Colorado Bill of Transfer to a Trust

Description

How to fill out Bill Of Transfer To A Trust?

US Legal Forms - one of the most important collections of legal documents in the United States - offers a selection of legal document templates that you can download or create.

By utilizing the website, you can access countless forms for business and personal purposes, organized by categories, states, or keywords. You can quickly find the latest editions of forms such as the Colorado Bill of Transfer to a Trust.

If you have a subscription, sign in and obtain the Colorado Bill of Transfer to a Trust from the US Legal Forms library. The Download option will be visible for every form you view.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form onto your device. Make adjustments. Complete, modify, and print and sign the downloaded Colorado Bill of Transfer to a Trust. Every template you add to your account does not expire and belongs to you indefinitely. So, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the Colorado Bill of Transfer to a Trust with US Legal Forms, the most extensive library of legal document templates. Utilize countless professional and state-specific templates that satisfy your business or personal needs.

- To begin using US Legal Forms for the first time, here are some simple steps to help you get started.

- Ensure you have selected the correct form for your area/county.

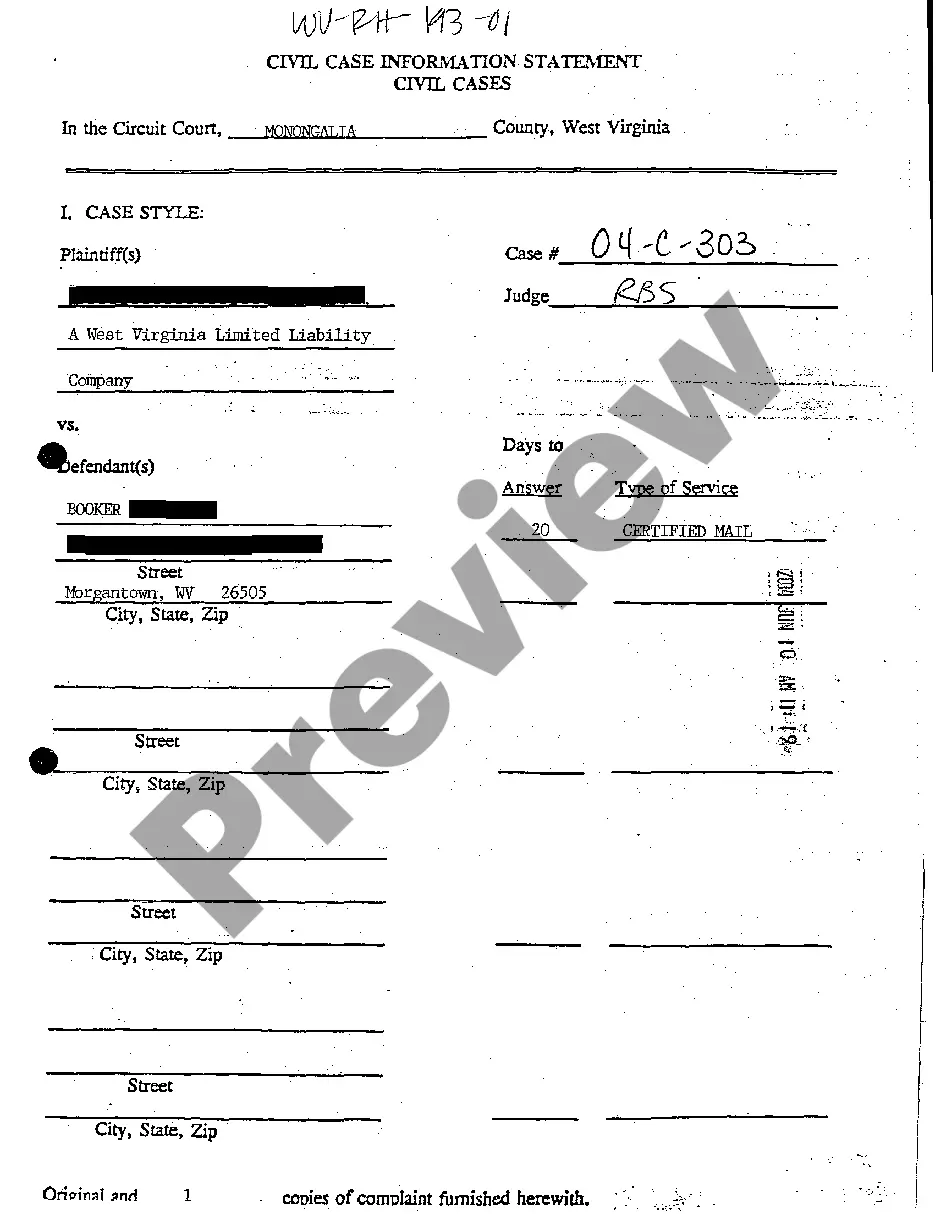

- Click the Preview button to review the content of the form.

- Examine the form description to confirm that you have selected the right form.

- If the form does not suit your requirements, use the Lookup field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Acquire now button.

- Then, choose the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Transferring property into a trust in Colorado involves utilizing a Colorado Bill of Transfer to a Trust to document the process. Make sure you prepare the bill accurately, including detailed descriptions of the property. After drafting the document, sign and, if required, notarize it to finalize the transfer. For ease and compliance, consider leveraging resources like uslegalforms, which provide templates and guidance.

To transfer assets into a trust, you need to create a Colorado Bill of Transfer to a Trust for each asset. This process typically involves drafting the bill, detailing the assets, and signing it with the necessary witnesses or notaries. Once completed, the assets officially belong to the trust, enabling better management and distribution of your estate. Using platforms like uslegalforms can help simplify this process.

While trusts offer several benefits, there are also disadvantages to consider. Placing property in a trust may limit your control over those assets, especially if you name a trustee. Additionally, managing a trust can involve ongoing administrative duties. It is advisable to consult a professional when using a Colorado Bill of Transfer to a Trust to understand how it may impact your property and estate plans.

One of the biggest mistakes parents make when setting up a trust fund is failing to transfer their assets into the trust. Without completing a Colorado Bill of Transfer to a Trust, the fund remains ineffective. This oversight can lead to complications during estate planning and management. Taking the time to properly fund the trust ensures your wishes are followed and offers protection for your beneficiaries.

The bill of transfer for a trust is a legal document used to transfer ownership of assets into a trust. This document details the assets being transferred and identifies the grantor, trustee, and beneficiary. In Colorado, using a Colorado Bill of Transfer to a Trust streamlines this process and provides clarity about the transferred properties. It is essential for ensuring your trust holds the intended assets efficiently.

To transfer property into a trust in Colorado, you need to execute a Colorado Bill of Transfer to a Trust. This document officially assigns ownership of the property to the trust. It is crucial to accurately describe the property and identify the trust correctly. Once you complete the bill, ensure it is signed and, if necessary, notarized to make it legally binding.

Transferring assets to a trust after death can be a complex process that usually involves probate procedures. In Colorado, a Bill of Transfer to a Trust can specify the management and distribution of assets after your passing. It’s essential to have a properly structured trust document in place beforehand to facilitate this process. Using uslegalforms can help you navigate these legal requirements efficiently, ensuring that your wishes are upheld.

Certain assets may not be suitable for placement in a trust. For example, retirement accounts like 401(k)s and IRAs often require different handling, as they may have specific beneficiary designations. Additionally, personal property that you wish to retain control over typically does not belong in a trust. When considering a Colorado Bill of Transfer to a Trust, it's wise to consult with a professional to identify what should and should not be included.

A bill of transfer in a trust is a legal document that outlines the movement of assets into a trust. Specifically in Colorado, a Bill of Transfer to a Trust allows you to specify which assets you are placing into the trust and under what terms. This essential document helps ensure that your assets are managed according to your wishes while benefitting your designated beneficiaries. Utilizing uslegalforms can streamline the preparation of this document for your estate plan.

When evaluating whether a transfer on death or a trust is better for your needs, consider your specific situation. A transfer on death designation allows assets to pass directly to beneficiaries without going through probate. Conversely, a Colorado Bill of Transfer to a Trust not only avoids probate but also provides more control over how and when your assets are distributed. Ultimately, the choice depends on your estate planning goals.