Colorado Seller's Real Estate Disclosure Statement

Description

How to fill out Seller's Real Estate Disclosure Statement?

You can dedicate time online exploring the legal document template that meets the state and federal standards you require.

US Legal Forms offers a vast selection of legal templates that are reviewed by experts.

You can easily obtain or create the Colorado Seller’s Real Estate Disclosure Statement through my services.

To find another version of the form, utilize the Search field to locate the template that meets your needs and requirements.

- If you currently have a US Legal Forms account, you can sign in and select the Download option.

- Subsequently, you can fill out, edit, produce, or sign the Colorado Seller's Real Estate Disclosure Statement.

- Every legal document template you purchase is yours indefinitely.

- To get another copy of any acquired form, visit the My documents section and click on the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure you have selected the correct document template for your chosen county/city.

- Check the form details to confirm that you have chosen the right one. If available, use the Review option to examine the document template as well.

Form popularity

FAQ

The document provided by the seller that described the condition of the property is known as the Transfer Disclosure Statement. As a buyer, you should receive this document during the contract contingency period.

But, there are 12 states that are still considered non-disclosure: Alaska, Idaho, Kansas, Louisiana, Mississippi, Missouri (some counties), Montana, New Mexico, North Dakota, Texas, Utah and Wyoming. In a non-disclosure state, transaction sale prices are not available to the public.

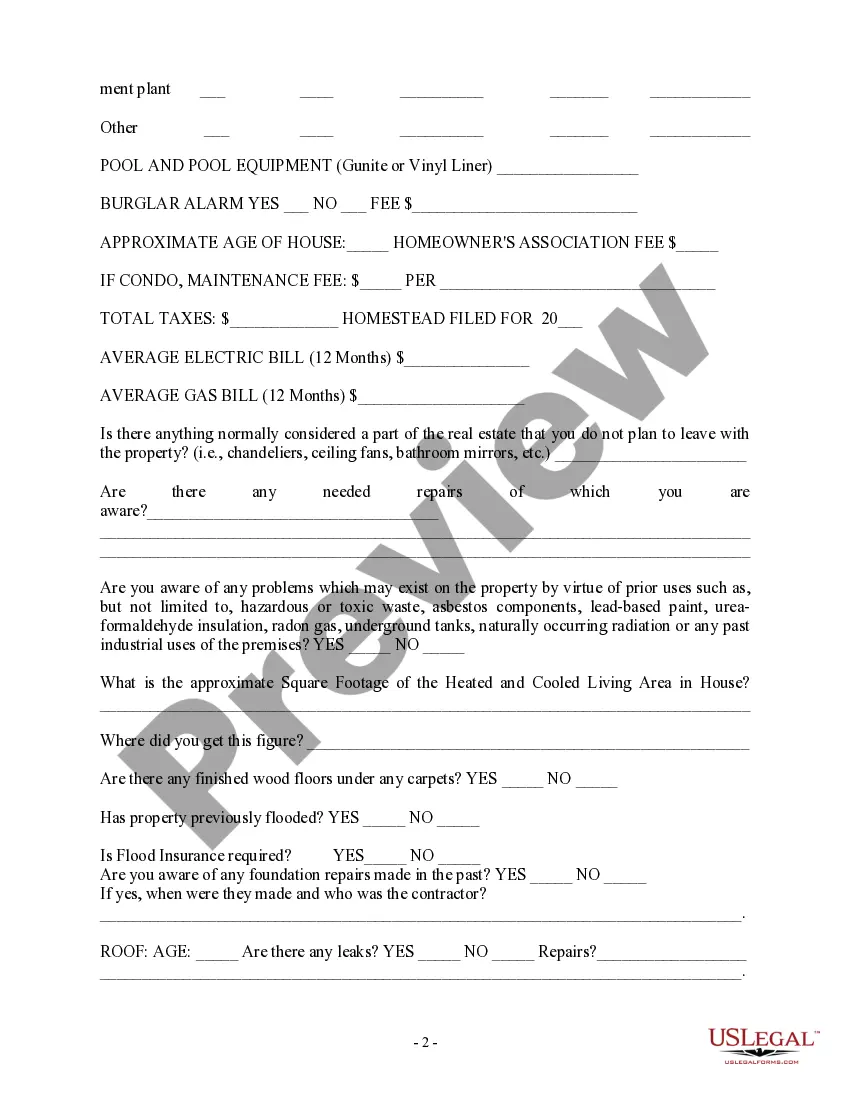

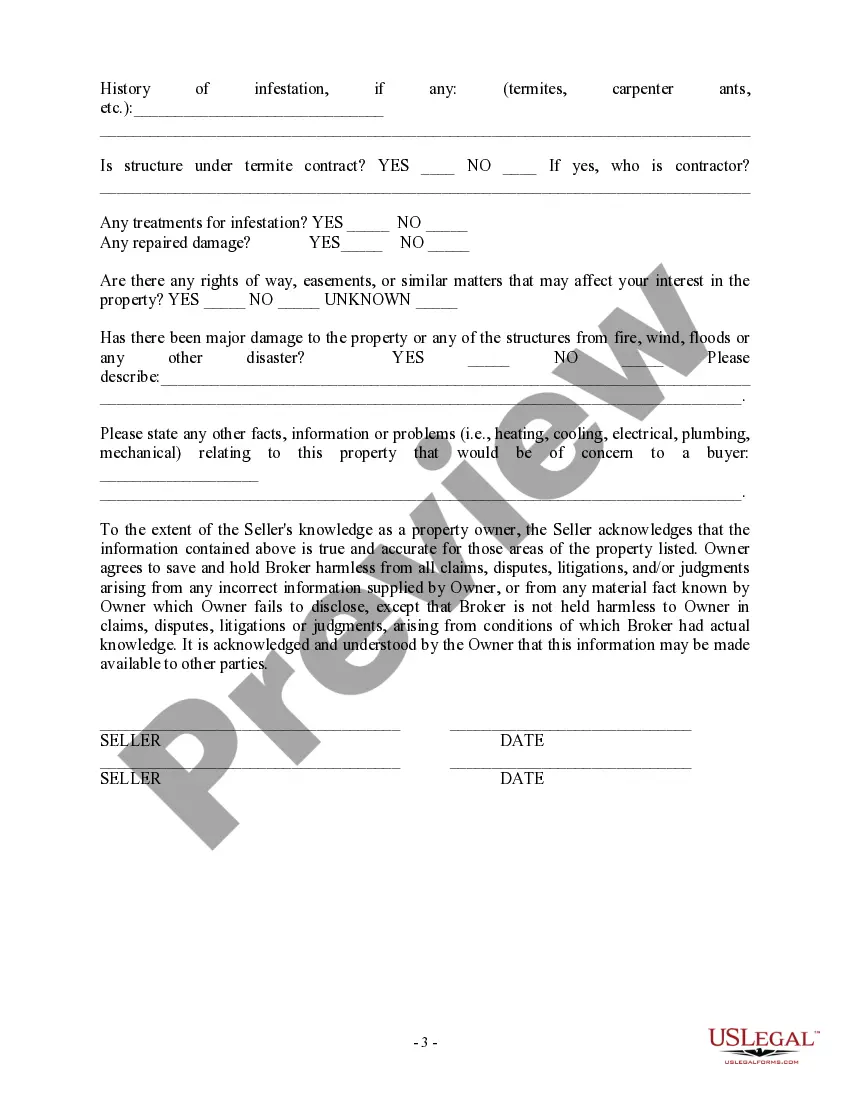

A Seller's Disclosure is a legal document that requires sellers to provide previously undisclosed details about the property's condition that prospective buyers may find unfavorable. This document is also known as a property disclosure, and it's important for both those buying a house and for those selling a house.

The use of these forms is a major step toward full disclosure and shifts the responsibility of disclosure to the one who knows the property best, the seller. In Colorado, the seller's property disclosure responsibility also extends to the real estate professional.

The licensee is the seller. -- The only time a licensee should fill out the Seller's Property Condition Disclosure or disclaimer forms is when he/she owns the property. You just studied 25 terms!

For example, even if the home wreaks of mold, the seller may not be responsible unless the buyer can prove that the seller actually knew about the mold. This rule is particularly problematic when the seller did not live in the home because the seller may have very little actual knowledge.

Colorado's Disclosure Laws. Colorado state statutes require that sellers of residential property disclose the following to buyers: That the property might be in a special taxing district, and where the buyer can go to find out whether the property is, in fact, within such a district.

A disclosure statement is a financial document given to a participant in a transaction explaining key information in plain language. Disclosure statements for retirement plans must clearly spell out who contributes to the plan, contribution limits, penalties, and tax status.

DUE DILIGENCE DOCUMENTS At a minimum, this could include copies of any agreement related to the property that the seller has with any third parties (tenants, contractors, vendors, solar providers, etc.) that may impact the buyer's use/ownership of the property.