Colorado Miller Trust Forms for Medicaid

Description

How to fill out Miller Trust Forms For Medicaid?

If you need to accumulate, acquire, or printing authentic document templates, utilize US Legal Forms, the most extensive collection of official forms, which are available online.

Utilize the site’s straightforward and user-friendly search to obtain the documents you require.

Different templates for business and personal reasons are categorized by groups and states, or keywords.

Every legal document template you purchase is yours permanently. You have access to every form you acquired in your account. Click the My documents section and select a form to print or download again.

Be proactive and download, and print the Colorado Miller Trust Forms for Medicaid with US Legal Forms. There are countless professional and state-specific forms available for your personal or business needs.

- Utilize US Legal Forms to acquire the Colorado Miller Trust Forms for Medicaid in merely a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download option to find the Colorado Miller Trust Forms for Medicaid.

- You can also access forms you previously obtained in the My documents tab of your account.

- If this is your first time using US Legal Forms, refer to the instructions below.

- Step 1. Ensure you have selected the form for your appropriate city/state.

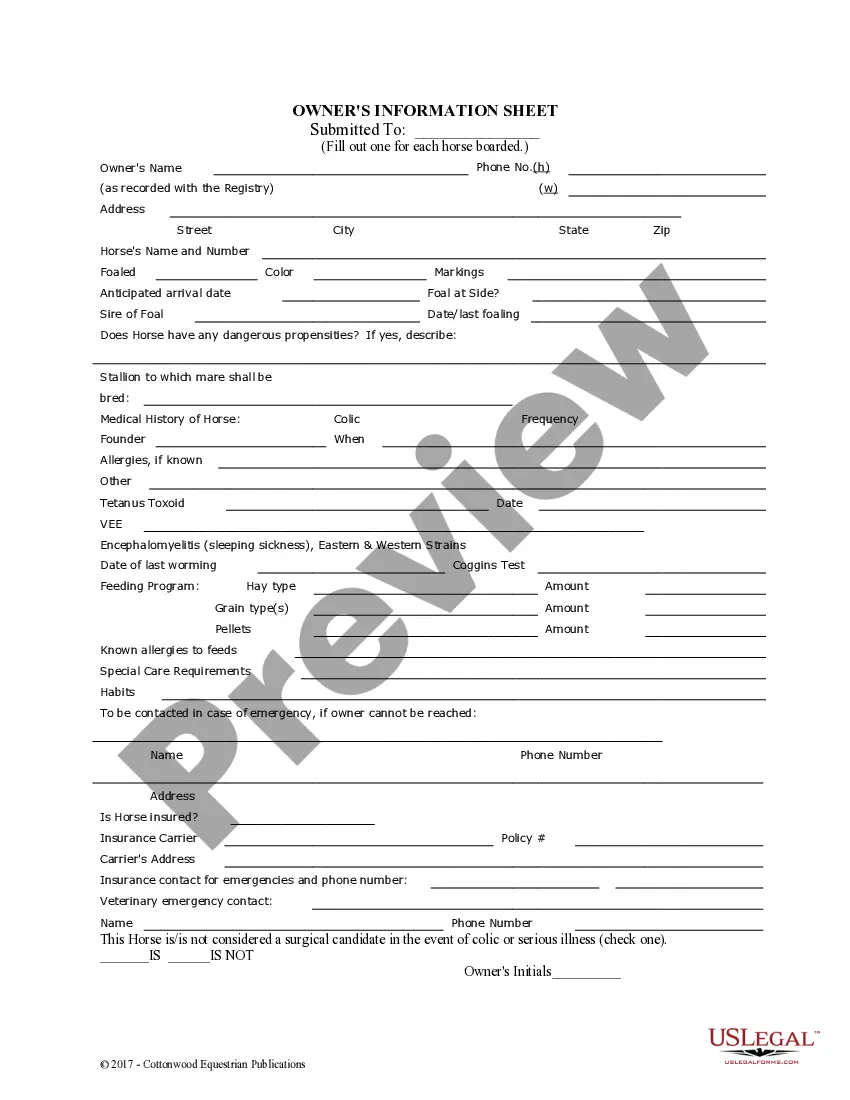

- Step 2. Use the Review option to examine the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have identified the form you need, click the Buy now option. Choose the pricing plan you prefer and provide your details to register for an account.

- Step 5. Process the transaction. You may use your Mastercard or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Colorado Miller Trust Forms for Medicaid.

Form popularity

FAQ

Yes, Medicaid does examine trusts during the eligibility process. Trusts can impact your Medicaid application, especially if they contain countable assets. The Colorado Miller Trust Forms for Medicaid may provide a strategy for correctly structuring your trust. Ensuring compliance with these regulations is vital for maintaining eligibility.

In Colorado, certain assets remain exempt when applying for Medicaid. For instance, your primary home, personal belongings, and a vehicle often do not count against the asset limit. Utilizing Colorado Miller Trust Forms for Medicaid can assist in protecting additional assets. This knowledge can greatly enhance your financial planning.

Yes, Colorado has an asset limit for Medicaid eligibility. As of 2023, individuals must have countable assets below a certain threshold to qualify. The Colorado Miller Trust Forms for Medicaid can help individuals manage their assets effectively. Understanding these limits is essential for anyone considering Medicaid benefits.

The primary benefit of a Miller trust lies in its ability to help individuals meet Medicaid eligibility requirements. By redirecting excess income into a trust, you can reduce your countable income, making it easier to qualify for critical Medicaid benefits. Additionally, the Colorado Miller Trust Forms for Medicaid simplify this process, providing clear guidelines for creating and managing your trust effectively.

In Colorado, a Medicaid trust is a special trust that allows individuals to qualify for Medicaid benefits while preserving their income. The trust holds certain assets that are exempt from Medicaid's asset limits. Utilizing the Colorado Miller Trust Forms for Medicaid helps streamline this process and ensures compliance with state regulations, allowing for effective financial management.

Setting up a Miller's trust involves filling out the Colorado Miller Trust Forms for Medicaid with accurate financial details. It’s essential to designate a trustee who will manage the trust according to Medicaid rules. After completing the forms, have them notarized and submit them to the appropriate Medicaid agency. This setup enables you to better manage your income for Medicaid eligibility.

Yes, a Miller trust can help you qualify for Medicaid by allowing you to set aside excess income. By utilizing the Colorado Miller Trust Forms for Medicaid, you can allocate your income into the trust, thereby reducing your countable income. This move allows you to meet Medicaid's financial eligibility criteria, ensuring access to vital healthcare services.

To establish a Miller trust, begin by obtaining the Colorado Miller Trust Forms for Medicaid. Complete the forms accurately, detailing the necessary information such as your income and assets. After filling out the forms, you must sign them in front of a notary and submit them to your local Medicaid office. This process helps ensure compliance with Medicaid income limits.

Using a trust in Medicaid planning involves drafting a Medicaid trust that details how your income and assets will be managed. Colorado Miller Trust Forms for Medicaid serve as a primary resource to structure your trust effectively. By incorporating a trust into your Medicaid strategy, you can optimize your financial situation while meeting eligibility requirements. This planning step is crucial for long-term care and should be tailored to your specific needs and circumstances.

While a Medicaid trust can provide significant benefits, it also has potential downsides you should consider. One disadvantage is that you may lose some control over your assets when placing them in the trust. Additionally, Colorado Miller Trust Forms for Medicaid may limit your options for accessing funds during your lifetime. It's essential to weigh these factors carefully and consult with a financial professional to ensure this approach aligns with your financial goals.