Colorado Escrow Check Receipt Form

Description

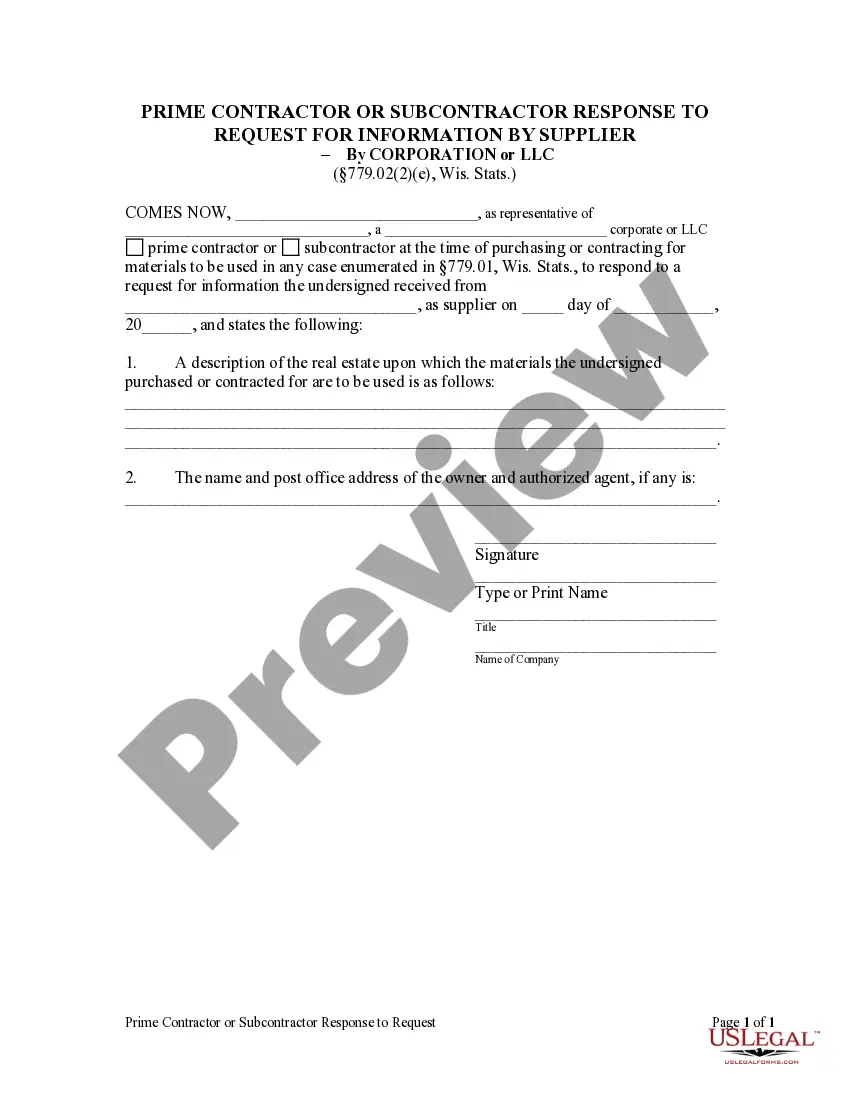

How to fill out Escrow Check Receipt Form?

You might allocate numerous hours online endeavoring to locate the legal document template that complies with the federal and state requirements you need.

US Legal Forms offers thousands of legal templates that are examined by experts.

You can conveniently download or print the Colorado Escrow Check Receipt Form from the service.

Review the template description to confirm that you have selected the right form. If available, use the Preview option to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Colorado Escrow Check Receipt Form.

- Each legal document template you acquire belongs to you for an extended time period.

- To get an additional copy of any purchased template, visit the My documents section and click on the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the state/city of your choice.

Form popularity

FAQ

Yes, you need to report the sale of an inherited home to the IRS. This process typically involves filing a 1099-S form to disclose the income from the sale. By using the Colorado Escrow Check Receipt Form, you can efficiently track the sale details, which simplifies your reporting obligations. It’s important to document everything accurately to ensure compliance.

Generally, inherited homes are not subject to federal estate tax when passed to individuals, but you might face capital gains tax upon sale. If you sell the inherited home, use the Colorado Escrow Check Receipt Form to document the transaction properly. This will help you assess the tax implications based on the property's fair market value at the time of inheritance. Always check for updates in tax laws to stay informed.

Yes, you must report 1099-S income on your tax return. This form notifies the IRS about the income generated from the sale of real estate. By keeping track of your transaction using the Colorado Escrow Check Receipt Form, you can effectively manage the information you need to include on your tax return. Consulting a tax adviser can provide further clarification on your specific situation.

To report the sale of real estate, you generally use Form 8949 and Schedule D. These forms allow you to properly document any gains or losses from the sale. When filling out the Colorado Escrow Check Receipt Form, it can serve as crucial documentation to support your reporting on these IRS forms. This organized approach can improve accuracy and compliance.

Exemptions from 1099-S reporting typically include transactions involving certain types of property transfers, like gifts or transfers between spouses. If you use the Colorado Escrow Check Receipt Form, it can help clarify whether your transaction falls under the exemptions. Be sure to review the IRS requirements to confirm your eligibility for reporting exemptions. It's wise to keep thorough records, just in case.

S certification exemption form allows certain transactions to be exempt from reporting on the 1099S. This form is necessary for specific situations where the IRS does not require a 1099S to be filed. Utilizing the Colorado Escrow Check Receipt Form can help you indicate if your transaction qualifies for this exemption. It's smart to read the IRS guidelines closely to ensure you meet all criteria.

Yes, if you sell an inherited house, you must file a 1099-S form. This form is essential for reporting the sale to the IRS, and it helps in determining any tax obligations associated with the gain. When you utilize the Colorado Escrow Check Receipt Form, it aids in organizing your transaction details, simplifying the filing process. Always consult a tax professional for personalized advice.

To report 1099-S for an inherited house, use the Colorado Escrow Check Receipt Form to ensure proper documentation during the sale. You should fill out the form that reflects the sale of the property and includes the necessary details about the transaction. By accurately reporting this, you comply with IRS regulations and avoid potential fines. Keeping a copy of the completed form for your records is also important.

Yes, Colorado is indeed an escrow closing state. This means that a neutral third party, known as the escrow agent, manages the closing process of real estate transactions. The Colorado Escrow Check Receipt Form is crucial as it helps ensure that all funds are handled securely and properly documented. When dealing with escrow transactions in Colorado, using this form can streamline your closing experience.

When filling out an escrow check, it is important to direct the payment to the proper entity. Typically, you should write an escrow check to the title company, real estate agent, or another person designated in the sales contract. Always refer to the terms outlined in your Colorado Escrow Check Receipt Form to ensure you are naming the correct recipient, which helps avoid delays in processing your payment.