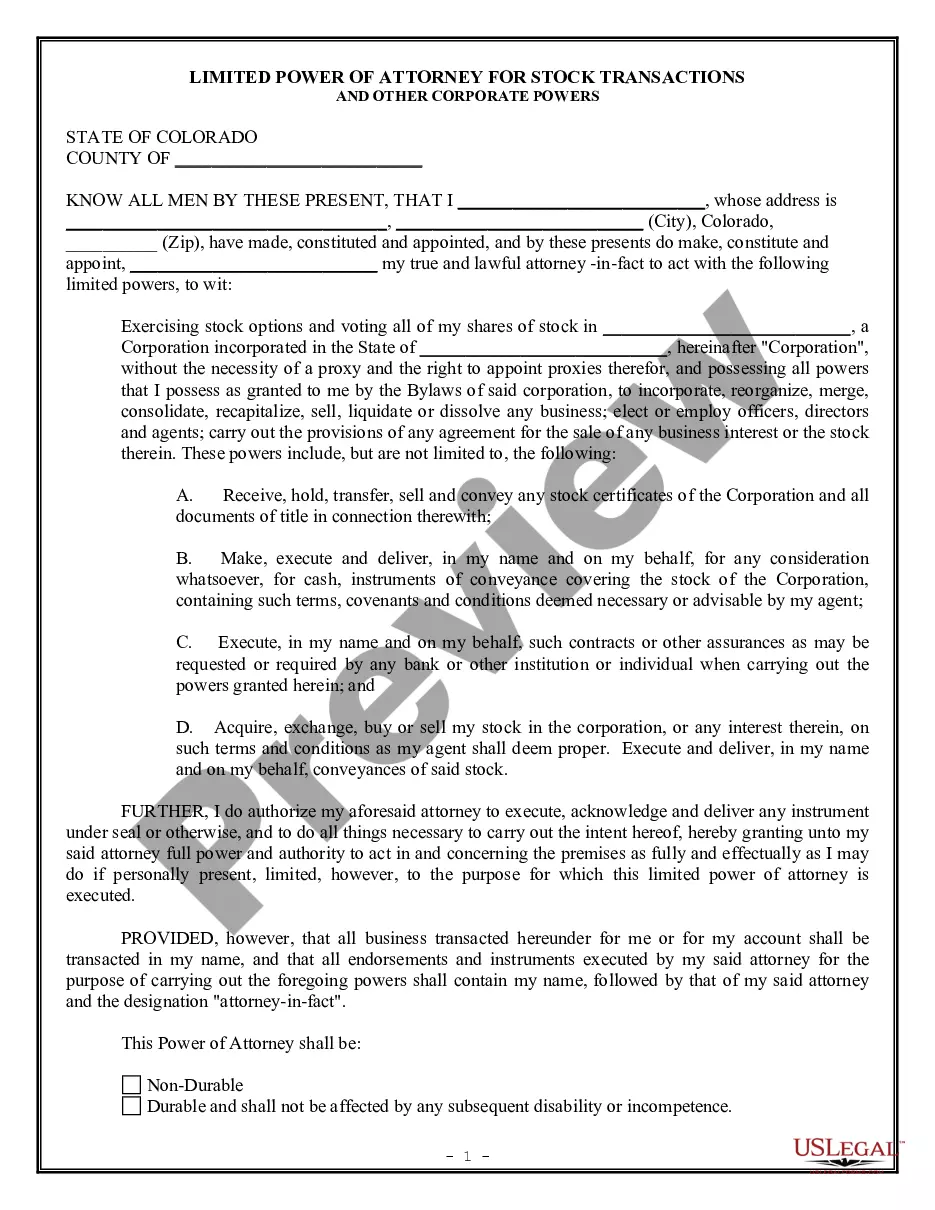

Colorado Limited Power of Attorney for Stock Transactions and Corporate Powers

Description

How to fill out Colorado Limited Power Of Attorney For Stock Transactions And Corporate Powers?

The greater the number of documents you need to create, the more anxious you become.

You can discover countless Colorado Limited Power of Attorney for Stock Transactions and Corporate Powers templates online, but you may be uncertain about which ones to trust.

Eliminate the difficulty of locating samples with US Legal Forms.

Once satisfied, click Buy Now to initiate the registration process and select a pricing plan that aligns with your needs.

- Obtain precisely composed documents that are tailored to meet state specifications.

- If you possess a US Legal Forms membership, Log In to your account, and you will find the Download option on the page for Colorado Limited Power of Attorney for Stock Transactions and Corporate Powers.

- If this is your first time using our platform, follow these instructions to sign up.

- Verify that the Colorado Limited Power of Attorney for Stock Transactions and Corporate Powers is legitimized in your residing state.

- Reassess your choice by reviewing the description or utilizing the Preview feature if available for the chosen document.

Form popularity

FAQ

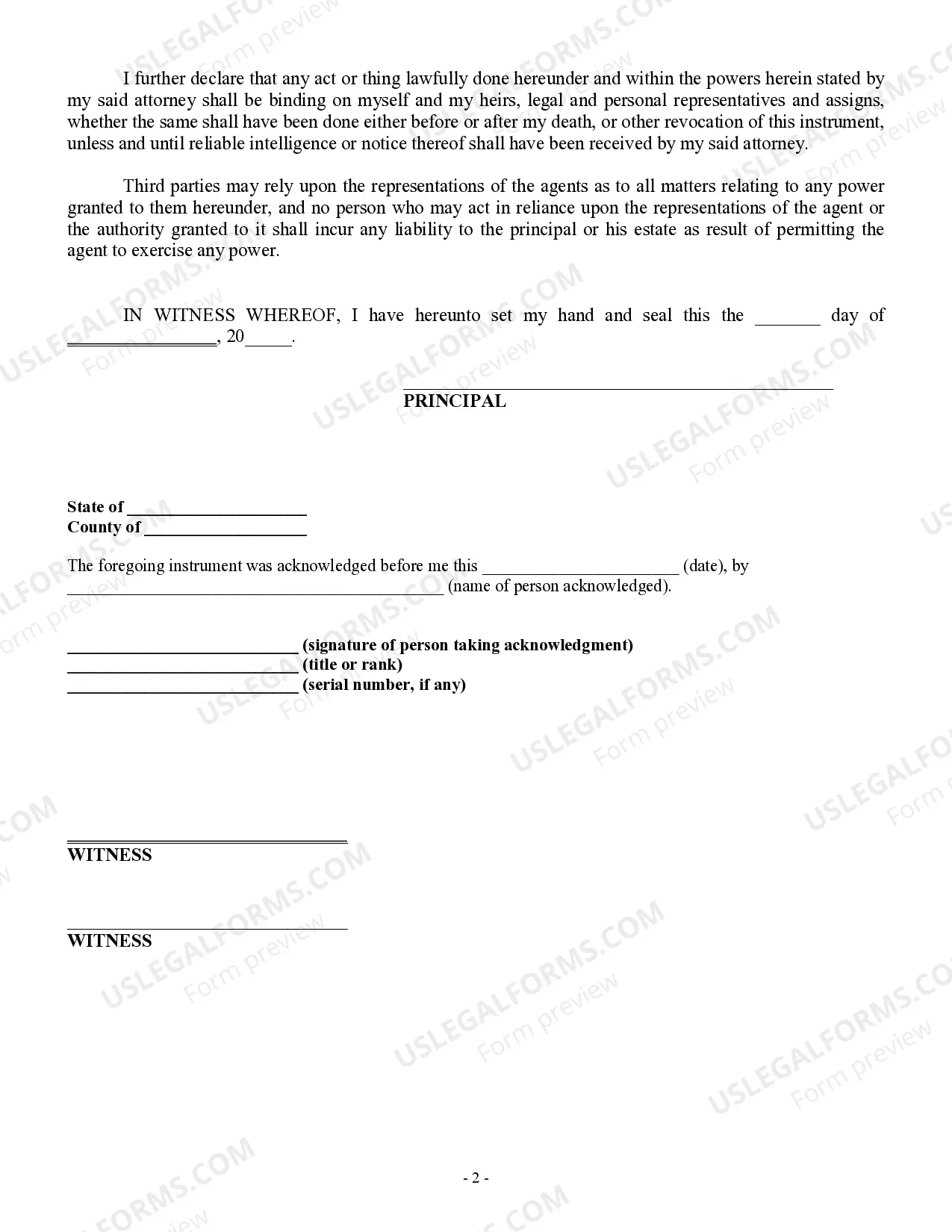

When submitting a co-power of attorney (co-POA), you must include all appointed attorneys in the document. Be certain to identify the responsibilities and limitations of each party involved. For a streamlined experience, consider using a service like uslegalforms, which provides guidance on submitting a co-POA efficiently.

To submit a power of attorney to the IRS, specifically your Colorado Limited Power of Attorney for Stock Transactions and Corporate Powers, you should complete Form 2848. After filling out the form, mail it to the appropriate IRS address. It is beneficial to keep a copy for your records and ensure that your representative is properly authorized for tax matters.

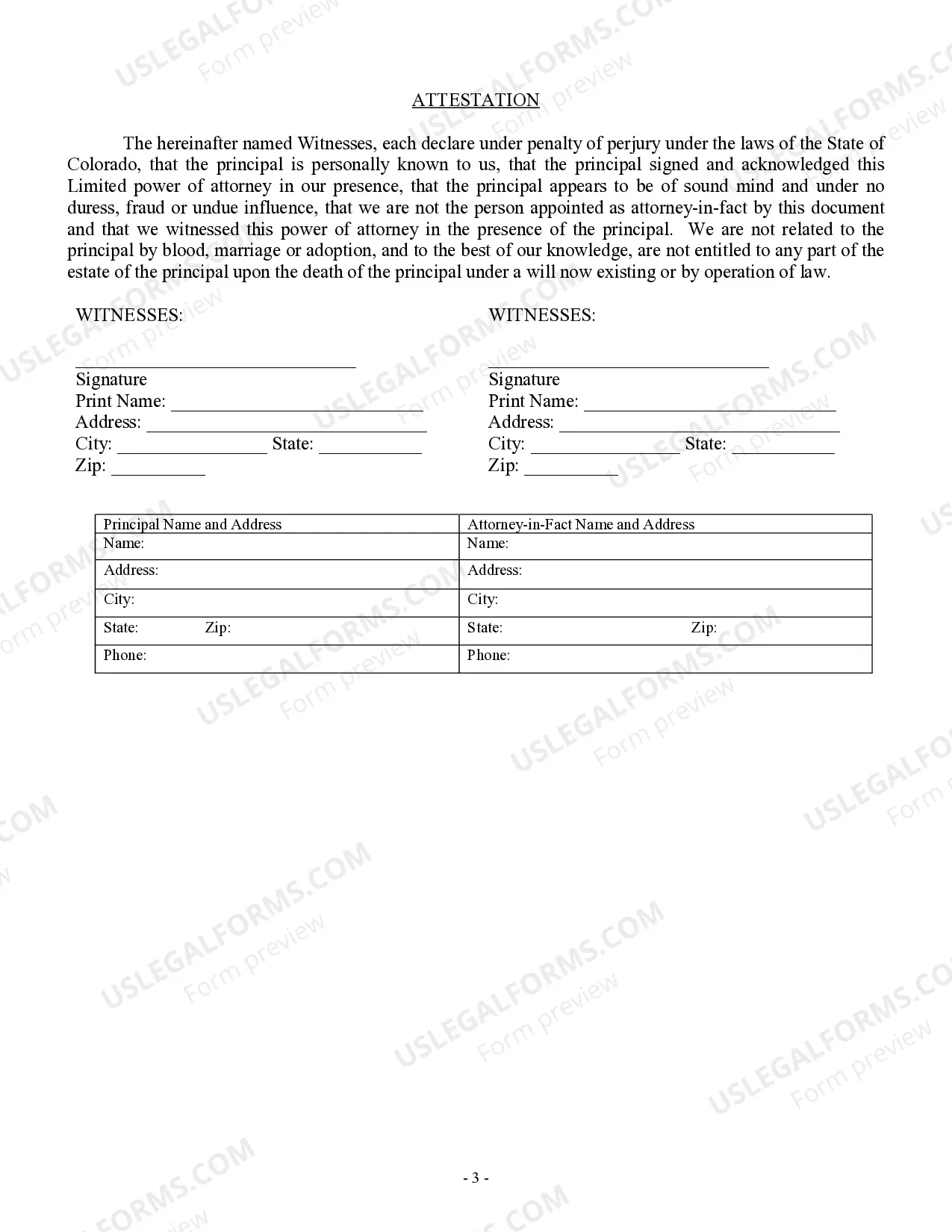

To fill out a limited power of attorney form, start by including your personal information and that of the person you are appointing. Clearly state the specific powers you are granting, such as managing stock transactions or corporate powers for your financial needs. Using a platform like uslegalforms can simplify this process with templates tailored for Colorado.

In Colorado, a medical power of attorney does not require notarization to be valid; however, having it notarized is highly recommended for added assurance. This can help prevent disputes about the document's authenticity. If you're also considering a Colorado Limited Power of Attorney for Stock Transactions and Corporate Powers, notarization can enhance credibility with financial institutions.

When you need to submit a Colorado power of attorney, such as the Colorado Limited Power of Attorney for Stock Transactions and Corporate Powers, you typically mail it to the relevant institution or party that will use it. Common mail recipients include banks, corporations, or attorneys. Be sure to retain copies for your records and verify the correct mailing address.

In Colorado, a power of attorney, including a Colorado Limited Power of Attorney for Stock Transactions and Corporate Powers, does not need to be recorded to be effective. However, some financial institutions or real estate transactions may require recording for specific actions. It is wise to check with the entity involved to ensure compliance with their requirements.

To obtain power of attorney in Colorado, you need to draft a power of attorney document that meets state requirements. You can choose to customize this document to fit specific needs, such as a Colorado Limited Power of Attorney for Stock Transactions and Corporate Powers. After signing, it may require notarization to enhance its validity, ensuring that your authority is recognized in financial and legal situations.

A power of attorney typically cannot make decisions regarding the principal's own medical care, change their will, or sign divorce papers on their behalf. These areas require the principal's direct input or consent. By understanding the limitations, you can use a Colorado Limited Power of Attorney for Stock Transactions and Corporate Powers effectively to focus on stock and financial matters.

Power of attorney grants authority over various financial and legal matters as specified in the document. This can include managing bank accounts, making investment decisions, or even handling real estate transactions. For those using a Colorado Limited Power of Attorney for Stock Transactions and Corporate Powers, it specifically focuses on stock handling, ensuring your actions are legally protected while managing another's assets.

A power of attorney for a stock power is a legal document granting authority to make decisions specifically related to the buying and selling of stocks. It allows the appointed individual to navigate the complexities of stock transactions on behalf of the principal. Using a Colorado Limited Power of Attorney for Stock Transactions and Corporate Powers ensures you have the proper legal scope to act effectively in these financial matters.