THis is an official form from the Colorado State Judicial Branch, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Colorado statutes and law.

Colorado Contact Information Change

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Colorado Contact Information Change?

The more paperwork you have to prepare, the more stressed you become.

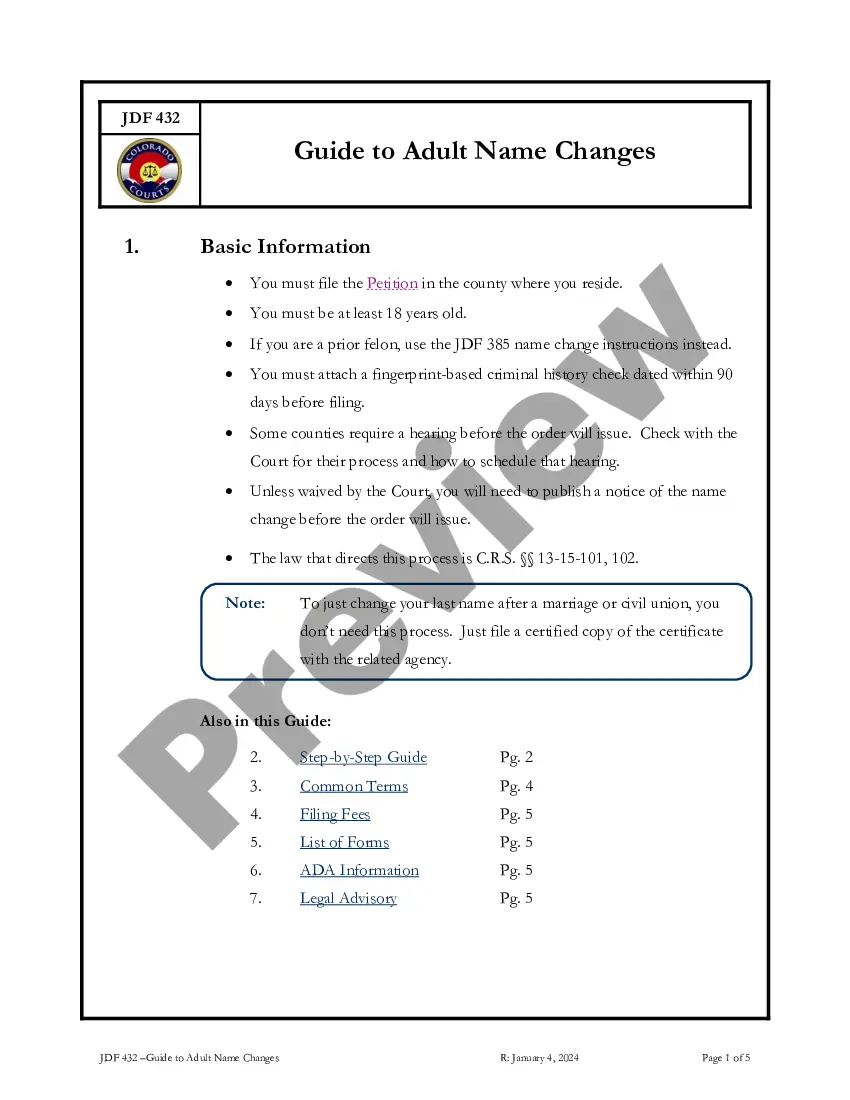

You can discover a vast array of Colorado Notice of Change of Address and/or New Name forms online, yet you may be uncertain about which ones to trust.

Eliminate the inconvenience of obtaining samples by using US Legal Forms. Acquire correctly drafted documents that comply with state requirements.

Input the required information to create your profile and process your order using PayPal or a credit card. Opt for an easy document format and receive your sample. Locate every document you download in the My documents section. Go there to prepare a new copy of your Colorado Notice of Change of Address and/or New Name. Even with well-drafted templates, it is still important to consider consulting a local attorney to review the completed form to ensure your records are accurately filled out. Achieve more for less with US Legal Forms!

- If you possess a US Legal Forms subscription, Log In to your account, and you will find the Download button on the webpage for the Colorado Notice of Change of Address and/or New Name.

- If you have not previously utilized our platform, complete the registration process by following these steps.

- Verify if the Colorado Notice of Change of Address and/or New Name is applicable in your state.

- Double-check your choice by reviewing the description or by using the Preview mode if available for the selected document.

- Simply click Buy Now to initiate the registration process and select a pricing plan that suits your needs.

Form popularity

FAQ

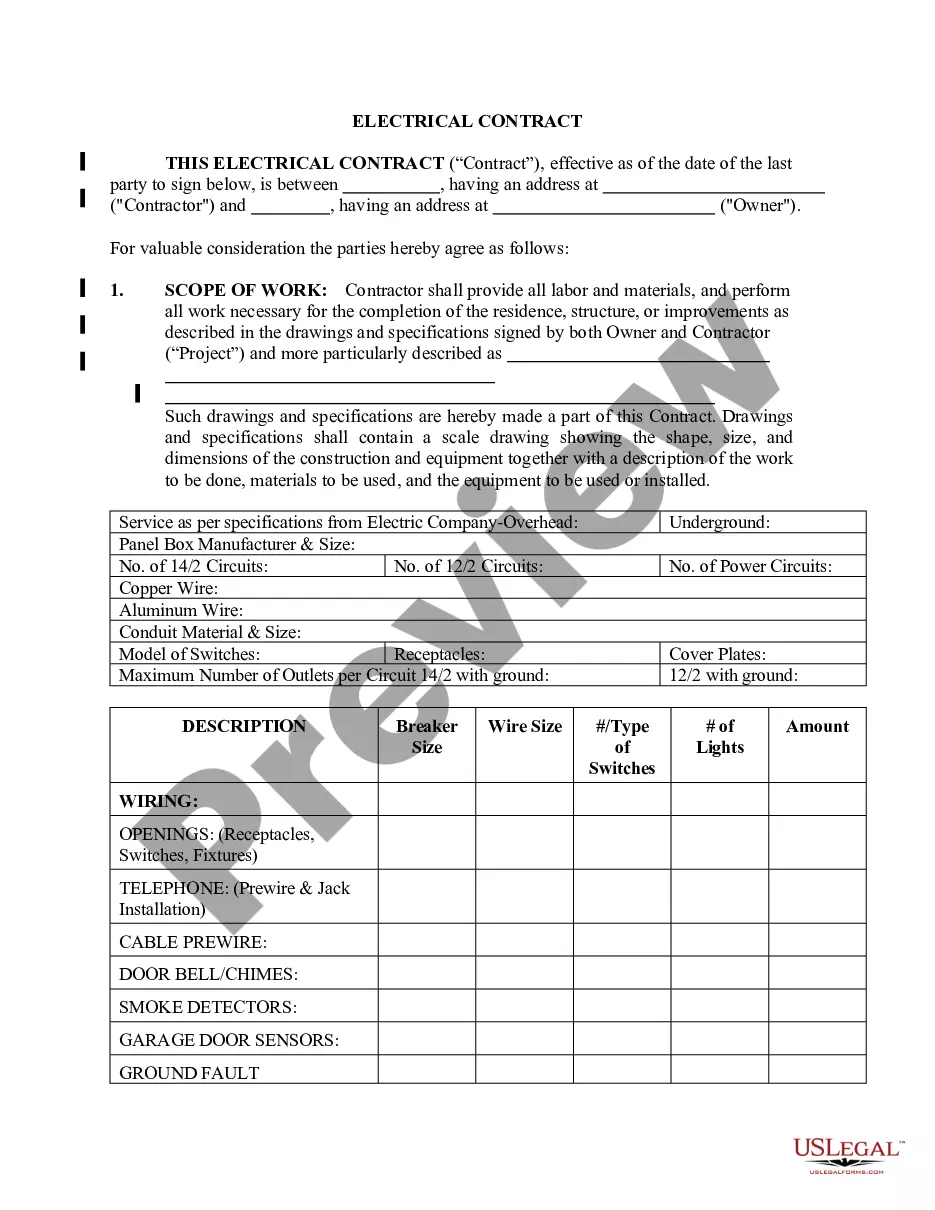

To change the address of your LLC in Colorado, submit the appropriate form to the Secretary of State. Be sure to include details about your old and new addresses. This Colorado Contact Information Change is vital for maintaining accurate business records and staying compliant with state regulations.

Yes, you can change your LLC address anytime you move. This process ensures that your business remains compliant and that you receive essential communications. Just follow the steps to implement this Colorado Contact Information Change through your state’s official channels.

Changing the address on your LLC in Colorado involves filling out a form provided by the Secretary of State. You will have to indicate your old address and the new address to complete this Colorado Contact Information Change. Once you submit the form, the updated address will become part of the public record, so make sure it is accurate.

To change your business address with the Colorado Department of Revenue, you must submit a specific form that updates your contact information. You can usually complete this process online for convenience. Additionally, ensure that your records reflect this Colorado Contact Information Change so you receive important correspondence in a timely manner.

To correct your business address, start by gathering the necessary documents that reflect the new address. You will need to file a form with the appropriate state or local agency that handles business registrations. It's crucial to ensure that this Colorado Contact Information Change is done promptly to avoid any issues with communication or compliance.

To change your address with Colorado Revenue, you should complete the appropriate form indicated on their official website. This process may also include updating your address in the online portal if you have an account. Taking these steps ensures that your Colorado contact information change is processed quickly and efficiently, leading to timely updates in your records.

Changing your address with the Revenue Department is important for maintaining accurate records. You can typically do this by completing an official form available on the state's Revenue Department website. It is crucial to ensure that your address aligns with your Colorado contact information change, as this affects various tax-related communications and services.

To change your address with the Internal Revenue Service, you have a couple of options. You can file Form 8822, which allows you to notify the IRS of your address change. Alternatively, you can also update your address when you file your next tax return. Taking these steps ensures your records are accurate and helps avoid issues related to your Colorado contact information change.

Yes, you can change your address for your tax refund by contacting the Colorado Department of Revenue. They will guide you through the process and update your records to reflect your new address. Making this change is essential to guarantee that your tax refund reaches you without any issues related to your Colorado contact information change.

To change your business address in Colorado, you must update your information with the Colorado Secretary of State. This process can often be completed online, where you need to provide your new business address. Keep in mind that ensuring your registered address reflects your current location is critical for the effectiveness of any Colorado contact information change.