Colorado Agreement to Store Certain Personal Property in Portion of Garage

Description

How to fill out Agreement To Store Certain Personal Property In Portion Of Garage?

If you want to be thorough, obtain, or create legal document templates, use US Legal Forms, the largest collection of legal forms available online. Take advantage of the site’s straightforward and user-friendly search feature to find the documents you require. Numerous templates for business and personal purposes are categorized by types and states, or keywords.

Utilize US Legal Forms to acquire the Colorado Agreement to Store Certain Personal Property in Part of Garage within just a few clicks.

If you are already a US Legal Forms customer, Log In to your account and click the Download button to access the Colorado Agreement to Store Certain Personal Property in Part of Garage. You can also retrieve forms you previously saved in the My documents tab of your account.

Every legal document template you acquire is yours permanently. You will have access to each form you saved in your account. Click the My documents section and select a form to print or download again.

Complete and download, and print the Colorado Agreement to Store Certain Personal Property in Part of Garage with US Legal Forms. There are millions of professional and state-specific forms you can use for your personal business or individual needs.

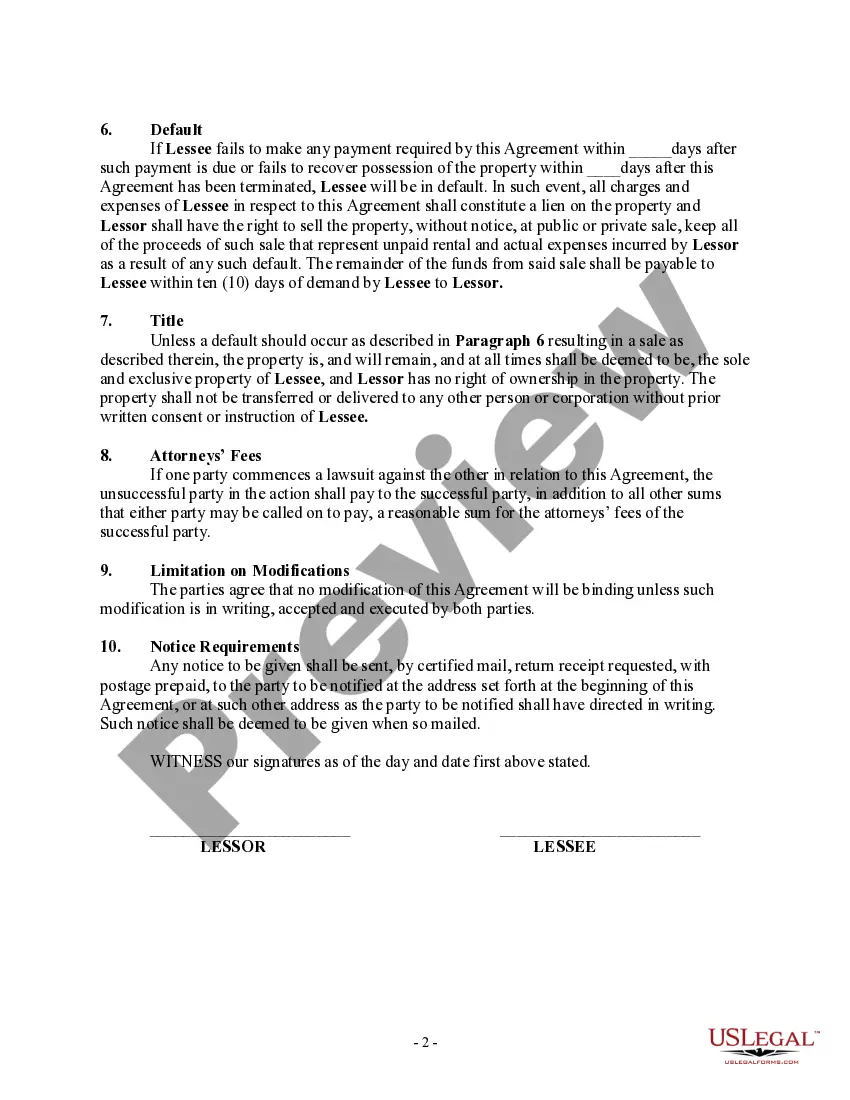

- Step 1. Ensure you have selected the form for the correct region/state.

- Step 2. Use the Preview option to review the document’s content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other forms in the legal document category.

- Step 4. Once you have found the form you need, select the Download now button. Choose the payment plan you prefer and enter your information to create an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the Colorado Agreement to Store Certain Personal Property in Part of Garage.

Form popularity

FAQ

In California, landlords may store their items on the property only if the tenancy agreement allows it. Tenants should be informed about what is being stored, along with any associated conditions. A Colorado Agreement to Store Certain Personal Property in Portion of Garage can help create a clear understanding and protect the interests of both the landlord and tenant, offering a structured approach to shared storage.

In New Zealand, landlords generally cannot store their belongings in a tenant's space without permission. If the tenant agrees, the landlord must clarify the terms of storage. A Colorado Agreement to Store Certain Personal Property in Portion of Garage could serve as a helpful reference in defining roles and expectations, ensuring both parties understand their rights and responsibilities.

An example of tangible property would be a car parked in a garage. This physical item is owned by an individual and can be moved, making it a clear example of tangible personal property. When discussing a Colorado Agreement to Store Certain Personal Property in Portion of Garage, understanding tangible property helps define what can be included in storage arrangements. Clear examples can help prevent confusion during the storage process.

Tangible personal property in Colorado includes physical items that can be touched and moved. This could range from vehicles and machinery to clothing and artwork. When you engage in a Colorado Agreement to Store Certain Personal Property in Portion of Garage, knowing what falls under tangible property ensures you store appropriate belongings. It is vital to categorize your items accurately for effective and legal storage.

Personal property in Colorado refers to assets owned by individuals that are not attached to real estate. This includes items like furniture, electronics, and vehicles. When entering into a Colorado Agreement to Store Certain Personal Property in Portion of Garage, identifying which items qualify as personal property helps clarify what can be stored. Being informed about what constitutes personal property can benefit everyone involved.

In Colorado, the exemption amount for personal property refers to the value of belongings that can be protected from creditors. Typically, this exemption allows individuals to retain a certain value, ensuring they have essentials. The Colorado Agreement to Store Certain Personal Property in Portion of Garage can incorporate details about these exemptions as they pertain to stored items. Always check the latest regulations to ensure compliance.

In Colorado, the time someone can leave their belongings on your property varies. Typically, a Colorado Agreement to Store Certain Personal Property in Portion of Garage outlines specific terms, including duration. It is essential to clarify how long the storage will last to prevent misunderstandings. Always refer to the agreement for guidelines on timeframes and responsibilities.

Yes, Colorado provides a property tax credit aimed at helping qualifying homeowners reduce their tax liability. This benefit often targets seniors and disabled individuals. It's important to research eligibility and application procedures, especially if you are thinking about a Colorado Agreement to Store Certain Personal Property in Portion of Garage, as these financial aspects can greatly impact your plans.

Owning a home in Colorado can offer multiple tax benefits, such as mortgage interest deductions and potential capital gains exclusions upon selling the property. Additionally, property owners can benefit from state-sponsored exemptions. Understanding these advantages is key, especially if you're considering agreements like the Colorado Agreement to Store Certain Personal Property in Portion of Garage to optimize your space.

In Colorado, property taxes may not be deductible on your state income taxes, but they can be on your federal return. This deduction can alleviate some of the financial burdens that property owners face. Therefore, it is vital to keep accurate records of your property taxes, especially if you enter into a Colorado Agreement to Store Certain Personal Property in Portion of Garage and wish to maximize your tax benefits.