Colorado Requisition Slip

Description

How to fill out Requisition Slip?

Are you in a circumstance that necessitates documentation for either professional or personal purposes on nearly every workday.

There are many legitimate document templates available online, but finding forms you can trust is challenging.

US Legal Forms offers thousands of template options, including the Colorado Requisition Slip, which are crafted to comply with state and federal regulations.

Once you locate the right form, click Acquire now.

Choose your desired pricing plan, enter the necessary details to create your account, and complete your transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms site and possess an account, simply Log In.

- Then, you can download the Colorado Requisition Slip template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

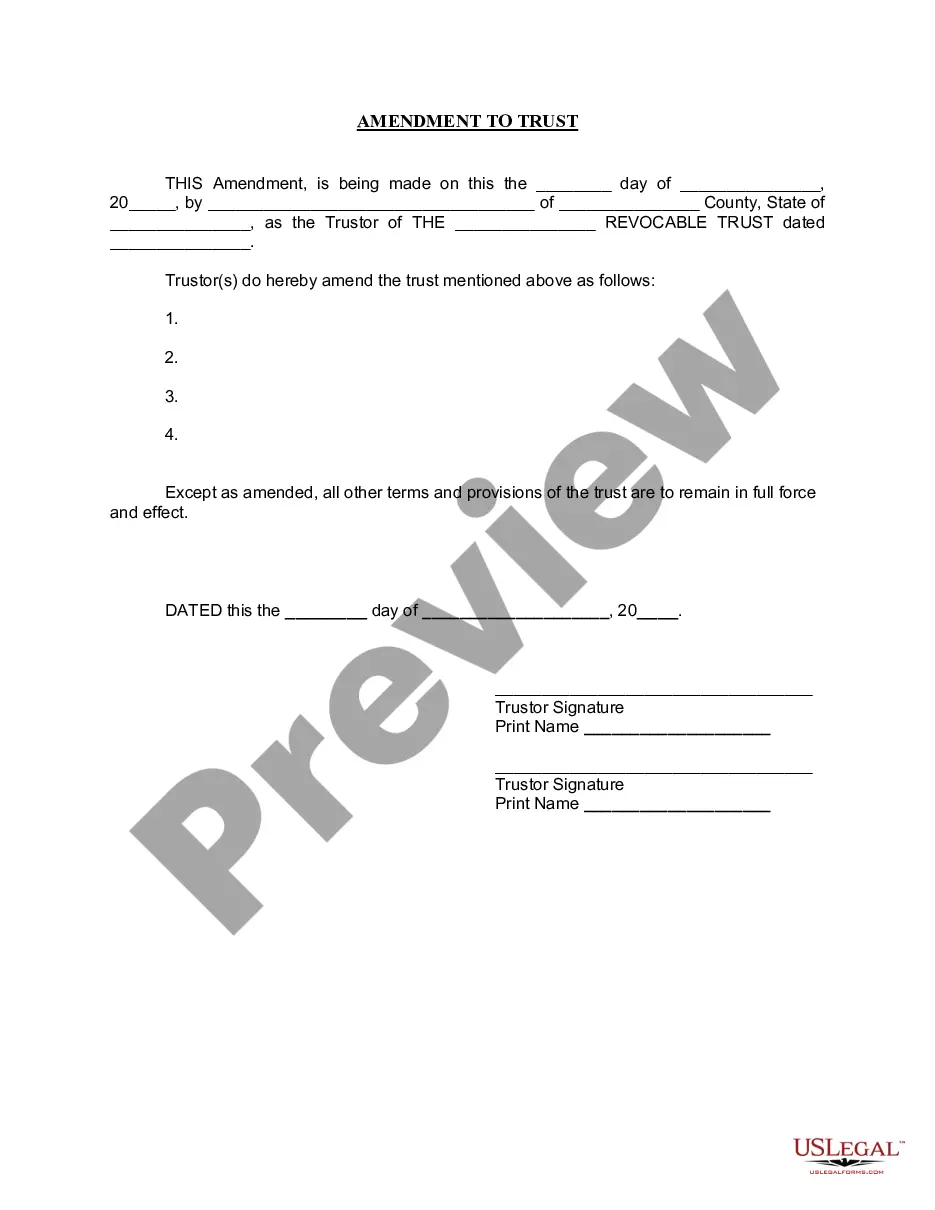

- Use the Preview button to examine the form.

- Review the description to confirm you have selected the correct form.

- If the form does not meet your requirements, utilize the Lookup field to find the appropriate form that suits your needs.

Form popularity

FAQ

A Colorado trust return must be filed by any trust that has income exceeding the state's threshold, as well as any trust that has taxable income. This includes both revocable and irrevocable trusts. If you are unsure about your filing responsibilities, referring to the Colorado Requisition Slip may help clarify what is needed for compliance.

Filling out the Colorado W4 involves providing your personal information and declaring your withholding allowances. Be sure to follow the instructions carefully to ensure accurate withholding from your paycheck. If you need assistance, look into resources that reference the Colorado Requisition Slip to clarify any questions about filling this form.

To submit the Colorado e-filer attachment form, you first need to complete the required sections of your electronic tax return. Attach the e-filer form as directed during the e-filing process, ensuring all documents are included. Using the Colorado Requisition Slip as a checklist can help ensure you've attached everything needed before submitting.

Yes, you can file your Colorado state taxes online, which offers convenience and quicker processing times. The state provides various e-filing options for individuals and businesses. If you are looking for an efficient way to submit your forms, using tools that incorporate the Colorado Requisition Slip can enhance accuracy and ease.

Yes, Colorado requires Limited Liability Companies (LLCs) to file certain documents to maintain active status. These documents include Articles of Organization and annual reports. To stay compliant, ensure that you are familiar with these requirements, and consider using the Colorado Requisition Slip for guidance.

Colorado form 106 is the state's corporate income tax return, used by corporations to report their income and calculate tax liabilities. Completing this form accurately is crucial for compliance with state tax laws. For businesses unsure about their obligations, the Colorado Requisition Slip provides a helpful reference point to ensure all necessary elements are included.

Colorado form 106 must be filed by corporations doing business in Colorado or those that derive income from sources within the state. This form is essential for reporting corporate income and calculating taxes owed. If your business operates in Colorado, using the Colorado Requisition Slip can streamline your filing experience.

If you earn income in Colorado, you typically must file a Colorado income tax return. This applies to residents and non-residents who earn income within the state. Additionally, you need to ensure you meet the income thresholds set by the state. Utilizing forms like the Colorado Requisition Slip can help simplify this process.

Skipping the filing of your 1099-G may raise red flags with the tax authorities, increasing the likelihood of an audit. It’s crucial to report any income accurately to avoid issues. By using the Colorado Requisition Slip, you can properly document your income and reduce the risk of an audit while ensuring compliance with tax laws.

Not receiving a 1099-G can happen for various reasons, including changes in mailing addresses. To ensure compliance, reach out to the issuer for a replacement. While you're solving this issue, the Colorado Requisition Slip can help you organize any related tax information, making the filing process smoother.