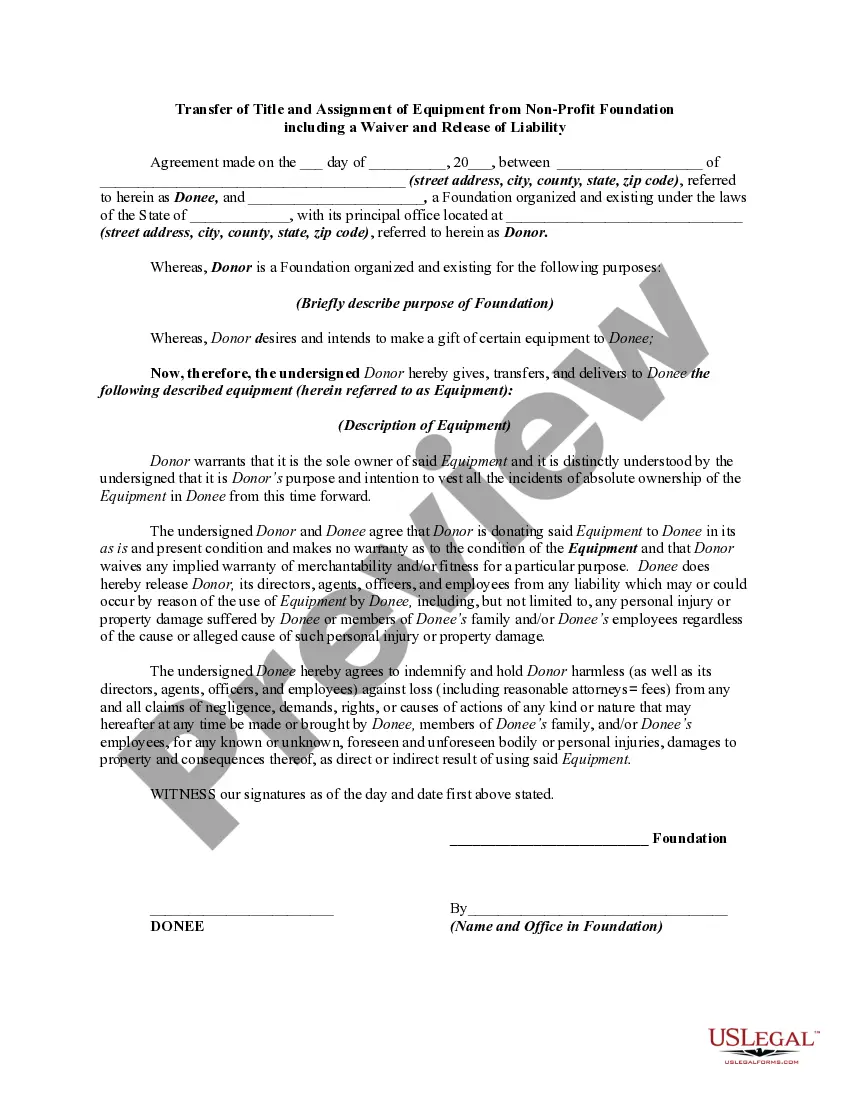

Colorado Transfer of Title and Assignment of Equipment from Nonprofit Foundation including a Waiver and Release of Liability

Description

How to fill out Transfer Of Title And Assignment Of Equipment From Nonprofit Foundation Including A Waiver And Release Of Liability?

Have you ever found yourself in a scenario where you need documentation for potential business or personal reasons almost all the time.

There are numerous legal document templates accessible online, but finding reliable forms can be challenging.

US Legal Forms offers a wide array of template forms, such as the Colorado Transfer of Title and Assignment of Equipment from Nonprofit Organization along with a Waiver and Release of Liability, designed to comply with federal and state regulations.

Once you find the right form, click Buy now.

Choose the pricing plan you prefer, complete the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After logging in, you will be able to download the Colorado Transfer of Title and Assignment of Equipment from Nonprofit Organization including a Waiver and Release of Liability template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

- Utilize the Review button to evaluate the form.

- Read the description to confirm that you have selected the appropriate form.

- If the form isn’t what you are looking for, use the Search field to find the form that fits your requirements.

Form popularity

FAQ

Your board of directors is the primary decision maker for your nonprofit and is responsible for overseeing its management. As a result, your board should approve any decision involving significant financial, legal, or tax issues, or any major program-related matter.

Explanation. A nonprofit corporation can buy and sell assets, similar to a profit-oriented entity. The fact that the nonprofit doesn't operate with a profit motive doesn't preclude it from signing a contract, borrowing and purchasing resources deemed operationally essential.

A nonprofit corporation can buy and sell assets, similar to a profit-oriented entity. The fact that the nonprofit doesn't operate with a profit motive doesn't preclude it from signing a contract, borrowing and purchasing resources deemed operationally essential.

A nonprofit corporation has no owners (shareholders) whatsoever. Nonprofit corporations do not declare shares of stock when established. In fact, some states refer to nonprofit corporations as non-stock corporations.

Because of its tax exempt status, nonprofit assets cannot be distributed to business members. Such distribution would violate the nonprofit status of the company. You are not permitted to give away or sell the assets of a nonprofit, but must rather transfer them to a similar nonprofit organization.

Financial Actions Once the decision has been made to dissolve, the nonprofit must stop transacting business, except to wind down its activities. The assets of a charitable nonprofit can only be used for exempt purposes. 6feff This means that assets may not go to staff or board members.

A liability waiver, or release waiver, is a legal document that a company or organization requires members of the public to sign in order to protect their organization from being sued if you sustain an injury.

The first step in the voluntary dissolution process is the approval by the majority of the board of directors or members, or both, to elect to wind up and dissolve the nonprofit corporation. (Corporations Code, sections 5033, 5034, 6610, 6610.5, 8610, 8610.5, 9680.)

Activity risks: The waiver should describe in detail the risks surrounding the activity or service provided by your company. The participant must be made fully informed of potential risks before they can take part in the activity. They must also be made aware that your company will not cover their insurance costs.

Typically, a volunteer waiver protects a service provider, like your nonprofit, from liability in the event of an accident involving any of your volunteers. In addition, the volunteer waiver should serve as a document of understanding between the nonprofit and its volunteers.