Colorado Sample Letter for Request for Instructions

Description

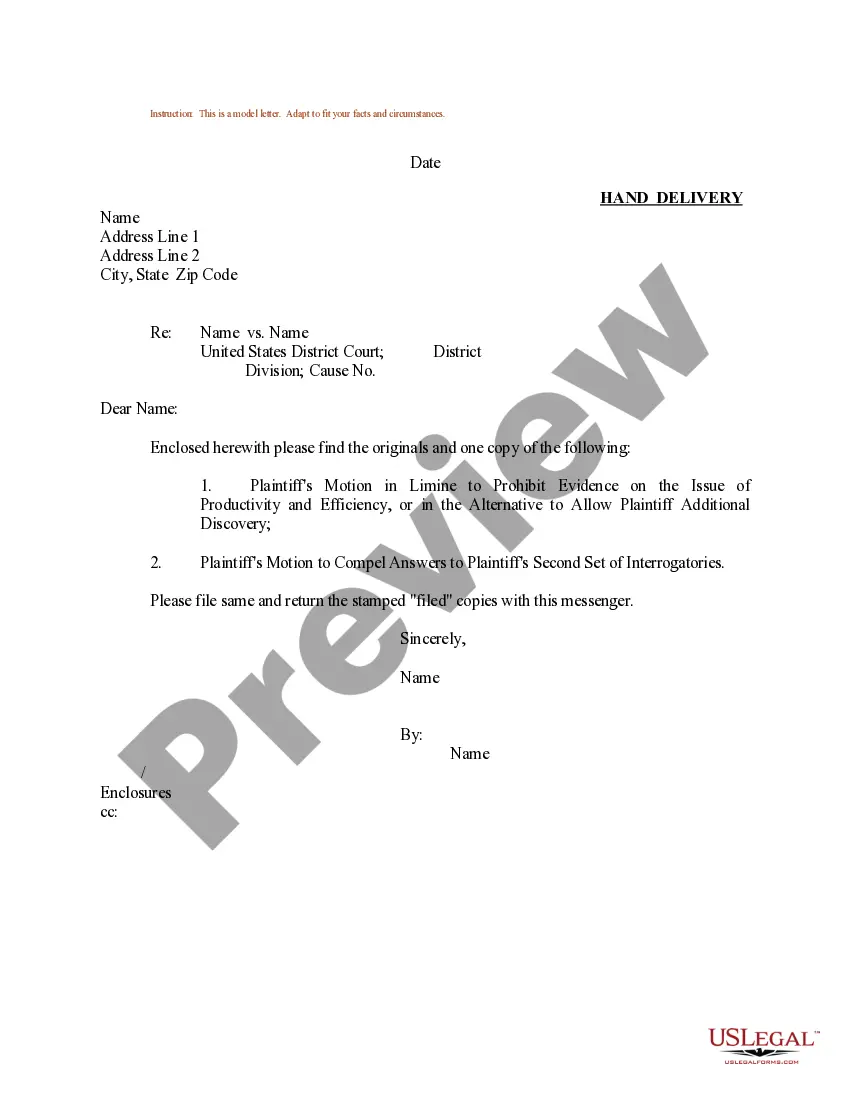

How to fill out Sample Letter For Request For Instructions?

If you need to obtain, secure, or print official document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the site’s straightforward and user-friendly search feature to locate the documents you require.

A collection of templates for business and personal purposes is organized by categories and states, or keywords.

Step 4. After you have found the form you need, click the Buy now button. Select the pricing plan you prefer and provide your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to find the Colorado Sample Letter for Request for Instructions with a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to retrieve the Colorado Sample Letter for Request for Instructions.

- You can also access forms you previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s details. Remember to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

The Dr. 1083 form is used for certain tax-related processes in Colorado, including setting up payments or requesting refunds. This form is crucial for taxpayers seeking to resolve specific tax issues with the Colorado Department of Revenue. Guidance on using this form effectively can be found in a Colorado Sample Letter for Request for Instructions, which ensures that you follow the correct procedures.

Yes, if you are an employee in Colorado, you should fill out a Colorado employee withholding certificate. This form helps your employer determine the correct amount of state income tax to withhold from your paycheck. For guidance on completing this form correctly, consider referencing a Colorado Sample Letter for Request for Instructions to ensure compliance.

To claim a TABOR refund in Colorado, you must file your state tax return for the applicable year. This refund, which arises from the Taxpayer's Bill of Rights, typically appears as a line item on your state tax return. Using a Colorado Sample Letter for Request for Instructions can help you understand the required forms and timelines for claiming your refund seamlessly.

Nonresidents who earn income from Colorado sources must file a Colorado nonresident return. This requirement applies to individuals who live outside of Colorado but receive income such as wages or rental income from within the state. If you have any questions about your specific situation, consider utilizing a Colorado Sample Letter for Request for Instructions for clarity.

Form 8454, also known as the Colorado Sample Letter for Request for Instructions, is a document utilized for certain tax filings in Colorado. It helps taxpayers communicate effectively with the Colorado Department of Revenue regarding their tax situations. When completing this form, it is essential to ensure accuracy to avoid any processing delays.

Form DR 1778 in Colorado is a specific document used for tax-related purposes. It often pertains to adjusting forms or instructions related to tax filings. If you're unsure how to complete it, consider referencing a Colorado Sample Letter for Request for Instructions for guidance on achieving clear communication with the department.

You can find your letter ID on official correspondence from the Colorado Department of Revenue or through your online tax account. If you need additional assistance locating your letter ID, using a Colorado Sample Letter for Request for Instructions can streamline your inquiry.

An ID letter is an official document issued by the Colorado Department of Revenue that serves as a unique identifier for taxpayers. It is used for various administrative purposes, including tracking and managing accounts. If you are unsure how to obtain one, consider drafting a Colorado Sample Letter for Request for Instructions.

To request a letter ID in Colorado, you typically need to fill out a specific form available on the Department of Revenue's website. This is essential for various tax-related processes. Utilize a Colorado Sample Letter for Request for Instructions if you need to write a formal request to ensure your application is clear and complete.

To speak with someone at the Colorado Department of Revenue, you can call their main office or visit their website for online resources. Make sure to have any relevant information ready to facilitate your conversation. Sometimes, preparing a Colorado Sample Letter for Request for Instructions can help clarify what you need to discuss.