Colorado Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate

Description

How to fill out Lease Of Retail Store With Additional Rent Based On Percentage Of Gross Receipts - Real Estate?

You might dedicate hours online trying to discover the valid document template that meets the state and federal requirements you have.

US Legal Forms provides thousands of legitimate forms that can be evaluated by professionals.

You can acquire or print the Colorado Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate from the services.

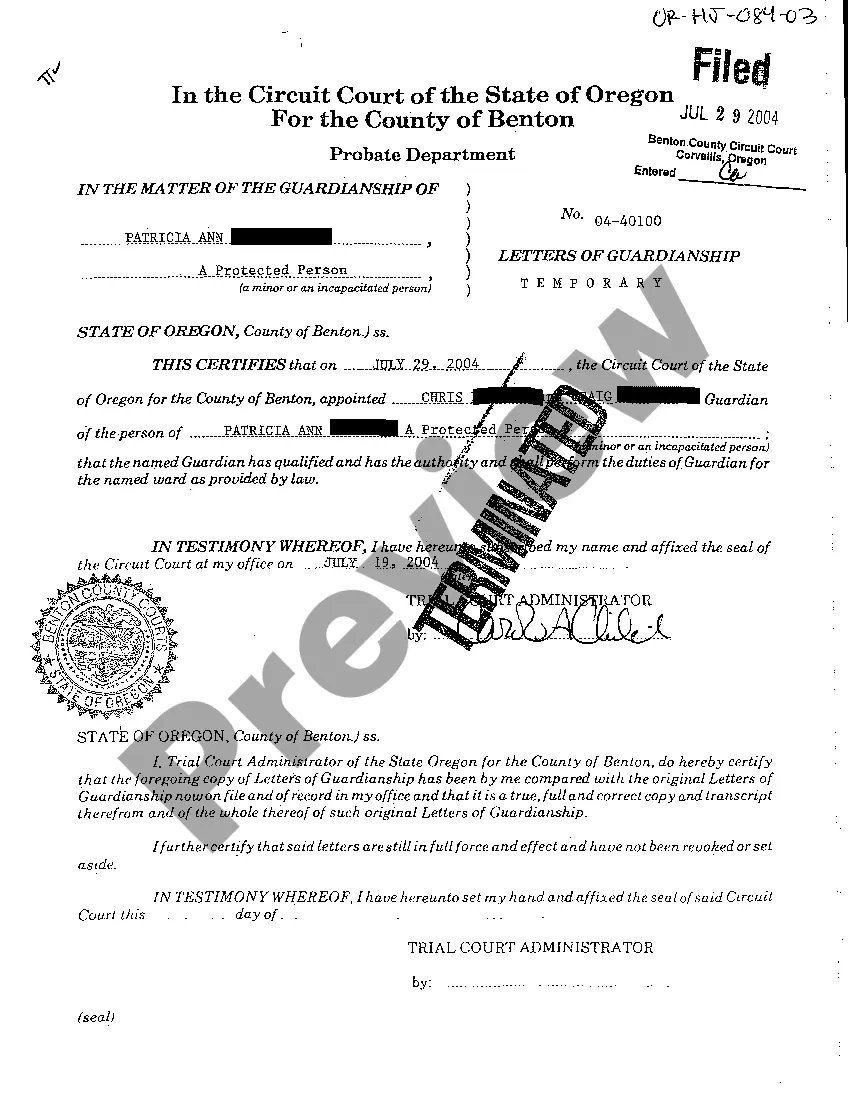

If available, utilize the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, edit, print, or sign the Colorado Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of the acquired form, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure that you have selected the correct document template for the area/city of your choice.

- Review the form outline to verify that you have chosen the appropriate template.

Form popularity

FAQ

The best percentage for rental varies based on industry standards, but it usually falls between 5% and 10% of gross receipts. In a Colorado Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, this range allows landlords and tenants to strike a balance that supports both parties. It is essential to consider factors like location, type of business, and potential sales when determining the ideal rate.

Retail tenants typically use a percentage lease, especially those in popular sectors such as restaurants, clothing stores, and other consumer goods retailers. In a Colorado Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, these tenants benefit from aligning rental costs with their sales performance. This arrangement allows for lower fixed costs, providing a safety net during slower sales periods.

Term percentage rent is the calculated rent amount based on a tenant's gross sales over a specified period. In the context of a Colorado Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, this rent model aligns the landlord's earnings with the tenant's sales success. It provides a flexible structure that can adapt to changing market conditions and tenant performance.

The breakpoint percentage of rent is the revenue figure that tenants must surpass before paying additional rent based on their gross receipts. In a Colorado Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, the breakpoint helps to define when percentage rent starts to apply. Tenants benefit from a clear understanding of their sales performance thresholds, allowing for better financial planning.

The tenant percentage refers to the portion of gross receipts that a tenant pays as rent under a Colorado Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. This percentage is often negotiated between the landlord and tenant and is usually applied after surpassing a specified sales threshold. It ensures that landlords receive a share of the tenant's success, encouraging a mutually beneficial relationship.

The maximum percentage for rent based on gross sales varies by lease agreement, but it typically ranges from 5% to 10%. It’s crucial to negotiate an amount that allows both the tenant to be profitable and the landlord to cover their expenses. Using the right platforms, like uslegalforms, can help you draft agreements that clearly outline these terms while ensuring they align with market standards.

The type of lease commonly used for retail businesses, based on a percentage of earnings, is known as a percentage lease. In a Colorado Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, this type of lease allows for adjustments in rent based on the tenant's sales performance. It creates a win-win situation by linking rent to business success.

In a commercial lease, percentage rent refers to the provision where the tenant pays a base rent plus a percentage of gross sales exceeding a specified amount. This arrangement is beneficial for both parties because it aligns the landlord’s income with the tenant's performance. In a Colorado Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, this provision fosters a collaborative relationship.

To calculate the leased percentage in commercial leasing, divide the square footage of your leased space by the total square footage of the property. In a Colorado Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, understanding your leased percentage can give valuable insights into rental negotiations and overall property value. A higher leased percentage typically correlates with lower overall costs per square foot.

The formula for rent typically consists of a base amount plus any additional fees tied to performance metrics, such as sales. In a Colorado Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, rent is often calculated as the base rent plus a percentage of gross receipts exceeding a predetermined threshold. This dual approach helps establish a fair rental rate based on the business’s success.