Colorado Rejection of Goods

Description

How to fill out Rejection Of Goods?

Selecting the appropriate genuine document template can be a challenge. Certainly, there are numerous templates accessible online, but how can you locate the authentic one you need.

Utilize the US Legal Forms website. The platform provides a vast array of templates, such as the Colorado Rejection of Goods, suitable for both business and personal needs. All forms are verified by experts and comply with state and federal regulations.

If you are already registered, sign in to your account and click on the Download button to obtain the Colorado Rejection of Goods. Use your account to browse through the legitimate forms you have acquired previously. Go to the My documents tab in your account to get another copy of the document you require.

US Legal Forms is the largest repository of legal documents where you can find numerous paper templates. Utilize the service to obtain professionally crafted documents that adhere to state requirements.

- First, ensure you have selected the correct form for your city/region. You can view the form using the Preview button and read the form description to confirm it is indeed the right one for you.

- If the form does not meet your needs, use the Search box to find the correct form.

- Once you are confident that the form is appropriate, click the Acquire now button to obtain the form.

- Select the payment plan you prefer and enter the required information. Create your account and pay for the order using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

- Complete, modify, print, and sign the acquired Colorado Rejection of Goods.

Form popularity

FAQ

The 3 day right to cancel in Colorado grants buyers the ability to void certain contracts within three days of signing. This right is designed to protect consumers from hasty decisions in significant purchases, ensuring they have a cooling-off period. Therefore, if you're dealing with scenarios related to Colorado Rejection of Goods, this right can provide essential recourse and reassurance, ensuring that your purchases meet your expectations.

The 3 day cancellation law in Colorado allows consumers to cancel certain transactions within three days, providing them a chance to reconsider their choices. This law applies mainly to specific situations like home contracts and timeshare agreements. When considering Colorado Rejection of Goods, being aware of this law can help consumers navigate their rights and protections regarding purchased goods.

The 3 day rule in Colorado allows certain buyers to cancel a contract within three days of signing. This rule applies mainly to specific types of transactions, such as door-to-door sales or certain consumer contracts. Understanding the implications of the 3 day rule is crucial, especially when dealing with situations involving Colorado Rejection of Goods, as it can protect buyers and provide them with options if they receive unsatisfactory products.

Yes, Colorado is a right to cure state, which means that sellers generally have the opportunity to correct a defect before a buyer can reject the goods. This is important in the context of Colorado Rejection of Goods, as it allows for more flexibility in contract enforcement. If the goods provided do not meet the agreed-upon standards, the seller can often remedy the situation, leading to a smoother transaction overall.

The highest sales tax rate in Colorado typically occurs in certain city and county jurisdictions where local taxes are added to the state sales tax. It can reach up to around 11.2% in some regions, depending on local regulations. If you experience a Colorado rejection of goods, understanding the local sales tax implications can help you evaluate your overall expenses.

The RTD tax, or Regional Transportation District tax, is a sales tax imposed to fund public transportation in the Denver metro area. The rate varies depending on the location within the district, but it generally supports services essential for commuters. If you are affected by the Colorado rejection of goods, understanding the RTD tax can be beneficial when considering transportation-related expenses.

Colorado return Form 104 is the primary income tax return used by residents and part-year residents. This form allows you to report your income, claim deductions, and calculate your tax obligations. If you encounter issues related to the Colorado rejection of goods, ensuring your Form 104 is accurate may facilitate smoother processing.

To file a protest with the Colorado Department of Revenue, you need to submit a written statement explaining your disagreement with their decision. Include any relevant documentation to support your position regarding the Colorado rejection of goods. This proactive step can help you resolve issues effectively.

When it comes to filing a Colorado return, you generally must do so if you have income from Colorado sources. If your income exceeds a specific threshold, it's essential to file a return. Understanding the implications of a Colorado rejection of goods can help you determine if any adjustments affect your filing requirements.

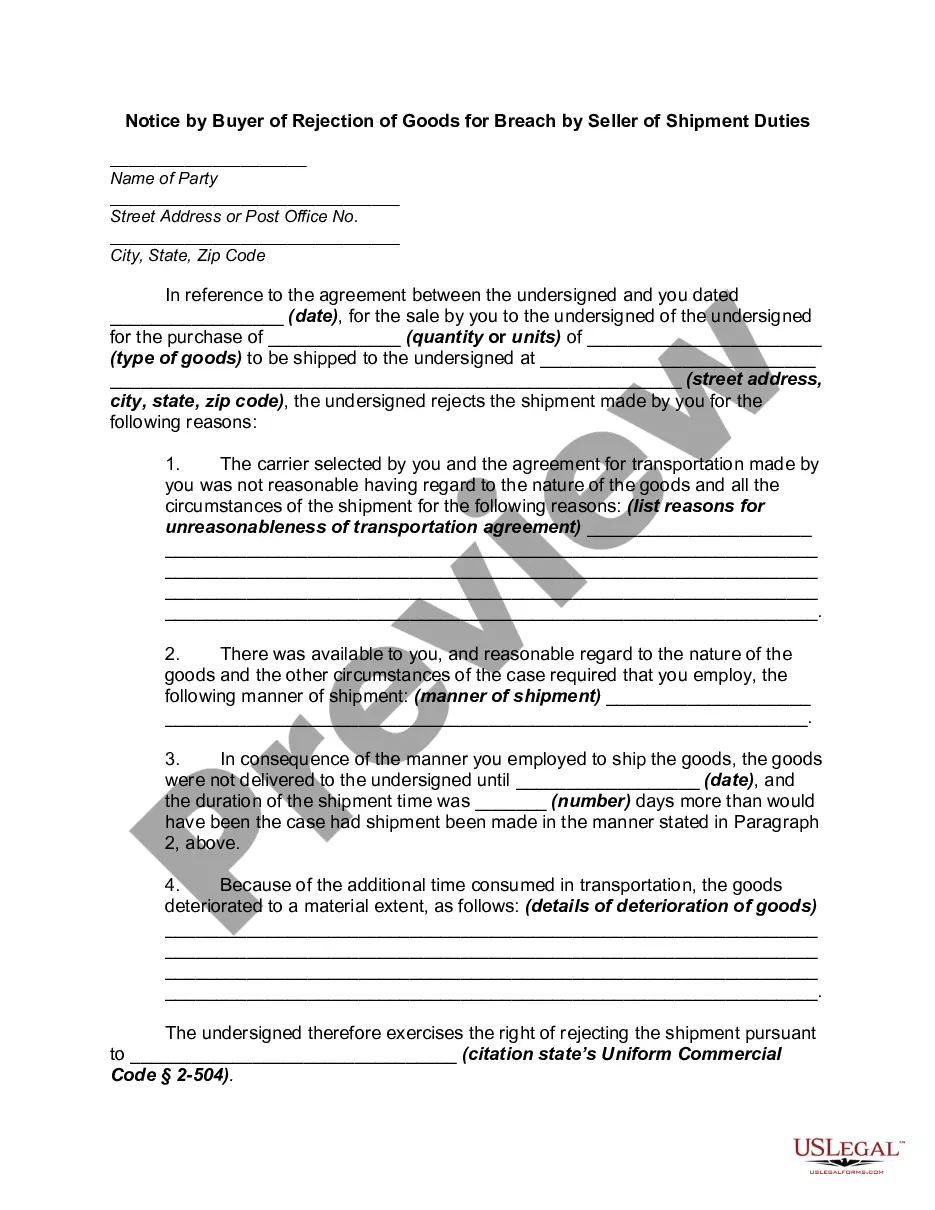

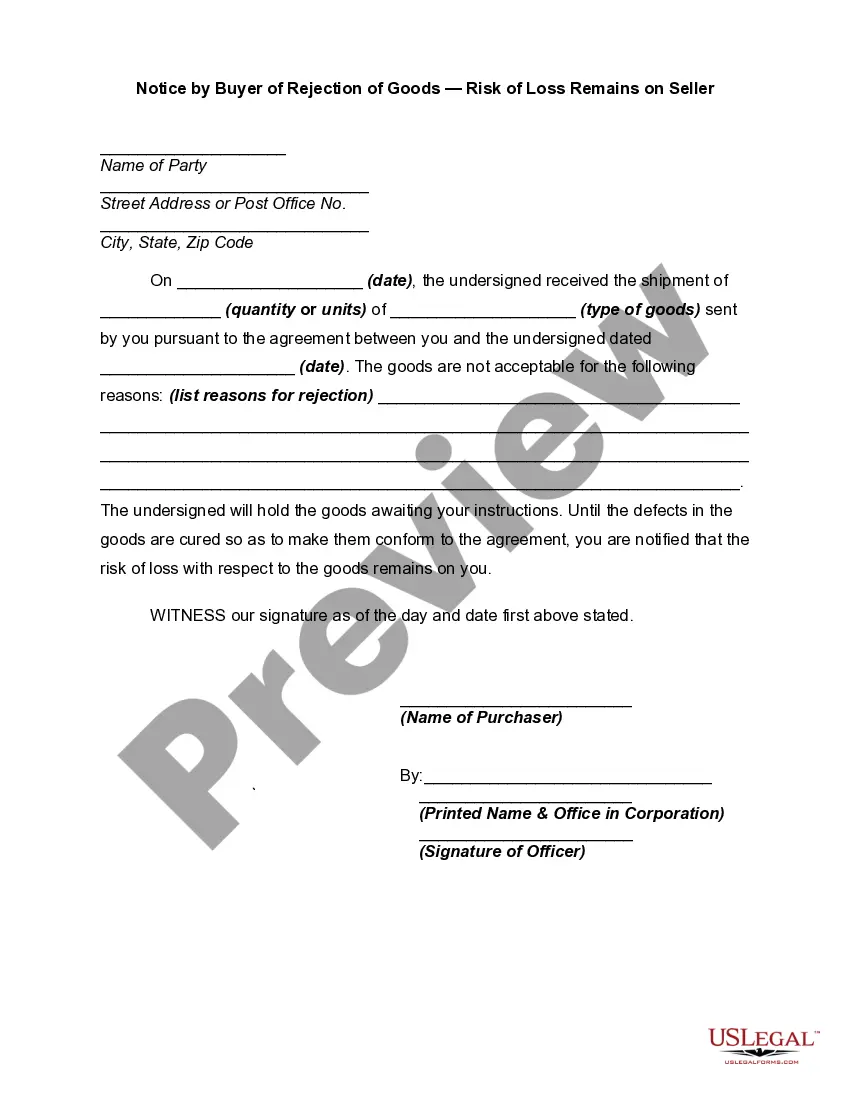

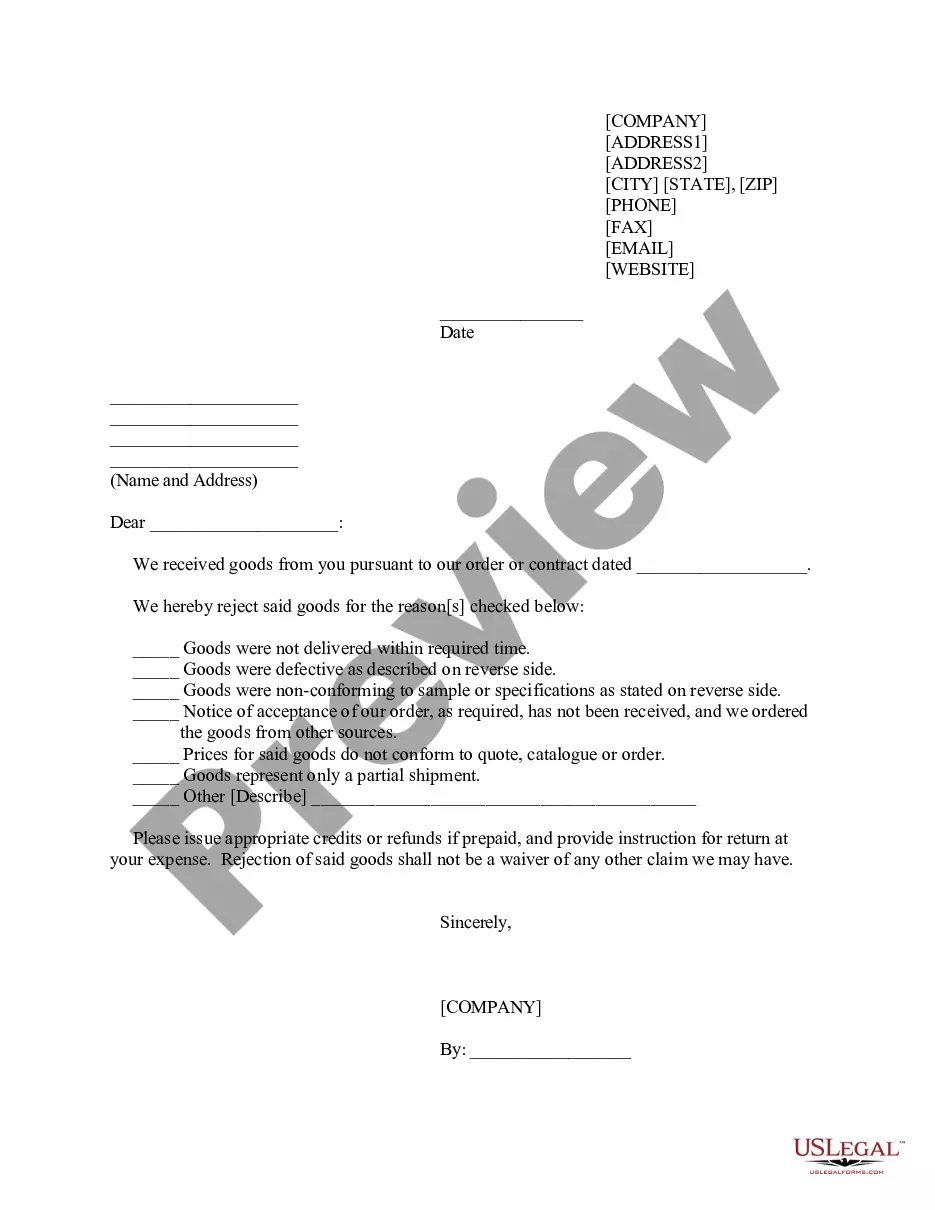

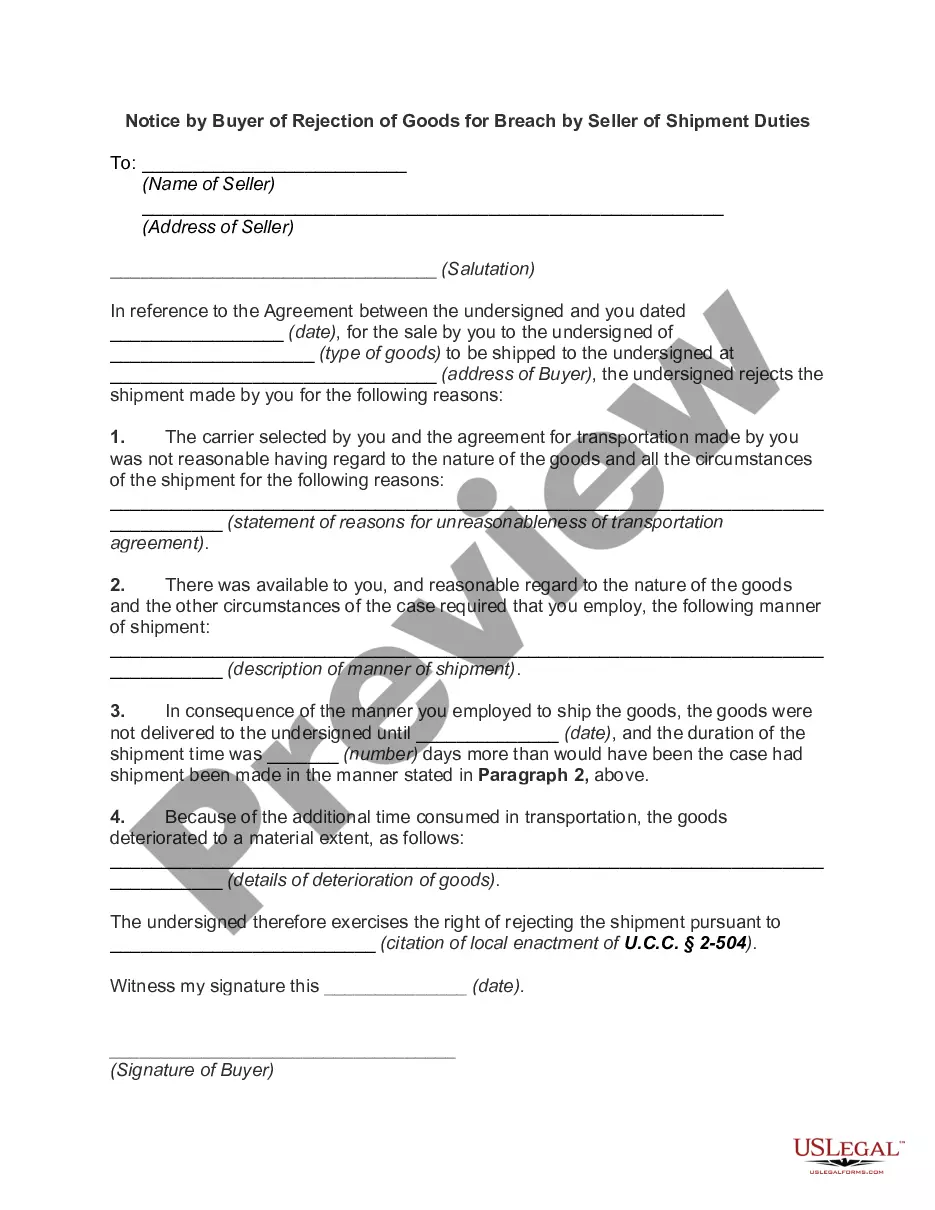

When goods are rejected, it means the buyer refuses to accept items that do not meet the terms of the sales agreement. This action often comes after evaluating the product's quality or condition. The rejection initiates the process for returning the goods, potentially allowing for exchanges or refunds. Understanding the implications of the Colorado Rejection of Goods ensures that you handle this situation correctly and legally.