Colorado Corporate Resolution Authorizing a Charitable Contribution

Description

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution.

How to fill out Corporate Resolution Authorizing A Charitable Contribution?

If you want to be thorough, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms, accessible online.

Employ the site's straightforward and user-friendly search function to find the documents you require.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click the Get Now button. Select the payment plan you prefer and input your details to register for an account.

Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to locate the Colorado Corporate Resolution Authorizing a Charitable Contribution in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Colorado Corporate Resolution Authorizing a Charitable Contribution.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

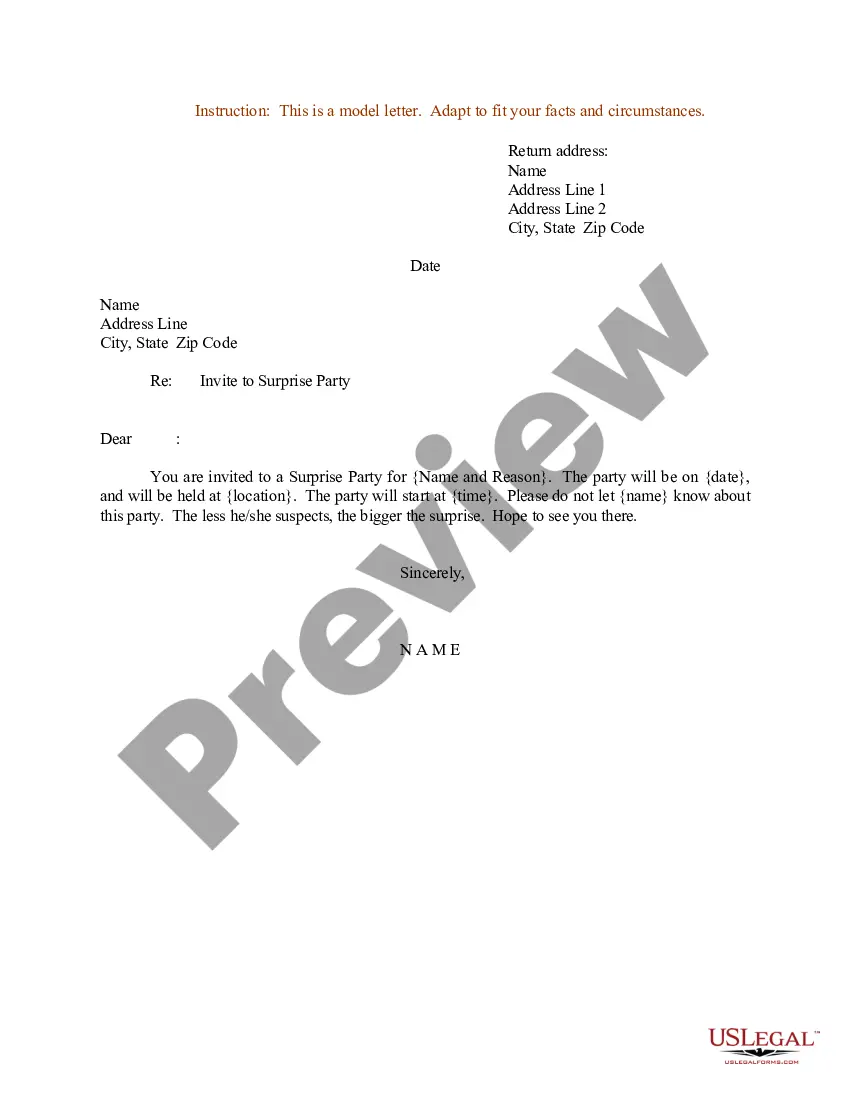

- Step 2. Use the Review option to inspect the form’s content. Don’t forget to read the notes.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

Nexus in Colorado is determined by several factors, including physical presence, employees, and the nature of business activities conducted within the state. By understanding how nexus is established, businesses can effectively manage their tax responsibilities. A Colorado Corporate Resolution Authorizing a Charitable Contribution can streamline this process and reinforce your commitment to regulatory compliance.

The corporate tax rate in Colorado is currently a flat rate applied to taxable income. Businesses making contributions for charitable causes may also want to consider the potential implications on their tax filings. A Colorado Corporate Resolution Authorizing a Charitable Contribution can help clarify how such contributions affect your company's overall tax obligations.

Nexus restrictions refer to the connection a business has with a state, determining tax obligations. If a corporation has a nexus in Colorado, it may incur taxes on its earnings. Crafting a Colorado Corporate Resolution Authorizing a Charitable Contribution can provide a structured approach to navigate these complexities and ensure compliance with state regulations.

Doing business in Colorado includes having an office, employees, or maintaining a significant presence in the state. Companies that engage in fundraising or charitable activities in Colorado must ensure they comply with local taxation and legal requirements. Utilizing a Colorado Corporate Resolution Authorizing a Charitable Contribution helps formalize these activities within the legal framework of the state.

Colorado use tax applies to items purchased out of state but used in Colorado. If a business obtains products for charitable purposes, registering them correctly can help avoid complications later. Ensuring you have a Colorado Corporate Resolution Authorizing a Charitable Contribution may provide clarity on such purchases and their tax implications.

Rule 39 22 301 in Colorado pertains to the state's tax regulations for corporate entities. This rule outlines the obligations for businesses regarding corporate income tax and how these taxes apply when engaging in charitable contributions. Companies planning to make charitable donations should consider drafting a Colorado Corporate Resolution Authorizing a Charitable Contribution to ensure compliance with local tax laws.

Yes, Colorado does impose a minimum corporate tax based on the corporation’s gross receipts. All corporations must ensure they comply with this requirement, even if they have chosen to make charitable contributions. If your corporation has adopted a Colorado Corporate Resolution Authorizing a Charitable Contribution, proper understanding of this tax can help in financial planning.

Certain nonprofit organizations that operate as charitable entities may be exempt from state tax in Colorado. Additionally, some organizations may receive tax-exempt status under specific conditions. If your business has adopted a Colorado Corporate Resolution Authorizing a Charitable Contribution, it might qualify under these exemptions; however, it is advisable to consult a tax professional.

Colorado Form 106 is specifically for C corporations operating in the state. If your corporation generates income or conducts activities in Colorado, you must file this form. Additionally, if your corporation has made a formal resolution like the Colorado Corporate Resolution Authorizing a Charitable Contribution, it is important to account for that when filing.

Any entity that has income sourced from Colorado must file a tax return. This includes both individuals and businesses that earn income within the state. If your corporation has established a Colorado Corporate Resolution Authorizing a Charitable Contribution, you should ensure compliance with state tax requirements.