indefinitely.

- To retrieve another copy of a purchased form, go to the My documents section and click the associated button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

Form popularity

FAQ

The payment on a fully amortized installment note is a fixed amount that encompasses both principal and interest. This consistent payment schedule is typically designed for the duration specified in the agreement, which is a key benefit of a Colorado Promissory Note with Payments Amortized for a Certain Number of Years. You can rest assured that your monthly obligations will remain predictable, simplifying your financial planning.

To make a promissory note for a balance payment, start by documenting the remaining amount due and the terms of repayment. Include specific dates for payments, interest rates, and any conditions affecting the payment schedule. For a Colorado promissory note with payments amortized for a certain number of years, this structured documentation is crucial to ensure clarity for both parties. Using platforms like US Legal Forms can simplify this process and help you create a robust note.

Yes, there are limitations on the amount for promissory notes. In Colorado, the amount may be influenced by local laws and the financial context of the transaction. Generally, parties can agree on any amount suitable for their circumstances, but higher amounts may carry additional regulatory or legal considerations. To navigate these limits effectively, consider using resources like US Legal Forms.

The limit of a promissory note typically depends on the agreement between the lender and the borrower, as well as state laws. In Colorado, a promissory note with payments amortized for a certain number of years can have flexible limits based on the financial circumstances of both parties. It is important to consider the repayment terms and the borrower's ability to make payments. Consulting with a legal expert can help you understand the implications of these limits.

The validity period of a promissory note can vary depending on the applicable laws, but generally, it remains enforceable for several years. In the context of a Colorado Promissory Note with Payments Amortized for a Certain Number of Years, it is vital to be aware of the statute of limitations, which usually allows creditors to enforce claims within a specific timeframe. Understanding this period helps both parties manage their financial responsibilities and legal rights effectively.

A promissory note can be deemed invalid for several reasons, including lack of essential elements like proper signatures, clear terms, or an unidentifiable borrower. If the note does not comply with state laws, like those governing a Colorado Promissory Note with Payments Amortized for a Certain Number of Years, it may also be rejected by courts. It is crucial to ensure that all parties involved understand their obligations and that the terms are legally binding for the note to hold validity.

In essence, a promissory note does not technically expire; however, the right to enforce it through legal action can be limited by the statute of limitations. This means that while the agreement may remain valid, if a party fails to act within the specified time, they may lose their ability to collect. With a Colorado Promissory Note with Payments Amortized for a Certain Number of Years, knowing the enforcement timeline helps both parties navigate their responsibilities.

A promissory note remains effective until the debt is either repaid or legally enforced, which pertains to its specific terms. Typically, the lifespan of the note is defined in the agreement, and can range from one year to several years based on the parties' preferences. For a Colorado Promissory Note with Payments Amortized for a Certain Number of Years, the agreed timeline is explicitly stated, providing both parties peace of mind.

The statute of limitations for enforcing a promissory note varies by state. In Colorado, the period is generally six years from the date of the default. This means if payment is not made, the lender has six years to initiate legal action. For a Colorado Promissory Note with Payments Amortized for a Certain Number of Years, understanding this limit is crucial to safeguard your interests.

Yes, a promissory note has a time limit that is defined by the agreement between the borrower and lender. Typically, this timeframe relates to how long the lender must wait before taking legal action for non-payment. For a Colorado Promissory Note with Payments Amortized for a Certain Number of Years, it's prudent to clearly state this limit in the document. This clarity helps protect both parties' rights.