Colorado General Form of Agreement to Incorporate

Description

How to fill out General Form Of Agreement To Incorporate?

If you want to finish, acquire, or create legal document templates, utilize US Legal Forms, the most significant assortment of legal documents, which can be accessed online.

Utilize the site’s straightforward and convenient search to locate the paperwork you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Use US Legal Forms to obtain the Colorado General Form of Agreement to Incorporate with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Colorado General Form of Agreement to Incorporate.

- You can also access forms you previously obtained from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct area/state.

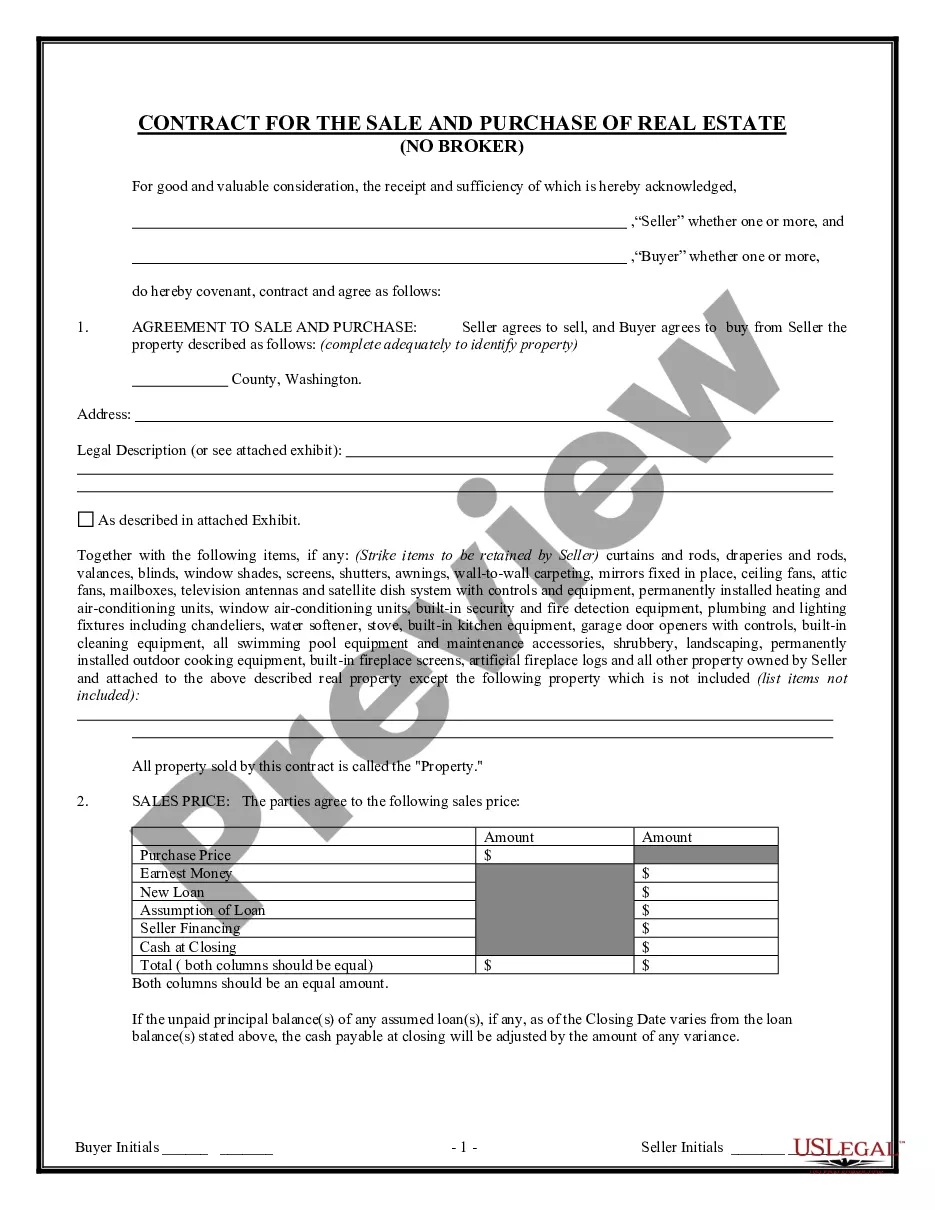

- Step 2. Utilize the Review option to examine the form's content. Don’t forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Forming a corporation in Colorado involves several steps, but it begins with filing the Articles of Incorporation. You will also need to obtain necessary licenses and permits. Throughout this process, consider leveraging the Colorado General Form of Agreement to Incorporate as a comprehensive resource, helping you adhere to all state requirements efficiently.

To start a corporation in Colorado, you need to file the Articles of Incorporation with the Secretary of State. This document requires specific information about your business and its structure. Using the Colorado General Form of Agreement to Incorporate simplifies this process, helping you focus on launching your business appropriately.

No, you do not need an LLC to start a corporation; they are separate types of business entities. Each has its own benefits and structures, depending on your business goals. If you are leaning towards forming a corporation, consider using the Colorado General Form of Agreement to Incorporate to navigate the formation process smoothly.

No, Colorado does not require an operating agreement for an LLC, but it is highly recommended. An operating agreement outlines the management structure and operating procedures, providing clarity among members. However, if you're considering formation options, the Colorado General Form of Agreement to Incorporate is a great tool for ensuring your business structure is established properly.

Yes, you can start a corporation by yourself in Colorado. This process allows a sole individual to establish a business entity, thereby limiting personal liability. Utilizing the Colorado General Form of Agreement to Incorporate makes it easier to draft the necessary documents and comply with state regulations.

To form a general partnership in Colorado, first, gather your partners and decide on a business name. Next, draft a partnership agreement to outline each partner's contributions and obligations. The Colorado General Form of Agreement to Incorporate can be a valuable tool in this process. Registering your partnership is not required but is often beneficial for formal recognition and legal clarity.

Incorporating in Colorado involves several key steps, starting with choosing a unique business name. You must then file your Articles of Incorporation with the Colorado Secretary of State. Utilizing the Colorado General Form of Agreement to Incorporate can help ensure that you meet all requirements and streamline the incorporation process. After filing, you will need to obtain any necessary permits and licenses to operate legally.

To form a general partnership in Colorado, you need at least two partners who agree to run a business for profit. While it is not mandatory to file specific forms with the state, creating a written agreement is highly advisable. Using the Colorado General Form of Agreement to Incorporate can provide a solid foundation, clarifying each partner’s roles and safeguarding their interests. Proper documentation simplifies your partnership establishment.

Writing a general partnership agreement involves clearly outlining roles, responsibilities, and profit-sharing among partners. Start with key elements such as partnership name, purpose, and contributions. Incorporating the Colorado General Form of Agreement to Incorporate can streamline this process, ensuring that all necessary details are included for legal protection. A well-drafted agreement will help avoid disputes and strengthen the partnership.

Yes, Colorado requires partnerships to file an annual partnership return. This return reports income, gains, losses, deductions, and credits. The key form for this is the Colorado General Form of Agreement to Incorporate, which also helps outline the partnership structure clearly. Understanding these requirements ensures compliance and smooth operations for your partnership.