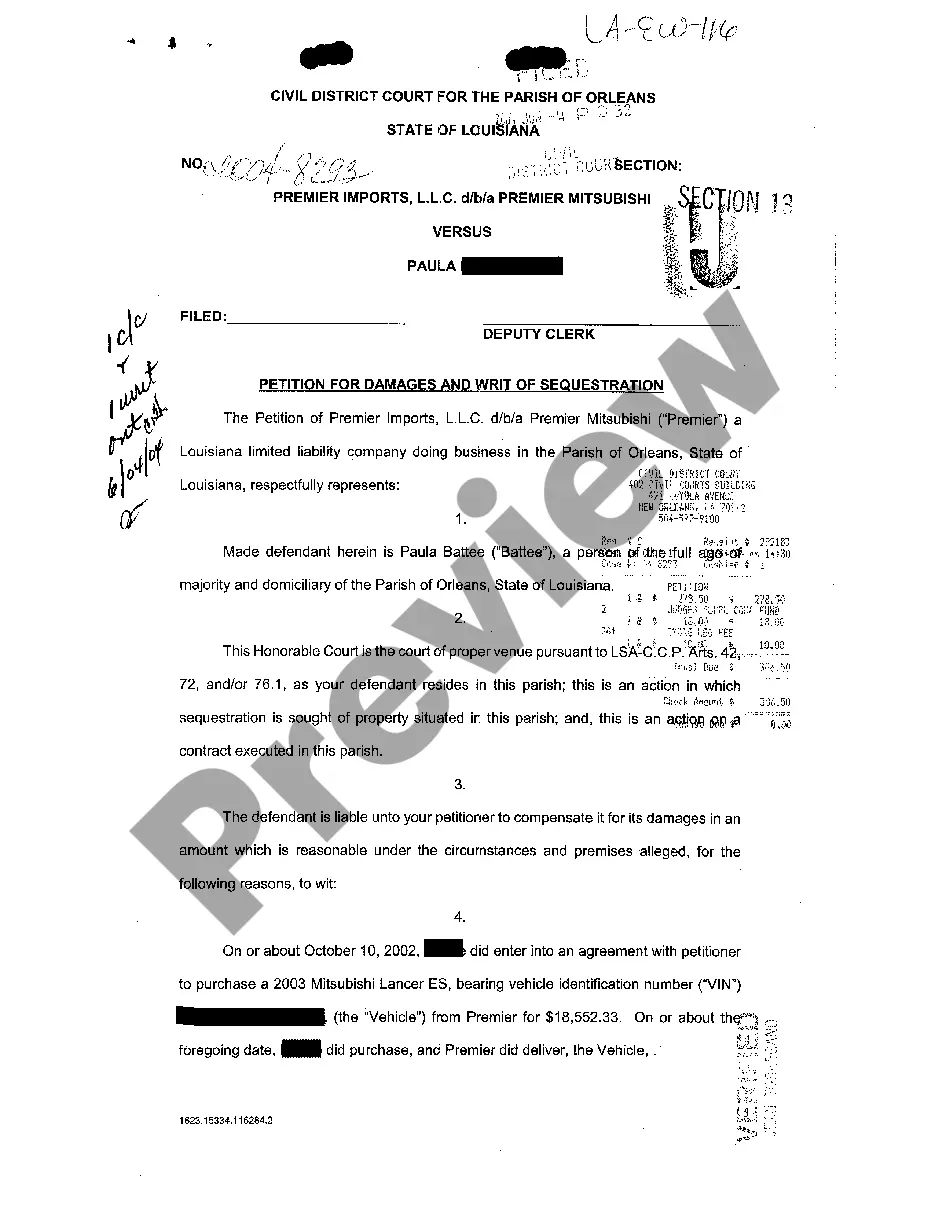

Colorado Reduce Capital - Resolution Form - Corporate Resolutions

Description

How to fill out Reduce Capital - Resolution Form - Corporate Resolutions?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal form templates that you can download or create.

By using the website, you can access numerous forms for business and personal purposes, categorized by types, states, or keywords.

You can find the latest versions of documents such as the Colorado Reduce Capital - Resolution Form - Corporate Resolutions in no time.

Check the form description to confirm that you have chosen the right form.

If the form does not meet your needs, use the Search box at the top of the screen to find a suitable one.

- If you already have a subscription, Log In to access the Colorado Reduce Capital - Resolution Form - Corporate Resolutions from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously saved forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some simple steps to help you get started.

- Ensure you have selected the correct form for your city/state.

- Review the form’s content using the Preview option.

Form popularity

FAQ

Business meals are indeed deductible in Colorado, aligning with both state and federal regulations. You need to maintain accurate documentation to substantiate these expenses and demonstrate their connection to business activities. Utilizing the Colorado Reduce Capital - Resolution Form - Corporate Resolutions can enhance your record-keeping, making it easier to claim your deductions.

Yes, food purchased during a business trip is generally deductible, subject to certain limitations. Typically, you can deduct 50% of your meal expenses while traveling for business purposes. To ensure accurate records for taxation, consider documenting these expenses with the Colorado Reduce Capital - Resolution Form - Corporate Resolutions, which helps streamline your financial management.

The Nexus threshold in Colorado refers to the level of business activity necessary for a business to be subject to state taxes. In Colorado, a business has Nexus if it has physical presence or sufficient economic presence in the state. Understanding these thresholds is crucial for compliance and taxation purposes. For assistance, consider consulting the Colorado Reduce Capital - Resolution Form - Corporate Resolutions to help navigate your business obligations.

Yes, Colorado allows the deduction for business meals, similar to federal guidelines. Remember to keep accurate records of your expenses to ensure compliance. Using the Colorado Reduce Capital - Resolution Form - Corporate Resolutions can help streamline your documentation process and make the deduction more manageable.

Yes, you can write off certain meals as a business expense, but there are guidelines to follow. You must be able to demonstrate that the meals are necessary and directly related to your business operations. By utilizing the Colorado Reduce Capital - Resolution Form - Corporate Resolutions, you can ensure that your expenses are accurately recorded and compliant with state laws.

You can find corporate resolution templates on various legal websites, including uslegalforms. They provide accessible resources, such as the Colorado Reduce Capital - Resolution Form - Corporate Resolutions, designed to help you draft accurate and legally compliant corporate resolutions with ease.

Not every LLC is required to have a corporate resolution, but it is often good practice to create one for significant decisions. These resolutions provide clarity and legality to important decisions made by the members. For those situations, the Colorado Reduce Capital - Resolution Form - Corporate Resolutions can guide you in documenting resolutions effectively.

Shareholder resolutions can typically be accessed through your company's investor relations department or the public filings of the corporation. Additionally, legal resources like uslegalforms include Drafting Templates such as the Colorado Reduce Capital - Resolution Form - Corporate Resolutions to assist in creating necessary shareholder documentation.

You can find corporate resolutions through legal document providers, state government websites, and legal firms specializing in corporate law. Websites like uslegalforms offer templates, including the Colorado Reduce Capital - Resolution Form - Corporate Resolutions, to simplify your search and ensure compliance with local laws.

A written resolution for capital reduction is a formal statement that details a company's decision to decrease its share capital. This process might involve reducing the number of shares or changing the nominal value of shares. The Colorado Reduce Capital - Resolution Form - Corporate Resolutions provides a valuable template to ensure your written resolution complies with legal requirements.